State & Local Business, Car Insurance, & Government Resources

The State and Local Internet directory provides convenient one-stop access to the websites of thousands of state agencies and city and county governments and other organizations. Use the drop-down menus on the left to view directory pages for:

- States: Looking for statewide business resources? We have created guides and linked to resources in every state to start, run, or improve your business. Also locate State Government Offices and Other Helpful Organizations - View all the websites in a given state -- from a state's home page or governor's site to the smallest counties or townships.

- Topics: The websites of state government constitutional officers, state legislatures, state judiciaries and departments across ALL states. Also locate resources for starting or improving upon your business such as loans and grants available in your particular state. If you are looking for other financial topics then we cover both personal and business topics. For example, at the request of our visitors, we have also included local insurance contacts for different insurance types such as auto insurance or home insurance. If there is anything else you would like help locating on a local level please don't hesitate to contact us.

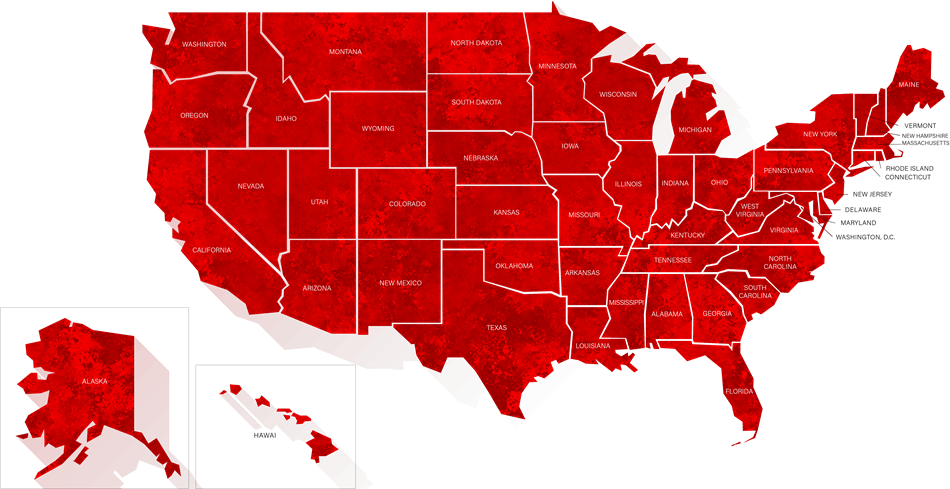

Select Your State Below for Business, Car Insurance, or Government Resources:

Exploring Local Car Insurance for Tailored Coverage & Personal Touch

When it comes to acquiring auto insurance, consumers have numerous choices available to them. Local insurance brokers play a pivotal role in assisting individuals in discovering the appropriate coverage that suits their requirements. There are three primary types of local insurance brokers: confined brokers, autonomous brokers, and carrier agents. Each of these brokers offers distinctive advantages, and comprehending their disparities can assist consumers in making well-informed decisions.

Confined Brokers

Confined brokers work solely for a single car insurance company. They are employed by the company to vend its policies. Since they represent only one carrier, they possess an extensive knowledge of the products and services offered by that particular company. Confined brokers can guide customers through the procedure of selecting the most suitable coverage based on their specific needs. Additionally, they often provide personalized customer service and aid with claims, offering a sense of continuity and familiarity.

Autonomous Brokers

On the other hand, autonomous brokers are not bound to a single car insurance carrier. They work with multiple companies, giving customers a broader range of alternatives. Autonomous brokers have the flexibility to compare policies from various carriers, allowing them to find the best coverage at competitive prices. Their expertise and impartiality enable them to offer unbiased advice tailored to the customer's needs. Autonomous brokers often develop long-standing relationships with their clients, providing ongoing support and assistance whenever required.

Carrier Agents

Carrier agents act as intermediaries between the customer and the insurance carrier. Unlike confined or autonomous brokers, carrier agents are not employed by the insurance company. Instead, they operate independently and work with multiple carriers to provide customers with a comprehensive range of alternatives. Carrier agents specialize in navigating the intricacies of insurance policies, ensuring customers receive suitable coverage that aligns with their preferences and budget. They act as advocates for the customer, helping to negotiate terms and provide valuable advice throughout the process.

Benefits of Local Car Insurance Agents

While going directly to a national carrier for auto insurance may appear convenient, there are advantages to working with local insurance brokers. One advantage is the personalized service they offer. Local brokers are often readily accessible, allowing customers to interact face-to-face or over the phone. This personal touch can be particularly valuable when it comes to understanding complex policy details or seeking assistance with claims.

Another benefit of local insurance brokers is their knowledge of the local market. They are familiar with the specific insurance requirements, regulations, and driving conditions in their area. This expertise allows them to tailor coverage alternatives to address potential risks and ensure customers have adequate protection.

Furthermore, local brokers often have established relationships with their customers. This familiarity can result in a higher level of customer service and a deeper understanding of individual needs and preferences. Whether it's a confined broker offering brand loyalty, an autonomous broker offering a variety of alternatives for home insurance and health insurance, or a carrier agent providing expert guidance, local brokers are dedicated to serving their community and building lasting relationships with their clients. Ask about Car Insurance First Month Free No Deposit.

Latest Posts

No posts found.7 General Insurance Concerns for All Insurance Types

Coverage Duration:

The length of the coverage period should be carefully considered, especially if you intend to buy more than one insurance policy. Generally speaking, the longer a policy is in effect, the better the protection it provides. However, there may be a trade-off between the cost and duration of coverage—the longer the term of coverage, the higher your premiums may be.

Claims Process:

Knowing the claims process is important so you can understand the steps to take when you have an incident or accident that requires insurance coverage. It's best to ask about a company's customer service before purchasing a policy, as this will give you an idea of how helpful they will be if you ever need to make a claim.

Deductibles:

Many insurance policies come with a deductible, which is the amount of money you must pay out-of-pocket before the insurer will cover any losses. It's important to consider this expense when comparing different policies as it can have a significant impact on your premiums and overall coverage.

Coverage Limits:

Insurance policies usually come with limits on the amount that can be paid out for any given incident or loss. Depending on your needs, you may want to explore options that provide higher coverage limits, such as umbrella policies.

Exclusions:

Insurance policies typically list exclusions, which are situations where the insurer will not pay out a claim. Be sure to read through the policy closely so you understand what is and isn't covered.

Renewal Options:

Most insurance policies have the option to be renewed once the initial term expires. It's important to understand how easy or difficult it is to renew a policy, as this could affect your ability to maintain coverage in the future. Additionally, some insurers may offer discounts or other incentives for renewing with them.

Additional Services:

Some insurance companies offer additional services or benefits that are included with your policy, such as legal assistance or roadside assistance. Be sure to ask about any services that may be included in the coverage and make sure they fit your needs.

© State & Local 1995-2023