Meaning of Inflation:

One primary macroeconomic concern in market economies is the maintenance of stable prices, or the control of inflation. Inflation is a situation where prices are persistently rising, thereby reducing the value of money.

It refers to a situation of constantly rising prices of commodities and factors of production. The opposite situation is known as deflation—a situation of constantly falling prices of commodities and factors of production.

Inflation can have severe consequences. Inflation is an increase in the general level of prices. It does not mean that prices are high, but, rather, that they are increasing. For example, assume that over the past 2 years the price of a particular combination of consumer goods in country A has been stable at Rs. 100.

Assume that in country B the price of that same combination of consumer goods has gone up from Rs. 10 to Rs. 30 over the last 2 years. Country B, not country A, faces a problem with inflation. Inflation refers to price movements, not price levels.

ADVERTISEMENTS:

With inflation, the price of every good and service does not need to increase because inflation refers to an increase in the general level of prices. An inflation rate of 7% does not mean that all prices are increasing by 7%; it means that, on average, prices are going up by that amount. Also, the mere existence of an increase in the general level of prices is not necessarily a matter of concern in an economy. An inflation rate of 2% to 3% per year would not present a policy problem. However, when prices increase by a larger percentage, such as 8% to 10% or more per year, inflation is a serious issue.

Inflation and the Price Level:

Inflation is a process in which the price level is rising and money is losing value. There are two features of this definition. Firstly, it is a monetary phenomenon. It is the price level and, therefore, the value of money that is changing, not the price of some particular commodity. For example, if the price of oil rises but prices of computers falls so that the price level (an average of prices) is constant, there is no inflation.

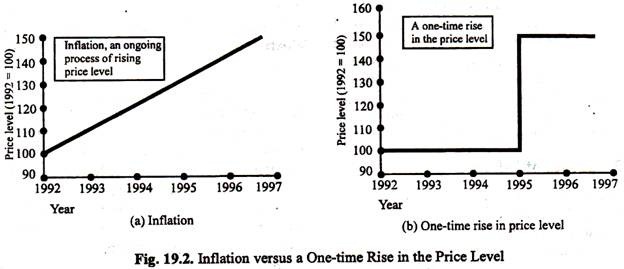

Second, inflation is an on-going process, not a one-shot affair. Figure 19.2 illustrates the distinction between an on-going process of rising prices and a onetime rise in the price level. In part (a), the price level rises continuously. In part (b), the price level rises at the beginning of 1997, a one-time rise, but is constant in the other years. The economy in part (a) is experiencing inflation but the economy in part (b) is not. It has had a one-time rise in its price level.

Nature and Types:

The rate at which the general level of prices increases can vary.

ADVERTISEMENTS:

Hence there are several types of inflation:

1. Creeping Inflation:

It refers to a rise in the price level of a rate of 2 to 3% per annum. This type of inflation does not do much harm and may, in fact, stimulate investment.

2. Moderate (mild) Inflation:

It refers to a rise of 4 to 5% inflation per annum and this rate is high enough to have undesirable effects. If the price level goes up by just 2 to 3% per annum, the situation is one of mild inflation.

3. Rapid Inflation:

ADVERTISEMENTS:

It refers to an annual rise of 6% or more in the general price index. It is definitely harmful and has undesirable effects on incomes, imports and exports, savings and consumption.

4. Hyperinflation (Recessionary Inflation):

If mild inflation is left unchecked for a long period, it is converted into hyperinflation. Hyperinflation is a phenomenon that usually accompanies war and its aftermath. It is a consequence of an attempt to finance government expenditure through printing of paper money. At first, the government deficit may be slight and the addition to the price level insignificant.

However, as the price level starts rising, the government must spend greater and greater nominal amounts of currency to obtain the same quantity of real resources. Meanwhile, consumers and investors comes to anticipate further price rise and intensify their bidding for real goods and services.

The climax of hyperinflation appears when the flight from money is such that the velocity of circulation approaches infinity. Hyperinflation is runaway inflation during which prices rise very fast. The value of money falls daily, or even hourly. People lose confidence in the currency and the monetary (currency) system ultimately breaks down. People refuse to accept payments in money. Commodities are preferred to money in most transactions.

At the end, the currency ceases to function as money and has to be abandoned. Thus the money economy yields place to barter economy. This type of inflation occurred in the then West Germany in 1923.

