Form 1-A POS GRAYSTONE COMPANY, INC.

News and research before you hear about it on CNBC and others. Claim your 1-week free trial to StreetInsider Premium here.

1-A POS LIVE 0001510524 XXXXXXXX 024-11421 THE GRAYSTONE COMPANY, INC. CO 2010 0001510524 7389 27-3051592 1 0 401 E. Las Olas Blvd #130-321 Fort Lauderdale FL 33301 954-271-2704 Anastasia Shishova Other 109346.00 0.00 6226.00 296873.00 412445.00 3549.00 42942.00 46491.00 0.00 365954.00 176926.00 120844.00 -4821.00 -132406.00 0.00 0.00 BF Borgers CPA PC Class A Common Stock 175541521 38981A506 OTCMarkets Class B Common Stock 51000000 None None Series B Preferred 617 None None None 0 true true false Tier2 Audited Equity (common or preferred stock) Y N Y Y N N 200000000 153541521 0.0170 3400000.00 0.00 540000.00 0.00 3940000.00 0.00 0.00 0.00 BF Borgers CPA PC 10000.00 TBD 30000.00 0.00 TBD 7500.00 3792500.00 true AK AL AR CA CO CT DC DE GA HI IA ID IL IN KS KY LA MA MD ME MI MN MO MS MT NC NE NH NJ NM NV NY OH OK OR PA RI SC SD TN UT VA VT WA WI WV WY A0 A1 A2 A3 A4 A5 A6 A7 A8 A9 B0 Z4 PR false The Graystone Company, Inc. Class B Common Stock 46000000 0 Issues pursuant to an acquisition of the issuer's current subsidiary in exchange for 100% of equity of the subsidiary. The Graystone Company, Inc. Class A Common Stock 7150000 0 $214,500 For the 46,000,000 shares of Class B Common Stock: Section 4(a)(2) of the Securities Act of 1933, as amended. For the 7,150,000 Class A Common Stock: Regulation A - Tier 2

As filed with the Securities and Exchange Commission on June 6, 2022

File No. 024-11421

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST QUALIFICATION AMENDMENT NO. 4

TO

FORM 1-A

DATED June 6, 2022

REGULATION A OFFERING CIRCULAR

UNDER THE SECURITIES ACT OF 1933

| THE GRAYSTONE COMPANY, INC. |

| (Exact name of registrant as specified in its charter) |

| Colorado |

| (State of other jurisdiction of incorporation or organization) |

|

|

| 401 E. Las Olas Blvd #130-321 |

| Fort Lauderdale, FL 33301 |

| Phone: : (954) 271-2704 |

| (Address, including zip code, and telephone number, |

| including area code of issuer’s principal executive office) |

|

|

| Registered Agents Inc. |

| 1942 Broadway St., STE 314C |

| Boulder, CO 80302, United States |

| (Name, address, including zip code, and telephone number, |

| including area code, of agent for service) |

Copies to:

Anastasia Shishova

Chief Executive Officer

401 E. Las Olas Blvd #130-321

Fort Lauderdale, FL 33301

Phone: (954) 271-2704

Email: [email protected]

| 7389 |

| 27-3051592 |

| (Primary Standard Industrial Classification Code Number) |

| (I.R.S. Employer Identification Number) |

EXPLANATORY NOTE

This is a post-qualification amendment to an offering statement on Form 1-A originally filed by The Graystone Company, Inc. (the “Company”) on January 22, 2021 and qualified on February 24, 2021, amended on April 21, 2021 through Post-Qualification Amendment and qualified on May 7 2021 and amended on April 4, 2022 through Post-Qualification Amendment and qualified on April 13, 2021. The primary purpose of this post-qualification amendment is modify the offer price.

In this post-qualification amendment, the Company also discloses that it has sold 29,150,000 shares of its Class A Common Stock under the offering statement, as qualified.

The Company is offering up to 200,000,000 shares at a purchase price of $[0.004-0.03] per share. Other than revising the disclosure in in this Offering Circular as necessary to reflect events described above, no other modifications have been made.

| An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Offering Circular was filed may be obtained. |

PRELIMINARY OFFERING CIRCULAR

June 6, 2022

Subject to Completion

THE GRAYSTONE COMPANY, INC.

UP TO 200,000,000 SHARES OF CLASS A COMMON STOCK

PRICE: $[0.004-0.03] PER SHARE

MINIMUM INVESTMENT: $[0.004-0.03] (1 SHARE)

SEE “SECURITIES BEING OFFERED” AT PAGE 40

The Graystone Company, Inc., a Colorado corporation (the “Company,” “we,” “us,” or “our,”) is offering a maximum of up to 200,000,000 shares of our Class A Common Stock, par value $0.0001 per share (referred to herein as the “Shares” or the “Class A Common Stock”) in a “Tier 2” offering under Regulation A (the “Offering”). The minimum investment amount per investor in this offering is $[0.004-0.03], or one (1) share of Class A Common Stock. As of the date of this Offering Circular, the Company has issued 29,150,000 Shares in this Offering for total proceeds of $754,500.

This Offering is being conducted on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be sold in this Offering. Offers and sales of the Shares will be made by our management, and specifically by our Chief Executive Officer, Anastasia Shishova, who will not receive any commissions or other remunerations for her efforts. We reserve the right to engage the services of a registered broker-dealer who will offer, sell and process the subscriptions for the Shares, although we do not presently expect to engage such selling agent. If any broker-dealer or other agent/person is engaged to sell our Shares, we will file a post-qualification amendment to the offering statement of which this Offering Circular forms a part disclosing the names and compensation arrangements prior to any sales by such persons. See “Plan of Distribution” on page 23 in this Offering Circular.

All of the Shares being offered for sale by the Company in this Offering will be sold at a fixed price of [$0.004-$0.03] per share for the duration of the Offering. There is no minimum amount we are required to raise from the Shares being offered hereby. There is no guarantee that we will sell any of the Shares being offered in this Offering. Additionally, there is no guarantee that this Offering will successfully raise enough funds to implement our Company’s business plan or to pay for the expenses of this Offering. Our Class A Common Stock is quoted on the OTC Pink Current Tier of OTC Markets under the symbol, “GYST.” On June 3, 2022, the last reported sale price of our Class A Common Stock was $0.0083 per share.

The approximate date of the commencement of the sales of the Shares in this Offering will be within two calendar days from the date on which the Offering is qualified by the Securities and Exchange Commission (the “SEC” or the “Commission”) and on a continuous basis thereafter until the maximum number of Shares offered hereby are sold. All funds received in this Offering will not be placed in escrow and will be immediately available to us. All offering expenses will be borne by us and will be paid out of the proceeds of this Offering.

