A limited liability partnership (“LLP”) is generally viewed as an alternative corporate business vehicle that provides the benefits of limited liability but allows its members the flexibility of organising their internal structure as a partnership based on a mutually arrived agreement. An LLP is one of the modes used by investors to invest or set-up business in India. In this primer, we have covered frequently asked questions related to LLPs.

1. What is an LLP?

What are the governing laws of an LLP? An LLP is a body corporate, and a legal entity separate from its partner. An LLP has perpetual succession. In India, an LLP is governed by the Limited Liability Partnership Act, 2008 (“LLP Act”) and rules made thereunder.

2. What are the steps to incorporate LLP?

2.1. The first step of incorporating an LLP involves reservation of name. An application for reservation of the name can be made through the web service, Reserve Unique Name LLP, available at the website of Ministry of Corporate Affairs (“MCA”).

2.2. Following the reservation of name, an LLP can be incorporated by making an application through the online portal of the MCA to the Registrar of Companies (“RoC”) having the jurisdiction over the state in which the LLP has its registered office.

2.3. Within 30 days of incorporation of the LLP, the limited liability partnership agreement should be executed by the partners and filed with the RoC. The limited liability partnership agreement lays down the inter-se rights, liabilities, and duties of the partners.

3. What are some of the typical terms of a limited liability partnership agreement?

3.1. The limited liability partnership agreement generally provides the mutual rights and duties of partners of an LLP inter-se and those of the LLP and its partners.

3.2. Some of the terms that a limited liability partnership agreement covers, include:

- Registered office of the LLP;

- Nature of business of the LLP;

- Rights of the partners;

- Contribution and profit share of the partners;

- Voting rights;

- Process for change in partner;

- Transfer/ assignment of rights; and

- Dispute resolution

3.3. In the absence of limited liability partnership agreement, the mutual rights and duties of the partners inter-se and those of the LLP and the partners are determined by the provisions of First Schedule of the LLP Act. Some of the provisions under the First Schedule include:

- Equal share of the partners in the capital, profit and losses of the LLP;

- Partners shall indemnify the LLP for any losses caused to it by his fraudulent action in conducting the business of the LLP;

- No remuneration for partners for acting in the business or management of the LLP;

- Prior consent of all partners for admission of new partners;

- Matters or issues relating to the LLP to be decided by a resolution passed by a majority in number of partners;

- Recording the decisions of the LLP in minutes within 30 days of taking the decision;

- Each partner to render true accounts and full information of all things affecting the LLP; and

- All disputes between the partners should be referred for arbitration as per the provisions of the Arbitration and Conciliation Act, 1996.

4. Who can be a partner in an LLP? What are the compliances under the LLP Act for appointment of a partner?

4.1. An LLP must have a minimum of two partners. If an LLP has less than 2 partners for a period of at least 6 months, then the sole partner of the LLP shall be personally liable for the obligations of the LLP during the period for which the LLP has less than 2 partners.

4.2. The partners of an LLP can be individuals and/or body corporates. An LLP can also be a partner in another LLP. In addition, an individual who is a partner in an LLP must not:

- be declared to be of unsound mind by court;

- be an undischarged insolvent; or

- have applied to be adjudicated as an insolvent.

4.3. A person can be appointed as a partner pursuant to the limited liability partnership agreement. A person can become a partner in an LLP by making capital contribution into the LLP or acquiring profit share in the LLP. In case the partner is a foreign partner then the consideration for acquisition of capital contribution or profit share is required to be made through normal banking channels and must be at a price not less that the fair market value as determined by a chartered accountant following internationally accepted valuation methods. If the capital contribution or profit share is for non-cash consideration or below the fair market value, then prior approval of the Reserve Bank of India will be required by such foreign partner for becoming a partner in the LLP. Foreign investment by a foreign partner in an LLP constitutes foreign direct investment (“FDI”) and is required to be reported to the Reserve Bank of India.

4.4. In case of appointment of a new partner, the LLP is required to amend its limited liability partnership agreement. Further, Form 3 is required to be filed with the RoC within 30 days of the amendment of the limited liability partnership agreement. In addition, the Form 4 (along with consent of the person to act as a partner) is required to be filed with the RoC within 30 days of appointment of the partner.

