What Is Proof Of Funds (POF)?

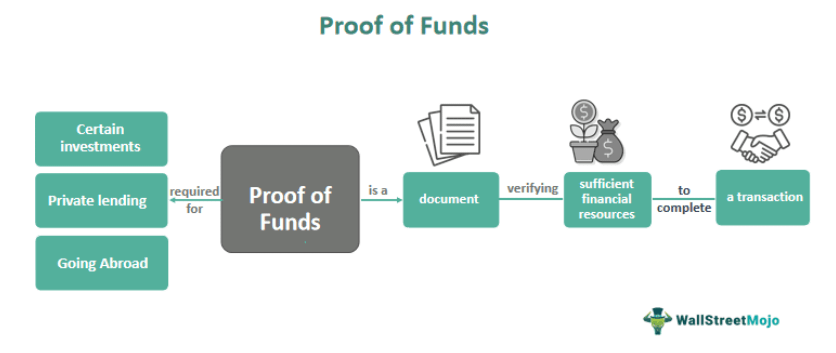

Proof of Funds (POF) is a document or bank statement that verifies that an individual or organization has sufficient financial resources to complete a transaction or investment. Its purpose is to validate funds, and it can take many forms, depending on the requirements of the requesting party.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Proof Of Funds (wallstreetmojo.com)

It is vital because financial institutions or investors often require it before approving a loan, extending credit, or making a significant investment. It could be a bank or financial institution letter confirming that the individual or organization has the necessary funds, a bank statement showing the account balance, a line of credit, or a certificate of deposit.

Table of contents

Key Takeaways

- Proof of Funds (POF) is a document or letter that shows a person has the necessary funds.

- POF is required by various institutions, such as banks, immigration departments, and private lenders, to ensure that the applicant has the financial capacity to undertake a specific transaction or support themselves during their stay in a foreign country.

- The required amount of funds for POF varies depending on the transaction or country, and it is typically determined by the institution requesting the POF.

- POF can be demonstrated through bank statements, investment portfolios, property deeds, or letters from financial institutions confirming the availability of funds.

Proof Of Funds Explained

Proof of Funds (POF) is a document that provides evidence that an individual or organization has the financial resources necessary to complete a transaction or investment. It is demanded by parties involved in business deals to ensure that the sender has the necessary funds to complete the transaction.

POF can take various forms, including bank statements, letters from financial institutions, line of credit statements, or certificates of deposit (CD). The document must indicate the sender’s financial standing, the source of the funds, and the availability of the funds.

POF is commonly required in real estate transactions, international trade, and other business deals involving significant amounts of money. For example, a home buyer may need to provide POF to demonstrate that they have enough funds to purchase a property.

The recipient typically requests the POF document, who may require it. Once the document is provided, the recipient can review it. It confirms that the sender has the necessary funds to complete the transaction. However, it is important to note that POF is not the same as proof of income. POF only confirms that an individual or organization has the necessary funds to complete a transaction. Although, it does not indicate the source of the funds or the ability to generate additional income.

How To Get?

To obtain Proof of Funds, one must have sufficient funds in their bank account or another financial institution. The exact process of obtaining proof of funds can vary depending on the requirements of the requesting party, but here are some general steps that may be involved:

- Contacting the financial institution: One should contact their bank or financial institution to request a letter or statement confirming their available funds. It is important to ask the financial institution what specific information they must include in the document, such as the account balance, account holder’s name, and contact information.

- Providing the necessary information: The financial institution will likely require some personal information to generate the document, such as the account holder’s name, account number, and other identifying information.

- Reviewing the document: Once generated, one should review it carefully to ensure that it accurately reflects their financial standing and includes all the necessary information. If any discrepancies or errors are found, they should be addressed with the financial institution.

Examples

Let us look at the examples to understand the concept better.

Example #1

As per an article by Business Today, proof of funds (POF) requirements for Express Entry applicants in Canada have been increased. Proof of funds is required to ensure that applicants have enough money to support themselves and their dependents during their initial stay in Canada and prevent them from burdening the Canadian social assistance system.

The new requirement mandates that single applicants must have a minimum of 13,757 Candian dollar, families with one child must have 17,127 Candian dollar, and families with two children must have 21,055 Candian dollar in settlement funds. Also, the article elaborates that Express Entry is Canada’s flagship application management system for key economic immigration programs. Thus, this change in settlement fund requirements aims to ensure that newcomers to Canada are financially stable and able to support themselves and their families. At the same time, they settle and integrate into Canadian society.