This Offering will terminate at the earlier of (i) the date at which the maximum offering amount has been sold; (ii) the date that is twelve (12) months from the date that the SEC deems this offering statement qualified, unless extended by our Company for an additional ninety (90) days, or (iii) the date the Offering is earlier terminated by the Company, in its sole discretion. At least every 12 months after this Offering has been qualified by the SEC, if the Offering is still ongoing at such time, the Company will file a post-qualification amendment to include the Company’s recent financial statements. The Company may undertake one or more closings on a rolling basis. After each closing, funds tendered by investors will be available to the Company. No sales of Shares will be made prior to the qualification of the Offering statement by the SEC.

| 2 |

Investing in our securities involves a high degree of risk, including the risk that you could lose all of your investment. Please read the section entitled “Risk Factors” beginning on page 8 of this Offering Circular about the risks you should consider before investing.

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

| Number of Class A Common Stock |

| PRICE TO |

|

| SELLING AGENT |

|

| PROCEEDS TO |

| |||

| Shares |

| PUBLIC |

|

| COMMISSIONS |

|

| THE COMPANY (1) |

| |||

| Per Share 1 |

| $ | [0.004-0.03] |

|

|

| 0.00 |

|

| $ | [0.004-0.03] |

|

| Maximum Offering 200,000,000 |

| $ | [800,000-6,000,000] |

|

|

| 0.00 |

|

| $ | [800,000-6,000,000 |

|

______________

| (1) | Before the payment of our expenses in this Offering which we estimate will be approximately $47,500. See “Use of Proceeds” appearing on page 24 of this Offering Circular. All expenses of the offering will be paid for by us using the proceeds of this Offering. |

If all the Shares are not sold in the Company’s Offering, there is the possibility that the amount raised may be minimal and might not even cover the costs of the Offering, which the Company estimates at $47,500. The proceeds from the sale of the securities will be placed directly into the Company’s account; any investor who purchases Shares will have no assurance that any monies, beside their own, will be subscribed to in the Offering. All proceeds from the sale of the securities are non-refundable, except as may be required by applicable laws. All expenses incurred in this Offering are being paid for by the Company from the proceeds of the Offering.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION, OR THE COMMISSION, DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

This Offering Circular is following the offering circular format described in Part II of Form 1-A

The date of this Offering Circular is June 6, 2022

| 3 |

|

| PAGE |

| |

|

|

|

|

|

|

| 4 |

| |

|

| 5 |

| |

|

| 5 |

| |

|

| 5 |

| |

|

| 6 |

| |

|

| 7 |

| |

|

| 8 |

| |

|

| 22 |

| |

|

| 23 |

| |

|

| 23 |

| |

|

| 30 |

| |

|

| 32 |

| |

|

| 39 |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |

| 39 |

|

|

| 43 |

| |

|

| 44 |

| |

| SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS |

| 44 |

|

|

| 45 |

| |

|

| 47 |

| |

|

| 48 |

| |

|

| 49 |

| |

|

| 50 |

| |

|

| 50 |

| |

|

| 50 |

| |

|

| 50 |

| |

|

| 50 |

| |

|

| F-1 |

|

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this Offering Circular prepared by us or to which we have referred you. We take no take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This Offering Circular is an offer to sell only the Shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this Offering Circular is current only as of its date, regardless of the time of delivery of this Offering Circular or any sale of Shares.

For investors outside the United States: We have not done anything that would permit this Offering or possession or distribution of this Offering Circular in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to the Offering and the distribution of this Offering Circular.

Certain data included in this Offering Circular is derived from information provided by third-parties that we believe to be reliable. The discussions contained in this Offering Circular relating to industry data are taken from third-party sources that the Company believes to be reliable and reasonable, and that the factual information is fair and accurate. Certain data is also based on our good faith estimates which are derived from management’s knowledge of the industry and independent sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified such third-party information, nor have we ascertained the underlying economic assumptions relied upon therein. The industry market data used in this Offering Circular involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data. While we are not aware of any material misstatements regarding any market, industry or similar data presented herein, such data was derived from third party sources and reliance on such data involves risks and uncertainties.

| 4 |

| Table of Contents |

We own or have applied for rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect our business. This Offering Circular may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this Offering Circular is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this Offering Circular are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Offering Circular contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “plan,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, or state other forward-looking information. Our ability to predict future events, actions, plans or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual outcomes could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could cause our forward-looking statements to differ from actual outcomes include, but are not limited to, those described under the heading “Risk Factors.” Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this Offering Circular. Furthermore, except as required by law, we are under no duty to, and do not intend to, update any of our forward-looking statements after the date of this Offering Circular, whether as a result of new information, future events or otherwise.

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

Our Shares are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant to Regulation A under the Securities Act, this Offering is exempt from state law “Blue Sky” review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that our Shares offered hereby are offered and sold only to “qualified purchasers” or at a time when our Shares are listed on a national securities exchange. “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D and (ii) all other investors so long as their investment in our Shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Accordingly, we reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A.

To determine whether a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified purchaser” definition, the investor must be a natural person who:

|

| 1. | whose net worth, or joint net worth with the person’s spouse or spousal equivalent, exceeds $1,000,000 at the time of the purchase, excluding the value of the primary residence of such person; or |

|

|

|

|

|

| 2. | had earned income exceeding $200,000 in each of the two most recent years or joint income with a spouse or spousal equivalent exceeding $300,000 for those years and has a reasonable expectation of reaching the same income level in the current year; or |

|

|

|

|

|

| 3. | is holding in good standing one or more professional certifications or designations or credentials from an accredited educational institution that the SEC has designated as qualifying an individual for accredited investor status; or |

|

|

|

|

|

| 4. | is a “family client,” as defined by the Investment Advisers Act of 1940, of a family office meeting the requirements in Rule 501(a) of Regulation D and whose prospective investment in the issuer is directed by such family office pursuant to Rule 501(a) of Regulation D. |

For purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles.

| 5 |

| Table of Contents |

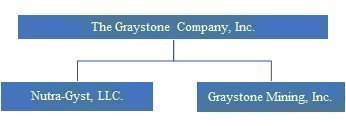

This summary highlights selected information contained elsewhere in this Offering Circular. This summary does not contain all of the information you should consider before investing in the Shares. You should read this entire offering circular carefully, especially the risks of investing in the Shares discussed under “Risk Factors,” before making an investment decision. In this Offering Circular, ‘‘The Graystone Company,’’ “Graystone,” “the “Company,’’ ‘‘we,’’ “GYST,” ‘‘us,’’ and ‘‘our,’’ refer to The Graystone Company, Inc. and our wholly owned subsidiaries, NutraGyst, Inc., and Graystone Mining, Inc. (“Graystone Mining”) unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal year’’ refers to our fiscal year ending November 30. Unless otherwise indicated, the term ‘‘Shares” refers to shares of the Company’s Class A Common Stock. All dollar amounts refer to US dollars unless otherwise indicated.

The Company

The Graystone Company has two distinct lines of business: (1) development and marketing of products holistic health products; and (2) Bitcoin Mining.

