Proof of Fund: Required Financial Documents for Canada Study Permit

I am going to discuss proof of funds in this article. Many of you have been asking me how much is proof of fund that you’re going to provide to your immigration officer. And what are the financial documents that you should provide?

Before we start I recommend you to check the Canada Study permit: Frequently asked questions. It consists of important information for all international students who wish to study in Canada.

After reading this article, you can check step by step guide on how to apply for a Canadian study permit online. In the guide, I have included screenshots of all the questions in the study permit application. And mentioned how to answer these questions.

Let’s get started.

Proof of funds

- Proof of funds means the documents that verify the financial position of International students in Canada.

- The financial documents must clearly state “From where the money came for your studies”.

The Government of Canada asks for proof of funds to make sure that the student has enough finances to support himself in Canada.

Types of funds

There are different types of funds that you can use to apply for a study permit in Canada. These are as follows:

- Cash

- Guaranteed investment certificate (GIC)

- Fixed Assets (immovable property such as house and land)

- Liquid Assets (Savings/current accounts, fixed deposits, policy investments, vehicle resale price, gold)

- Sponsorship (Financial support from relatives and non-relatives living outside/inside of Canada)

- 1st Tuition fee receipt

Cash

Cash can be used as a type of fund to prove your financial status to the immigration officer.

- However, it is not recommended to use cash as primary proof of funds.

The immigration officer wants to see the proof of funds and proving the cash amount with official documents is difficult.

Pro tip: Transfer the cash to your bank account. And provide sources of cash transfer. For example proof of selling a car, property, gold, etc. Money should mature at least 4 months in the bank

The majority of the time parents of the student sell their houses or land and deposit a large sum of cash in the student’s bank account. Here you can provide

- proof of relationship to the owner of assets

- proof of ownership

- proof of sale

- Include the details in the letter of support

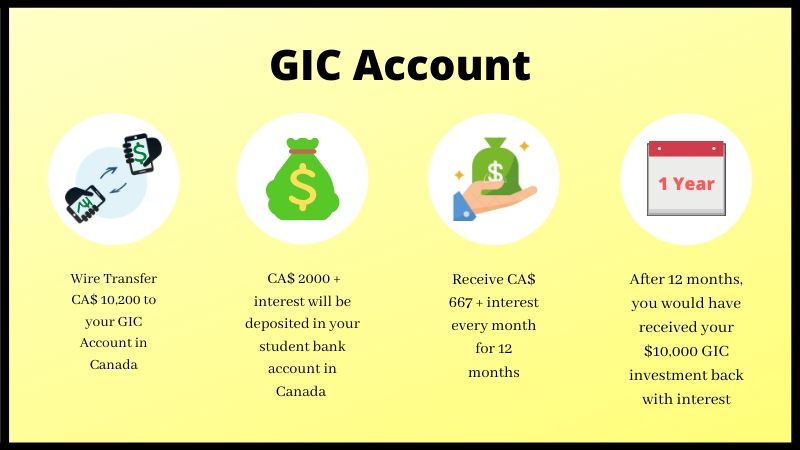

What is GIC and how is it done?

So what is GIC, you keep hearing this term…

GIC means Guaranteed Investment Certificate. When you land in Canada, you keep getting monthly money from your GIC.

what you have to do…

You have to open an online bank account under your name in the home country. Get a GIC account in Canada from an approved financial institute. And then you have to wire 10200 CAD to a bank account approved financial institute in Canada

10000 towards your GIC and 200 for the processing fee in that bank account. After that, you get a receipt. You have to print it and put it in your visa application.

how does it work with 10000 CAD of GIC?

When you land in Canada you get 2000 in your bank account in Canada for your initial setup costs. And at the end, all the remaining amount is divided across the 12 months that will 667 per month. The amount you will get over the next 12 month

The following financial institutions offer GICs that meet the criteria:

Amount of funds required

The amount of proof of funds that you’re going to present to the immigration officer varies depending on

- your program

- if you have a spouse or children with you.

Amount of fund based on program

If you’re alone coming here in Canada, the standard or minimum requirement for the proof of fund can be calculated with a simple formula.

For one year program

- The amount of fund should be one year of the cost of living plus one year of your tuition fee.

Note:

Due to lack of funds, many international students go for one year program of study. But after completing studies, they opt for another study program.

The reason is that international students are allowed to work in Canada. They save money from their jobs. And use it to extend their studies and stay in Canada. Learn more: How to Work and Get PR with 1+1 Year Course

For two years program

- The amount of fund should show at least the 1st year tuition fees + 2 years cost of living.

For your one-year cost of living according to the CIC website, you should provide 10,000 Canadian dollars. This amount includes your one year of expense such as your monthly rental, your groceries, clothing, transportation, etc.

- One year cost of living expenses for International student= 10,000 CAD

Amount of fund based on family members

This amount of 10k or 10,000 Canadian dollars is for an international student. But if you have a family member with you that will accompany you. Then, you should add an additional amount. For example

If you and 2 family members want to come to a province outside Quebec for a year, you will need

- living expenses: $10,000 (for the student)

- living expenses: $4,000 (for the first family member)

- living expenses: $3,000 (for the second family member)

Total: $17,000 + 1st year tuition fee (for one year)

Financial documents required as proof of funds

Financial documents depend on the financial option selected by the International student. For a study permit, an international student can use any of these methods to cover his finances.

- Self-funding

- GIC

- Scholarship

- Financial support from relatives

- Financial support from non-relatives

- Financial support from within Canada

- First-year tuition fee

Prove payment of first-year tuition fee

To prove the full payment of the first-year tuition fee, you can submit one of these documents:

- a receipt from the DLI

- an official letter from the DLI confirming payment of tuition fees

- a receipt from a bank showing that tuition fees have been paid to the DLI

- proof that the tuition fee amount has been transferred into a repository account at the DLI to be applied to the tuition bill at a later date

Financial documents to prove self-funding

Many international students finance their own studies in Canada. If you are one of them and you have enough money to support your living expenses and studies in Canada. Then you have to provide the following financial documents as proof of funds.

- Employment Certificate and three month pay slips or proof of business (such as business license under your name)

- Your bank statements for the last six months (also include Bank certificates)

- Income tax return for past two years

- Proof of GIC (mandatory in SDS but optional in the regular stream)

- Proof of Fixed Assets (immovable property such as house and land) (if any)

- Proof of Liquid Assets (fixed deposits, policy investments, vehicle resale price, gold)(if any)

- First-year tuition fee (mandatory in SDS but optional in the regular stream)

Financial documents to prove GIC

What is GIC? It is a guaranteed investment certificate. In this program, you will invest in approved financial institutions in Canada. And they give you the money back little by little every month. Learn how GIC works (also includes a list of approved financial institutes)

You can provide any one of these financial documents from the financial institution to prove your GIC account

- a letter of attestation

- a GIC certificate

- an Investment Directions Confirmation or

- an Investment Balance Confirmation

Note: It’s only an option for those who are planning to apply through the regular stream. But for those who are applying through the Student Direct Stream, it is required for you to provide your GIC investment certification.

How to prove scholarship

Government and other agencies often provide financial support to international students in Canada. You need to provide proof of this financial assistance.

- First-year tuition fee (mandatory in SDS but optional in the regular stream)

- An official letter from the sponsoring organization is mandatory requirement.

The official letter must include e full amount of the award, its duration, and any governing conditions.

How to prove financial support from relatives

The list of relatives includes your father, mother, grandparents, brother, sister, aunt, uncle, and cousins. They all can provide financial support for your studies and living expenses in Canada.

Here is the list of Mandatory financial documents to prove financial support from relatives

- Sponsor’s government Id

- Income Tax Returns of your relative for the past two years

- Reference letter from your relative. Also known as Affidavit. Check a sample of Affidavit

- Relatives bank statements (stamped) for the last six months plus bank certificate

- Employment Certificate and three months payslips or proof of business (business license under the sponsor’s name)

- First-year tuition fee (mandatory in SDS but optional in the regular stream)

- Proof of your relationship

- Proof of GIC (mandatory in SDS but optional in the regular stream)

You can strengthen your application by providing proof of supplementary funds

- Proof of fixed assets such as house or land (if any)

- Proof of liquid assets such as savings, fixed deposits, policy investments, vehicle resale price, gold (if any)

Note:

Documents to prove a relationship with the sponsor. If your sponsor is

- Parent: provide their official Ids and your birth certificate or official id

- Siblings: provide your and your sibling’s birth certificate or official ids

- Grandparents: provide your, your mother/father’s birth certificate or official ids and grandparents’ official Ids.

- Aunt/uncle: provide your, your mother/father, and your aunt/uncle birth certificate or official IDs

- Cousins: provide your, your mother/father, cousin’s parent, and cousin’s birth certificate or official ids.

- Stepparents: provide your birth certificate and marriage certificate of your parents

- In-laws: your marriage certificate and additional identification documents of your in-laws

How to prove financial support from non-relatives

Other than your relatives, a non-relative like friends, friends parents, etc can also financially support your studies in Canada.

- The list of financial documents to prove financial support from non-relatives is the same as that of relatives.

- But you don’t need to provide proof of your relationship.

- Instead, the Affidavit or letter of support must provide a detailed explanation as to why this person or institution is providing financial support to you

Prove financial support from within Canada

You can also have a sponsor within Canada. Your sponsor in Canada can provide you food, accommodation, transportation, etc. Here is the list of financial documents that can be submitted by your sponsor within Canada.

- Official identification documents

- A certificate of employment and three months’ payslip

- Bank statement and certificate

- T4 (T4 is a tax document in Canada)

- Tenancy certificate

- Proof of relationship (if any)

- Affidavit or letter of support

Note:

The affidavit should state that they are going to sponsor you to study here in Canada. How will they sponsor you through expenses, your monthly expenses or your accommodation, or your tuition fee?

They should also state your relationship with them. And then also your sponsor should provide or should state what is their motivation to sponsor you to study in Canada.

Proof of fund based on student application

As you know, there are two streams in Canada for international students to apply for a study permit.

- Student direct stream (SDS)

- the regular stream

and there are some pretty big differences between these two streams.

| Comparison | SDS | Regular Stream |

|---|---|---|

| Availability | Only for 7 countries* | Worldwide |

| Acceptance letter from DLI | Required | Required |

| Current location | Outside of Canada | Inside or outside of Canada |

| First-year tuition payment | Must be paid | Optional |

| Proof of financial support | Required | Required |

| Guaranteed Investment Certificate (GIC) | Required | Optional |

| Processing time | Usually 20 calendar days | Varies by country. Check processing times |

*China, India, Morocco, Pakistan, the Philippines, Senegal or Vietnam

Financial documents for Student Direct Stream

Here is the list of required financial documents or proof of funds to apply for a Canada study permit through Student Direct Stream (SDS).

- Proof of GIC

Proof of full payment of first-year tuition fee

Country-specific financial documents. Check for your country requirements here.

Financial documents for General category

For general category or regular stream, you can provide any of these mentioned financial documents as proof of funds.

- Proof of a Canadian bank account in your name

- Proof of a student or education loan from a bank

- Proof of Self-funding

- Proof of GIC

- Proof of Scholarship

- Proof of Financial support from relatives

- Proof of Financial support from non-relatives

- Proof of Financial support from within Canada

- Proof of First-year tuition fee

Final word: Here is the list of 8 common problems and their solutions for international students. You can avoid these worst-case scenarios. And if you face any of them, then there is a solution for it.

![Coursera Vs Pluralsight: Which is Best For You? [2024 Updates]](https://www.2-study.com/wp-content/webpc-passthru.php?src=https://www.2-study.com/wp-content/uploads/2023/12/Coursera-Vs-Pluralsight-800x450.jpg&nocache=1)

![Masterclass vs Skillshare: Here are the Key Differences [2024 Update]](https://www.2-study.com/wp-content/webpc-passthru.php?src=https://www.2-study.com/wp-content/uploads/2023/12/Masterclass-vs-Skillshare-800x450.jpg&nocache=1)

I am an international student from Brazil and am making plans to study in Canada.

The biggest question is about financial proof.

I have a significant amount invested in “stock investment” applied that would be sufficient to meet the amounts requested by the Canadian Government.

The question is, whether this type of investment is accepted as financial evidence for applying for a visa to study

Regards