Markets

The Biggest Companies in the World in 2021

View the full-resolution version of this infographic.

The Biggest Companies in the World

View the high-resolution version of the infographic by clicking here.

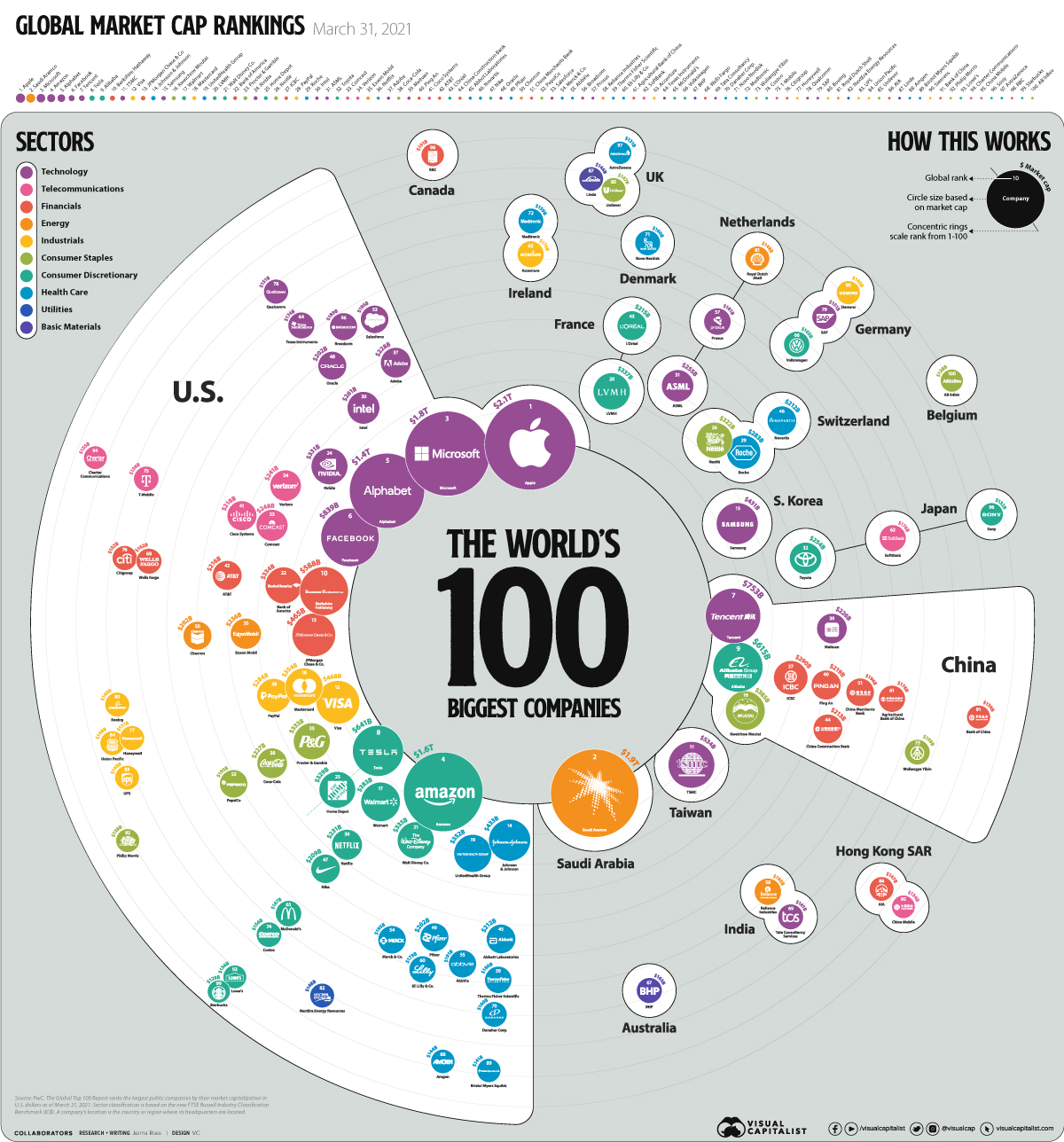

Since the COVID-19 crash, global equity markets have seen a strong recovery. The 100 biggest companies in the world were worth a record-breaking $31.7 trillion as of March 31 2021, up 48% year-over-year. As a point of comparison, the combined GDP of the U.S. and China was $35.7 trillion in 2020.

