Phil Murphy reelected governor of New Jersey in face-saving win for Democrats

Phil Murphy was reelected as New Jersey’s governor, emerging victorious after an unexpectedly close battle for the leadership of the state.

Murphy, a Democrat, narrowly defeated his Republican opponent Jack Ciattarelli, Associated Press announced early on Wednesday evening, almost a full day after polls in the state closed.

The victory also saved the Democratic Party some face, given Republican Glenn Youngkin defeated Terry McAuliffe on Tuesday in Virginia’s run-off for governor.

Virginia’s constitution prohibits governors from serving consecutive terms, which had rendered incumbent leader Ralph Northam, a Democrat, ineligible.

In the 2020 presidential election, Joe Biden carried New Jersey by a 16-point margin over Donald Trump, and defeated the 45th president by 10 points in Virginia.

Read more on the gubernatorial elections here

Priceline parent ‘encouraged’ by signs of recovery as travel bookings jump

Online travel reservation company Booking Holdings said travel demand rebounded in the third quarter and that it was “encouraged” by signs of recovery in parts of the world.

The Connecticut-based company behind travel websites including Priceline and Kayak said gross travel bookings — the dollar value of services booked by customers net of cancellations — rose 77 per cent from a year ago to $23.7bn.

Revenues climbed to $4.67bn, a 77 per cent increase from 12 months ago when pandemic-related restrictions crushed travel demand. That topped forecasts for $4.3bn, according to a Refinitiv survey of Wall Street analysts.

While the company was “materially and negatively impacted” by the pandemic, chief executive Glenn Fogel said he was “encouraged by the signs of recovery we saw in many parts of the world.”

“We are pleased to report another quarter of sequential improvement in room night trends, which was primarily driven by better results in Europe,” Fogel said.

Travel demand is expected to strengthen as Covid-19 cases in the US decline and as the government lifts restrictions on vaccinated overseas travellers next week.

Booking Holdings reported net income $769m or $18.60 a share in the three months ended in September, compared with $801m or $19.56 a share in the year ago quarter. Adjusting for one-time items the company report earnings of $37.70 a share.

Booking shares, which are up 9 per cent year-to-date, climbed 7 per cent in after-hours trade.

US stocks close at record high after Fed signals it will not rush to raise rates

Wall Street stocks climbed to fresh record highs while Treasury prices slipped as the Federal Reserve confirmed plans to scale back its substantial pandemic-era monetary stimulus.

The US central bank announced it would begin winding down its monthly bond-buying programme later this month.

The announcement had been widely expected, and stock markets reacted positively to the lack of any further shock despite earlier concerns the pull back in crisis-era stimulus could derail the recent equities rally.

The S&P 500, which had slipped slightly earlier in the day, swung to a gain after the Fed’s announcement. The index extended its gains as chair Jay Powell said at a press conference the Fed could adjust the pace of its tapering but stressed that “we wouldn’t want to surprise markets” and would provide ample warning ahead of any change. He added that the central bank would not rush to raise interest rates.

The benchmark S&P 500, tech-heavy Nasdaq Composite and Russell 2000 index of smaller companies all closed at record highs, up 0.6 per cent, 1 per cent and 1.9 per cent respectively.

The yield on the two-year US Treasury note, which moves inversely to the price of the debt and tracks interest rate expectations, hit an 18-month high of 0.55 per cent last week. The current fed funds rate is slightly higher than zero.

Read more on the day’s market moves here

Biden acknowledges ‘upset’ Americans following Republican win in Virginia governor’s race

US president Joe Biden acknowledged that Americans were “upset and uncertain about a lot of things”, calling for Democrats to urgently pass his flagship economic legislation after his party suffered stinging setbacks in state and local elections across the country.

“People want us to get things done. They want us to get things done,” Biden told reporters at the White House on Wednesday. “And that’s why I’m continuing to push very hard for the Democratic Party to move along and pass my infrastructure bill [and] my ‘Build Back Better’ bill,” he added.

Biden spoke a day after Glenn Youngkin, a Republican, won the governors’ race over Democrat Terry McAuliffe in Virginia, a state that Biden carried by 10 percentage points in 2020, while the governors race in New Jersey, which Biden won by 16 points last year, was too close to call.

“People are upset and uncertain about a lot of things. From Covid to school to jobs, to a whole range of things - and the cost of a gallon of gasoline,” Biden said, adding that if his economic agenda was signed into law, the US would be “in a position where you’re going to see a lot of those things ameliorated, quickly and swiftly”.

Qualcomm’s diversification strategy pays off despite challenge of chip shortage

Qualcomm shares jumped nearly 6 per cent after-hours on Wednesday on signs the company’s strategy to diversify and expand beyond mobile phones was paying off despite a global shortage of semiconductor chips.

The company — which designs, makes and licenses chips used in mobile phones and other devices — said revenues in its fiscal fourth quarter rose 12 per cent to $9.3bn, ahead of forecasts at $8.86bn, thanks to record revenues across its handset, automotive and Internet of Things divisions.

Qualcomm expects adjusted earnings per share - a number closely watched by analysts - between $2.90 and $3.10 in the current quarter, well ahead of forecasts of $2.59, according to Refinitiv data. It said revenues will come in between $10bn and $10.8bn versus the $9.68 bn projected by analysts.

“We are well positioned to continue to lead in mobile and enable the digital transformation of industries with our broad portfolio of relevant technologies,” Cristiano Amon, chief executive, said.