The Company’s holistic health products line of business is focused on developing and marketing proprietary products in two categories: (i) Longevity and Wellness and (ii) Fertility (which we refer to collectively herein as “holistic health products”). We plan to generate revenues through the sales of our planned products. We have not sold any products or generated any revenues to date. All of the Company’s operations related to its holistic health product development and marketing activities are conducted through the Company’s wholly-owned subsidiary NutraGyst.

The Company also intends to engage in “Bitcoin Mining” – i.e. the process by which Bitcoins are created, resulting in new blocks being added to the blockchain and new Bitcoins being issued to the miners. Miners engage in a set of prescribed complex mathematical calculations to add a block to the blockchain and thereby confirm cryptocurrency transactions included in that block’s data. Miners that are successful in adding a block to the blockchain are automatically awarded a fixed number of Bitcoins for their effort. All of the Company’s operations related to Bitcoin Mining will be conducted through the Company’s wholly owned subsidiary, Graystone Mining, Inc., a Florida corporation incorporated in the State of Florida on April 13, 2021. The Company will only mine Bitcoin.

The Company intends to purchase and maintain ASIC (application-specific integrated circuit) computers - computers that are specifically designed for cryptocurrency mining - that will be used for Bitcoin Mining. We plan to initially place the Bitcoin Mining equipment with 3rd party datacenters or farms (often referred as a “Co-Location”) that will power and operate our Bitcoin Mining equipment for a fee – however, in the future, we intend to conduct our Bitcoin Mining operations from our own facilities, which we expect will be based in Miami, Florida. We plan to generate revenues through receiving Bitcoin from our Bitcoin Mining equipment. As of the date of this Offering Circular, we have not generated any revenues to date or acquired any Bitcoin Mining equipment.

The Graystone Company, Inc. was originally incorporated in the State of New York on May 27, 2010 under the name of Argentum Capital, Inc. The Company was reincorporated in Delaware on January 10, 2011 and subsequently changed its name to The Graystone Company, Inc. on January 14, 2011. The Company was reincorporated in Colorado on May 1, 2016. The Company is domiciled in the state of Florida, where it maintains its corporate headquarters in Fort Lauderdale, FL. On November 6, 2020 the Company effected a reverse merger with NutraGyst, Inc., a Colorado corporation, after which NutraGyst became a wholly owned subsidiary of the Company, and the business of NutraGyst became the business of the Company going forward.Subsequently, the Company has added a Bitcoin Mining line of business operations, which will be conducted by Graystone Mining, our wholly-owned subsidiary.

There is limited historical financial information about us upon which to base an evaluation of our performance. We have generated revenues of $176,926 for the period of November 30, 2021, compares to no revenue for the period of November 30, 2020. The revenue for November 30, 2021, breaks out as $38,126 in bitcoin mining revenue and $138,800 in the sale of bitcoin mining equipment. This increase in revenue is contributed to the company beginning operations and launching of its bitcoin mining division and beginning to resale equipment.

The Company has also incurred operating losses of $132,406 during period ended November 30, 2021 compared to $1,240 in operating losses during the period ended November 30, 2020. This increase in operating loses is contributed to: (1) formation and legal and auditing expenses, (2) the company beginning operations and (3) launching of its bitcoin mining division.

As of November 30, 2021, the Company had no cash on hand or other capital resources. Anastasia Shishova, our Chief Executive Officer, during the period ended November 30, 2021, loaned the Company a total amount of $133,829 reflecting payments and expenses paid on behalf of the Company. As of November 30, 2021, the Company repaid $92,027 leaving a balance owed to our CEO of $42,942. As of November 30, 2021, the Company recorded a note payable of $42,942. The note payable is not evidenced by a written note, is unsecured and bears no interest and is due upon demand. No officer or director, however, is under any obligation to advance us any funds and there are no third-parties that have committed to investing in, or funding the Company.

During the period ended November 30, 2021, the Company issued 18,525,000 shares of Class A Common Stock in exchange for $499,500 in cash pursuant to its Regulation A offering.

As of November 30, 2021, the Company had $57,333 in cash on hand and $52,013 in bitcoin. On May 17, 2021, Anastasia Shishova transferred 0.3648155 Bitcoin to the Company in exchange for a note payable of $16,179 which was the market value of the bitcoin at the time of the transfer. As stated above, this note payables are not evidenced by a written note, is unsecured and bears no interest and is due upon demand.

| 6 |

| Table of Contents |

| Securities being offered by the Company |

| 200,000,000 shares of Class A Common Stock, at a fixed price of $[0.004-0.03] offered by us directly. this Offering Circular. |

|

|

|

|

| Securities being offered by the Selling Stockholders |

| None. |

|

|

|

|

| Offering price per share |

| $[0.004-0.03] |

|

|

|

|

| Number of shares of Class A Common Stock outstanding before the offering |

| 175,541,521 shares of Class A Common Stock are currently issued and outstanding. |

|

|

|

|

| Number of shares of Class A Common Stock outstanding after the offering |

| 346,391,521 shares of Class A Common Stock will be issued and outstanding if we sell all of the shares we are offering herein. |

|

|

|

|

| Number of other classes of stock outstanding before the offering |

| The following shares are currently issued and outstanding: 51,000,000 shares Class B Common Stock 617 shares of Series B Preferred Stock |

|

|

|

|

| Number of other classes of stock outstanding after the offering of common stock |

| The following shares are currently issued and outstanding: 51,000,000 shares Class B Common Stock 617 shares of Series B Preferred Stock |

|

|

|

|

| The minimum number of shares to be sold in this offering |

| None. |

|

|

|

|

| Market for the shares of Class A Common Stock |

| Our Class A Common Stock is quoted on the OTC Pink Current Tier of OTC Markets under the symbol, “GYST.” On June 3, 2022, the last reported sale price of our Class A Common Stock was $0.0083 per share. |

|

|

| |

| Use of Proceeds |

| We intend to use the proceeds of this Offering to pay all of the expenses of the Offering, and to use the remaining proceeds (i) to fund our Bitcoin Mining operations; and (ii) to fund the development and marketing of our line of holistic health products. We will also use a portion of the proceeds from this offering for general operating capital. We reserve the right to change the foregoing use of proceeds if management believes it is in the best interests of the Company. |

|

|

|

|

| Termination of the Offering |

| This Offering will terminate at the earlier of (i) the date at which the maximum offering amount has been sold; (ii) the date that is twelve (12) months from the date that the SEC deems this offering statement qualified, unless extended by our Company for an additional ninety (90) days, or (iii) the date the Offering is earlier terminated by the Company, in its sole discretion. At least every 12 months after this Offering has been qualified by the SEC, if the Offering is still ongoing at such time, the Company will file a post-qualification amendment to include the Company’s recent financial statements. The Company may undertake one or more closings on a rolling basis. After each closing, funds tendered by investors will be available to the Company. No sales of Shares will be made prior to the qualification of the Offering statement by the SEC. |

|

|

|

|

| Subscriptions: |

| All subscriptions once accepted by us are irrevocable. |

|

|

|

|

| Risk Factors: |

| See “Risk Factors” and the other information in this Offering Circular for a discussion of the factors you should consider before deciding to invest in shares of our Class A Common Stock. |

| 7 |

| Table of Contents |

An investment in our Class A Common Stock is highly speculative and involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described below together with all of the other information included in this Offering Circular. The statements contained in this Offering Circular that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the value of our Class A Common Stock could decline, and an investor in our securities may lose all or part of their investment.

