If it feels like the Covid pandemic pushed us further towards a cashless society, other international crises may help reverse the trend.

Cash is increasingly preferred by aid agencies to provide quick, effective and more dignified relief in disaster areas.

International disaster risk management consultant James Shepherd-Barron says sending ‘buckets and blankets’ to disaster victims can be counterproductive.

The first cash dispenser

The subject brings together Portmahomack-based Mr Shepherd-Barron’s day job as an adviser to governments, UN agencies and international aid organisations, and his interest in the distribution of cash.

The latter stems from his father, John Shepherd-Barron, the man behind the world’s first cash dispenser, which later developed into automated teller machines (ATMs).

June 27 is the 55th anniversary of the unveiling of the first machine in a branch of Barclays in Enfield.

In honour of his father, Mr Shepherd-Barron marks the date as World ATM Day and hosts the ATM Appreciation Society website.

He also wrote the book The Hole in the Wall, about the origins of the cash machine.

The use of cash, and of ATMs, during world crises crosses into his main role.

He argues access to the machines is not only a more cost-effective way to distribute humanitarian aid, but represents freedom, choice and financial independence.

It is also fundamental to reducing poverty worldwide, reducing disaster risk and enhancing financial inclusion, he asserts.

“The aid world, over the last five or so, has moved from giving stuff like buckets and blankets to cash.

“Giving people stuff can be totally counterproductive.

‘More practical and cost effective’

“It’s usually not what they need, it clogs up logistics and you can end up with a left shoe for summer when what you need is a pair of boots for winter.

“Cash gives people agency and dignity. It’s more practical, it’s more cost effective and there is much less wastage.

“It is seen as a way of providing people with essential disaster relief quickly by allowing recipients to choose what they want to buy.”

Mr Shepherd-Barron is also Adjunct Professor at Fordham University and CEO of the Aid Workers Union, the support service for independent aid professionals.

He said in previous disasters In Pakistan, India and Bangladesh, affected populations have been helped by ATMs being flown and floated in to remote areas.

They have also been used to supply cash in refugee camps including in Somalia, Jordan and Turkey.

Mr Shepherd-Barron says cash can also help disaster-affected populations recover more quickly than providing money digitally.

Digital money does not re-circulate and involves fees, while cash recirculates in local economies, generating many times its face value as it does so.

“Some say people will waste cash, but if you are really poor you don’t. Hardly any gets wasted.

“It provides a different social dynamic and all the evidence now points to cash being more effective and more efficient.

Military tactic

“Whatever way we send cash assistance, either via mobile wallets, tokens or ATM cards, over 90% gets cashed out and converted into banknotes at the first available opportunity.

“People trust it, they know it works in times of crisis and they know it will not restrict purchasing behaviour.”

He said limiting access to cash can be used as a military tactic in places like Somalia, Myanmar/Burma and contested areas in Ukraine.

“Without access to cash, you erode democracy and without access to ATMs you are limiting access to cash.

“You could even argue that’s happening in Scotland if people have less and less access to critical services because banks find it expensive to run ATMs and bank branches.

“Eventually you start losing your democratic ability to choose how to pay.”

A lack of access to money led to the first cash dispenser being developed.

In 1965, John Shepherd-Barron, then managing director of De La Rue Instruments, was unable to cash a cheque on a Saturday, arriving one minute after his bank closed.

Later, lying in his bath, he thought of a way of delivering money automatically through a hole in the bank’s wall.

Mr Shepherd-Barron, the former chairman of Ross and Cromarty Enterprise who died in 2010, led the team that made the device that was unveiled in Enfield.

