What is Net Worth of a Company?

The company’s net worth is nothing but the Book value or Shareholders Equity of the firmShareholders Equity Of The FirmShareholder’s equity is the residual interest of the shareholders in the company and is calculated as the difference between Assets and Liabilities. The Shareholders' Equity Statement on the balance sheet details the change in the value of shareholder's equity from the beginning to the end of an accounting period.read more. The company’s net worth is the value of the assets after paying off its liabilities like debt. Please note that net worth is different from “market value” of the company or “market capitalization.”

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Net Worth of a Company (wallstreetmojo.com)

In simple terms, net worth is the net assetsNet AssetsThe net asset on the balance sheet is the amount by which your total assets exceed your total liabilities and is calculated by simply adding what you own (assets) and subtract it from whatever you owe (liabilities). It is commonly known as net worth (NW).read more and earnings after deducting all the liabilities and the expenses.

Table of contents

Net Worth Of A Company Explained

The net worth of the company can be calculated from two methods where the first method is to deduct the total liabilities of the company from its total assets and the second method is to add the share capital of the company (both equity and preference) and the reserves and surplus of the company.

A positive net worth indicates that the company’s assets exceed its liabilities, suggesting that it has built up value and has resources available to cover its obligations. This can instill confidence in investors and creditors, as it reflects the company’s ability to generate profits and withstand financial setbacks.

Conversely, a negative net worth signifies that the company’s liabilities outweigh its assets, indicating financial distress and potential insolvency. This may raise concerns among stakeholders about the company’s viability and ability to meet its financial obligations. Negative net worth can result from sustained losses, excessive debt, or significant asset write-downs.

Overall, the net worth of a company is a fundamental measure of its financial strength and stability. It provides valuable insights into the company’s ability to generate value for shareholders, manage its debts, and weather economic uncertainties. As such, monitoring changes in net worth over time is essential for assessing the company’s performance and making wise investment or lending decisions.

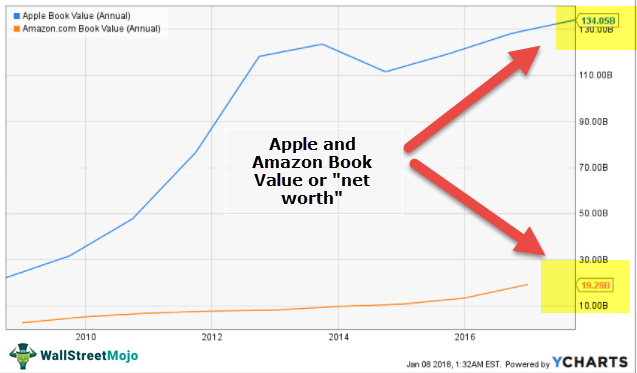

Let us take the example of Apple and Amazon. We note that Apple’s Net worth is $134.05 billion, and that of Amazon is $19.2 billion. However, their market capitalizationMarket CapitalizationMarket capitalization is the market value of a company’s outstanding shares. It is computed as the product of the total number of outstanding shares and the price of each share.read more (market value) is 898.5 billion (Apple) and 592.29 billion (Amazon), respectively.

Formula

Let us understand the formula that shall act as the basis of our understanding of the workings of a net worth of a company calculator.

Net Worth of the company formula = Total Assets – Total Liabilities;

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Net Worth of a Company (wallstreetmojo.com)

The above is also known as Shareholders’ Equity or the Book Value.

Also, please note that this is different from Tangible Book Value, which also removes the value of intangible assetsIntangible AssetsIntangible Assets are the identifiable assets which do not have a physical existence, i.e., you can't touch them, like goodwill, patents, copyrights, & franchise etc. They are considered as long-term or long-living assets as the Company utilizes them for over a year. read more such as goodwill, patents, etc.

Financial Modeling & Valuation Courses Bundle (25+ Hours Video Series)

–>> If you want to learn Financial Modeling & Valuation professionally , then do check this Financial Modeling & Valuation Course Bundle (25+ hours of video tutorials with step by step McDonald’s Financial Model). Unlock the art of financial modeling and valuation with a comprehensive course covering McDonald’s forecast methodologies, advanced valuation techniques, and financial statements.

Video on How to Calculate Net Worth of a Company?

How to calculate?

Now that we understand the basics and the formula of the concept, let us also understand how to calculate it. For the ease of understanding, let us discuss through an example.

Mr. A has got hold of the balance sheet of Q Company. But while traveling, Mr. A lost the last part of the balance sheet. So how would he calculate the net worth of a company ABC?

Here’s the remainder of the document.

Balance Sheet of ABC Company

| 2016 (In US $) | 2015 (In US $) | |

|---|---|---|

| Assets | ||

| Current Assets | 300,000 | 400,000 |

| Investments | 45,00,000 | 41,00,000 |

| Plant & Machinery | 13,00,000 | 16,00,000 |

| Intangible Assets | 15,000 | 10,000 |

| Total Assets | 61,15,000 | 61,10,000 |

| Liabilities | ||

| Current LiabilitiesCurrent LiabilitiesCurrent Liabilities are the payables which are likely to settled within twelve months of reporting. They're usually salaries payable, expense payable, short term loans etc.read more | 200,000 | 2,70,000 |

| Long term LiabilitiesLong Term LiabilitiesLong Term Liabilities, also known as Non-Current Liabilities, refer to a Company’s financial obligations that are due for over a year (from its operating cycle or the Balance Sheet Date). read more | 1,15,000 | 1,40,000 |

| Total Liabilities | 3,15,000 | 4,10,000 |

Here the computation is easy. All Mr. A needs to do is calculate the Net worth of a company ABC by deducting the total liabilities from the total assets.

| 2016 (In US $) | 2015 (In US $) | |

|---|---|---|

| Total Assets (A) | 61,15,000 | 61,10,000 |

| Total Liabilities (B) | 3,15,000 | 4,10,000 |

| Net Worth (A – B) | 58,00,000 | 57,00,000 |

Can It Be Negative?

In short, the answer is yes, the net worth of a company can indeed be negative, indicating a situation where its liabilities exceed its assets. A negative net worth can signal financial distress and may raise concerns among investors, creditors, and other stakeholders about the company’s financial health and ability to meet its obligations. It reiterates the importance of closely monitoring financial performance and implementing corrective measures to restore positive net worth and financial stability.

Several factors can contribute to a negative net worth. Let us discuss the top few through the explanation below.

- Sustained Losses: If a company consistently operates at a loss over an extended period, its accumulated losses can outweigh its accumulated profits, resulting in a negative net worth.

- Excessive Debt: Taking on excessive debt relative to its assets can lead to negative net worth, especially if the company struggles to generate sufficient income to service its debt obligations.

- Asset Depreciation: Significant write-downs or depreciation of assets can reduce their value on the balance sheet, potentially pushing the company’s net worth into negative territory.

- Economic Downturns: Economic downturns or adverse market conditions can erode the value of a company’s assets, leading to a decline in net worth.

- Mismanagement: Poor financial management, inadequate risk management, or strategic missteps can also contribute to a negative net worth.

How Would We Interpret Its Growth Or Decrease?

Both for businesses and individuals, assets and liabilities can go down or go up.

Suppose we see that the net worth of a business or an individual has been growing. In that case, we can easily say that the increase in the assets and the earnings of the business or the individual has been more than the increase in the liabilities and the expenses, or we can also say that the decrease in the assets and the earnings of the business is smaller than the decrease in the liabilities or the expenses.

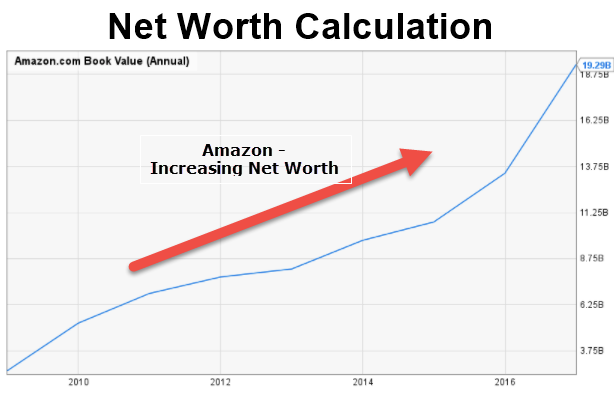

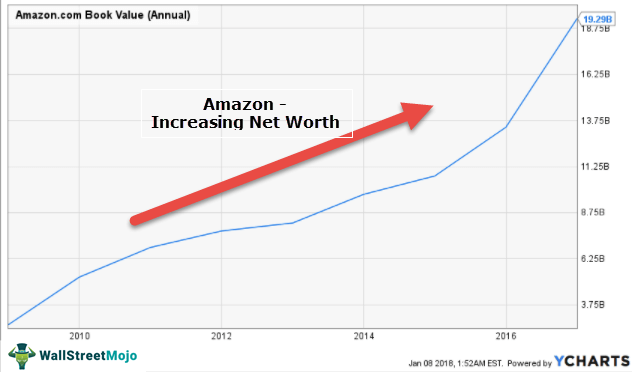

Increasing Net Worth of a company Example

Amazon’s Net worth has been increasing continuously over the past five years. This is because they have been able to increase their Assets and earnings over some time.

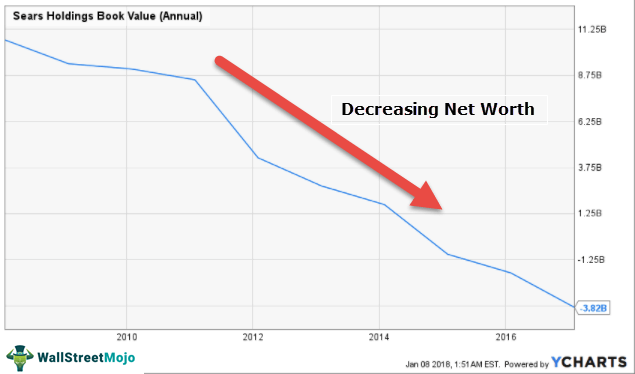

Decreasing Net Worth of a Company Example

Sears Holding, is a classic example of the decrease in Net worth over time. Sears has been reporting continuous losses resulting in the negative book value of the firm.

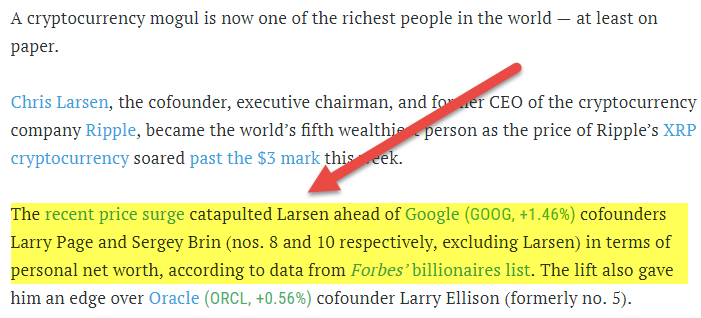

What is net worth from an individual perspective?

Recently, Chris Larsen (co-founder) of cryptocurrencyCryptocurrencyCryptocurrency refers to a technology that acts as a medium for facilitating the conduct of different financial transactions which are safe and secure. It is one of the tradable digital forms of money, allowing the person to send or receive the money from the other party without any help of the third party service.read more company Ripple has become the fifth wealthiest person in terms of net worth. Now that we understand what net worth is to the company let us look at how net worth can be calculated in the case of an individual.

source: fortune.com

From an individual’s perspective, net worth means the difference between how much a person owns and how much she owes.

Let’s take a simple example to illustrate this.

David has a home, a car, and a portfolio of investments. His home is worth $120,000. The car he owns is about $20,000. And the portfolio of investments is $50,000. He has taken a mortgage loan for his home, around $60,000, of which he already paid off $10,000. He has also taken a car loan of $10,000. What would be his net worth at this juncture?

This is quite a simple example.

All we need to do is add up David’s assets and then subtract all the liabilities from that.

- David’s total assets would be = ($120,000 + $20,000 + $50,000) = $190,000.

- There is a twist in this example. It says that out of the $60,000 David has taken as a loan, $10,000 is already paid off. That means at this moment his mortgage loan amount is = ($60,000 – $10,000) = $50,000.

- Now, we can add up his liabilities. It would be = ($50,000 + $10,000) = $60,000.

- That means, at this juncture, David’s net growth would be = ($190,000 – $60,000) = $130,000.

Net Worth Vs Liquid Net Worth

Let us understand the distinctions between net worth and liquid net worth through the comparison below.

Net Worth

- Net worth represents the total value of assets owned by an individual or company after deducting all liabilities.

- It includes both tangible assets (such as cash, property, and investments) and intangible assets (such as intellectual property and goodwill).

- Net worth provides a comprehensive view of an individual’s or company’s overall financial health and ability to cover debts and obligations.

- It serves as a key metric for assessing long-term financial stability and evaluating investment opportunities.

Liquid Net Worth

- Liquid net worth refers to the value of assets that can be easily converted into cash within a short period, typically within 30 days.

- It includes cash, savings, checking accounts, stocks, bonds, and other highly liquid investments.

- Liquid net worth excludes assets that are not easily converted into cash without significant time or effort, such as real estate, retirement accounts, and certain types of investments.

- Liquid net worth provides a more immediate measure of an individual’s or company’s financial liquidity and ability to meet short-term financial obligations or unexpected expenses.

Recommended Articles

This has been a guide to the Net Worth of a Company, its formula, and calculation, along with practical examples. If you want to learn more about such accounting topics, you may have a look at these recommended articles –

Website is just fantastic and offers many options that are easily accessible from the same website.