Risks Related to Our Business and Industry

We have a limited operating history with respect to our new line of business. Such limited operating history may not provide an adequate basis to judge our future prospects and results of operations.

We have limited experience and a limited operating history as a company seeking to be a producer of holistic health products, as well as seeking engage in Bitcoin Mining in which to assess our future prospects as a company, as we only started this new line of business in November 2020 after the Reverse Merger was effected. In addition, in April 2021, we expanded to include a new line of business related to Bitcoin Mining. With respect to our holistic health products business, the market for our planned products is highly competitive. If we fail to successfully develop and sell our products in an increasingly competitive market, we may not be able to capture the growth opportunities associated with them or recover our development and marketing costs, and our future results of operations and growth strategies could be adversely affected. Additionally, with respect to our Bitcoin Mining operations, we are a new entrant into an industry with many experienced participants with significantly greater experience and resources than us. There is no guarantee we will be successful in generating revenues from our Bitcoin operations, which could significantly harm our operating results, and our viability as a Company. Our limited operating history may not provide a meaningful basis for investors to evaluate our business, financial performance, and prospects with respect to either line of our business.

Our management has concluded that there is a substantial doubt about our ability to continue as a going concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report for the period ending November 30, 2021.

The Company has incurred operating losses of $132,046 during the period ended November 30, 2021 compared to $1,240 during the period ended November 30, 2020 0. There are no assurances that the Company will be able to either (1) achieve a level of revenues adequate to generate sufficient cash flow from operations; or (2) obtain additional financing through either private placement, public offerings and/or bank financing necessary to support its working capital requirements. To the extent that funds generated from operations and any private placements, public offerings and/or bank financing are insufficient, the Company will have to raise additional working capital. No assurance can be given that additional financing will be available, or if available, will be on terms acceptable to the Company. If adequate working capital is not available to the Company, it may be required to curtail or cease its operations. Due to uncertainties related to these matters, a substantial doubt about the ability of the Company to continue as a going concern is raised. The accompanying audited consolidated financial statements do not include any adjustments related to the recoverability or classification of asset-carrying amounts or the amounts and classification of liabilities that may result should the Company be unable to continue as a going concern.

| 8 |

| Table of Contents |

We may fail to successfully execute our business plan.

Our shareholders may lose their entire investment if we fail to execute our business plan. Our prospects must be considered in light of the following risks and uncertainties, including but not limited to, competition, the erosion of ongoing revenue streams, the ability to retain experienced personnel and general economic conditions. We cannot guarantee that we will be successful in executing our business plan. If we fail to successfully execute our business plan, we may be forced to cease operations, in which case our shareholders may lose their entire investment.

Compliance with Regulation A and reporting to the SEC could be costly.

Compliance with Regulation A could be costly and requires legal and accounting expertise. We have limited experience complying with the provisions of Regulation A or making the public filings required by the rule. After this offering is qualified by the SEC, we’ll have to file an annual report on Form 1-K, a semiannual report on Form 1-SA, and current reports on Form 1-U. Our staff may need to be increased in order to comply with our Regulation A reporting requirements. Compliance with Regulation A will also require greater expenditures on outside counsel and outside auditors in order to remain in compliance. Failure to remain in compliance with Regulation A may subject us to sanctions, penalties, and reputational damage and would adversely affect our results of operations.

We will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 2 issuers. Therefore, we will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies and our investors could receive less information than they might expect to receive from exchange traded public companies.

We will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 2 issuers. The ongoing reporting requirements under Regulation A are more relaxed than for companies under the Exchange Act. The differences include, but are not limited to, being required to file only annual and semiannual reports, rather than annual and quarterly reports. Annual reports are due within 120 calendar days after the end of the issuer’s fiscal year, and semiannual reports are due within 90 calendar days after the end of the first six months of the issuer’s fiscal year. Therefore, our investors could receive less information than they might expect to receive from exchange traded public companies.

We do not have any intellectual property rights, and our CEO is the holder of certain trademark applications, which she permits us to use, if she no longer permits such use or if she is unable to protect them or they become subject to intellectual property rights claims, our business may be harmed.

The particular formulas, blends, and components of the products we develop are important assets for us, as are the names for our product lines. We do not hold any patents protecting our intellectual property, and our CEO has filed a trademark applications for “Commodity Wellness” “Ferō”, and the slogan “Nourish the body, heal the Earth” recently, which have not yet been granted as of the date of this Offering Circular. Our CEO permits us the right to use the foregoing trademarks. However, there is no written agreement memorializing the right to use the trademarks and our CEO can choose to stop allowing us this right at any time. Further, various events outside of our control pose a threat to such intellectual property rights as well as to our business. Regardless of the merits of the claims, any intellectual property claims could be time-consuming and expensive to litigate or settle. In addition, if any claims against us are successful, we may have to pay substantial monetary damages or discontinue any of our practices that are found to be in violation of another party’s rights. We also may have to seek a license to continue such practices, which may significantly increase our operating expenses or may not be available to us at all. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete.

| 9 |

| Table of Contents |

We are reliant on the efforts of our sole executive officer, Anastasia Shishova.

We rely on our Chief Executive Officer, Anastasia Shishova, and will need additional key personnel to grow our business, and the loss of key personnel or inability to hire key personnel could harm our business. We believe our success has depended, and continues to depend, on the efforts and talents of our Chief Executive Officer, who has expertise that could not be easily replaced if we were to lose her services.

The ability of our Chief Executive Officer to control our business may limit or eliminate minority stockholders’ ability to influence corporate affairs.

Voting control of the Company is held by Anastasia Shishova, our Chief Executive Officer, who owns approximately 90% of the voting power of the Company because she currently owns 46,000,000 shares of Class B Common Stock, which carries 2,500 votes per share, giving her voting control of the Company. Because of this voting control, she will be in a position to significantly influence membership of our board of directors, as well as all other matters requiring stockholder approval. The interests of our Chief Executive Officer may differ from the interests of other stockholders with respect to the issuance of shares, business transactions with or sales to other companies, selection of other officers and directors and other business decisions. The minority stockholders will have no way of overriding decisions made by our Chief Executive Officer.

There is a Voter Agreement between our Chief Executive Officer and our largest shareholder that may limit minority stockholder’s ability to influence corporate affairs.