5. Open vs. Suppressed Inflation:

Open inflation is said to occur when the government makes to attempt to control it. However, when prices are controlled by certain administrative measures such as fixation of price-ceilings, rationing or otherwise, inflation is said to have been suppressed (or repressed). Suppressed inflation also goes by the name repressed inflation.

Suppressed inflation refers to a situation where demand exceeds supply, but the effect on prices is minimised by the use of such devices as price controls and rationing. It may be noted that price controls do not deal with the cause of inflation; they merely seek to suppress the symptoms.

The excess demand still exists and it will tend to show itself in the form of waiting lists, queues, and, almost inevitably, in the form of black markets. Thus prices are held in check in the controlled sector but there is disproportionate rise in prices in the uncontrolled sector. This happens due to the fact that private cash holding — as also holding of bank balances — increase during a period of suppressed inflation.

6. Galloping Inflation:

When inflation proceeds very fast or at a very rapid rate, it is called galloping inflation.

7. Sellers’ Inflation:

ADVERTISEMENTS:

Nowadays, sellers often add a margin (mark-up) to cost before fixing up price. This causes mark-up inflation or sellers’ inflation.

8. Partial vs. True Inflation:

According to some economists, any continuous rise in the price level must not be taken for inflation. Whenever the price level increases, the producers reap larger profits and necessarily tend to produce more. As a result of this, unemployed inputs are put into use, unemployed workers get jobs, unused land and capital goods are made use of. And, because of this, the volume of production also increases. So long as this happens, it can only be termed as partial inflation. Thus, partial inflation rises if the price level is accompanied by increase in the volume of production of goods and services.

But partial inflation cannot continue for long. A time comes when all the factors become fully employed. In this condition of full employment no further increase in production can be envisaged. On the other hand, as a result of competition among the producers the factor-prices — rent, wages interest and profit — tend to rise.

Since factor prices are also factor-incomes — incomes of the suppliers of the factors of production, people have larger income than before. Larger incomes mean more expenditures and, necessarily, more pressure of purchasing power upon goods and services.

ADVERTISEMENTS:

For, in the situation of full employment, production cannot increase any further. It is tins situation which has been called true inflation by modern economists. Thus true inflation implies a situation of continuously rising price level without any possibility of corresponding increase in production.

Causes of Inflation:

Because inflation is an upward movement in the general level of prices, and because prices result from the interaction of buyers’ demand and sellers’ supply decisions, a logical way of classifying the causes of inflation is according to whether they originate from the buyers’ or the sellers’ side of the market. Inflation originating from upward pressure on prices from the buyers’ side of the market is termed demand-pull inflation. Inflation originating from upward pressure from the sellers’ side of the market is called cost-push inflation.

In fact following Keynes economists have identified two broad types of inflation demand-pull inflation and cost-push inflation. A study of these two types of inflation enables us to analyse the causes of inflation.

Demand-Pull Inflation:

When buyers’ demands to purchase goods and services exceed sellers’ abilities to supply them, prices of available goods and factors are pushed up, and demand-pull inflation occurs. When demand subsides, so does the pressure on prices.

ADVERTISEMENTS:

We may define inflation as a situation associated with rising prices and the falling value of money. Inflation occurs when prices are generally rising and the value of money is correspondingly falling. Inflation can occur from an increase in aggregate demand, or a decrease in aggregate supply, or both.

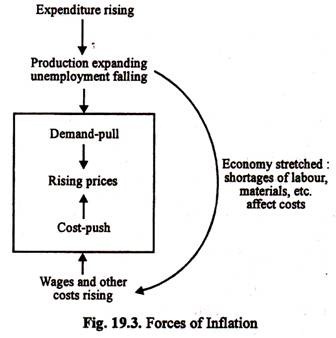

To study the forces that generate inflation, we distinguish two types of impulses that can get an inflation started. The causes are complicated but can be explained by two kinds of forces affecting the price level. These forces are sometimes distinguished by the terms ‘demand-pull’ and ‘cost-push’ (Fig. 19.3). We will first study demand-pull inflation.

Inflationary Gap:

Classical economists believed that the root cause of inflation was continuous rise in money supply. But modern discussion of inflation goes in terms of what Keynes termed ‘inflationary gap’.

It is a situation in which aggregate demand in the economy is greater than the aggregate supply of resources coming forward to the market. The consequences are persistently rising prices and costs (and disequilibrium in the balance of payments).