In today’s graphic, we use PwC data to show the world’s biggest businesses by market capitalization, as well as the countries and sectors they are from.

The Top 100, Ranked

PwC ranked the largest publicly-traded companies by their market capitalization in U.S. dollars. It’s also worth noting that sector classification is based on the FTSE Russell Industry Classification Benchmark, and a company’s location is based on where its headquarters are located.

Here is the top 100 ranking of the biggest companies in the world, organized from the biggest to the smallest.

| Rank | Company name | Location | Sector | Market Capitalization |

|---|---|---|---|---|

| 1 | APPLE INC | 🇺🇸 United States | Technology | $2.1T |

| 2 | SAUDI ARAMCO | 🇸🇦 Saudi Arabia | Energy | $1.9T |

| 3 | MICROSOFT CORP | 🇺🇸 United States | Technology | $1.8T |

| 4 | AMAZON.COM INC | 🇺🇸 United States | Consumer Discretionary | $1.6T |

| 5 | ALPHABET INC | 🇺🇸 United States | Technology | $1.4T |

| 6 | FACEBOOK INC | 🇺🇸 United States | Technology | $839B |

| 7 | TENCENT | 🇨🇳 China | Technology | $753B |

| 8 | TESLA INC | 🇺🇸 United States | Consumer Discretionary | $641B |

| 9 | ALIBABA GRP | 🇨🇳 China | Consumer Discretionary | $615B |

| 10 | BERKSHIRE HATHAWAY | 🇺🇸 United States | Financials | $588B |

| 11 | TSMC | 🇹🇼 Taiwan | Technology | $534B |

| 12 | VISA INC | 🇺🇸 United States | Industrials | $468B |

| 13 | JPMORGAN CHASE | 🇺🇸 United States | Financials | $465B |

| 14 | JOHNSON & JOHNSON | 🇺🇸 United States | Health Care | $433B |

| 15 | SAMSUNG ELECTRONICS | 🇰🇷 South Korea | Technology | $431B |

| 16 | KWEICHOW MOUTA | 🇨🇳 China | Consumer Staples | $385B |

| 17 | WALMART INC | 🇺🇸 United States | Consumer Discretionary | $383B |

| 18 | MASTERCARD INC | 🇺🇸 United States | Industrials | $354B |

| 19 | UNITEDHEALTH GRP | 🇺🇸 United States | Health Care | $352B |

| 20 | LVMH MOET HENNESSY | 🇫🇷 France | Consumer Discretionary | $337B |

| 21 | WALT DISNEY CO | 🇺🇸 United States | Consumer Discretionary | $335B |

| 22 | BANK OF AMERICA | 🇺🇸 United States | Financials | $334B |

| 23 | PROCTER & GAMBLE | 🇺🇸 United States | Consumer Staples | $333B |

| 24 | NVIDIA CORP | 🇺🇸 United States | Technology | $331B |

| 25 | HOME DEPOT INC | 🇺🇸 United States | Consumer Discretionary | $329B |

| 26 | NESTLE SA | 🇨🇭 Switzerland | Consumer Staples | $322B |

| 27 | IND & COMM BK | 🇨🇳 China | Financials | $290B |

| 28 | PAYPAL HOLDINGS | 🇺🇸 United States | Industrials | $284B |

| 29 | ROCHE HOLDING | 🇨🇭 Switzerland | Health Care | $283B |

| 30 | INTEL CORP | 🇺🇸 United States | Technology | $261B |

| 31 | ASML HOLDING NV | 🇳🇱 Netherlands | Technology | $255B |

| 32 | TOYOTA MOTOR | 🇯🇵 Japan | Consumer Discretionary | $254B |

| 33 | COMCAST CORP | 🇺🇸 United States | Telecommunications | $248B |

| 34 | VERIZON COMMUNICATIONS | 🇺🇸 United States | Telecommunications | $241B |

| 35 | EXXON MOBIL CORP | 🇺🇸 United States | Energy | $236B |

| 36 | NETFLIX INC | 🇺🇸 United States | Consumer Discretionary | $231B |

| 37 | ADOBE INC | 🇺🇸 United States | Technology | $228B |

| 38 | COCA-COLA CO | 🇺🇸 United States | Consumer Staples | $227B |

| 39 | MEITUAN | 🇨🇳 China | Technology | $226B |

| 40 | PING AN | 🇨🇳 China | Financials | $219B |

| 41 | CISCO SYSTEMS | 🇺🇸 United States | Telecommunications | $218B |

| 42 | AT&T INC | 🇺🇸 United States | Financials | $216B |

| 43 | L'OREAL | 🇫🇷 France | Consumer Discretionary | $215B |

| 44 | CHINA CONSTRUCTION BANK | 🇨🇳 China | Financials | $213B |

| 45 | ABBOTT LABS | 🇺🇸 United States | Health Care | $212B |

| 46 | NOVARTIS AG | 🇨🇭 Switzerland | Health Care | $212B |

| 47 | NIKE INC | 🇺🇸 United States | Consumer Discretionary | $209B |

| 48 | ORACLE CORP | 🇺🇸 United States | Technology | $202B |

| 49 | PFIZER INC | 🇺🇸 United States | Health Care | $202B |

| 50 | CHEVRON CORP | 🇺🇸 United States | Oil & Gas | $202B |

| 51 | CHINA MERCH | 🇨🇳 China | Financials | $196B |

| 52 | PEPSICO INC | 🇺🇸 United States | Consumer Staples | $195B |

| 53 | SALESFORCE.COM | 🇺🇸 United States | Technology | $195B |

| 54 | MERCK & CO | 🇺🇸 United States | Health Care | $195B |

| 55 | ABBVIE INC | 🇺🇸 United States | Health Care | $191B |

| 56 | BROADCOM INC | 🇺🇸 United States | Technology | $189B |

| 57 | PROSUS NV | 🇳🇱 Netherlands | Technology | $181B |

| 58 | RELIANCE INDS | 🇮🇳 India | Energy | $180B |

| 59 | THERMO FISHER | 🇺🇸 United States | Health Care | $180B |

| 60 | ELI LILLY & CO | 🇺🇸 United States | Health Care | $179B |

| 61 | AGRICULTURAL BANK OF CHINA | 🇨🇳 China | Financials | $178B |

| 62 | SOFTBANK GROUP | 🇯🇵 Japan | Telecommunications | $176B |

| 63 | ACCENTURE PLC | 🇮🇪 Ireland | Industrials | $176B |

| 64 | TEXAS INSTRUMENT | 🇺🇸 United States | Technology | $174B |

| 65 | MCDONALDS CORP | 🇺🇸 United States | Consumer Discretionary | $167B |

| 66 | VOLKSWAGEN AG | 🇩🇪 Germany | Consumer Discretionary | $165B |

| 67 | BHP GROUP LTD | 🇦🇺 Australia | Basic Materials | $163B |

| 68 | WELLS FARGO & CO | 🇺🇸 United States | Financials | $162B |

| 69 | TATA CONSULTANCY | 🇮🇳 India | Technology | $161B |

| 70 | DANAHER CORP | 🇺🇸 United States | Health Care | $160B |

| 71 | NOVO NORDISK | 🇩🇰 Denmark | Health Care | $160B |

| 72 | MEDTRONIC PLC | 🇮🇪 Ireland | Health Care | $159B |

| 73 | WULIANGYE YIBI | 🇨🇳 China | Consumer Staples | $159B |

| 74 | COSTCO WHOLESALE | 🇺🇸 United States | Consumer Discretionary | $156B |

| 75 | T-MOBILE US INC | 🇺🇸 United States | Telecommunications | $156B |

| 76 | CITIGROUP INC | 🇺🇸 United States | Financials | $152B |

| 77 | HONEYWELL INTL | 🇺🇸 United States | Industrials | $151B |

| 78 | QUALCOMM INC | 🇺🇸 United States | Technology | $151B |

| 79 | SAP SE | 🇩🇪 Germany | Technology | $151B |

| 80 | BOEING CO | 🇺🇸 United States | Industrials | $149B |

| 81 | ROYAL DUTCH SHELL | 🇳🇱 Netherlands | Oil & Gas | $148B |

| 82 | NEXTERA ENERGY | 🇺🇸 United States | Utilities | $148B |

| 83 | UNITED PARCEL | 🇺🇸 United States | Industrials | $148B |

| 84 | UNION PAC CORP | 🇺🇸 United States | Industrials | $148B |

| 85 | UNILEVER PLC | 🇬🇧 United Kingdom | Consumer Staples | $147B |

| 86 | AIA | 🇭🇰 Hong Kong SAR | Financials | $147B |

| 87 | LINDE PLC | 🇬🇧 United Kingdom | Basic Materials | $146B |

| 88 | AMGEN INC | 🇺🇸 United States | Health Care | $144B |

| 89 | BRISTOL-MYER SQB | 🇺🇸 United States | Health Care | $141B |

| 90 | SIEMENS AG | 🇩🇪 Germany | Industrials | $140B |

| 91 | BANK OF CHINA | 🇨🇳 China | Financials | $139B |

| 92 | PHILIP MORRIS INC | 🇺🇸 United States | Consumer Staples | $138B |

| 93 | LOWE'S COS INC | 🇺🇸 United States | Consumer Discretionary | $136B |

| 94 | CHARTER COMMUNICATIONS | 🇺🇸 United States | Telecommunications | $135B |

| 95 | CHINA MOBILE | 🇭🇰 Hong Kong SAR | Telecommunications | $134B |

| 96 | SONY GROUP CORP | 🇯🇵 Japan | Consumer Discretionary | $132B |

| 97 | ASTRAZENECA PLC | 🇬🇧 United Kingdom | Health Care | $131B |

| 98 | ROYAL BANK OF CANADA | 🇨🇦 Canada | Financials | $131B |

| 99 | STARBUCKS CORP | 🇺🇸 United States | Consumer Discretionary | $129B |

| 100 | ANHEUSER-BUSCH | 🇧🇪 Belgium | Consumer Staples | $128B |

Note: Data as of March 31, 2021.

Within the ranking, there was a wide disparity in value. Apple was worth over $2 trillion, more than 16 times that of Anheuser-Busch (AB InBev), which took the 100th spot at $128 billion.

In total, 59 companies were headquartered in the United States, making up 65% of the top 100’s total market capitalization. China and its regions was the second most common location for company headquarters, with 14 companies on the list.

Risers and Fallers

What are some of the notable changes to the biggest companies in the world compared to last year’s ranking?

Tesla’s market capitalization surged by an eye-watering 565%, temporarily making Elon Musk the richest person in the world. Food delivery platform Meituan and PayPal benefited from growing e-commerce popularity with their market capitalizations growing by 221% and 151% respectively.

Tech companies TSMC and ASML Holdings were also among the top 10 risers, thanks to a shortage of semiconductor chips and growing demand.

On the other end of the scale, Swiss companies Nestlé, Novartis, and Roche Holding were all among the bottom 10 companies by market capitalization growth. China Mobile was the only company to decline with a -12% change. The company was delisted from the New York Stock Exchange as a result of an executive order issued by former president Donald Trump, and recently announced its intention to list on the Shanghai Stock Exchange.

A Sector View

Across the 100 biggest companies in the world, some sectors had higher weightings.

| Sector | Total Market Cap in Top 100 | % of Top 100 Market Cap | Number of Companies in Top 100 |

|---|---|---|---|

| Technology | $10.5T | 33.0% | 20 |

| Consumer Discretionary | $6.0T | 18.9% | 17 |

| Financials | $3.4T | 10.8% | 14 |

| Health Care | $3.3T | 10.5% | 16 |

| Energy | $2.7T | 8.5% | 5 |

| Consumer Staples | $2.0T | 6.4% | 9 |

| Industrials | $2.0T | 6.4% | 9 |

| Telecommunications | $1.3T | 4.1% | 7 |

| Basic Materials | $0.3T | 1.0% | 2 |

| Utilities | $0.1T | 0.5% | 1 |

Technology had the highest market capitalization and was also the most common sector, with Big Tech dominating the top 10. Companies in the consumer discretionary, financials, and health care sectors also had a strong representation in the ranking.

Despite having only five companies on the list, the energy sector amounted to almost 10% of the top 100’s market capitalization, mostly due to Saudi Aramco’s whopping valuation.

An Uncertain Recovery

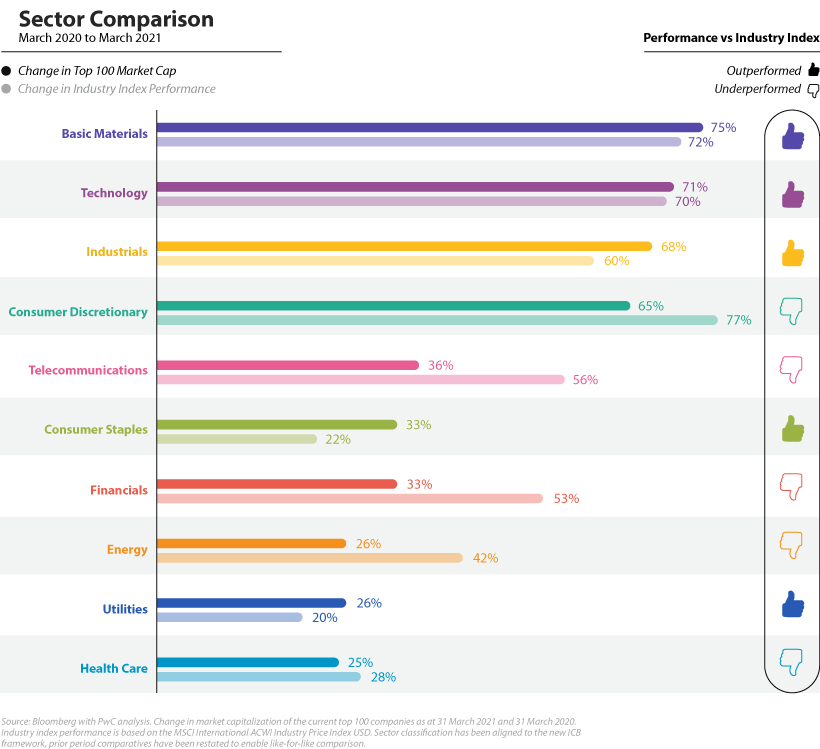

From near market lows on March 31, 2020, all sectors saw increases in their market capitalization. However, top 100 companies in some sectors outperformed their respective industry index, while others did not.

Basic materials and industrials, both cyclical sectors, were high performers in the top 100 and outperformed their respective industry indexes. Technology companies also outperformed, and accounted for $255 billion or 31% of all shareholder distributions by the top 100, far more than any other sector. Apple alone spent $73 billion on share buybacks and $14 billion in dividends in the 2020 calendar year.

On the other hand, the worst-performing sectors in the top 100 were health care, utilities, and energy. While the index performance for health care and utilities was also relatively poor, the wider energy sector performed fairly well.

It’s perhaps not surprising that all sectors saw positive returns since their low levels in March 2020, buoyed by fiscal stimulus and central bank policies. As countries begin to reopen, will the value of the biggest companies in the world continue to climb?

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money1 week ago

Money1 week agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population