On January 15, 2021, all of the holders of the Company’s Class B Common Stock entered into a Voter Agreement (the “Voter Agreement”) pursuant to which they agreed to vote their shares in the Company in a manner such that the number of shares of Class B Common Stock authorized by the Company will not be increased above 51,000,000 without the unanimous consent of each holder of the Class B Common Stock. Further, pursuant to the Voter Agreement, the holders agreed not to vote in favor of the creation of any class of stock that will have superior rights to the Class B Common Stock without the approval of each Class B holders. The parties to the Voter Agreement include Anastasia Shishova, our Chief Executive Officer and Paul Howarth, our largest shareholder. Anastasia Shishova holds 46,000,000 Class B Common Stock shares of the Company and Paul Howarth holds 5,000,000 Class B Common Stock shares of the Company. The Voter Agreement therefore has the effect of preserving the voting rights of each of Ms. Shishova and Mr. Howarth, as each share of Class B Common Stock carries 2,500 votes per share, and together, these individuals own 51,000,000 shares of Class B Common Stock, representing all of the authorized Class B Common Stock. Therefore, no additional shares of Class B Common Stock can be authorized and issued without the consent of these two individuals, providing them with significant control over the Company’s business. It is unlikely that investors in this offering will have any meaningful ability to influence the Company’s operations.

The current outbreak of the coronavirus may have a negative effect on our ability to conduct our business and operations and may also cause an overall decline in the economy as a whole and could materially harm our Company.

If the current outbreak of the coronavirus continues to grow, the effects of such a widespread infectious disease and epidemic may inhibit our ability to conduct our business and operations and could materially harm our Company. The coronavirus may cause us to have to reduce operations as a result of various lock-down procedures enacted by the local, state or federal government, which could restrict our ability to conduct our business operations. The coronavirus may also cause a decrease in spending on the types of products that we plan to offer, as a result of the economic turmoil resulting from the spread of the coronavirus and thereby having a negative effect on our ability to generate revenue from the sales of our products.. The continued coronavirus outbreak may also restrict our ability to raise funding when needed and may also cause an overall decline in the economy as a whole. The specific and actual effects of the spread of coronavirus are difficult to assess at this time as the actual effects will depend on many factors beyond the control and knowledge of the Company. However, the spread of the coronavirus, if it continues, may cause an overall decline in the economy as a whole and also may materially harm our Company.

| 10 |

| Table of Contents |

We are a holding company and depend upon our subsidiary for our cash flows.

We are a holding company. All of our operations are conducted, and almost all of our assets are owned, by our subsidiary, NutraGyst. Consequently, our cash flows and our ability to meet our obligations depend upon the cash flows of our subsidiary and the payment of funds by this subsidiary to us in the form of dividends, distributions or otherwise. The ability of our subsidiary to make any payments to us depends on its earnings, the terms of their indebtedness, including the terms of any credit facilities and legal restrictions. Any failure to receive dividends or distributions from our subsidiary when needed could have a material adverse effect on our business, results of operations or financial condition.

The Company has borrowed funds from our Chief Executive Officer

The Company has borrowed $133,829 from our CEO, Anastasia Shishova. The note payable is not evidenced by a written note, is unsecured and bears no interest and is due upon demand. Any demand by Ms. Shishova to repay these loans immediately could have a material adverse effect on our business, results of operations or financial condition. The Company repaid $92,027 of this note leaving a remaining balance of $42,942.

Risks Related to our Holistic Health Products Business

Our holistic health products are not yet fully developed, and there is no guarantee that we will successfully develop our products.

The development of the Fertility and Longevity and Wellness products that we intend to produce is a costly, complex and time-consuming process, and the investment in product development often involves a long wait until a return, if any, is achieved on such investment. We continue to make investments in new products, which are inherently speculative. Unforeseen obstacles and challenges we encounter in development process may result in delays in or abandonment of product commercialization, may substantially increase the costs of development, and may negatively affect our results of operations. If we are unable to develop and commercialize our products successfully, it will significantly affect our viability as a company.

If we fail to increase our brand recognition, we may face difficulty in obtaining customers.

Because we have not yet started selling our products, we currently do not have strong brand identity or brand loyalty. We believe that establishing and maintaining brand identity and brand loyalty is critical to attracting customers once we have commercially viable products. Maintaining and enhancing our brand recognition in a cost-effective manner is critical to achieving widespread acceptance of future products and is an important element in our effort to increase our customer base. Successful promotion of our brand will depend largely on our ability to maintain a sizeable and active customer base, our marketing efforts and our ability to provide reliable and useful products at competitive prices. Brand promotion activities may not yield increased revenue, and even if they do, any increased revenue may not offset the expenses we will incur in building our brand. If we fail to successfully promote and maintain our brand, or if we incur substantial expenses in an unsuccessful attempt to promote and maintain our brand, we may fail to attract enough new customers or retain our existing customers to the extent necessary to realize a sufficient return on our brand-building efforts, in which case our business, operating results and financial condition, would be materially adversely affected.

| 11 |

| Table of Contents |

Our wellness product business is subject to inherent risks relating to product liability and personal injury claims.

As a seller of products designed for human consumption, we are subject to product liability claims if the use of our products is alleged to have resulted in injury. Our products consist of minerals, herbs and other ingredients that are classified as foods or dietary supplements and are not subject to pre-market regulatory approval in the United States. Our products could contain contaminated substances, and some of our products contain ingredients that do not have long histories of human consumption. Previously unknown adverse reactions resulting from human consumption of these ingredients could occur. We may also be obligated to recall affected products. If we are found liable for product liability claims, we could be required to pay substantial monetary damages. Furthermore, even if we successfully defend ourselves against this type of claim, we could be required to spend significant management, financial and other resources, which could disrupt our business, and our reputation as well as our brand name may also suffer. We do not carry product liability insurance. As a result, any imposition of product liability could materially harm our business, financial condition and results of operations. In addition, we do not have any business interruption insurance, and as a result, any business disruption or natural disaster could severely disrupt our business and operations and significantly decrease our revenue and profitability.

We are subject to numerous laws and regulations relating to the products we intend to develop and sell, and may incur significant penalties for noncompliance with such laws and regulations.

The manufacture, labeling and distribution of the products that we intend to distribute is regulated by various federal, state and local agencies. These governmental authorities may commence regulatory or legal proceedings, which could restrict the permissible scope of our product claims or the ability to sell our products in the future. The FDA regulates our products to ensure that the products are not adulterated or misbranded.

Failure to comply with FDA requirements may result in, among other things, injunctions, product withdrawals, recalls, product seizures, fines and criminal prosecutions. Our advertising is subject to regulation by the FTC under the FTCA. In recent years, the FTC has initiated numerous investigations of dietary and nutrition supplement products and companies. Additionally, some states also permit advertising and labeling laws to be enforced by private attorney generals, who may seek relief for consumers, seek class action certifications, seek class wide damages and product recalls of products sold by us. Any actions against us by governmental authorities or private litigants could have a material adverse effect on our business, financial condition and results of operations.

Political, economic and regulatory policies may vary from country to country.

