INTRODUCTION

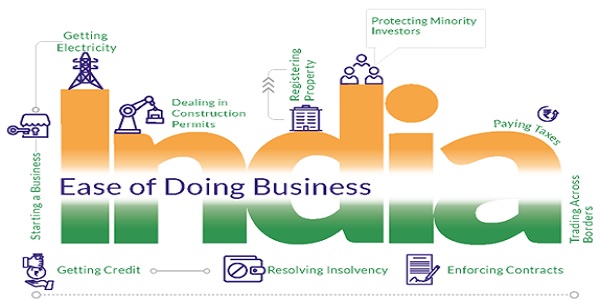

A favorable business environment is a prerequisite for the economic growth of a nation. A country like India which is among the fastest developing countries in the world has the potential to surpass the leading countries in terms of business. The Make in India initiative which has been launched by the government in 2014 with a vision of transforming India into a manufacturing hub has made efforts to enhance the Ease of Doing Business (EODB) in India by attracting more domestic and international companies to invest and do business in India. India’s progress towards jumping 79 spots in the rankings to 63rd place out of 190 countries is a result of the government’s consistent efforts over the past few years and its endeavor to strengthen its position as a preferred place to do business.

|

Due to the circumstances which existed before, there was a time when it was asked – Why India? Now after looking at the impact of the reforms that have taken place in the country, it is being asked – ‘Why not India’? |

MAKE IN INDIA

It is an initiative launched by Prime Minister Narendra Modi on 25 September 2014 to encourage national, as well as multi-national companies to manufacture their products in India. The main aim is to raise the contribution of the manufacturing sector by 25% of the GDP by the year 2025. It targets 25 sectors of the economy which ranges from Information technology (IT), Business Process Management (BPM), automobile, etc. with the main objective of job creation, fostering innovation, enhancing skill development, and protecting intellectual property.

BRIEF HIGHLIGHTS OF A FEW IMPORTANT INITIATIVES BY THE GOVERNMENT

|

Initiative |

Description |

| MCA 21 | The MCA 21 project is instrumental in the incorporation process. It impacts the starting a business parameter in ease of doing scores. With this project in place, the ministry of corporate Affairs offers a broad bouquet of e-services to corporate citizens.

The MCA 21 project is also instrumental in ensuring processes for greater transparency in the conduct of a corporate entity. |

| GST | The multiplicity of indirect taxes and multiplicity of institutions managing & collecting indirect taxes will be history. GST would club all the indirect taxes into one and there would be uniform and easy procedures of payment. |

| Taxpayers’ services and TRACES by Income Tax Department | Corporate Income Tax is adding value to the score of EODB. Through multiple projects, the Income Tax Department has facilitated various e-services to the individuals as well as the corporate citizens. These services include e-filing of income tax returns, online payment of taxes, e-TDS reconciliation etc. |

| The Insolvency and Bankruptcy Code, (2016) | The Insolvency and Bankruptcy Code, (2016) is a big statutory reform on bankruptcy. The code brings about an amendment to the existing 11 laws to offer a consolidated law that defines a time limit to resolve insolvency and has a provision for a regulator to oversee the process. This will have a big implication on the EODB score. |

| e-biz portal | The e-biz portal provides various services to entrepreneurs in starting and running a business. The entrepreneur can create an account and avail of the industry-specific services at one location. |

| e-Courts | Automation of courts through e-courts which allow the complainants to file cases electronically. There are many sub-parameters on which a lot remains, e.g. improving the quality of judicial processes, automation of courts, creation of alternative dispute resolution agencies, creation of more commercial courts, and bringing about judicial sector reforms. |

| e-Procurement | Selling to the government has become easier after the launch of the e-procurement module in various government departments. The tendering process has become online and transparent. |

| Land records and property registration | Digitization of land records and property registration helps businesses to have a seamless experience. Digital records are less prone to forgery and hence offer better enforceability. |

| e-Municipality | Though e-Municipality is one of the Mission Mode Projects, a lot remains to be done in terms of simplifying the processes. |

| Pradhan Mantri Mudra Yojana | The government’s efforts to provide loans to the Micro, Small and Medium enterprises through Pradhan Mantri Mudra Yojna (PMMY) are paying off by making it easy for the MSMEs to obtain institutional loans from banks at very competitive rates. |

| Power Sector Reforms | India’s score on getting an electricity connection is good for the EODB ranking. This can be attributed to the power sector reforms in general and the digitalization of the application process in particular. |

| Shram Suvidha Portal | Shram Suvida Portal is a one-stop shop for Labour Laws compliance. It consolidates information on labour inspection and its enforcement. It promotes the use of a common Labour Identification Number (LIN) to comply with more than 40 labor laws. |

