Background Information about the Utica Shale

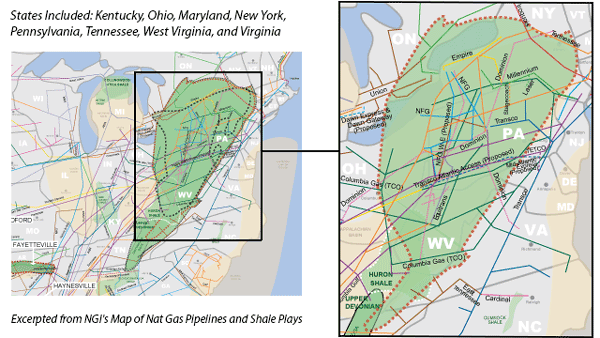

The Utica Shale is a massive formation that lies beneath portions of Ohio, West Virginia, Pennsylvania, Kentucky, Maryland, New York, Tennessee, Virginia and a part of Canada. In a September 2012 report, the United States Geological Survey (USGS) estimated that the Utica has a recoverable potential of 940 million barrels of oil, and approximately 38 trillion cubic feet of natural gas. That estimate, though, has proved conservative at best. With far more drill bits having proved-up the play in Ohio, a West Virginia University-led study released in mid-2015 estimated that the Utica contains more than 20 times as much technically recoverable natural gas resources than previously thought when the USGS released its report (see Shale Daily, July 14, 2015).

WVU’s Appalachian Oil and Natural Gas Research Consortium said the Utica contains technically recoverable resources of an astounding 782 Tcf of natural gas and nearly 2 billion bbl of oil, an estimate that surpasses the USGS’s most recent estimate for all recoverable resources in the Appalachian Basin. The consortium has long been a trusted resource in the region, and at the very least, its work shows that the Utica is also comparable to the nation’s largest gas field in the Marcellus Shale. In August 2011, the last time the USGS released a resource estimate for the Marcellus; it said the formation contained 84 Tcf of natural gas and 3.4 billion bbl of oil. That number, however, is likely outdated, with producers in Pennsylvania churning out more than 4 Tcf of natural gas in 2014 alone.

“The revised resource numbers are impressive, comparable to the numbers for the more established Marcellus Shale play, and a little surprising based on our Utica estimates of just a year ago, which were lower,” consortium Director Doug Patchen told NGI at the time WVU’s report was released. “But this is why we continued to work on the resource estimates after the project officially ended a year ago. The more wells that are drilled, the more the play area may expand, and another year of production from the wells enables researchers to make better estimates.”

Despite its geologic reach, most of the oil and gas exploration and development activity in the Utica has thus far been focused in Eastern Ohio. But the boundaries have shifted slowly since early 2014, with operators setting out to delineate the formation in Northern West Virginia and more recently in Southwest Pennsylvania (see Shale Daily, March 26, 2014). Driven by a need to pad their reserves, grow production, and, more recently, in a shift away from falling liquids prices, several of the Appalachian Basin’s leading producers have been drawn to an area with incredibly strong dry gas shows that encompasses a sort of geographic circle running from Southeast Ohio, over to Southwest Pennsylvania and down to Northern West Virginia.