Changes in the general political, economic and regulatory policies of the countries that we plan to buy materials for our products from, or in which we plan to operate, may adversely affect our planned business activities, ability to execute our plan of operations and financial performance. Examples of political, economic and regulatory policy changes include, among others, changes in political leadership or system of government; changes in monetary and fiscal policy; expropriation or nationalization of businesses owned by foreigners; currency devaluation; the imposition of foreign exchange controls; changes to the tax code; renegotiation or nullification of existing licenses, permits, leases or other contracts or agreements; and financial crisis.

Our planned acquisition of raw materials from international sources subjects us to risk from currency fluctuations.

Because of our planned international sourcing of raw materials, we are going to be subject to risks from currency fluctuations, such as changes in foreign exchange rates, particularly between the Japanese Yen and the U.S. dollar, as our initial raw materials are expected to be acquired from Japan. For example, if the value of the Japanese Yen were to increase compared to the value of the U.S. dollar, we could receive less value for purchases of raw materials when purchasing in Japan, which could force us to increase our prices, or settle for lower margins on our product sales. If either of these outcomes occur, our results of operations may be harmed.

| 12 |

| Table of Contents |

Adverse publicity or consumer perception of our holistic health products and any similar products distributed by others could harm our reputation and adversely affect our sales and revenues.

We believe we are highly dependent upon positive consumer perceptions of the safety and quality of our products as well as similar products distributed by other nutrition supplement companies. Consumer perception of nutrition supplements and our products, in particular, can be substantially influenced by scientific research or findings, national media attention and other publicity about product use. Adverse publicity from these sources regarding the safety, quality or efficacy of nutritional supplements and our products could harm our reputation and results of operations. The mere publication of news articles or reports asserting that such products may be harmful or questioning their efficacy could have a material adverse effect on our business, financial condition and results of operations, regardless of whether such news articles or reports are scientifically supported or whether the claimed harmful effects would be present at the dosages recommended for such products.

The industry of Fertility and Longevity and Wellness dietary supplements and products is highly competitive, and our failure to compete effectively could adversely affect our market share, financial condition and future growth.

The industry of Fertility and Longevity and Wellness-related supplements and products we intend to produce is highly competitive with respect to price, brand and product recognition and new product introductions. Several of our competitors are larger, more established and possess greater financial, personnel, distribution and other resources. We face competition (a) in the health food channel from a limited number of large nationally known manufacturers, private label brands and many smaller manufacturers of dietary and nutrition supplements; and (b) in the mass-market distribution channel from manufacturers, major private label manufacturers and others. Private label brands at mass-market chains represent substantial sources of income for these merchants and the mass-market merchants often support their own labels at the expense of other brands. As such, the growth of our brands within food, drug, and general mass-market merchants are highly competitive and uncertain. If we cannot compete effectively, we may not be profitable.

A shortage in the supply of key raw materials used needed to manufacture our products could increase our costs or adversely affect our sales and revenues.

Our inability to obtain adequate supplies of raw materials in a timely manner or a material increase in the price of the raw materials used in our products could have a material adverse effect on our business, financial condition and results of operations.

The purchase of many of our products is discretionary, and may be negatively impacted by adverse trends in the general economy and make it more difficult for us to generate revenues.

Our business is affected by general economic conditions since our products are discretionary and we depend, to a significant extent, upon a number of factors relating to discretionary consumer spending. These factors include economic conditions and perceptions of such conditions by consumers, employment rates, the level of consumers' disposable income, business conditions, interest rates, consumer debt levels and availability of credit. Consumer spending on our products may be adversely affected by changes in general economic conditions.

We may not be able to anticipate consumer preferences and trends within the diet and nutritional industry, which could negatively affect acceptance of our products by retailers and consumers and result in a significant decrease in our revenues.

Our products must appeal to a broad range of consumers, whose preferences cannot be predicted with certainty and are subject to rapid change. Our products will need to successfully meet constantly changing consumer demands. If our products are not successfully received by our customers, our business, financial condition, results of operations and prospects may be harmed.

| 13 |

| Table of Contents |

Risks Related to our Bitcoin Mining Business

Currently, there is relatively limited use of Bitcoin in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect our results of operations.

Bitcoin has only recently become accepted as a means of payment for goods and services by certain major retail and commercial outlets and use of Bitcoin by consumers to pay such retail and commercial outlets remains limited. Conversely, a significant portion of Bitcoin demand is generated by speculators and investors seeking to profit from the short- or long-term holding of Bitcoin. Many industry commentators believe that Bitcoin’s best use case is as a store of wealth, rather than as a currency for transactions, and that other cryptocurrencies having better scalability and faster settlement times will better serve as currency. This could limit Bitcoin’s acceptance as transactional currency. A lack of expansion by Bitcoin into retail and commercial markets, or a contraction of such use, may result in increased volatility or a reduction in the Bitcoin Index Price, either of which could adversely affect our results of operations.

If regulatory changes or interpretations require the regulation of Bitcoins under the Securities Act and Investment Company Act by the SEC, we may be required to register and comply with such regulations. To the extent that we decide to continue operations, the required registrations and regulatory compliance steps may result in extraordinary, non-recurring expenses to us. We may also decide to cease certain operations. Any disruption of our operations in response to the changed regulatory circumstances may be at a time that is disadvantageous to investors.

Current and future legislation and SEC rulemaking and other regulatory developments, including interpretations released by a regulatory authority, may impact the manner in which Bitcoins are treated for classification and clearing purposes. In particular, Bitcoins may not be excluded from the definition of “security” by SEC rulemaking or interpretation. As of the date of this Offering Circular, we are not aware of any rules or interpretations that have been proposed to regulate Bitcoins as securities. We cannot be certain as to how future regulatory developments will impact the treatment of Bitcoins under the law. Such additional registrations may result in extraordinary, non-recurring expenses, thereby materially and adversely impacting an investment in us. If we determine not to comply with such additional regulatory and registration requirements, we may seek to cease certain of our Bitcoin Mining operations. Any such action may adversely affect an investment in us.

To the extent that Bitcoins are deemed by the SEC to fall within the definition of a security, we may be required to register and comply with additional regulation under the Investment Company Act, including additional periodic reporting and disclosure standards and requirements and the registration of our Company as an investment company. Additionally, one or more states may conclude Bitcoins are a security under state securities laws which would require registration under state laws including merit review laws which would adversely impact us since we would likely not comply. Such additional registrations may result in extraordinary, non-recurring expenses of our Company, thereby materially and adversely impacting an investment in our Company. If we determine not to comply with such additional regulatory and registration requirements, we may seek to cease all or certain parts of our Bitcoin Mining operations. Any such action may adversely affect an investment in us.

We may not be able to respond quickly enough to changes in technology and technological risks, and to develop our intellectual property into commercially viable products.