ADVANTAGES OF STARTING A BUSINESS IN INDIA

LARGE POPULATION:

Macro economically a large population and a big market without borders with generally established logistics to do business are one of the major advantages of starting a business in India. India’s young population and growing economic power promise to be a magnet for foreign companies for decades to come.

COMPREHENSIVE TAX SYSTEM:

India has a comprehensive network of tax treaties. Moreover, recently Indian tax system has been modified by the Direct Taxes Code as well as the Goods and Service Tax (GST) to provide ease of doing business.

BUSINESS-FRIENDLY LAWS:

In recent years, several important bills that are beneficial for most industrial sectors have been passed in the Indian Parliament. The Goods and Services Tax Bill has increased efficiency in the movement of products across India. The Direct Taxes Code Bill has cleaned up tax laws. But the most important (and most controversial) law will be the Land Acquisition Bill. The Companies Bill, which updates India’s corporate law for the 21st century, has also been passed. Such business-friendly laws make it easy for international players to actualize their plans of entering India.

LOW OPERATIONAL COST:

There is a noticeable Low cost of operation possible from infrastructures to phones to the internet to labour to salaries to anything required to set up a business. Moreover, workers are ready to work at a low cost. Not only this but the tax strategies of India compared to other countries are very moderate and hence could cut the cost of operation of the business.

INDIAN FINANCIAL SYSTEM:

India has a well-regulated financial system that has access to developed markets all over the world and can be financed through multiple sources restricted to some rules and regulations of RBI etc.

VAST TRADE NETWORK:

India boasts a vast network of technical and management institutions that are of the highest international standards backed by regional and bilateral free trade agreements. In addition to that, there are numerous trading partners to trade with. These institutions develop excellent human resources.

STRONG BASE OF ENGLISH-SPEAKING POPULATION:

India has a strong base of an English-speaking population for business purposes. The historical relationship between the UK and India means that Indians have a high level of English. Although the accent and vocabulary of Indian English are slightly different from that of British or American English, international organizations will benefit immensely from graduates’ ability to speak English fluently, as well as their command of the many local Indian languages. The relatively few language barriers make doing business in India quite attractive for international organizations.

INDIAN WORK ETHICS AND WORKING CLASS:

Indians are known for their work ethics all over the world. The blend of hardworking nature with the willingness to learn and never say no attitude is what sets Indians apart from their South Asian counterparts. Moreover, the huge no. of the Indian population falls under the working-age group i.e. 18 to 65 adds more years to service availability in the Indian Market. The youth has come out of the closet and now looking for opportunities. Businesses can leverage this opportunity by generating employment and increasing productivity.

GOVERNMENT’S INITIATIVES:

The government of India has taken several initiatives to attract foreign investments in India’s diverse sectors. It has announced a number of attractive schemes and policies from time to time to lure investments. The individual ministries of different industries have made special attempts to ease the rules and regulations related to foreign investment in the industry.

STARTUP INDIA MOVEMENT:

Under the head of the ‘Start-up India Movement’ the government is introducing several reforms to create possibilities for getting Foreign Direct Investment (FDI) and foster business partnerships. Some initiatives have already been undertaken to alleviate the business environment from outdated policies and regulations. This reform is also aligned with the parameters of the World Bank’s ‘Ease of Doing Business’ index to improve India’s ranking on it.

India is well endowed with mineral and agricultural resources, and it has seen a significant increase in offshore outsourcing and manufacturing over the last couple of decades, which has helped India’s economy grow at a tremendous rate. It is very interesting how foreign companies and foreign investors are benefited from doing business in India.

SIMPLIFYING THE BUSINESS ECOSYSTEM IN INDIA

The World Bank’s Ease of Doing Business Project is the key driver of regulatory reforms. It ranks 190 economies on various parameters from cradle to grave of a business cycle on a set methodology which indicates how easy it is to do business in the country. These parameters are as under:

STARTING A BUSINESS:

The introduction of SPICe+ and AGILE PRO form by the Ministry of Corporate Affairs (MCA) saves the time and effort required for a nascent Company Incorporation.