5. What are the provisions relating to FDI in an LLP?

5.1. A person resident outside India or an entity incorporated outside India (other than a citizen of or an entity incorporated in Pakistan or Bangladesh), not being a Foreign Portfolio Investor or a Foreign Venture Capital Investor, may contribute to the capital of an LLP operating in sectors or activities where foreign investment up to 100 per cent is permitted under automatic route and there are no FDI linked performance conditions.

5.2. Downstream investment by an LLP which is not owned and controlled by resident Indian citizen or owned or controlled by person resident outside India is allowed in an Indian company in sectors where foreign investment up to 100% is permitted under the automatic route and there are no FDI linked performance conditions.

5.3. Investment in an LLP is subject to the compliance of the conditions of the LLP Act.

5.4. An LLP having foreign investment, engage in a sector where foreign investment up to 100% is permitted under the automatic route without any FDI linked performance conditions, may be converted into a company under the automatic route and vice-versa.

5.5. Investment in an LLP can be made either by way of capital contribution or by way of acquisition or transfer of profit shares. This should be achieved at a price not less than the fair market value as determined by a chartered accountant following internationally accepted valuation methods.

5.6. In case of transfer of capital contribution or profit share from a person resident outside India, the transfer should be made for a consideration not less than the fair market value. In case of transfer of capital contribution or profit share from a person resident outside India to a person resident in India, the transfer shall be for a consideration which is not more than the fair market value.

6. What is the liability of a partner in an LLP?

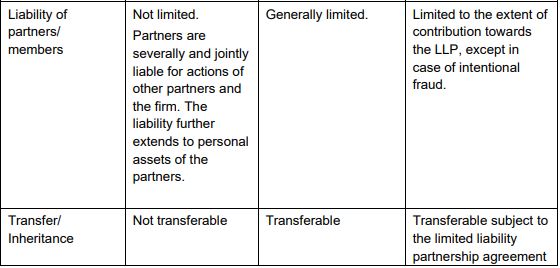

6.1. The obligation of an LLP whether under contractual arrangements or otherwise is the sole obligation of the LLP and will not extend to its partners. The obligations of the LLP are required to be met through the property of the LLP. The liability of a partner of an LLP, except in case of fraud, is limited to such partner’s contribution in the LLP as provided under the limited liability partnership agreement.

6.2. A partner acts as an agent of only the LLP and not as an agent of the other partners of the LLP. An LLP can be held liable for wrongful acts or omissions of a partner which are undertaken by the partner as a part of the LLP’s business or with the authority of the LLP. However, an LLP will not be liable for acts undertaken by a partner if such partner does not have the requisite authority to undertake an action on behalf of the LLP and the person dealing with the LLP is aware that the partner does not have such authority.

7. Who can be a designated partner?

7.1. Any partner can be designated as the designated partner in an LLP. In case of a body corporate which is a partner in an LLP, the body corporate can appoint an individual as a nominee to act as designated partner on its behalf. In case of an LLP in which all the partners are body corporates, nominees of such body corporates shall act as designated partners. 7.2. An individual can be a designated partner in an LLP if such individual:

- has provided prior consent to act as designated partner;

- has not been adjudicated insolvent in the past 5 years;

- has not suspended payments to creditors or made composition with creditors in the past 5 years;

- has not been convicted by a court for any offence involving moral turpitude and has not been sentenced in this respect to imprisonment for a term of at least 6 months; and

- has not been convicted by the court for any offence involving the intent to defraud the creditors of the LLP or any other person or an act carried out for any fraudulent purpose or for conducting the affairs of the LLP in a fraudulent manner.

8. What are the statutory obligations and liabilities of a designated partner?

8.1. An LLP is required to have at least two designated partners. At least one of designated partner of an LLP should be resident in India i.e., the person should have stayed in India for a period of at least 182 days during the immediately preceding one year.

8.2. Under the provisions of the LLP Act, designated partners are responsible for all acts required to be undertaken by an LLP in respect of compliance of the LLP Act including filing of documents, returns, statements or reports under the LLP Act. The designated partner will be liable for penalties imposed on the LLP for non-compliance of these acts.

8.3. Some of the statutory obligations of a designated partner under the LLP Act are provided below:

- signing the annual statement of account and solvency on behalf of the LLP;

- signing and authenticating the notice to be sent to the RoC with respect to any change in information relating to partners of the LLP, including admission of new partners or cessation of existing partners; and

- ensuring that any order passed by a tribunal with respect to compromise, or arrangement, or reconstruction is duly filed with the RoC.

8.4. Apart from the statutory obligations, the limited liability partnership agreement may provide additional responsibilities of the designated partners or provide for delegation of powers by partners to the designated partners in case of body corporates.

9. Can an existing partnership firm be converted to LLP?

9.1. An existing partnership firm can be converted into an LLP by complying with the provisions of the LLP Act if the partners of the LLP so converted comprises of all the partners of the partnership firm and no one else.

9.2. An application in this regard can be made by filing Form 17 along with form FiLLiP (incorporation form) with the RoC. The application should also contain a statement by all the partners in the format prescribed in Form 17. Upon approval, the RoC will issue a certificate of registration.

9.3. The converted LLP will be required to inform the concerned registrar of firms with which it was registered about the conversion and of the particulars of the LLP within 15 days of registration.

9.4. Any existing agreement or contract or pending proceeding or continuance of conviction, ruling, order or judgment of which the partnership firm was a part prior to conversion, will continue to have the same effect as if the converted LLP were a part of the same. Further, every partner of the partnership firm which has been converted into an LLP, shall continue to be personally liable for the liabilities and obligations of the partnership firm which were incurred prior to the conversion or which arose from any contract entered prior to the conversion.

10. Can a company be converted into an LLP?

10.1. A private limited company or an unlisted company can be converted into an LLP under the provisions of the LLP Act.

10.2. A private limited company or an unlisted company can convert into an LLP only if:

- there are no security interests in its assets subsisting or in force at the time of application; and

- the shareholders of the company become the only partners of the LLP to which it is converted.

10.3. The application for this purpose should be made in Form 18 along with form FiLLiP (incorporation form) before the RoC. The Form 18 should also be accompanied with the statement of the shareholders of the applicant company as prescribed in the form.

10.4. Any existing agreement or contract which the company was a part prior to the conversion will continue to have the same effect as if the converted LLP were a part of the same. Similarly, any existing appointment in any role or capacity which is in force prior to the conversion, or the authority or power conferred on the company which is in force immediately prior to the date of registration of conversion shall have the same effect as if the LLP was appointed for the role or was conferred with authority or power.

10.5. An LLP can also be converted into a private limited company by complying with the provisions of the Companies Act 2013 and the relevant rules made thereunder.

11. What are the documents required to be filed by an LLP annually?

11.1. An LLP is required to file statement of account & solvency in Form 8 and annual return LLP in Form 11 annually.

11.2. The annual return is required to be filed within 60 days of close of the financial year and statement of accounts & solvency shall be filed within 30 days from the end of six months of the financial year to which it relates.

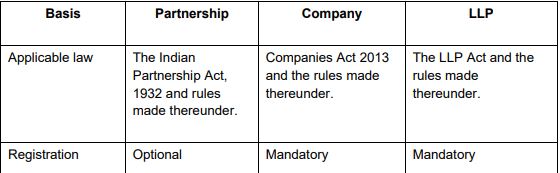

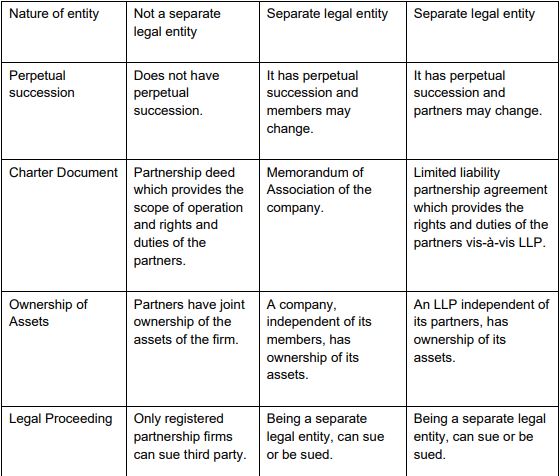

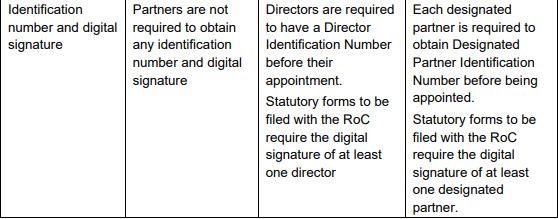

12. What are the key differences between an LLP, a company and a partnership firm under the Indian legal regime?