Changes in legislative, regulatory or industry requirements or in competitive technologies may render certain of our planned products obsolete or less attractive. Our mining equipment may become obsolete, and our ability to anticipate changes in technology and regulatory standards and to successfully develop and introduce new and enhanced products on a timely basis will be a significant factor in our ability to remain competitive. We cannot provide assurance that we will be able to achieve the technological advances that may be necessary for us to remain competitive or that certain of our products will not become obsolete.

| 14 |

| Table of Contents |

We are increasingly dependent on information technology systems and infrastructure (cyber security).

Our operations are potentially vulnerable to breakdown or other interruption by fire, power loss, system malfunction, unauthorized access and other events such as computer hackings, cyber-attacks, computer viruses, worms or other destructive or disruptive software. Likewise, data privacy breaches by persons with permitted access to our systems may pose a risk that sensitive data may be exposed to unauthorized persons or to the public. It is critical that our systems provide a continued and uninterrupted performance for our business to generate revenues. There can be no assurance that our efforts will prevent significant breakdowns, breaches in our systems or other cyber incidents that could have a material adverse effect upon our business, operations or financial condition of the Company.

If we are unable to attract, train and retain technical and financial personnel, our business may be materially and adversely affected.

Our future success depends, to a significant extent, on our ability to attract, train and retain key management, technical, regulatory and financial personnel. Recruiting and retaining capable personnel with experience in pharmaceutical products is vital to our success. There is substantial competition for qualified personnel, and competition is likely to increase. We cannot assure you we will be able to attract or retain the technical and financial personnel we require. If we are unable to attract and retain qualified employees, our business may be materially and adversely affected.

The SEC is continuing its probes into public companies that appear to incorporate and seek to capitalize on the blockchain technology, and may increase those efforts with novel regulatory regimes and determine to issue additional regulations applicable to the conduct of our business or broadening disclosures in our filings under the Securities Exchange Act Of 1934.

As the SEC stated previously, it is continuing to scrutinize and commence enforcement actions against companies, advisors and investors involved in the offering of cryptocurrencies and related activities. At least one Federal Court has held that cryptocurrencies are “securities” for certain purposes under the Federal Securities Laws.

According to a recent report published by Lex Machina, securities litigation in general and those that are related to blockchain, cryptocurrency or Bitcoin specifically, showed a marked increase during the first two quarters of 2018 as compared to 2017. The total number of securities cases that referenced “blockchain,” “cryptocurrency” or “Bitcoin” in the pleadings tripled in the first half of 2018 alone compared to 2017.On the same day, the SEC announced its first charge against unregistered broker-dealers for selling digital tokens after the SEC issued The DAO Report in 2017. The SEC charged TokenLot LLC (TokenLot), a self-described “ICO Superstore”, and its owners, Lenny Kugel and Eli L. Lewitt, with failing to register as broker-dealers. On November 16, 2018 the SEC settled with two cryptocurrency startups, and reportedly has more than 100 investigations into cryptocurrency related ventures, according to a codirector of the SEC’s enforcement. As the regulatory and legal environment evolves, the Company may in its mining activities become subject to new laws, and further regulation by the SEC and other federal and state agencies.

Recently, the SEC on February 11, 2020, filed charges against an Ohio-based businessman who allegedly orchestrated a digital asset scheme that defrauded approximately 150 investors, including many physicians. The agency alleges that Michael W. Ackerman, along with two business partners, raised at least $33 million by claiming to investors that he had developed a proprietary algorithm that allowed him to generate extraordinary profits while trading in cryptocurrencies. The SEC’s complaint alleges that Ackerman misled investors about the performance of his digital currency trading, his use of investor funds, and the safety of investor funds in the Q3 trading account. The complaint further alleges that Ackerman doctored computer screenshots taken of Q3’s trading account to create. In reality, as alleged, at no time did Q3’s trading account hold more than $6 million and Ackerman was personally enriching himself by using $7.5 million of investor funds to purchase and renovate a house, purchase high end jewelry, multiple cars, and pay for personal security services.

In another recent action filed on March 16, 2020, the SEC obtained an asset freeze and other emergency relief to halt an ongoing securities fraud perpetrated by a former state senator and two others who bilked investors in and outside the U.S. and obtained an asset freeze and other emergency relief to halt an ongoing securities fraud perpetrated by a former state senator and two others who bilked investors in and outside the U.S. The SEC’s complaint alleges that Florida residents Robert Dunlap and Nicole Bowdler worked with former Washington state senator David Schmidt to market and sell a purported digital asset called the “Meta 1 Coin” in an unregistered securities offering, conducted through the Meta 1 Coin Trust. The complaint alleges that the defendants made numerous false and misleading statements to potential and actual investors, including claims that the Meta 1 Coin was backed by a $1 billion art collection or $2 billion of gold, and that an accounting firm was auditing the gold assets. The defendants also allegedly told investors that the Meta 1 Coin was risk-free, would never lose value and could return up to 224,923%. According to the complaint, the defendants never distributed the Meta 1 Coins and instead used investor funds to pay personal expenses and for other personal purposes.

| 15 |

| Table of Contents |

Banks and financial institutions may not provide banking services, or may cut off services, to businesses that provide digital currency-related services or that accept digital currencies as payment, including financial institutions of investors in our securities.

A number of companies that provide Bitcoin and/or other digital currency-related services have been unable to find banks or financial institutions that are willing to provide them with bank accounts and other services. Similarly, a number of companies and individuals or businesses associated with digital currencies may have had and may continue to have their existing bank accounts closed or services discontinued with financial institutions in response to government action, particularly in China, where regulatory response to digital currencies has been particularly harsh. We also may be unable to obtain or maintain these services for our business. The difficulty that many businesses that provide Bitcoin and/or derivatives on other digital currency-related services have and may continue to have in finding banks and financial institutions willing to provide them services may be decreasing the usefulness of digital currencies as a payment system and harming public perception of digital currencies, and could decrease their usefulness and harm their public perception in the future.

It may be illegal now, or in the future, to acquire, own, hold, sell or use Bitcoin, Ethereum, or other cryptocurrencies, participate in the blockchain or utilize similar digital assets in one or more countries, the ruling of which could adversely affect the company.

Although currently Bitcoin, Ethereum, and other cryptocurrencies, the Blockchain and digital assets generally are not regulated or are lightly regulated in most countries, including the United States, one or more countries such as China and Russia may take regulatory actions in the future that could severely restrict the right to acquire, own, hold, sell or use these digital assets or to exchange for fiat currency. Such restrictions may adversely affect the Company. Such circumstances could have a material adverse effect on the ability of the Company to continue as a going concern or to pursue this business opportunity at all, which could have a material adverse effect on the business, prospects or operations of the Company and potentially the value of any cryptocurrencies the Company holds or expects to acquire for its own account and harm investors.

