A’s turn down Black-led group’s bid for half of Oakland Coliseum

A’s turn down Black-led group’s bid for half of Oakland Coliseum

Trending

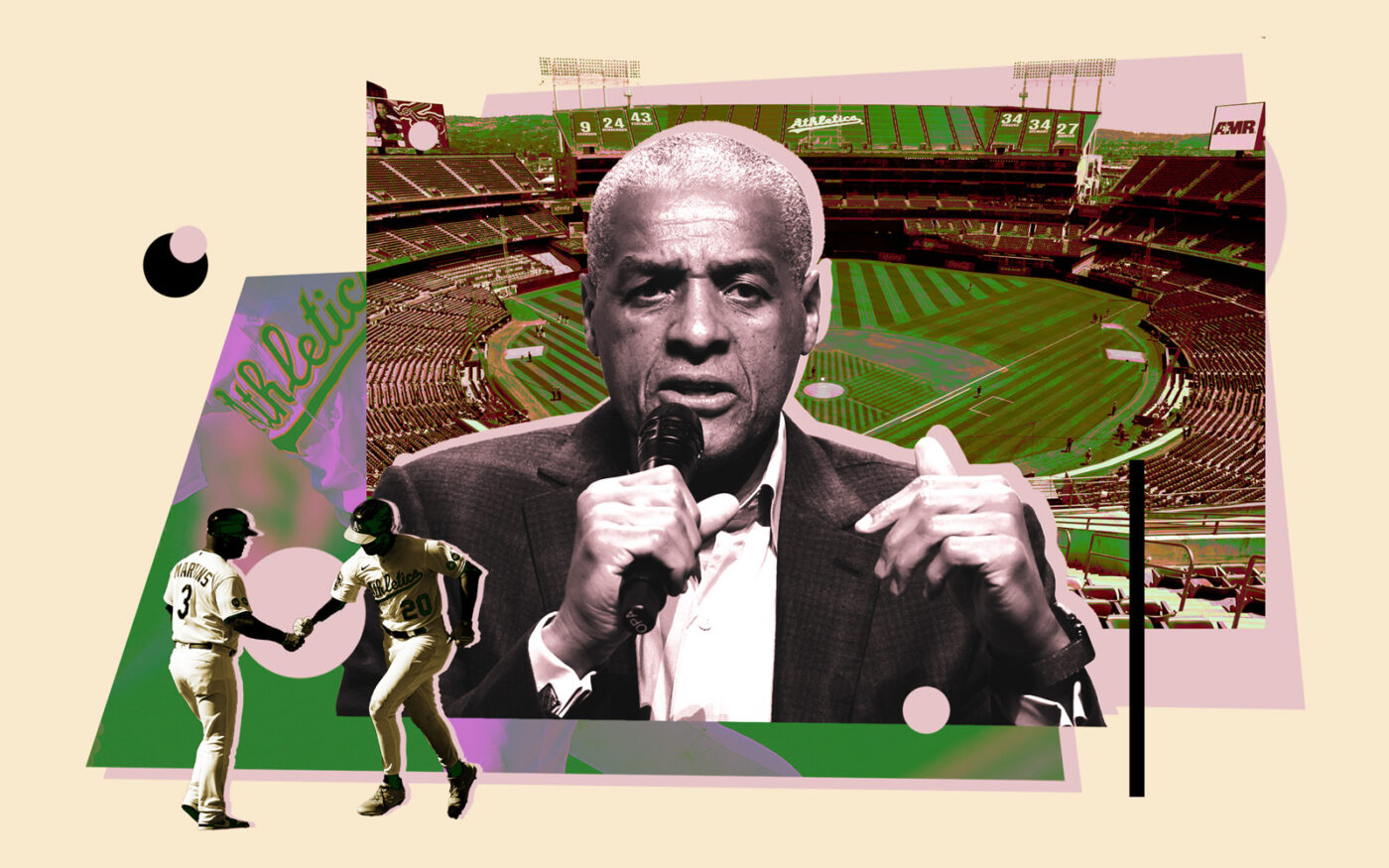

A look at Jim Reynolds, Chicago investor who wants in on Oakland Coliseum

Reynolds’ Loop Capital also has a role in South Side’s biggest development projects

Even as Jim Reynolds’ Loop Capital makes big moves in Chicago, the investor is looking west.

A financial services industry veteran, Reynolds now has a hand in some of the South Side’s biggest real estate projects, including the $4 billion Bronzeville Lakefront redevelopment and a $100 million film studio in South Shore.

Reynolds is also part of the African American Sports and Entertainment Group, a Black-led consortium of investors formed in 2020 that bid for the Oakland Athletics’ share of the sprawling Oakland Coliseum complex in California as the team prepares to move to Las Vegas.

The Oakland Coliseum presents a major redevelopment opportunity as well as a challenge — the MLB franchise this week rejected AASEG’s offer to buy the team’s share of the 155-acre complex.

The rejection threatens to hold up the $5 billion redevelopment the group is planning in partnership with the city of Oakland, which would turn the rundown baseball stadium, sports arena and parking lot into a center for Black-owned sports teams, housing, retail, restaurants and nightlife.

The stated goals of the Oakland proposal — revitalizing a blighted area with a development team that reflects its demographics — fall in line with those of Reynolds’ Chicago projects. In a 2021 op-ed in Crain’s, Reynolds wrote that minorities should have more equity in Chicago’s megadevelopments, especially on the South and West Sides.

“Transformative for ‘some’ rather than ‘all’ is no longer enough,” he wrote.

Reynolds, who couldn’t immediately be reached for an interview last week, has said his roots in Englewood, one of Chicago’s poorest neighborhoods, make his projects on the South Side especially meaningful.

“This one is near and dear because we’re going to take these young people, we’re going to revitalize this community and bring economic activity and jobs and hope back,” Reynolds said in February as his Regal Mile Studios project broke ground, the Chicago Sun-Times reported.

After earning a bachelor’s degree in political science from the University of Wisconsin, La Crosse, Reynolds began his career trading municipal bonds in 1981, when bonds were still traded “from a blue book — you actually printed out the prices of munis from the day before,” he recently told industry publication The Bond Buyer. He earned a masters of management degree from Northwestern University’s Kellogg School of Management the following year.

He founded Loop Capital with a staff of six people in 1997; his wife, Sandy Reynolds, is a co-founder. The firm now has a staff of more than 260 and is one of the largest privately-held investment banks in the United States.

Though Reynolds’ firm focuses on traditional investments, Loop appears to have taken more interest in backing big real estate projects in recent years, particularly infrastructure and government partnerships.

The firm started its first investment fund in 2018, with an assist from former NBA star Magic Johnson, aiming to raise $1 billion for infrastructure projects.

“We believe, and I think it’s kind of accepted now, that over the next decade the U.S. is going to be the No. 1 [public-private partnerships] market on the planet,” Reynolds told Crain’s in 2019.

He even argued for privatizing some public infrastructure assets entirely during a panel discussion in 2017.

“Why is it better that the governments need to own all these things?” he asked, arguing that London’s Heathrow is a better airport than New York’s LaGuardia because of its private investors.

The Oakland project isn’t Reynold’s first foray into sports stadiums. When Loop Capital was getting started, the firm was hired by the Illinois Sports Facilities Authority to study bond refinancing options for Comiskey Park, the former home of the Chicago White Sox, according to reports. Reynolds is a former member of the sports facilities board.

In 2021, Reynolds told Crain’s that those types of public-sector clients were necessary for minority-owned financiers at that time, but didn’t offer much in the way of profit margins.

Things are different two decades later, as corporations started to put more weight behind diversity programs and pledges. A 2021 report found that the minority, women or veteran-led firms participated in 29 percent of debt sales by investment-grade companies in the United States the previous year, up 7 percent from a decade earlier, according to the Wall Street Journal.

Loop Capital was one of the firms hired by Northbrook-based Allstate to underwrite its $1.2 billion bond sale to finance a portion of its acquisition of National General Holdings Corp.

Reynolds told Crain’s earlier this year that his “biggest break was in 2019, 2020 and 2021,” when the firm became more profitable as “capital markets really, really exploded.”

He also shared a sentiment that could come in handy when navigating development hurdles in Oakland.

“My personal motto is never get angry,” he said. “Success is the best revenge.”

Read more

A’s turn down Black-led group’s bid for half of Oakland Coliseum

A’s turn down Black-led group’s bid for half of Oakland Coliseum

Black-led consortium wants to buy A’s share of Oakland Coliseum

Black-led consortium wants to buy A’s share of Oakland Coliseum

Chicago approves $4B Bronzeville Lakefront redevelopment

Chicago approves $4B Bronzeville Lakefront redevelopment