Example #2

A potential home buyer is interested in purchasing a house that costs $500,000. The buyer is planning for a mortgage of $400,000. But, they still need to come up with the remaining $100,000 to complete the purchase.

The buyer contacts a private lender willing to lend them the $100,000. But the lender requires Proof of Funds before they can approve the loan. Thus, the lender wants to ensure the buyer has the necessary funds to complete the purchase and that they’re taking on only a little debt.

In this case, the buyer must provide a bank statement from their financial institution confirming $100,000 in available funds. Thus, this document would serve as Proof of Funds and help the private lender feel confident in the buyer’s ability to complete the transaction.

Financial Modeling & Valuation Courses Bundle (25+ Hours Video Series)

–>> If you want to learn Financial Modeling & Valuation professionally , then do check this Financial Modeling & Valuation Course Bundle (25+ hours of video tutorials with step by step McDonald’s Financial Model). Unlock the art of financial modeling and valuation with a comprehensive course covering McDonald’s forecast methodologies, advanced valuation techniques, and financial statements.

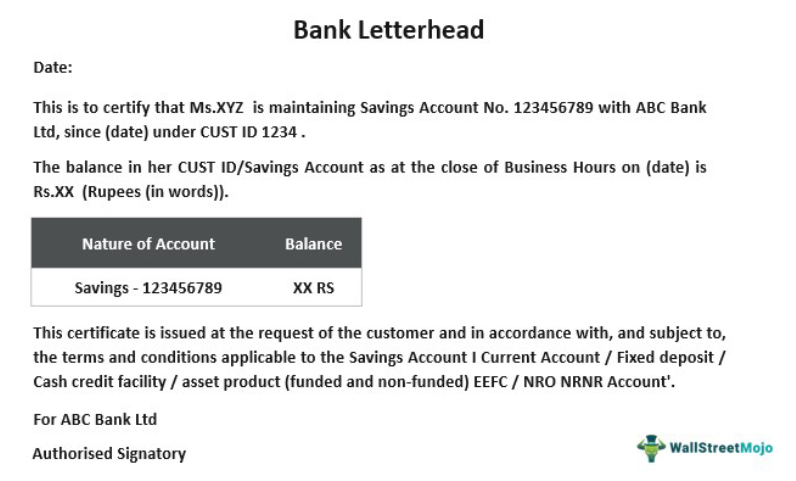

Letter Sample

Below is a template of POF in the form of a bank statement that validates the bank balance of the person in question that will serve the purpose of a particular transaction.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Proof Of Funds (wallstreetmojo.com)

Proof Of Funds vs Pre-Approval

Let us look at the differences between POF and pre-approval.

| Feature | Proof of Funds | Pre-approval |

|---|---|---|

| Purpose | To demonstrate that the borrower has the necessary funds to complete a transaction | To indicate that a lender has assessed the borrower’s creditworthiness and determined that they are eligible for a loan up to a certain amount |

| Required for | Cash transactions, private lending, and certain investment opportunities | Mortgage applications and making offers on properties |

| Information needed | A bank statement or letter from the financial institution confirming the availability of funds | Information about the borrower’s income, assets, and credit history |

| Processing time | Can be obtained quickly if funds are readily available | It can take several days to several weeks to process, depending on the lender and the borrower’s circumstances |

| Applicability | Generally applicable to all types of transactions | Generally applicable to real estate transactions and mortgages |

Frequently Asked Questions (FAQs)

To show Proof of Funds for Canadian immigration, applicants must provide bank statements or other documents from a financial institution. It should show they have enough money to support themselves and their dependents during their stay in Canada. The required amount depends on the number of family members.

Solicitors typically check Proof of Funds during the conveyancing process, which is the legal transfer of property ownership. The buyer must provide proof that they have the necessary funds to complete the transaction before the sale can proceed.

Proof of Funds can be withdrawn once the transaction is complete or the purpose is fulfilled. However, if it is required for immigration purposes, the funds must be maintained until the end of the applicant’s initial stay in the country.

Yes, in some cases, a pension can be used as Proof of Funds if it meets the minimum required amount. It should be readily available. However, the specific requirements for using a pension as Proof of Funds may vary depending on the institution or transaction.

Recommended Articles

This article has been a guide to what is Proof Of Funds. We explain it with its letter sample, examples, how to get it, and comparison with pre-approval. You may also find some useful articles here –

Leave a Reply