If regulatory changes or interpretations require the regulation of Bitcoin or other digital assets under the securities laws of the United States or elsewhere, including the Securities Act of 1933, the Securities Exchange Act of 1934 (the “Exchange Act”) and the Investment Company Act of 1940 or similar laws of other jurisdictions and interpretations by the SEC, the Commodity Futures Trading Commission (the “CFTC”), the Internal Revenue Service (“IRS”), Department of Treasury or other agencies or authorities, the Company may be required to register and comply with such regulations, including at a state or local level. To the extent that the Company decides to continue operations, the required registrations and regulatory compliance steps may result in extraordinary expense or burdens to the Company. The Company may also decide to cease certain operations. Any disruption of the Company’s operations in response to the changed regulatory circumstances may be at a time that is disadvantageous to the Company.

Our digital currencies may be subject to loss, theft or restriction on access.

There is a risk that some or all of our digital currencies could be lost or stolen. Digital currencies are stored in digital currency sites commonly referred to as “wallets” by holders of digital currencies which may be accessed to exchange a holder’s digital currency assets. Hackers or malicious actors may launch attacks to steal, compromise or secure digital currencies, such as by attacking the digital currency network source code, exchange miners, third-party platforms, cold and hot storage locations or software, or by other means. As we increase in size, we may become a more appealing target of hackers, malware, cyber-attacks or other security threats. Any of these events may adversely affect our operations and, consequently, our investments and profitability. The loss or destruction of a private key required to access our digital wallets may be irreversible and we may be denied access for all time to our digital currency holdings or the holdings of others held in those compromised wallets. Our loss of access to our private keys or our experience of a data loss relating to our digital wallets could adversely affect our investments and assets.

| 16 |

| Table of Contents |

Incorrect or fraudulent digital currency transactions may be irreversible.

Once a transaction has been verified and recorded in a block that is added to a blockchain, an incorrect transfer of a digital currency or a theft thereof generally will not be reversible and we may not have sufficient recourse to recover our losses from any such transfer or theft. It is possible that, through computer or human error, or through theft or criminal action, our digital currency rewards could be transferred in incorrect amounts or to unauthorized third parties, or to uncontrolled accounts. Further, at this time, there is no specifically enumerated U.S. or foreign governmental, regulatory, investigative or prosecutorial authority or mechanism through which to bring an action or complaint regarding missing or stolen digital currency. To the extent that we are unable to recover our losses from such action, error or theft, such events could have a material adverse effect on our ability to continue as a going concern or to pursue our new strategy at all, which could have a material adverse effect on our business, prospects or operations of and potentially the value of any Bitcoin or other digital currencies we mine or otherwise acquire or hold for our own account.

We are subject to risks associated with our need for significant electrical power. Government regulators may potentially restrict the ability of electricity suppliers to provide electricity to mining operations, such as ours.

The operation of a Bitcoin or other digital currency mine can require massive amounts of electrical power. Our mining operations can only be successful and ultimately profitable if the costs, including electrical power costs, associated with mining a Bitcoin are lower than the price of a Bitcoin. As a result, any mine we establish can only be successful if we can obtain sufficient electrical power for that mine on a cost-effective basis with a reliable supplier, and our establishment of new mines requires us to find locations where that is the case. There may be significant competition for suitable mine locations, and government regulators may potentially restrict the ability of electricity suppliers to provide electricity to mining operations in times of electricity shortage, or may otherwise potentially restrict or prohibit the provision or electricity to mining operations. If we are unable to receive adequate power supply and are forced to reduce our operations due to the availability or cost of electrical power, our business would experience materially negative impacts.

Because we don’t expect to initially host our own Bitcoin Mining equipment, our business is dependent on 3rd parties maintaining the equipment and providing adequate service. Any disruptions in service from these 3rd parties could negatively impact our business.

We do not expect to initially host our Bitcoin Mining equipment. We plan to use 3rd parties to host, maintain, and service the equipment on our behalf. If these 3rd parties cease operations or have other disruptions to the services, we have engaged them to provide, our Bitcoin Mining operations may be halted without any recourse available by the Company. Such a result could harm the value of your investment in the Company.

We do not anticipate having a predictable stream of revenue from Bitcoin Mining operations, and the variability of our revenues from Bitcoin Mining may result in cash shortfalls, which would in turn have a material adverse effect on us.

We cannot predict with any certainty the future performance that will be realized on our Bitcoin Mining activities. If we are unable to achieve a sufficient level of revenues during our operating period, or if our operating expenses are significantly higher than we expect, we may experience cash shortfalls. If we experience a cash shortfall, we may be forced to cease operations. We have no commitments for future debt or equity financing and we cannot be sure that any financing would be available in a timely manner, on terms acceptable to us, or at all. Any equity financing could dilute ownership of existing stockholders and any borrowed money could involve restrictions on future capital raising activities and other financial and operational matters, which could materially and adversely affect our business, financial condition and results of operations. If we were unable to obtain financing as needed, we could cease to be a going concern.

| 17 |

| Table of Contents |

Since there has been limited precedence set for financial accounting of digital assets, it is unclear how we will be required to account for digital asset transactions in the future.

Since there has been limited precedence set for the financial accounting of digital assets, it is unclear how we will be required to account for digital asset transactions (i.e. receiving or selling Bitcoin) or assets. Furthermore, a change in regulatory or financial accounting standards could result in the necessity to restate our financial statements. Such a restatement could negatively impact our business, prospects, financial condition and results of operation.

In the Internal Revenue Service’s (“IRS”) release titled, “Notice 2014-21”, they stated “For federal tax purposes, virtual currency is treated as property. General tax principles applicable to property transactions apply to transactions using virtual currency.”

Additionally, in the same notice, the following question was asked: “Q-8: Does a taxpayer who “mines” virtual currency (for example, uses computer resources to validate Bitcoin transactions and maintain the public Bitcoin

transaction ledger) realize gross income upon receipt of the virtual currency resulting from those activities?” The IRS responded with: A-8: Yes, when a taxpayer successfully “mines” virtual currency, the fair market value

of the virtual currency as of the date of receipt is includible in gross income. See Publication 525, Taxable and Nontaxable Income, for more information on taxable income.”

The following are important guidelines that the IRS has put in place in regard to accounting for digital assets:

|

| • | Cryptocurrency is NOT treated as currency to determine losses or gains under tax laws. |

|

| • | Taxpayers MUST include the fair market value of the virtual currency as taxable income when it is used to pay for goods or services. |

|

| • | The fair market value is determined as of the date acquired; basically, it is (virtually) exchanged for U.S. dollars for tax purposes. |

|

| • | A taxpayer can have a virtual loss or gain. |

After reviewing the relevant guidance released by the IRS through notices and publications as seen above, we plan to account for our digital assets as follows; Once we commence our operations, we will be paid cryptocurrency once a day from the blockchain. After taking the fair market value of that cryptocurrency payment, it will be recorded as gross income. Once we transfer that cryptocurrency payment to an exchange like Coinbase to “Convert” it to fiat currency, i.e. US dollars, then the ordinary income rate applies to any gain or loss from the conversion if it is different than the fair market value recorded on the date we received the payment.

As an example: