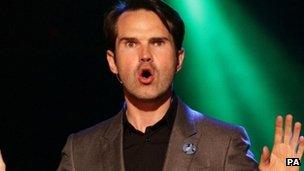

Jimmy Carr tax affairs 'morally wrong' - Cameron

- Published

Prime Minister David Cameron has said the tax arrangements of comedian Jimmy Carr are "morally wrong".

He made the comment to ITV News after reports that Carr was understood to be a member of a legal but aggressive tax avoidance scheme.

According to the Times, Carr told an audience on Tuesday: "I pay what I have to and not a penny more."

HM Revenue and Customs has said it is taking "firm action to protect the Exchequer from unacceptable tax loss".

More than 1,000 people, including Carr, are thought to be using the Jersey-based K2 scheme, which is said to be sheltering £168m a year from the Treasury.

Under the scheme, an individual resigns from their company and any salary they subsequently receive is paid to an offshore trust.

The individual then receives a small amount of that as salary and the rest as a loan, which because it can technically be recalled, does not attract tax.

'Dodgy schemes'

Carr was reportedly confronted over his financial arrangements during a show in Tunbridge Wells, Kent, by an audience member who shouted: "You don't pay tax."

His lawyers have insisted he has done nothing wrong, but the Treasury has said K2 is already being investigated.

According to the Times, the K2 scheme allows someone on an income of £280,000 to reduce their tax bill from £127,000 to just £3,500.

In an interview with ITV News, the prime minister was asked about Carr's arrangement.

He replied: "Some of these schemes we have seen are quite frankly morally wrong.

"People work hard, they pay their taxes, they save up to go to one of his shows. They buy the tickets. He is taking the money from those tickets and he, as far as I can see, is putting all of that into some very dodgy tax avoiding schemes."

The Liberal Democrats' deputy leader, Simon Hughes, said it was "completely unacceptable" for stars to avoid paying proper rates of tax.

In his Budget speech in March, Chancellor George Osborne described illegal tax evasion and legal but aggressive tax avoidance as "morally repugnant".

The BBC News Channel's chief political correspondent Norman Smith said having waded into the row, there would now be huge political pressure on Mr Cameron and Mr Osborne to take action against the individuals and schemes concerned.

Labour leader Ed Miliband said: "I'm not in favour of tax avoidance obviously, but I don't think it is for politicians to lecture people about morality.

"I think what the politicians need to do is - if the wrong thing is happening - change the law to prevent that tax avoidance happening."

'Preparing to litigate'

The Times is also reporting that Take That band members Gary Barlow, Howard Donald and Mark Owen have used another partnership run by Icebreaker Management Services.

It provides tax relief in return for investments in the music industry.

The newspaper quoted lawyers for Barlow, Owen, Donald and their manager Jonathan Wild who said all four paid significant tax and did not believe the Icebreaker programme was a tax avoidance scheme.

HMRC said it had already successfully challenged one avoidance scheme run by Icebreaker, which it refers to as Icebreaker 1.

"This type of scheme will fail where there is circular borrowing which serves no economic purpose or which cannot, in fact, be used in a trade," a spokesman said.

"We are now preparing to litigate Icebreaker 2 but for legal reasons cannot say more at this time.

"We examine the implementation of avoidance schemes in detail and will not let any aspect of these cases go unchallenged."

The spokesman added: "We have taken firm action to protect the Exchequer from unacceptable tax loss."

A spokesman for Icebreaker Management Services Ltd said the firm "recognises the need for the proper administration and collection of taxes, and that it is essential that anyone who seeks to make use of tax relief does so properly and within the law".

"Abuse of the tax system for personal gain is, of course, never acceptable," he added.

- Published14 June 2012

- Published24 May 2012

- Published28 March 2012