Suppose the total value of output in a country in a particular period is Rs. 900 crores. The government now takes away Rs. 150 crores to meet its own needs. So the private sector is left with Rs. 750 crores for its own expenditure — consumption and investment. From the national income analysis we know that the value of money income of the country is always equal to the net value of output.

ADVERTISEMENTS:

Here also the total money income of the people (Rs. 750 crores) is equal to the net value of output (Rs. 900 crores-Rs. 150 crores = Rs. 750 crores) at current prices. As long as expenditure is equal to income there is no pressure on prices and no inflation. Prices remain virtually stable.

Suppose now the government injects Rs. 200 crores of money in the economy (either by borrowing from banks or creating money to finance its own expenditure). This expenditure is made on factors of production. They earn incomes of an equivalent amount. So money income of the people rises to Rs, 950 crores (Rs. 750 crores + Rs. 200 crores). The government may now tax a part of income (say, Rs. 50 crores). A part of the increased income (disposable) will be saved and a part spent.

Suppose people save Rs. 50 crores and spend Rs. 100 crores. So the net money income available for expenditure is Rs. (950 – 50 – 50) or Rs. 850 crores. So there is an increase over the previously available income amounting to (Rs. 850 crores – Rs. 750 crores =) Rs. 100 crores. The excess represents the inflationary gap, which will put an upward pressure on price. If there is no corresponding increase in output, the price rise will continue until the value of output and the level of income are equalised.

K. Kurihara defines the gap as “the excess of anticipated expenditure over available output at base (z. e., pre-inflation prices).” The gap can be eliminated (i) either by reducing money income through reduction in government expenditure (ii) or by increasing output of goods and services.

According to Keynes and his followers (called Keynesians) demand-pull inflation occurs when there is a continuous increase in aggregate demand so that aggregate demand exceeds aggregate supply at the existing price level. In such a situation a persistent rise in the general price level is quite inevitable. In other words, due to excess demand pressures the price level will be persistently pushed upwards.

This explains why the process of demand-pull inflation has been compared to the behaviour of the price level at an auction. In every bidding situation the auctioneer sets a relatively low starting price and expects that demand will initially exceed the limited quantity which is available. The excess demand bids up the price and the product goes to the highest bidder. The process goes on until excess demand disappears (i.e., until no buyer remains). The process of demand-pull inflation can well be analyzed by using one of the important tools of modern macroeconomics — aggregate demand curve and aggregate supply curve.

ADVERTISEMENTS:

It may be noted that, unlike the classical economists, Keynes assumed rigidity of wages and prices. In his view, at very low levels of output an increase in aggregate demand will lead to an increase in output, the price level remaining unchanged. However, as the economy gradually approaches full employment, further increases in aggregate demand will lead to upward pressure on prices, while, at the same time, output (GNP) will continue to increase.

According to Keynes this is not inflation in the true sense. Such a situation can, at best, be described as one of partial inflation. But once the economy reaches the full employment state its actual output will be equal to its potential output.

There will not be any further scope for raising output even if aggregate demand continues to increase. At this stage any further increase in aggregate demand simply leads to a rise in the general price level. According to Keynes, true inflation occurs only when the economy is at full employment.

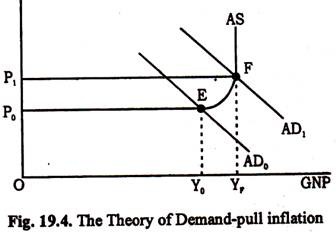

The theory of demand-pull inflation is illustrated in Fig. 19.4. Here AD0 is the initial aggregate demand curve and AS is the aggregate supply curve. The economy is initially in equilibrium with the price level p0 and actual output (GNP) Y0 which is less than potential (full employment) output YF.

Now suppose aggregate demand rises to AD1 (due to some reason, such as an increase in government expenditure). As a result the price level will rise to P1. However, since there are employed resources in the economy as also idle capacity, and output will also increase to YF, the full employment level. This is a situation of partial inflation, and not true inflation.

ADVERTISEMENTS:

However, once the economy reaches the stage of full employment, any further increase in aggregate demand will simply result in a persistent rise in the general price level. Thus, in short, a continuous increase in aggregate demand will generate a persistent rise in the general price level once the economy succeeds in producing its potential (full employment level of) output. This is the essence of Keynes’ theory of demand-pull inflation.

The sources of an increase in aggregate demand are:

1. Tax cut:

For example, a cut in taxes, by increasing disposable income, might lead to a rise in consumption expenditures.

2. A fall in the rate of interest:

A fall in the rate of interest is likely to encourage an increase in investments as also as increased consumption spending on durable goods such as T.V. sets, refrigerators, cars, or even houses.

ADVERTISEMENTS:

3. Government expenditure:

The government might also increase its own expenditure which may be financed by printing paper currency.

4. Exchange rate changes:

The government might also bring about a reduction in the rate of exchange so as to raise export or reduce import. However, any of these factors might cause just once for-all-change in demand and prices. But none would cause a persistent rise in demand and, hence, a persistent rise in the general price level. But the fact remains that an increase in any one of them might initiate a rise in prices which might be the approximate cause of inflation.

The Quantity Theory Explanation:

It is interesting to note here that there is no logical contradiction between the quantity theory of money (according to which inflation is a purely monetary phenomenon) and Keynes’ theory of demand-pull inflation. A close look shows that the demand-pull hypothesis is exactly the same as the quantity theory hypothesis.

However, the Keynesians argue that in reality aggregate demand may rise for several reasons. The increase in the supply of money is just one possible reason. Differently put, in the Keynesian model, even if there is no change in money supply an increase in aggregate demand is still possible — if there is an increase in income velocity of money.

Demand-pull inflation has a tendency to occur when the economy is close to or at full employment. At full employment the economy is operating at full capacity and producing the maximum amount of goods and services possible. Production cannot be readily expanded.

At the same time, with all but the frictionally unemployed working and earning income, consumer demand for goods and services is high. Also, because consumer demand is high, businesses may find it profitable to expand and invest in new buildings and machinery. This demand, or spending pressure, by both house-holds and businesses — coupled with production at or near capacity — sets off demand-pull inflation.

Demand-pull inflation is also related to the amount of money in the economy. The ability of households and businesses to spend depends in part on the amount of money available for spending. If the supply of money in the economy increases at a faster rate than the increase in production, there may be upward pressure on prices.

Also, if the economy is at full employment and more money is put into the hands of businesses and consumers, the result will be inflationary. Thus, too much money in the economy and in the hands of businesses and consumers can contribute to demand-pull inflation.

Cost-Push Inflation:

When price increases are caused by pressures from the sellers’ side of the market, cost-push inflation occurs. With this type of inflation, increases in sellers’ costs are wholly or partially passed on to buyers in the form of higher prices.

Anything that represents a cost to a business is a potential source of price increases, and, if significant enough, of cost-push inflation. This means that upward pressure on prices could come from increased costs of labour, raw materials, fuels, machinery, borrowing, and so on. Attempts to increase profit by raising prices can also be a source of cost-push inflation.

So inflation can also be explained from the supply side. It is in this context that the theory of cost-push inflation becomes relevant. Such inflation occurs when the source of upward pressure on prices is rising costs. The causes of such inflation may now be discussed.

1. Rise in wages:

Since in most countries (particularly developing countries) labour costs account for the major portion to total costs, attention has inevitably focused on wage increases as a source of inflation. In fact, modern economists use the term ‘wage-push (cost) inflation’ to refer to this type of inflation.

The ultimate cause of such inflation seems to be wage increases in excess of productivity increases. Annual price rise is taken to be the difference between annual wage rise and annual productivity rise. If wages rise faster than labour productivity, a price rise, from the supply side, is quite inevitable.

It is, of course, not possible for workers to demand and succeed in getting wage increases in excess of productivity increases independently of the state of the economy. Instead, the truth is that the ability of workers to obtain wage increases, through trade unions, is greater the closer the economy is to full employment and the more likely are shortages of skilled workers.

2. Currency depreciation:

However, wage increases in excess of productivity increases are not only cause of cost-push inflation. Another important cause seems to be a fall in the external value of a country’s currency. For a country like India — which mainly imports capital goods such as machinery and transport equipment — a fall in the external value of rupee in the foreign exchange market will have an immediate effect on the prices of imported capital goods.

3. Profit margin:

Another cause of such inflation is that employees, by increasing their profit margins, create upward pressure on costs and thus drive up final prices.

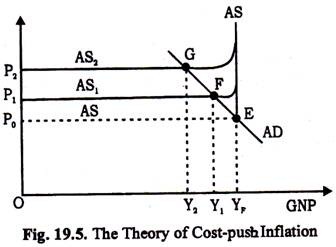

In Fig. 19.5 we illustrate the effect of rising costs on the price level by using the familiar aggregate demand and aggregate supply framework. Here AD and AS are initial aggregate demand and aggregate supply curves. The economy is initially in equilibrium at point E with the general price level at P0 and output as YF.

If there is now an increase in cost at all levels of output due to some exogenous shocks (over which producing units have no control) such as a rise in wage due to trade union pressure, or currency depreciation which raises the cost of imported articles, the aggregate supply curve will shift upward to AS1.

The economy now reaches equilibrium at point F which corresponds to a low level of output (Y1) and a higher general price level (P1). If there is a further increase in costs of production due to quoter exogenous factor, the aggregate supply curve now shift again (to AS1) and the economy will reach a new equilibrium point G.

At this point the price level is higher (P2) but output is lower (7). Every time the aggregate supply curve stuns to the left due to some external shock, the price level rises. This is why Lipsey has called this inflation by the name supply-shock inflation. Thus the essence of the theory of cost-push inflation is that a persistent rise in cost of production will generate a persistent rise in the general price level.

Cost-push inflation may occur even when there is unemployment, as the pressure. On prices comes not from demand but from costs, prices rise because costs are rising.

According to Paul Samuelson one major cause of cost-push inflation is that wages rise faster than labour productivity. If wages rose in line with productivity, then the higher wage costs could be met from the increased output. If, however, wages rise by a greater amount than productivity, the money to pay for the increased wage cost must come from elsewhere, i.e., higher prices.

It should be mentioned that a cost-push inflation may be attributed to increases in costs other than wages. For example, increases in raw material prices may cause costs to rise. Higher cost of raw materials is passed on in higher prices of the finished goods which use those materials. However, increases in wager rates unaccompanied by the increases in output per man-hour are the best known cause of rising costs.

Cost-push inflation, which is also referred to simply as cost inflation, has almost invariably been described as stemming from labour union pressure on wage rates. It is wage-cost inflation. This analysis starts from the recognition that wage rates in a modern economy are not strictly market-determined. They do not adjust immediately to whatever level may be necessary to ‘clear’ the labour market.

They are ‘administered prices’, and, as such, do not rise when the demand for labour exceeds the supply thereof. What is crucially important is that rising wages are not exclusively the result of an excess demand for labour. Collective bargaining often produces wages rate that bears no relationship to excess demand for labour.

Suppose that employers are forced to raise wages when there is no scarcity of labour. If the wage rise transcends productivity, it cannot but raise employers’ cost of production and reduce their willingness to supply goods at the previously prevailing prices.

Since there may not be any reason for reduction in supply to be accompanied by an equivalent reduction of demand, commodity prices cannot but rise. Unless and until prices rise in the same proportion as wage rates, there would exist a tendency for the supply of goods to fall short of demand, thus causing the price rise to continue until the previous ratio of wages to prices was restored.

It is spontaneous inflation. It requires no excess demand; it can even occur when there is some or perhaps considerable unemployment. It occurs because wage rates increase even with no excess demand for labour.

This type of inflation is more difficult to control by monetary or fiscal means than demand inflation. To avoid it, aggregate demand must be kept or pushed low enough and sufficient unemployment created — that unions will not seek or else employers will refuse to grant —wage increase in excess of productivity increases. This may mean a very high rate of unemployment.

Even if it does not, it may require a sacrifice of the rate of economic growth that we want. For, according to this view, fiscal and monetary measures can control inflation only by putting pressure on the employer, so that, in his turn, he may put pressure on the union.

Employers’ profits are thus caught between the upper milestone of a restrictive monetary or fiscal policy, operating to reduce aggregate demand, and the lower milestone of upward wage pressure. Profits must be squeezed until employers are able and willing to squeeze the inflation out of wage demands. This may be disastrous for investment and, thus, for growth.

Deflation and Disinflation:

Before leaving the discussion of inflation, two important related terms should be examined deflation and disinflation. Deflation occurs when there is a sustained decrease in the general level of prices. This does not mean that a few items decrease in price, or that there is a decrease for a short period of time. In the United States, deflation has not occurred since the 1930s.

Although a sustained decrease in the general level of prices might sound attractive, deflation —like inflation — can create problems for households and businesses. For example, homeowners wishing to move could be forced to sell their houses for less than they paid for them, and businesses could suffer losses if their products’ prices dropped to a level that did not cover previously incurred production costs.

A reduction of the inflation rate is referred to as disinflation. Disinflation does not mean that prices are falling, rather it refers to a slowing of the rate of increase in prices.