SPICE+ (Simplified Performa for Incorporating Company Electronically (Plus) is an integrated Web Form.

- Five-page form and other attachments for reserving the name of the Company with the Ministry of Corporate Affairs have been simplified into a simple web service with only three fields to be filled.

- Incorporation, DIN allotment, Mandatory issue of PAN, Mandatory issue of TAN, Mandatory issue of EPFO registration, Mandatory issue of ESIC registration, Mandatory issue of Profession Tax registration (Maharashtra), Mandatory Opening of Bank Account for the Company, and Allotment of GSTIN (if so applied for).

- Elimination of incorporation fee for companies with an authorized capital of up to Rs. 15 Lakh.

- No requirement of inspection before registration under the Shops & Establishment Act in Mumbai and Delhi.

PAYING TAXES:

Reduction of corporate tax from 30% to 25% for mid-sized companies. Domestic companies can opt for concessional tax regime @ 22% (effective tax rate: 25.17% inclusive of surcharge and cess). Such a company cannot claim any income tax incentive or exemption. Such companies are not liable to pay the Minimum Alternate Tax (MAT).

Robust IT infrastructure of online return filing for Indian taxpayers.

The Goods and Service Tax came into effect on 01 July 2017. It subsumes eight taxes at the Central and nine taxes at the State level.

The Employee State Insurance Corporation (ESIC) has developed a fully online module for electronic return filing with online payment. This has substantially reduced the time to prepare and file returns.

With the introduction of the e-verification system, there remains no physical touchpoint for document submission to income tax authorities.

Instead of filing 3 GST returns, the taxpayer has to now file only 2 returns.

RESOLVING INSOLVENCY:

The Insolvency and Bankruptcy Code of 2016 has introduced new dimensions in resolving insolvency in India. It is India’s first comprehensive legislation on corporate insolvency. The objective of the Code is the maximization of the value of assets by aiming at reorganization rather than the liquidation of the Corporate Debtor. The Code has seen success as the creditor is in charge rather than the debtor in charge. The increase in recovery rate to 71 % is evidence of its success. This law is evolving and once a long drawn and painful process, of closure of a business is now a faster and more efficient process. Under Fast-track Corporate Insolvency Resolution Process (CIRP) for mid-sized companies, the process for insolvency shall be completed within 90 days with a maximum grace period of another 45 days.

Key Benefits

- Free up Resources of the Economy

- Resolve a Viable Company

- Better Realization by the Creditors

- Liquidation of Unviable Business

- Preserve Jobs

PROTECTING MINORITY INVESTORS:

This indicator is concerned with measuring the protection of minority interests from conflict of interest and shareholders’ rights in corporate governance. Many amendments have been made to the Companies Act which has strengthened the minority investor protection in India.

Major improvements:

- Claims against defaulting directors can be claimed now.

- The constitution of the National Company Law Tribunal ensures greater shareholder protection.

- Full Shareholder protection has been provided against defaulting directors and claims for damages.

GETTING CREDIT:

Central Registry of Securitization Asset Reconstruction and Security Interest (CERSAI) is a geographically unified electronic registry that provides for registration by asset type. Since 2017, CERSAI also provided a search through the debtor’s name.

Priority is given to secured creditors over government dues for recovery of their dues.

Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) (Central Registry) Rules, 2011 was amended to include additional types of charges, including a security interest in – immovable property by the mortgage, hypothecation of plant and machinery, stocks, debt including book debt or receivables, intangible assets, patent, copyright, trademark, under-construction building.

The definition of property, which now includes immovable as well as intangible, allows CERSAI to register these additional charges.

ENFORCING CONTRACTS:

Faster resolution of commercial disputes is pivotal to boosting investor confidence in the dispute resolution mechanism of the country. The adoption of technology for case management by lawyers and judicial officers is leading to speedier dispute resolution. e-filing of cases has been introduced in district courts of Delhi and Mumbai.

eCourts Services Portal

The app and portal offer the following case-related services for litigants and lawyers.

- To access the laws, regulations, and case law.