Leading the result, Qualcomm’s chip division recorded a 56 per cent rise in revenues to $7.4bn.

Revenues for its RF-front end division, which designs antenna and the digital basebands, rose 45 per cent to $1.2bn. In its automative and IoT units, revenues rose 44 per cent to $270m and 66 per cent to $1.5bn, respectively.

“Our results across RF front-end, Automotive and IoT attest to the success of our technology roadmap and revenue diversification strategy,” Amon said.

He also said full-year 2021 revenues of $33.6bn were ahead of targets presented at its 2019 Analyst day and up 43 per cent from a year ago.

Fed to start winding back $120bn-a-month stimulus programme

The Federal Reserve said it would begin scaling back its massive $120bn monthly bond-buying programme this month, a critical milestone for a US economy that is recovering from the pandemic and contending with surging inflation.

The decision is the culmination of months of debate among Fed officials about the level of support the world’s largest economy needs as price pressures begin to extend beyond the sectors most sensitive to the post-pandemic reopening.

At the end of its two-day policy meeting on Wednesday, the Federal Open Market Committee said it would reduce its purchases of Treasury securities by $10bn per month, having achieved “substantial further progress” towards its twin goals of maximum employment and inflation that averages 2 per cent. The central bank will also reduce its purchases of agency mortgage-backed securities by $5bn a month.

The tapering process is set to begin in mid-November, which suggests the stimulus programme would cease altogether in June 2022. The purchases would be reduced further at the beginning of December, to $60bn in Treasuries and $30bn in agency mortgage-backed securities and further reductions are seen to be “appropriate” each month.

The Fed committee said it was “prepared to adjust the pace” of the tapering process “if warranted by changes in the economic outlook,” adding that the remainder of the bond-buying programme would “foster smooth market functioning and accommodative financial conditions” to “support the flow of credit to households and businesses”.

Read more on the Fed’s latest decision here

US stocks soften ahead of Federal Reserve meeting

Wall Street equities held near record highs and Treasuries were steady as traders awaited a decision from the US central bank about scaling back its substantial pandemic-era monetary stimulus.

The S&P 500 share index drifted 0.1 per cent lower after lunchtime on Wednesday, having closed at record highs for the four previous sessions as investors cheered earnings updates that signalled large companies were managing inflationary pressures.

The Nasdaq Composite inched up 0.1 per cent, while Europe’s Stoxx 600 regional equity gauge added 0.4 per cent, closing at a record high for the third successive day.

Headline inflation in the US is running at more than 5 per cent. Improvements in the world’s largest economy from 2020’s shocks are expected to prompt the Federal Reserve to declare on Wednesday that it plans to reduce the crisis-era spending that has lowered borrowing costs since March last year.

The world’s most influential central bank telegraphed these intentions at its September meeting, where half of its policymakers also forecast the first post-pandemic rate rise next year.

The yield on the two-year US Treasury note, which moves inversely to the price of the debt and tracks interest rate expectations, hit an 18-month high of 0.55 per cent last week. The current Fed funds rate is slightly higher than zero.

Read more on the day’s market moves here.

China plans to quadruple nuclear weapons stockpile, Pentagon says

China plans to quadruple its nuclear stockpile by 2030, according to a Pentagon assessment that points to a shift in Chinese policy with big implications for the balance of military power.

The US defence department said China could have 700 deliverable nuclear warheads by 2027 and would boost its stockpile — currently estimated in the low 200s — to at least 1,000 warheads by the end of the decade. It marked a dramatic increase from last year’s estimate when the Pentagon said China was on course to double its stockpile.

“If this was an emoji, it would be the ‘eyes popping’ emoji,” said Caitlin Talmadge, an expert on Chinese nuclear weapons at Georgetown University.

The US has 3,800 warheads with 1,800 deployed, according to the Nuclear Information Project at the Federation of American Scientists.

The Pentagon’s 2020 China military power report, which was released on Wednesday, said Beijing was “expanding the number of land, sea, and air-based nuclear delivery platforms and constructing the infrastructure necessary to support this major expansion of its nuclear forces”.

The warning comes weeks after the Financial Times reported China had tested a nuclear-capable hypersonic weapon that General Mark Milley, chairman of the US joint chiefs, later said was “very close” to a “Sputnik moment”, referring to the USSR launching the first artificial satellite in 1957.

Read more on the Pentagon’s assessment here.

US puts Israeli spyware firm NSO Group on trade blacklist

The US has added NSO Group, the Israeli military spyware company that created software that has been traced to the phones of journalists and human rights activists, to a trade blacklist in an effort to tackle the growing surveillance threat posed by technology companies.

NSO and a smaller Tel Aviv-based company, Candiru, were among four companies added by the US commerce department on Wednesday to its so-called entity list, which would restrict exports of US technology to the companies.

Both are part of a growing Israeli cyber industry that often recruits veterans of the army’s elite units and sells software allowing clients to hack computers and cell phones remotely.

NSO’s licensed military-grade software, Pegasus, was last year revealed to have been used to target smartphones belonging to 37 journalists, human rights activists and other prominent figures.

The company has said repeatedly that it sells its weapon only to nations to fight terrorism and serious crime, and with the approval of the Israeli government. A spokesperson did not immediately respond to a message seeking comment.

Read more on the Israeli spyware firm blacklisted by the US.

Ford sales continue to recover as inventory improves

Ford’s sales in October continued to improve from an ugly dip in August, as the inventory available for customers to buy increased.

The Dearborn, Michigan carmaker sold about 176,000 vehicles last month, a 4 per cent decline from October 2020 but a 42 per cent improvement over the 124,000 sold in August.

A worldwide shortage of semiconductors has battered the car industry this year, with manufacturers struggling to produce enough cars and trucks to satisfy consumer demand.

Ford chief financial officer John Lawler said last week that while the carmaker expects “the scope and severity” of the shortage to diminish, supply problems could last into 2023.

But the latest numbers suggest chip constraints have eased at Ford in recent months. Andrew Frick, the company’s vice-president for sales in North America, said that increased inventory “made Ford the best-selling automaker in America for the second month in a row, which was last accomplished 23 years ago”.

US services sector growth hits record high in October

Activity in the US services sector hit a record high last month as declining Covid-19 cases boosted demand, although supply chain problems continued to weigh on activity.

The Institute for Supply Management’s index tracking non-manufacturing activity rose to 66.7 in October from 61.9 the month before, according to a survey published on Wednesday. A reading above 50 signals expansion.

October’s reading was the highest since the index began in 2008 and exceeded economists’ expectations that it would stay little changed at 62.

Activity was boosted by an increase in new orders and employment, although staffing remains a challenge. However, the report showed that inventories contracted for the fifth consecutive month, weighed down by supply chain disruptions and higher costs.

“In October, strong growth continued for the services sector . . . however, ongoing challenges — including supply chain disruptions and shortages of labour and materials — are constraining capacity and impacting overall business conditions,” said Anthony Nieves, chair of the ISM services business survey committee.

Rothermeres make offer to take Daily Mail publisher private

The Rothermere family has made an offer for the 64 per cent of the Daily Mail’s publisher that it does not already own, marking the end of a wholesale restructuring of the group.

The Rothermeres, who founded the group more than a century ago, have made an offer that values the Daily Mail and General Trust’s listed A shares at 1,263p each, a 16 per cent premium to Tuesday’s closing price. It has been recommended by the group’s independent directors.

The deal values the listed A shares at a total of £2.7bn. If approved, shareholders will receive 255p for each share, along with a 568p per share special dividend, a 17.3p per share final dividend and 0.5749 shares in Cazoo, a car trading website.

Wall Street slips from record as investors anticipate Fed meeting

Wall Street equities hovered near record highs and Treasuries were steady as traders awaited a decision from the US central bank about scaling back its substantial pandemic-era monetary stimulus.

The S&P 500 share index drifted 0.1 per cent lower after closing at record highs for the four previous sessions as investors cheered earnings updates that signalled large companies were managing inflationary pressures. The Nasdaq Composite was also 0.1 per cent lower.

Headline inflation in the US is running at more than 5 per cent, while improvements in the world’s largest economy from the shocks of 2020 are expected to prompt the Federal Reserve to declare on Wednesday it plans to reduce the crisis-era spending that has lowered borrowing costs since March last year.

The world’s most influential central bank telegraphed these intentions at its September meeting, where half of its policymakers also forecast the first post-pandemic rate rise next year.

Government bond markets have whipsawed in the past two weeks as traders speculated about how quickly the central bank would taper its monthly purchases of $120bn of Treasury notes and mortgage-backed securities and whether this would be a precursor to interest rate rises next year.

The yield on the two-year Treasury note, which moves inversely to the price of the debt and tracks interest rate expectations, hit an 18-month high of 0.55 per cent last week, while the current fed funds rate is just above zero.

Read more on today’s market moves here

US private sector adds 571,000 jobs in October

Private employers in the US added 571,000 jobs in October, according to payroll processor ADP, a sign that hiring picked up after businesses struggled to fill record-level job openings over the summer.

Service-sector employers hit hard by the pandemic led the way in hiring. The leisure and hospitality sector posted the biggest gain with 185,000 jobs added, followed by professional and business services and companies in the trade, transportation and utilities category.

The increase in private employment surpassed economists’ forecast for 400,000 new jobs and potentially sets the stage for a strong jobs report from the labour department this week.

However, the ADP and labour market surveys often diverge. In September, the ADP report found that private sector jobs rose by 523,000, while total non-farm payrolls grew by 194,000.

The labour department’s report on Friday is expected to show that employers added 450,000 non-farm jobs in October, which would snap two straight months of slower growth.

Michael Pearce, senior US economist at Capital Economics, said the ADP report suggested there was some “upside risk” to the group’s below-consensus forecast of 300,000 new jobs for the month.

“Either way, the big story in the labour market is the worsening shortages that are pushing up wage growth,” Pearce added.

Young borrowers drive US credit rebound

The youngest generation of borrowers is driving the rebound in US consumer credit, according to a new report by credit bureau TransUnion.

Generation Z, people aged 26 and younger, grew their average credit card balances by 14 per cent over the past year, bucking the broader trend of high paydown rates card issuers have reported throughout the pandemic. Average balance growth for millennials over the same period was less than 2 per cent.

Gen Z has repeatedly demonstrated a higher appetite for credit than millennials who came of age during the financial crisis, said Matt Komos, vice-president of research and consulting.

“Gen Z consumers have had the benefit of coming of age in one of the longest expansions of economic prosperity in American history,” Komos said.