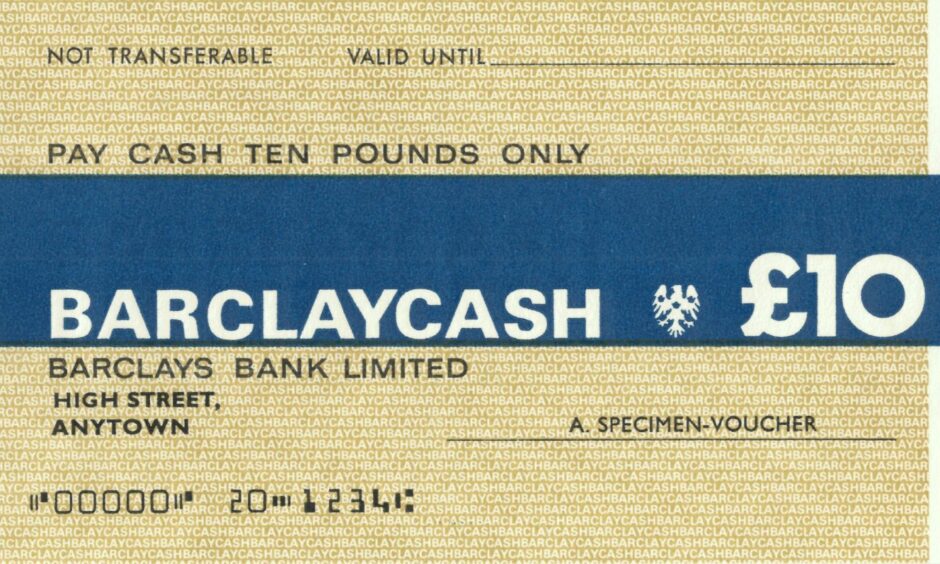

Customers could withdraw 10 pre-packed £1 notes using a special token, a paper voucher designed to look like a cheque.

Wife decided on four-figure PIN

The token was impregnated with carbon 14, a mildly radioactive substance, and was detected by the machine and matched against a PIN (personal identification number).

The four-figure PIN was decided after Mr Shepherd-Barron’s wife Caroline said the original six figures were too many to remember.

Today there are more than three million ATMs around the world.

As well as in the high street and shopping centres, they can be found in the remote outback, the Antarctic, churches and even the Vatican.

Around 10.6 billion cash withdrawals are made every month around the world.

A Barclays spokesman said: “Barclays is proud to have launched the world’s first ATM.

“Since 1967 technology and cash usage has evolved significantly. That is why we continue to innovate and invest in technologies that make banking easier for our customers and were the first UK bank to offer contactless and mobile cash withdrawals.”

John Shepherd-Barron was made an OBE in 2005 for his contribution to the industry. The following year he was given a lifetime achievement award by ATM industry association (ATMIA).

ATMIA CEO Mike Lee said: “His ATM developed for Barclays Bank was first over the finishing line in that it was the first installed ATM in the world.”

Technology has transformed banking

He said there were other co-inventors who played a key role in the collective development of ATM technology, internationally.

“But I see him as the pioneer who actually got the actual deployment of ATMs into the high street first.

“It is a technology which has transformed banking by making banking accessible 24 x 7 and thus paving the way for what we see today with self-service banking – a great empowerment for consumers worldwide.”

10 ATM facts

- In the US, a bank ATM averages more than 7,000 transactions per month.

- In Europe, an average ATM conducts 197 transactions every 24 hours.

- An ATM in the Whistler mountain resort in Canada allows skiers to warm their hands on the machine as they withdraw cash

- The smallest ATM is made by Lego

- The ATM in the Vatican is the only one where you can choose to carry out the transaction in Latin

- A machine in Dubai dispenses gold bullion

- The machine located furthest north is about 800 miles from the North Pole at Svalbard in Norway.

- The furthest south is about 840 miles from the South Pole at McMurdo Research Station in Antarctica

- Leading up to the Queen’s Platinum Jubilee celebrations £1.7 billion was withdrawn from cash machines between Monday and Sunday.

- That included £322 million on June 1, the busiest Wednesday for withdrawals since before the pandemic.

More bang for your buck? Read on…

Free access to cash ‘should be set in law’ for rural communities

Study shows how cash machine use has plummeted by as much as 70% across north and north-east

Map: North-east communities turning away from cash among highest in Scotland

Are you interested in more exclusive and breaking Highland and Islands news from the P&J? If so, why not join our dedicated Facebook page HERE