- To access the forms/documents to be submitted to the court.

- To receive the notifications on emails/SMS.

- To track the status of the case.

- To view and manage the case documents.

- To view court order decisions in a particular case.

TRADING ACROSS BORDERS:

Time and cost to export and import have been considerably reduced by electronic sealing of containers, up-gradation of port infrastructure, and allowing electronic submission of supporting documents with digital signatures.

India Customs Electronic Gateway (ICEGATE) allows traders the facility to lodge their clearance documents online at a single point.

ICEGATE offers a host of services:

- Electronic filing of Bill of Entry

- Shipping bill

- E-payment of custom duty

- Web-based Common Signer utility for signing all the Customs Documents

- Facility to file online supporting documents through e-Sanchit

- End-to-end electronic IGST Refund

- 24X7 helpdesk facility for its trading partners

- e-payment of Central Excise and Service Tax

- online registration for Intellectual Property Rights (IPR)

- Document Tracking status at Customs Electronic Data Interchange (EDI)

- online verification of DEPB/DES/EPCG licenses

- IE code status

- PAN-based Customs House Agent (CHA) data,

- IGST Refund Status and

- links to other important websites/information related to EXIM Trade

DEALING WITH CONSTRUCTION PERMITS:

India will now be counted among the top nations in the world where it is easiest to obtain all permits related to construction. Online Building Permission System (OBPS) is an online Single Window for obtaining all building permissions. In Delhi and Mumbai, all relevant agencies have been brought on board this single window system thereby eliminating the requirement on the part of the applicant to engage with each agency individually.

- Municipal Corporations of Delhi, as well as Municipal Corporation of Greater Mumbai, have introduced fast track approval system for issuing building permits with features such as Common Application Form (CAF), provision of using digital signature, and online scrutiny of building plans.

- Implementation of Risk-Based Classification of buildings helped in strengthening building regulations considerably.

- Application for Joint Site Inspection which essentially stipulates all inspections with regards to Fire, Water, Sewage, Environment, Archaeological etc. be conducted simultaneously. This ensures transparency and efficiency in obtaining the required No Objection Certificates (NOC).

- 2056 Urban Local Bodies across the country have replicated this Online Building Permission System.

- Cost of obtaining construction permits reduced from 23.2% to 5.4% of the economy’s per capita income.

REGISTERING PROPERTY:

Digitization of land records has been one of the top priorities to bring efficiency and transparency in property-related transactions. It allows citizens to view property transaction records in a digital mode.

- You can access all the property maps on a portal for free.

- View & Download Obtain Property cards by clicking on the property map.

- View & Download Detailed Plot Report can be seen just by entering the plot number

Benefits of Digitized Cadastral Maps in Delhi & Mumbai:

- No need to physically visit government departments for obtaining maps.

- Anytime, anywhere access to maps.

- No hassle of handling bulky hard copies.

CONCLUSION

In 2016 India was at the 130th rank in the World Bank’s Ease of Doing Business Index. Within a few years, India has climbed up to the 63rd place which indicates an improvement of 67 ranks as a result of the improvement made by the Government in its policies launched under the Make in India campaign that targets creating more than 100 million jobs by the year 2022, making India a manufacturing hub and raising the contribution of manufacturing sector’s share to GDP to 25%. In a nutshell, the Government has been initiating significant reforms to improve the ease of doing business in India. Several initiatives have been taken by the Government across different parameters to support the growth of ease of doing business environment in the country. Consistent progress made across different parameters is likely to expedite India’s ranking in the top 50 countries in ease of doing business in years ahead.

|

We say this with full confidence this is the best time to be in India! In today’s India, many things are rising and many are falling. ‘Ease of Doing Business’ is rising and so is ‘Ease of Living. |

Does everybody , including Finance Ministry, Chartered Accountants Bodies, Indian Tax Payers , Senior Citizen Tax Payers think that a person of 18 and a person of 75/80/90 should be treated at par with respect to compliance of Tax Laws, ensuring timely Returns ( I believe there are hundreds), paying Taxes in Time, and face penalties. IF THEY DO NOT, SHOULD THEY NOT TAKE UP THE SUBJECT WITH CBDT, FINANCE MINISTRY, REVENUE SECRETARY, FINANCE MINISTER AND PRIME MINISTER.