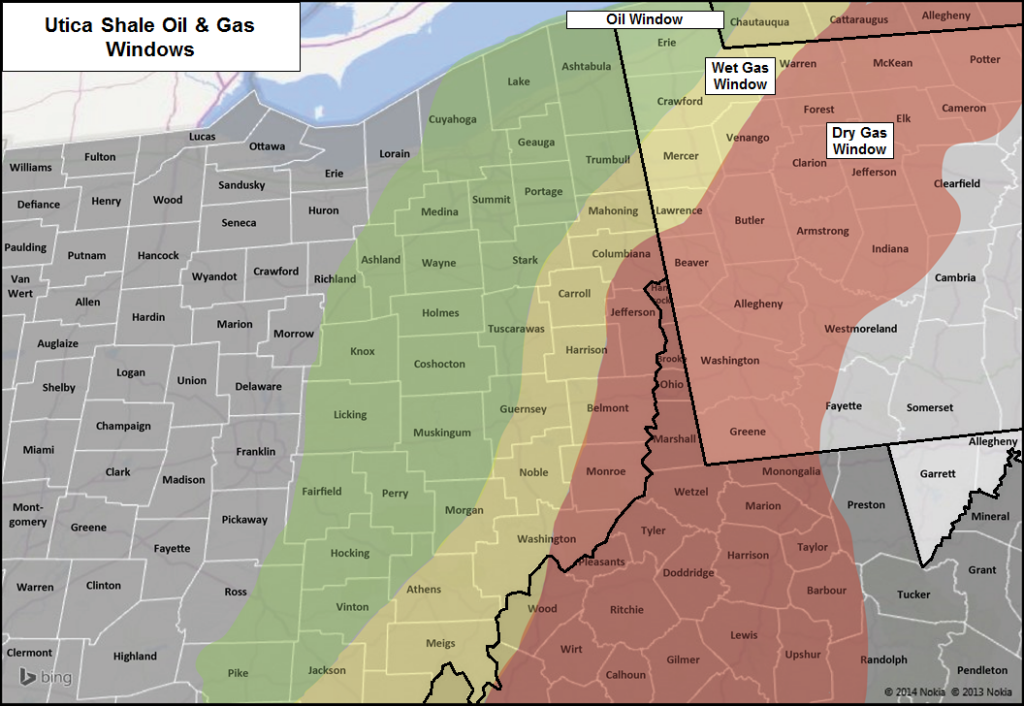

The robust development in Ohio so far has been attributable to its wet and dry gas windows and the possibility of an oil window farther to the north. Production in the state has also been boosted by the Point Pleasant carbonate formation, which lies just below the Utica, and has in actuality served as the play’s primary target. The Utica is shallower in Ohio, meaning it is relatively less expensive to drill. The Utica ranges between 2000′-8000′ feet deep in Ohio, but increases to as much as 14000′ deep in portions of Pennsylvania.

The Keystone State has increasingly become a part of the Utica horizon. In north-central Pennsylvania, more than 100 miles away from what was previously thought of as the Utica’s sweetspot in Southeast Ohio, the formation ranges anywhere from 3,000-5,000 feet deeper than the Marcellus, which was once the sole target for operators in that part of the state.

A Royal Dutch Shell plc affiliate has tested more than two wells in Tioga County. In late 2014, the company said its Neal and Gee wells were drilled to a total depth of 14,500 and 15,500 feet, respectively. The Gee well had an initial flowback rate of 11.2 MMcf/d, while the Neal well had a peak flow rate of 26.5 MMcf/d. Months later, Seneca Resources Corp. said its Utica well drilled on state-owned land in Tioga County, PA, had a 24-hour peak production rate of 22.7 MMcf/d. Little is generally known about Utica mechanics that far east.

As of October 2015, the Pennsylvania Department of Environmental Protection showed that 43 Utica permits have been issued in Tioga County and five Utica permits have been issued in nearby Potter County, PA. Today, although a few small operators continue to explore the Utica in the area, it remains hamstrung by both a lack of takeaway and a waning appetite for risk amid depressed natural gas prices (see Shale Daily, Oct. 13, 2015).

In addition to the play’s inflated resource estimate, a tight, seven-county swath encircling Northern West Virginia, Southeast Ohio and Southwest Pennsylvania, where results have seemingly reinforced one another, have prompted renewed excitement about the Utica’s role in pushing the Appalachian Basin’s prolific gas production higher (see Shale Daily, Aug. 25, 2015). In Southeast Ohio and Northern West Virginia, operators have tested Utica wells between 25 MMcf/d and nearly 47 MMcf/d.

In Southwest Pennsylvania, the stakes have edged higher, where Range Resources Corp.; EQT Corp. and Consol Energy Inc. have all tested deep, dry Utica wells between 59-72.9 MMcf/d. Although those wells have come with astronomical price tags — costing about $30 million each — management teams have said they’re aiming to get costs down to between $12-15 million per well. EQT has said it would suspend its Upper Devonian drilling program in 2016 and defer some Marcellus drilling to build a 10 well Utica program in Pennsylvania. Range had two other Utica wells planned for Pennsylvania at the time of this writing, while Consol was preparing to hydraulically fracture its second and indicated it was thinking along the same lines as EQT.

“Over the next two to three years [we] expect the dry Utica to become the primary focus of our development plan and a greater and greater contributor to production growth,” said Consol COO Timothy Dugan of the company’s acreage in Ohio and Pennsylvania. Still, the eye-popping initial production rates from the wells tested to date have financial analysts, company officials and industry onlookers concerned about decline rates. Last December, Range’s Claysville Sportsman’s Club Unit 11H Utica well in Washington County, PA, tested at 59 MMcf/d. It was the first such well drilled in Southwest Pennsylvania. But the company’s reservoir modeling and production history led it in October 2015 to announce an estimated ultimate recovery (EUR) for the well of 15 Bcf, or 2.8 Bcf per 1,000 feet of lateral. For now, that appears to be no better than the company’s leading Marcellus EUR’s, which range from 17-18 Bcf, or 2.5-3 Bcf per 1,000 feet of lateral. Range CEO Jeffrey Ventura said at the time that in the current commodity price environment, the Utica wells can’t compete with the Marcellus. After the company drills and completes its third Pennsylvania Utica well, it plans to drill no more in 2016.

“When you look at our plan for next year, our focus is really going to be on the Marcellus. We think with those three [Utica] wells, coupled with activity around us, it’ll give us a really good handle on what the Utica ultimately is,” Ventura said of the company’s plans for 2016 after it announced the Utica EUR, which was similar to one issued by EQT. “But what we know is we have 10 years worth of production history and thousands of wells that really delineate our [Marcellus] position, so that’s the low-risk piece.”

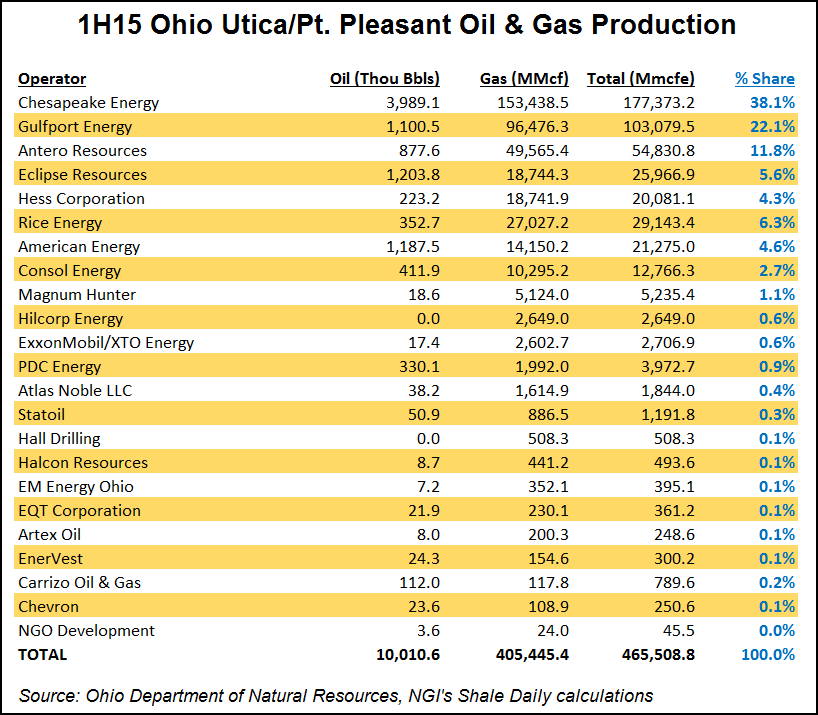

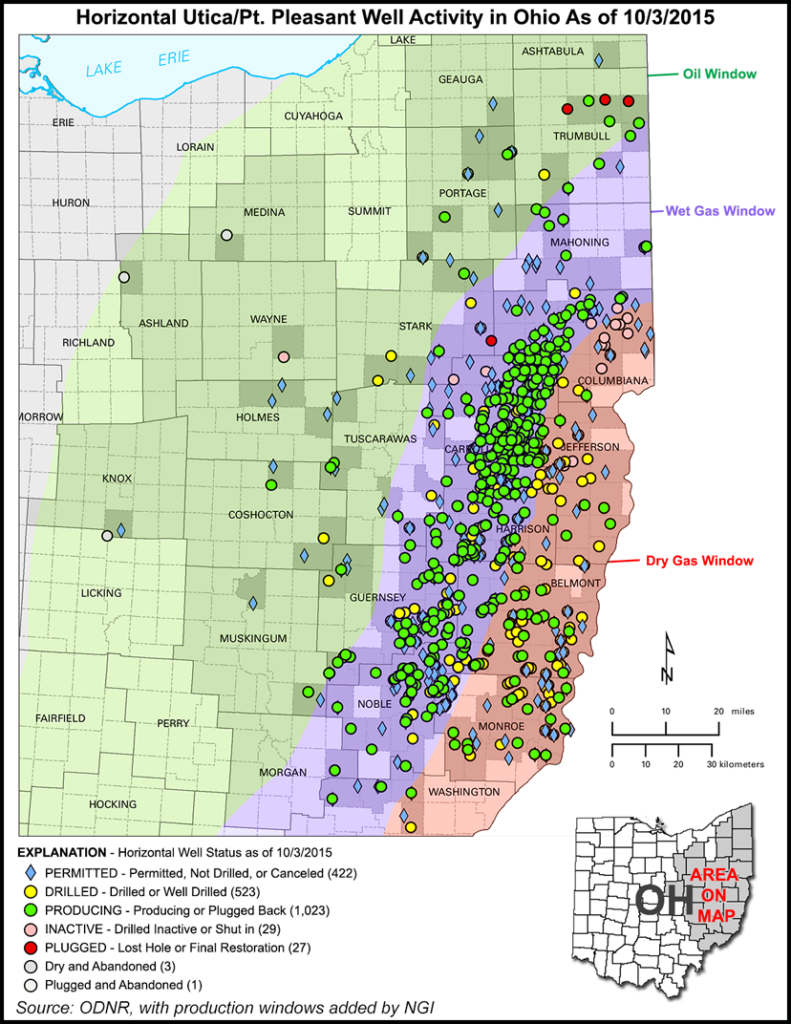

For now, the wells in Ohio cost less than half what they do in nearby Pennsylvania and are still cheaper than in West Virginia. As of October 2015, the Ohio Department of Natural Resources had issued 2,065 horizontal Utica permits and 1,629 horizontal Utica wells had been drilled. Permitting and production have grown rapidly in the state since speculation began in earnest there around 2009.