Despite the higher activity among young consumers, overall credit card debt remains well below the record highs set in the quarters leading up to the pandemic as most consumers used extra cash to pay down balances. Economic expansions are historically correlated with rising debt levels, but loan balances have been stagnant this year even as consumer spending surpassed pre-pandemic levels.

Average debt per borrower was 14 per cent lower than in 2019.

Credit card lenders are eager to jump start loan growth and have been bombarding consumers with offers for new cards to attract new business. Those efforts resulted in a record 19.3m new credit card originations in the third quarter. Gen Z accounted for the largest growth in originations as many lenders targeted that demographic specifically, Komos said.

Covid infections pick up in Europe, says WHO

Covid-19 infections are rising in Europe while the number of coronavirus cases stabilises or falls in the rest of the world, the World Health Organization said in its latest update.

Cases in Europe rose 6 per cent in the week to October 31, WHO’s latest epidemiological update found on Wednesday, while they rose 3 per cent in the Americas and 2 per cent in the Western Pacific.

The Eastern Mediterranean region, where cases fell 12 per cent, reported the largest decreases followed by south-east Asia and Africa, where cases declined 9 per cent.

Deaths linked to coronavirus increased 8 per cent worldwide to more than 50,000 in the week to October 31, mainly driven by a 50 per cent increase in south-east Asia. In Europe, they rose 12 per cent and 10 per cent in the Western Pacific region.

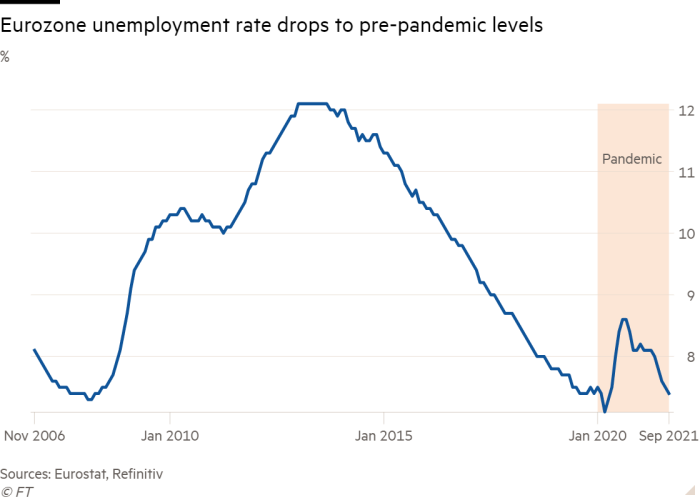

Eurozone joblessness slides to pre-pandemic levels as staff shortages abound

Eurozone unemployment has dropped to pre-pandemic levels as a strong economic recovery leaves many businesses struggling with staff shortages.

The jobless rate across the single currency region fell to 7.4 per cent in September, down from 8.6 per cent in the same month last year and 0.1 percentage points lower than in August, Eurostat data showed.

About 2m fewer Europeans looked for work compared with the same month last year, prompting unemployment to fall to levels of December 2019.

Jobless rates vary from 14.6 per cent in Spain to about 3 per cent in Germany and the Netherlands. However, all countries showed marked improvements over the past few months as the economy gathered pace.

Separate data from a recent business survey run by the European Commission revealed that about one in four eurozone businesses in the services and manufacturing sector cited a lack of workers as a factor limiting production in October. This was the highest proportion registered since the start of the survey in 1985, with the share rising to one in three in Germany.

Instead, the proportion of businesses reporting not enough demand dropped to a survey low.

Unemployment data has not been a comprehensive measure of the labour market during the pandemic as millions of workers were in government job support schemes.

However, the number of furloughed workers has fallen throughout the summer and in the autumn, with data for Germany showing about 600,000 workers in the scheme in September, down from a peak of 6m in April last year.

More timely data from Spain revealed that furloughed workers dropped to fewer than 200,000 from 3.6m in the spring last year.

Melanie Debono, senior Europe economist at Pantheon Macroeconomics, expects unemployment to fall in the coming month.

UK services activity boosted by strong demand but staff shortages persist

Business activity in the UK services sector rose sharply last month, as strong demand, staff shortages and supply chain disruption contributed to inflationary pressure ahead of a Bank of England decision on interest rates.

The IHS/Markit purchasing managers’ index for services was 59.1 in October, up from 55.4 the previous month, indicating a clear majority of survey respondents observed an increase in activity. The composite index, which includes manufacturing, was 57.8 per cent, the highest reading for three months and an increase on an earlier estimate made in October.

Rising costs for energy, fuel and raw materials drove price increases, and reported input cost inflation from survey respondents hit a survey record high. About 59 per cent of respondents reported an increase in average costs in October compared with 15 per cent last year.

The fast expansion and increased costs could put pressure on the Bank of England to raise interest rates at this week’s Monetary Policy Committee meeting. The central bank’s chief economist, Huw Pill, has told the Financial Times the decision on whether to increase the rate is “live”.

Duncan Brock, group director at the Chartered Institute of Procurement and Supply, said the rise in rates was “seemingly likely”, potentially putting pressure on UK household budgets even as it took the heat from the overinflating economy.

He said the current fast expansion of activity was driving job creation, but noted that managers were still worried about filling vacancies and rising input costs.

“Escalating business costs remain deeply concerning as salaries rocketed along with fuel and energy costs and material shortages as a result of supply chain disorder,” he said.

What to watch in the US

Fed decision: The Federal Reserve is widely expected to announce that it will begin scaling back its $120bn monthly bond-buying programme amid concerns about inflation. The Fed has signalled it is likely to reduce its purchases of Treasury securities by $10bn a month and agency mortgage-backed securities by $5bn, starting as early as mid-November. The Fed will issue its statement at 2pm ET, with Jay Powell holding a press conference 30 minutes later.

US earnings: It’s another busy day on the US earnings calendar with Qualcomm, Booking Holdings and Norwegian Cruise Lines among companies reporting results. Chipmaker Qualcomm’s quarterly update comes at a time when semiconductor shortages and supply chain disruptions have affected hamstrung carmakers and manufacturing. Meanwhile, results from Norwegian and Booking Holdings will offer clues on consumers’ appetite for travel.

Economic indicators: Hiring by the US private sector is expected to have cooled last month, with payrolls projected to have increased by 400,000 in October, compared with 568,000 the previous month. Investors will also watch the Institute for Supply Management’s non-manufacturing index, a gauge of service sector activity, which is expected to stay little changed at 62.

Guns: Supreme Court justices will hear arguments in a major Second Amendment case that questions how far states can go in regulating gun rights when weapons are carried outside of one’s home. The New York case has led to fears the court could dramatically expand the right to carry firearms in public.

Markets: Stock futures tracking the S&P 500 slipped 0.1 per cent as investors got ready for the Fed’s latest decision. The S&P 500 and Nasdaq Composite closed at record highs on Tuesday, while the Dow, fuelled by earnings, closed above 36,000 for the first time.

European stocks steady as investors anticipate Fed meeting

European equities held near record highs and bond markets were steady as traders awaited a decision from the US central bank about how quickly it will scale back its substantial pandemic-era monetary stimulus.

The Stoxx Europe 600 share index opened flat, after hitting all-time highs earlier in the week as investors cheered earnings updates that signalled large companies were managing inflationary pressures. London’s FTSE 100 drifted 0.1 per cent lower.

Futures markets tracking the US’s broad-based S&P 500 dipped 0.1 per cent after the share index closed at record highs for the four previous sessions.

Headline inflation in the US is running at more than 5 per cent, while improvements in the world’s largest economy following the shocks of 2020 are expected to prompt the Federal Reserve to declare it can now shrink its crisis-era spending that has lowered borrowing costs since March last year.

Government bond markets have whipsawed in the past two weeks as traders speculated about how quickly the central bank plans to reduce its monthly purchases of $120bn of Treasury notes and mortgage-backed securities, and whether the so-called tapering will be a precursor to interest rate rises next year.

“Investors are using the bond markets to play out their central bank forecasts,” said Rebecca Chesworth, senior strategist at State Street’s SPDR exchange traded fund unit. “But equity markets have got that calming factor of good earnings coming through.”

Wind turbine maker Vestas says renewable energy faces ‘challenging’ times

Wind turbine maker Vestas has warned that global supply chain hold-ups, rising energy prices and high raw materials costs were creating an “increasingly challenging” environment for renewable energy as it cut its profit margin guidance for the second time in three months.

The Danish group, one of the world’s top turbine manufacturers, painted a difficult picture for the industry a day after global leaders at COP26 in Glasgow had lauded clean energy technologies as critical to meeting goals to curb global warming.

The company on Wednesday cut its full-year profit margin guidance before special items to 4 per cent, having trimmed it to 5-7 per cent in August from 6-8 per cent.

The move came after Vestas suffered a 21 per cent fall in earnings to €325m before interest, taxes and special items in the third quarter compared with the same period a year ago, pushing its profit margin for the three months down to 5.9 per cent versus 8.6 per cent last year. This was despite a 16 per cent increase in revenue to €5.54bn as demand for turbines and related services remained high.

The group has maintained its full-year revenue guidance since the second quarter but chief executive Henrik Andersen blamed the cut in its profit margin outlook on “supply chain instability and rising energy prices as well as accelerated cost inflation from raw materials, transport, and turbine components”.

Andersen warned the problems were expected to persist in 2022.

UK’s Landsec scoops up majority stake in Salford’s MediaCity

Landsec has bought a majority stake in MediaCity, home to the BBC and ITV, for £425.6m as the UK commercial landlord bets that city centres will enjoy a post-pandemic revival.

The group’s purchase of three-quarters of the 37-acre media and technology hub in Salford, Greater Manchester, comes two days after it offered to buy regeneration-focused developer U+I and invest up to £800m over the next five years.

MediaCity, which has a gross asset value of £567.5m and is the UK’s biggest tech and media hub outside London, was previously owned by a joint venture between Legal & General and Peel L&P. Landsec will partner with Peel L&P, which will keep a 25 per cent stake.

Landsec’s purchase of the waterside area, which also houses THG, Kellogg’s and more than 250 tech businesses, includes £293.6m of debt, reducing its equity investment to £207.6m.

Next sales uplift to be offset by higher costs

Next left its full-year profit forecast unchanged despite a better than expected performance in the third quarter, saying that much of the benefit of higher sales in recent weeks would be consumed by higher costs.

Over the past five weeks, the fashion retailer has beaten its internal sales forecast by £14m. Across the third quarter as a whole, full-price sales excluding finance income were 18.7 per cent higher than the same quarter before the pandemic.

But the company said on Wednesday that the additional profit would be “largely offset” by investment in digital marketing and the increased use of air freight to overcome supply chain problems.

It also said it expected the impact of pent-up demand to wane in the fourth quarter and that inflationary pressure on household budgets could reduce discretionary spending.

Fourth-quarter sales growth is still expected to slow to about 10 per cent.

Next upgraded its full-year forecast in September and expects to make an adjusted pre-tax profit of £800m, its highest level since 2016. The average of analysts’ forecasts is around the same level.

Anglo’s head of strategy Wanblad to take over from Cutifani as chief executive

Anglo American has named South African Duncan Wanblad as chief executive, replacing Mark Cutifani who is stepping down after nine years in the role.

The appointment of the 54-year-old head of strategy and business development had been expected by analysts and investors, although most anticipated his move after the completion of a big copper project in Peru next year.

Cutifani, 63, who has become synonymous with the company, will be a tough act to follow. Under the avuncular Australian, Anglo has been transformed from the sector’s laggard into a miner that arguably has better growth potential than rivals Glencore, Rio Tinto and BHP.

As head of Anglo’s copper business Wanblad drove the development of the Quellaveco copper mine in Peru, which is due to come on stream next year. He also masterminded the acquisition of Sirius Minerals, a deal that will take Anglo back into the fertiliser market.

Anglo maintains a large presence in South Africa, where it mines platinum group metals, iron ore and diamonds.

Average UK house price surpasses £250,000 for first time

The average price of a UK home was more than £250,000 for the first time last month, as house price growth continued to run higher than before the pandemic.

House prices rose 9.9 per cent in October compared with the previous year, monthly figures by Nationwide building society showed, down slightly from 10 per cent in September. Month on month, prices increased 0.7 per cent.

The price of the average UK home has risen by more than £30,000 since the start of the Covid-19 pandemic as more people sought to move house during lockdown and the government acted to protect property prices despite a hit to the economy by cutting tax on housing transactions.

Robert Gardner, Nationwide’s chief economist, said demand for homes had remained strong despite the end of the stamp duty holiday on September 30. Mortgage applications in September were more than 10 per cent above the monthly average recorded in 2019, he said.

“Combined with a lack of homes on the market, this helps to explain why price growth has remained robust,” Gardner said.

However he said a range of factors, including falling consumer confidence, could hit house prices.

Analysts say a rise in borrowing costs could cool house prices over the coming months as lenders respond to accelerating inflation and the likelihood of a Bank of England interest rate rise by increasing the ultra-low mortgage rates that have, in part, fuelled the boom.

The looming rise in mortgage rates “represents a much bigger threat to house prices”, Samuel Tombs, chief UK economist at Pantheon Economics, said.

Turkish inflation reaches highest level in almost 3 years

Inflation in Turkey crept higher again in October, reaching its worst level in almost three years.

Consumer prices rose by 19.89 per cent on an annual basis, according to data published by the Turkish Statistical Institute, up from 19.58 per cent the previous month and the fastest rate of increase since January 2019.

The October data, though slightly lower than forecast by analysts, will nonetheless fuel dismay among economists and Turkish opposition parties at the stance of the country’s central bank.

Acting under the close watch of president Recep Tayyip Erdogan, a notorious opponent of high interest rates, the bank has been lowering borrowing costs even as inflation has reached close to four times its official 5 per cent target.

President Erdogan has faced mounting public discontent at the rising cost of basic goods. Annual food price inflation stood at more than 27 per cent last month, according to the latest data.

Lufthansa posts first profit during the pandemic

Lufthansa beat analysts’ expectations to post a quarterly profit for the first time since the pandemic began, benefiting from a surge in bookings as international borders reopen.

The German group, which is in the process of slimming down its business and is axing 30,000 staff, eked out earnings of €17m ($19.7m) before interest and taxes for the three months to the end of September.

In the previous quarter, Lufthansa booked a loss of more than €950m.

The Frankfurt-based carrier said that although the 19.6m passengers it had carried in the last quarter represented just 46 per cent of pre-crisis 2019 levels, new bookings had surged to 80 per cent of pre-pandemic norms.

“We are back to black,” said chief executive Carsten Spohr, “now it is a question of continuing on the path of successful change”.

The planned opening of the US border to travellers from Europe on 8 November generated “a boom in demand in recent weeks”, the airline said. “Since the announcement of the opening, the number of weekly bookings has increased by 51 per cent compared to the previous weeks.”

Lufthansa’s cargo business also posted record earnings before interest and taxes of €301m for the quarter. The division continued to benefit from high demand, caused in part by limited freight capacity in passenger planes.

Lufthansa, which employed almost 137,000 people at the start of the pandemic, said its total headcount was now down to 107,000 as the response to voluntary redundancy schemes “significantly exceeded original expectations”.

What to watch in Europe today

COP26: The summit will shift focus, seeking to mobilise public and private financing of its climate goals. On Tuesday, more than 100 global leaders pledged to halt deforestation in their countries by 2030.

EU: The eurozone’s purchasing managers’ index for services will be published by IHS Markit on Wednesday. The zone’s manufacturing PMI fell to an eight-month low of 58.3 in October, with supply-side issues disrupting output and denting order book volumes.

UK: IHS Markit will also release data on the strength of the UK’s services sector. Economic recovery in the UK regained momentum in October, with an increase in the PMI driven by services, which account for about 80 per cent of the total economy.

Next: The UK fashion retailer releases its third-quarter results on Wednesday. Next upgraded its forecasts for the fourth time in September, predicting its full-year profit would rise to a five-year high, fuelled by pent-up demand for clothing, record levels of household saving and a drop in overseas holidays.

Republican Glenn Youngkin wins Virginia governor’s race

Republican Glenn Youngkin has won the Virginia governor’s race in a crushing result for President Joe Biden and his Democratic party with just a year to go until midterm elections.

Youngkin, the former co-chief executive of the private equity group Carlyle, was projected as the winner of the contest against Democrat Terry McAuliffe by the Associated Press in the early hours of Wednesday.

In another ominous sign for Democrats, a second governor’s race in New Jersey was still too close to call after a contest that incumbent Phil Murphy had been projected to win by a wide margin turned into a nail-biter.

With an estimated 96 per cent of votes counted, Youngkin led in Virginia with just shy of 51 per cent of the vote, compared with 48.4 per cent for McAuliffe, according to the AP. More than 3m Virginians voted in Tuesday’s election.

Read more about the governor’s race here.

ByteDance founder to give up final executive position

ByteDance’s Zhang Yiming is stepping down as chair of the Chinese social media giant he founded almost a decade ago, relinquishing his last formal executive position at the company, according to a person familiar with the matter.

Zhang led the Beijing based company to create a string of hit apps like viral video programs TikTok and Douyin, but found himself in the centre of a geopolitical storm last year as the Trump administration tried to force the sale of part of its global business.

In May he announced he would step down as ByteDance chief to work on “longer-term initiatives”, saying that his introverted personality made him less than an “ideal manager”. At the same time, he also began to transition the chair role to his successor and co-founder Liang Rubo, the person said.

Zhang remains a senior adviser at the company and still comes into the office, but does not yet have a new formal title, the person added.

By Wednesday, ByteDance’s leadership page on its website, which earlier this year showed Zhang and investors who sit on the company’s global board, had disappeared.

Chinese premier says economy facing ‘downward pressure’

Chinese premier Li Keqiang said the country was facing “downward pressure”, in a sign of official recognition of the problems facing the world’s second-largest economy.

As well as new Covid-19 restrictions, recent obstacles to Chinese growth have included power shortages, rising food costs and the struggles of its heavily-indebted property sector.

During a visit to the State Administration for Market Regulation, the country’s top regulator, Li said that greater support was needed for small and medium-sized enterprises, including reducing fees and taxes.

Li said the pressure had arisen for “multiple reasons”, but did not list them. He added, however, that China needed to ensure the stable price and supply of coal and electricity, which authorities have sought to control in recent months after shortages.

Power deficits and property sector woes pushed China’s manufacturing activity to contract for the second consecutive month in October, with the official manufacturing PMI coming in at 49.2, below the 50-point threshold that differentiates expansion from contraction.

Ant-backed Kakao Pay shares soar after IPO

Shares in South Korea’s most popular mobile payments app more than doubled on Wednesday as it made its stock market debut in Seoul.

Shares rose sharply from their price of Won90,000 ($76.50) to trade as high as Won230,000 before falling back down to Won189,000, according to data from Refinitiv.

Kakao Pay, which is 39 per cent owned by Jack Ma’s Ant Group, the Chinese financial technology company, had planned to launch an IPO in August. But the listing was delayed after regulators asked Kakao Pay to revise its prospectus amid concerns about high valuations in the country.

The company was spun off from Kakao Corp, its parent company, in 2017 and offers mobile payment, remittance, insurance and loan services.

South Korean regulators have intensified scrutiny of big IPOs in recent months over concerns that valuations were overpriced.

Krafton, the Korean gaming company backed by Chinese internet group Tencent, was forced to lower its IPO price by more than 10 per cent and cut the deal size by almost a quarter in July after regulators asked for more information on how it came up with its listing price.

Read more about the Kakao Pay IPO here.

Biden promises vaccines for children will come within days

Joe Biden has promised young children in the US will have access to Covid-19 vaccines within days after the US Centers for Disease Control and Prevention gave the final go-ahead for BioNTech and Pfizer to supply their vaccine to people under 12.

The US president said on Tuesday evening that the children’s vaccination programme would start almost immediately and be at capacity by next week following the CDC’s decision.

Biden said in a statement: “We have reached a turning point in our battle against Covid-19: authorisation of a safe, effective vaccine for children age five to 11. It will allow parents to end months of anxious worrying about their kids, and reduce the extent to which children spread the virus to others. It is a major step forward for our nation in our fight to defeat the virus.”

Pfizer had begun shipping children’s doses of its vaccine to medical centres around the country in anticipation of the decision. The doses are roughly a third as powerful as those given to older children and adults.

CDC advisers back Covid vaccine for children aged 5 to 11

A panel of top US scientific experts has backed the use of the BioNTech/Pfizer Covid-19 vaccine for children aged five to 11, paving the way for the nationwide rollout of jabs for younger children.

An advisory committee to the Centers for Disease Control and Prevention voted unanimously on Tuesday to authorise the vaccine — a decision which is expected to be formally signed off by CDC director Rochelle Walensky imminently.

The Biden administration plans to begin vaccinating children as early as this week and has enlisted more than 20,000 paediatricians, family doctors, pharmacies and other providers to administer the jabs. The Pfizer shot will be administered in “kid-sized” doses which are a third of the size of jabs for people aged 12 and over.

Earlier at the meeting, Walensky told committee members it was important to get as many people vaccinated as possible against Covid-19, including children.

“In this most recent Delta wave, we saw pediatric admission rates higher than they had [been] in any previous wave of the pandemic, reaching a rate of 25 hospitalisation per 100,000 per year in children between the ages of five to 11,” she said.

However, the Biden administration faces a challenge owing to high levels of vaccine hesitancy with almost a third of parents saying they would not get their children immunised.

Democrats nearing deal on ‘Salt’ cap on federal tax deductions

Democratic lawmakers appeared to near a deal on the so-called “Salt” cap on federal tax deductions for state and local taxes on Tuesday, in a win for House moderates from wealthier states who have long railed against the policy.

Donald Trump’s 2017 tax reforms limited the amount households could deduct in state and local property taxes from their federal income tax at $10,000, in a move that hit homeowners in states with high state and local property taxes, such as New York, New Jersey and California. Critics accused the then-president of unfairly punishing voters in “blue” states that voted against him 2016.

A small group of House Democrats, led by Josh Gottheimer of New Jersey, have led efforts to include a reversal of the tax changes in President Joe Biden’s “Build Back Better” plan, threatening to withhold support for the wider bill unless the cap is eliminated. But progressive critics have opposed the move, saying it would disproportionately benefit rich Americans.

Lawmakers seemed to be nearing a deal to scrap the cap for five years on Tuesday. Democrats on Capitol Hill are now weighing a five-year suspension of the cap, through 2025, retroactively applied to include the current tax year, according to one person briefed on the negotiations.

Gottheimer issued a joint statement on Tuesday with fellow New Jersey Democrat Mikie Sherrill and New York Democrat Tom Suozzi, saying the cap “remains a punishing blow to our home states . . . as we work to recover from the pandemic and get our economies on strong footing and our constituents back to work”.

“Today’s news is encouraging for a Salt cap repeal to be included in the final reconciliation package,” they added, saying they would “continue to work” with Democrats in the House and Senate on the issue.

But it remained unclear whether all 50 Democratic senators would sign up to such a move. Bernie Sanders, the progressive Vermont senator, issued a scathing statement on Tuesday evening saying “the last thing we should be doing is giving more tax breaks to the very rich”. Sanders said he was “open to a compromise approach” to protect the “middle class in high tax states”, but added: “I will not support more tax breaks for billionaires.”

Lyft brushes off driver shortage concerns in forecast-beating quarterly result

Ride-sharing company Lyft, Uber’s only significant rival in the US market, reported strong earnings for its third quarter.

For the second consecutive period, Lyft said it had achieved adjusted ebitda (earnings before interest, taxation, depreciation and amortisation) profitability, the preferred (but sometimes maligned) measurement for the underlying health of the ride-sharing businesses.

It got there with revenues of $864m, up 73 per cent on the same period last year, and 13 per cent on this year’s second quarter. Analysts expected $860m. Net income came in considerably better than Wall Street had hoped, with losses of $71.5m versus estimates of almost $200m.

In the wake of continued widespread labour shortages, chief executive Logan Green said driver supply was up nearly 45 per cent on the same quarter last year.

“We are well positioned for a continued recovery and I’m excited to build on the momentum in our business,” Green said.

Lyft’s shares were up more than 6 per cent in immediate after-hours trading. Uber reports its third quarter earnings on Thursday, having all but promised investors its first ever quarter of adjusted ebitda profitability.

What to watch in Asia today

New Zealand: The country will release a series of data, including figures for quarterly employment, labour costs and the Reserve Bank of New Zealand’s report on financial stability.

Purchasing managers’ indices: October services PMIs for India, Japan and China come out today, as do manufacturing PMIs for Hong Kong and the Philippines. The indices are measures of whether sectors report an overall expansion or contraction in activity month-to-month.

Sydney Film Festival: The festival will commence today after being postponed twice because of the pandemic.

Japan culture day: Japan takes a one-day holiday to celebrate culture, arts and academia. The stock market is closed.

Malaysia monetary policy: The southeast Asian country is expected to keep its benchmark interest rate at a record low of 1.75 per cent, according to economists polled by Bloomberg, to support an economy hit hard Covid-19 lockdowns.

US stocks close at records ahead of Fed decision

Wall Street climbed to fresh record highs and the Dow closed above 36,000 for the first time ahead of the Federal Reserve’s latest monetary policy decision.

The S&P 500 closed up 0.4 per cent to notch another record intraday high and closing high, as investors cheered a quarterly earnings season that has exceeded analysts’ expectations. This is the fourth consecutive day of record highs.

The technology-focused Nasdaq Composite was up 0.3 per cent at the bell and notched a record close. The Dow Jones Industrial Average rose 0.4 per cent to close above 36,000 for the first time.

The moves come ahead of the Fed’s latest monetary policy decision tomorrow, when the central bank is expected to announce that it will begin tapering its $120bn monthly asset purchases. The taper has been fully priced into the market, but investors will be listening closely for hawkish signals in the announcement that could indicate when rate rises might begin.

The 2-year Treasury yield, which tracks US monetary policy expectations, declined 0.06 percentage points to 0.44 per cent after touching an 18-month high last week. Bond yields move inversely to prices.

Read more on today’s market moves here.

Comments