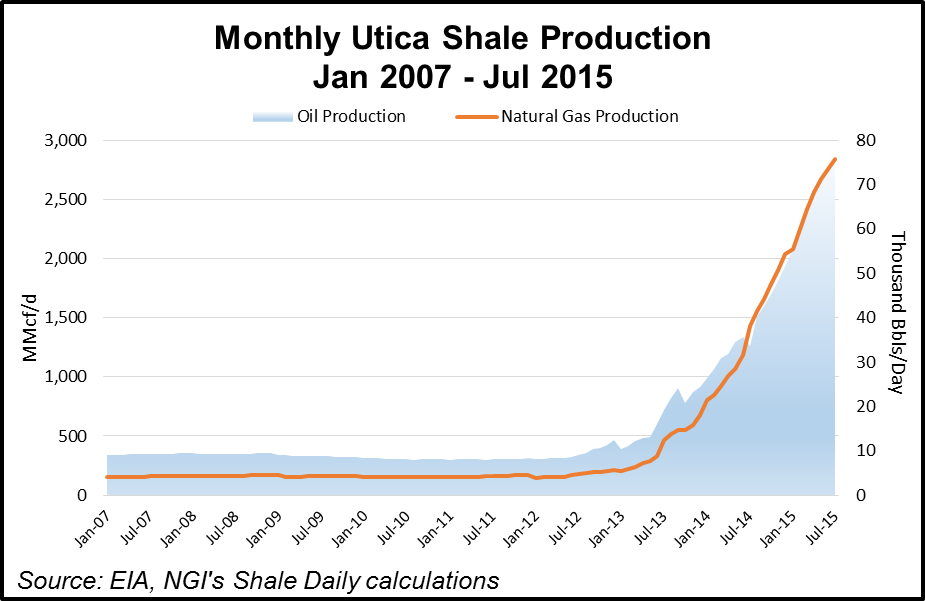

Oil and gas production in the Utica has increased sharply. According to the EIA, operators were producing more than 3 Bcf/d in October 2015. Shale production in the state went from 2.5 Bcf in 2011, when the state released its first figures from five commercial Utica wells, to about 452 Bcf three years later in 2014, the latest period for which full-year data are available. In fact, while production was expected to drop in nearly every shale basin across the country, Jefferies LLC found in a September 2015 survey that Northeast supply would increase 1.4 Bcf/d year-over-year in 2016 — split fairly equally between both the Marcellus and Utica.

One key question surrounding the burgeoning potential of dry gas production in the Utica is would it simply replace higher cost production areas in other parts of North America, or would it be additive to total U.S. production? That remains to be seen, but with more than enough natural gas pipeline takeaway capacity being built out of Appalachia, gas from both the Marcellus and the Utica most likely will at least have the opportunity to displace higher cost production in the coming years. But as far as being additive to total U.S. production, at least one high profile executive in Appalachia doesn’t quite see it. “In terms of near to medium-term supply, since these are Marcellus players diverting capital away from Marcellus development, PA Utica production growth really just replaces what would’ve otherwise been Marcellus production growth, “ said Rice Energy CEO Daniel Rice, on the company’s 3Q15 earnings conference call. “Therefore, we do not believe that this is an additive source of supply to the basin.”

Like its counterpart in the Marcellus; natural gas processing and takeaway has been playing catch-up in the Utica for years now. The volatility of gas prices also continues to threaten the bottom line of Utica operators, especially for those that rely on it more than others do to drive earnings and growth. But a suite of high-profile pipeline projects continue to be planned for the basin. Most recently, the Rockies Express Pipeline started-up its East-to-West expansion, adding 1.2 Bcf/d of incremental westbound capacity from its easternmost point in Clarington, OH, to Moultrie, IL. Sunoco Logistics Partners LP’s Mariner East pipelines are also expected to help move natural gas liquids from Ohio, West Virginia and Pennsylvania, and Marathon’s proposed Cornerstone Pipeline would move condensate from the emerging hub at Cadiz, OH in Harrison County to Marathon’s Canton, OH refinery. Another example is the Atlantic Coast Pipeline, which would move Utica dry gas to power generators in the Southeast.

Historically, Devon Energy Corp. was an early entrant into the Utica Shale, securing some of its first horizontal permits in 2011 in Ashland and Medina counties, OH, where it drilled and plugged dry holes. It continued to permit across a swath of land throughout the next year along the Utica’s western edge, completing unsuccessful wells in Coshocton and Wayne counties in search of black oil. It even drilled as far west as Knox County, OH, which is more than 100 miles west of the play’s current core in the southeast part of the state, before abandoning the Utica and selling its acreage. Activity within the oil window has been far less prevalent, and there is much debate within the industry as to just how economical this portion of the Utica will be. A slew of black oil wells has been drilled (primarily in northern Ohio), with more than two dozen volatile oil wells drilled farther south near Guernsey and Tuscarawas Counties, according to EV Energy Partners LP (EVEP). Moreover, several operators — including BP plc and Halcon Resources Corp. — have announced plans in recent years to abandon their development of the Utica’s northern tier in Ohio, which today is generally perceived to consist of Mahoning, Trumbull, Stark and Portage counties, and to a lesser extent Tuscarawas County.

The challenge in the oil window appears to be fracture design and minimizing reservoir damage upon completion. EVEP had been among the Utica oil window pioneers. In mid-2015, after 90 days of production, the company’s closely watched Nettles 3H well in Tuscarawas County, OH, which was stimulated with a mixture of liquid butane and mineral oil instead of water, failed to meet the company’s expectations. It was the latest effort to crack the code of the Utica’s volatile oil window, where EVEP estimates up to 30 million bbl of oil are in place across more than 70,000 acres in Stark, Tuscarawas and Guernsey counties. The costly Nettles well was drilled in partnership with other operators to learn more about the window’s rock mechanics. The test came after EVEP’s joint venture partner, Chesapeake Energy Corp., had drilled its own volatile oil well in Tuscarawas County in 2014 with what EVEP said had been encouraging results. Chesapeake’s Parker well, however, was super fracked using more water and proppant than an average horizontal well, EVEP management said.

“The Nettles well production is about half that of the Parker well,” EVEP’s Executive Chairman John Walker said in May 2015, when the company discussed the results. “We are continuing to perform additional testing on the Nettles well and in addition, Chesapeake plans to drill about six more wells in the area.”

“We will eventually conquer the raw mechanics to be able to get at this 30-plus million bbl of oil in place,” EVEP CEO Mike Mercer added. “But it just takes some time and money, and we are not going to be the primary company that leads the way there either.”

It’s only a matter of time, sources have said, before operators learn how to move oil molecules through the small pores of shale rock underneath a five-county region in northeast Ohio and a larger area to the west. Some acreage in Northwest Pennsylvania is believed to hold the same potential. In late 2015, both Rex Energy Corp. and Seneca Resources Corp. announced their intent to test more Utica wells in Northwest Pennsylvania as well (see Shale Daily, July 8, 2015).

Counties

Core Ohio Utica Counties As Identified by the Ohio Department of Natural Resources: Ashland, Ashtabula, Belmont, Carroll, Columbiana, Coshocton, Crawford (immature), Delaware (immature), Fairfield, Franklin (immature), Geauga, Guernsey, Harrison, Holmes, Huron (immature), Jefferson, Knox, Lake, Licking, Lorain, Madison (immature), Mahoning, Marion (immature), Medina, Monroe, Morgan, Morrow (Immature), Muskingum, Noble, Perry, Pickaway (immature), Portage, Richland (immature), Stark, Summit, Trumbull, Tuscarawas, Union (immature), Washington, Wayne

Note: Immature counties are likely not commercially viable. As of 12/7/13, none of the 1,015 horizontal permits the ODNR had issued were in the immature counties.

Pennsylvania: Armstrong, Beaver, Butler, Cameron, Clarion, Crawford, Elk, Erie, Forest, Jefferson, Lawrence, McKean, Mercer, Potter, Venango, Warren, Tioga

Local Major Pipelines

Natural Gas: ANR East Project (Proposed), Clarington Hub, Cobra Pipeline, Columbia Gas Transmission, Dominion Transmission, East Ohio Gas, Mountain Valley (Proposed), Nexus Gas Transmission (Proposed), Rockies Express, Rover (Proposed), Tennessee, Texas Eastern

Crude Oil: Cornerstone Pipeline (Condensate) (Proposed)

NGLs: ATEX Express, Mariner East 2 (Proposed), Mariner West, TEPPCO, UMTP (Proposed), Utopia East (Proposed)

More information about Shale Plays:

Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily