Navigating through your financial transactions has never been easier with our comprehensive guide to using Check Register Forms. These Fillable Forms are essential tools for anyone looking to keep a detailed record of their banking activities. Whether you’re managing personal finances or overseeing a business account, our guide provides step-by-step instructions, practical examples, and expert tips to ensure you can track every deposit, withdrawal, and balance with precision. Dive into the world of organized financial management today and transform the way you handle your Banking Form needs.

Download Check Register form Bundle

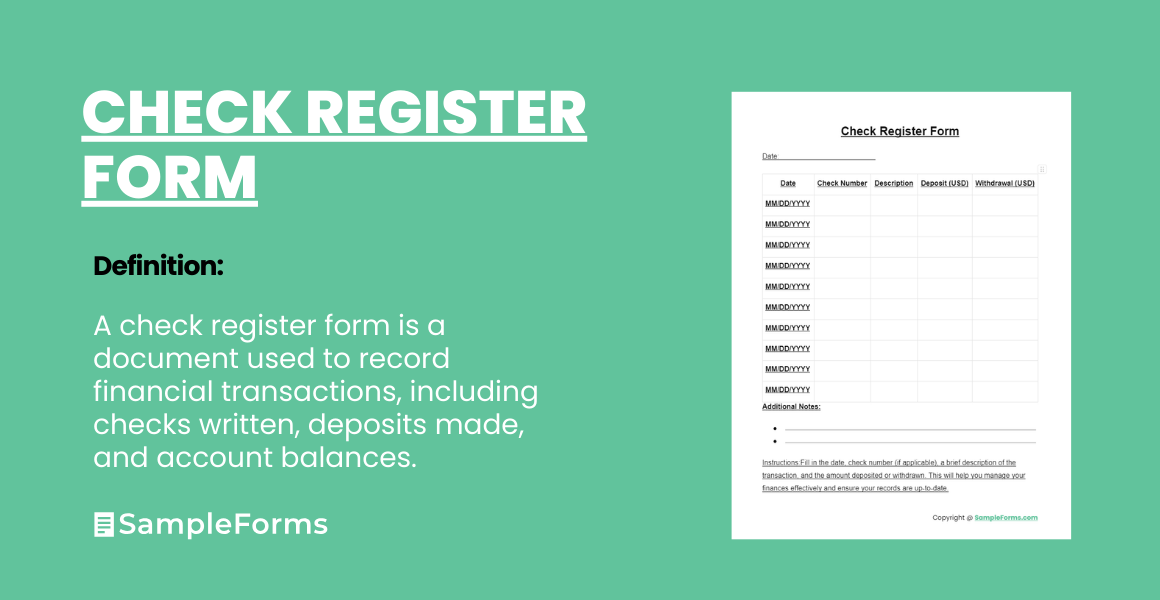

What is a Check Register Form?

A Check Register Form is a document used to record financial transactions for a checking account. This essential banking form serves as a personal ledger, allowing individuals to track deposits, withdrawals, and the current balance of their account. It helps in maintaining an accurate financial record, preventing overdrafts, and ensuring efficient money management. By using fillable forms, users can easily update and organize their financial information, making it a crucial tool for personal and business finance.

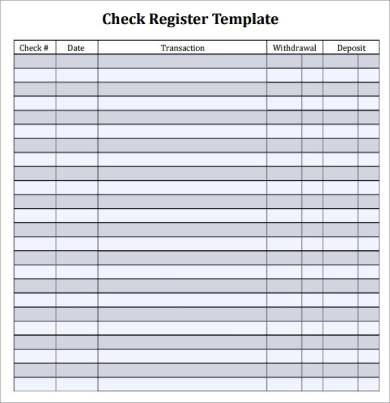

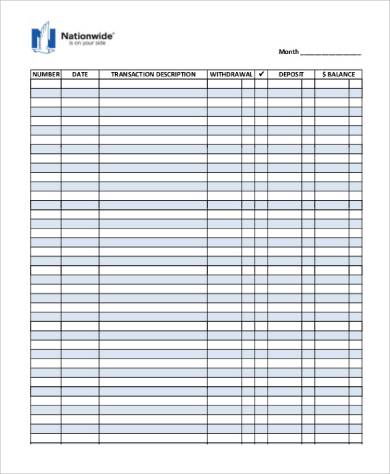

Check Register Form Format

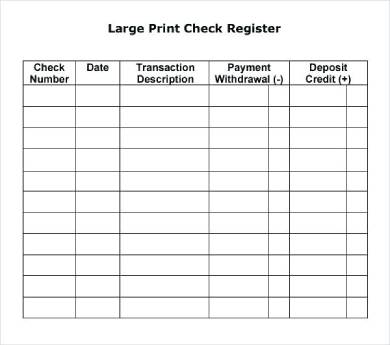

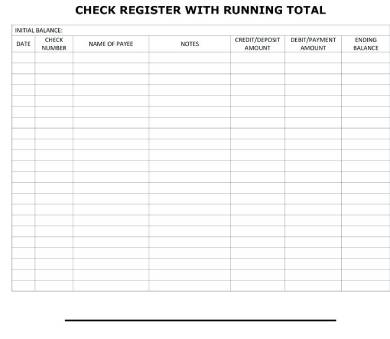

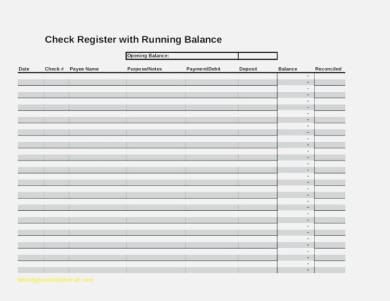

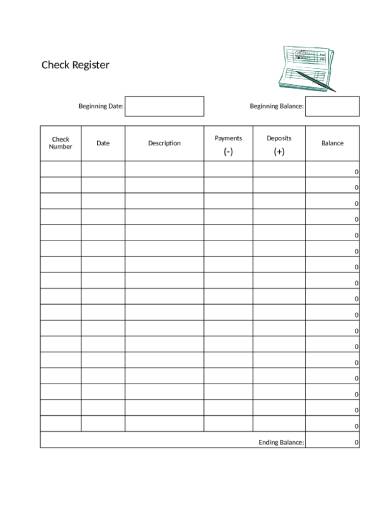

Columns:

- Date: Records transaction date (MM/DD/YYYY or DD/MM/YYYY).

- Check Number: For tracking checks; leave blank for other transactions.

- Description: Brief transaction details (payee, deposit source, etc.).

- Withdrawal: Amounts taken out of the account.

- Deposit: Amounts added to the account.

- Balance: Running total post-transaction.

Features:

- Large Print: Enhanced readability.

- Notes Section: Extra details (receipt numbers, codes).

- Double-Sided Printing: More transactions, less space.

Design:

- Clear Columns: Avoids confusion, guides users.

- Sequential Entries: Encourages chronological tracking.

- Signature Space: Adds security/ownership.

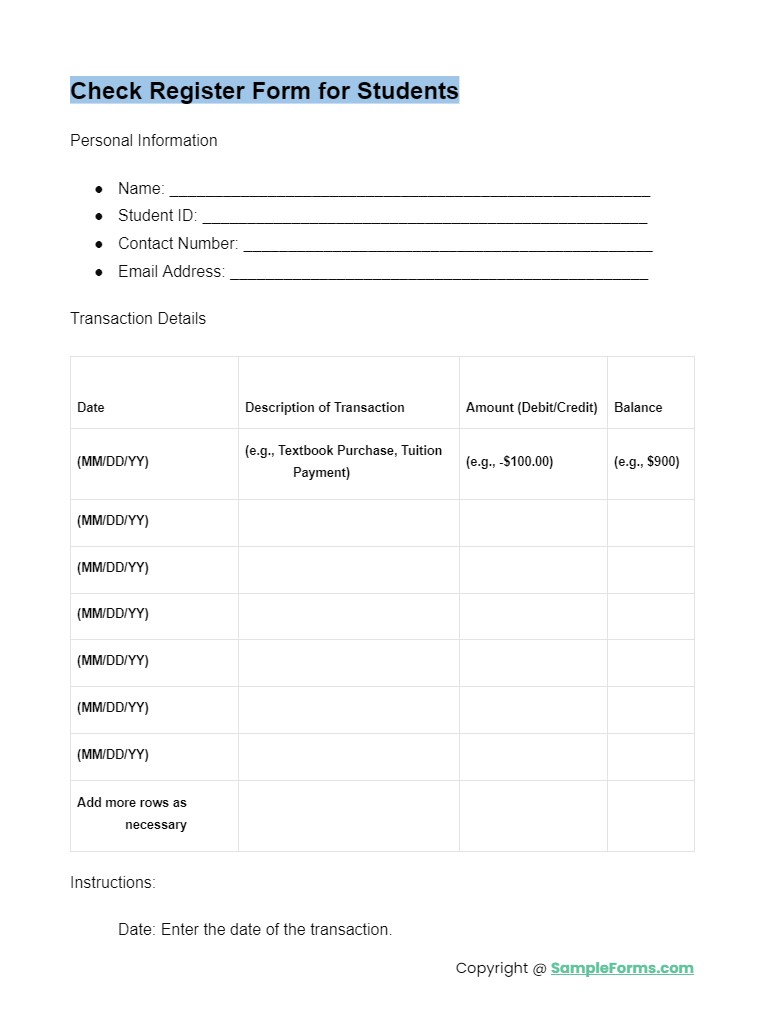

Check Register Form for Students

A Check Register Form for students is an essential tool for managing personal finances and scholarships. It helps track spending, avoid overdrafts, and learn financial responsibility early in life.

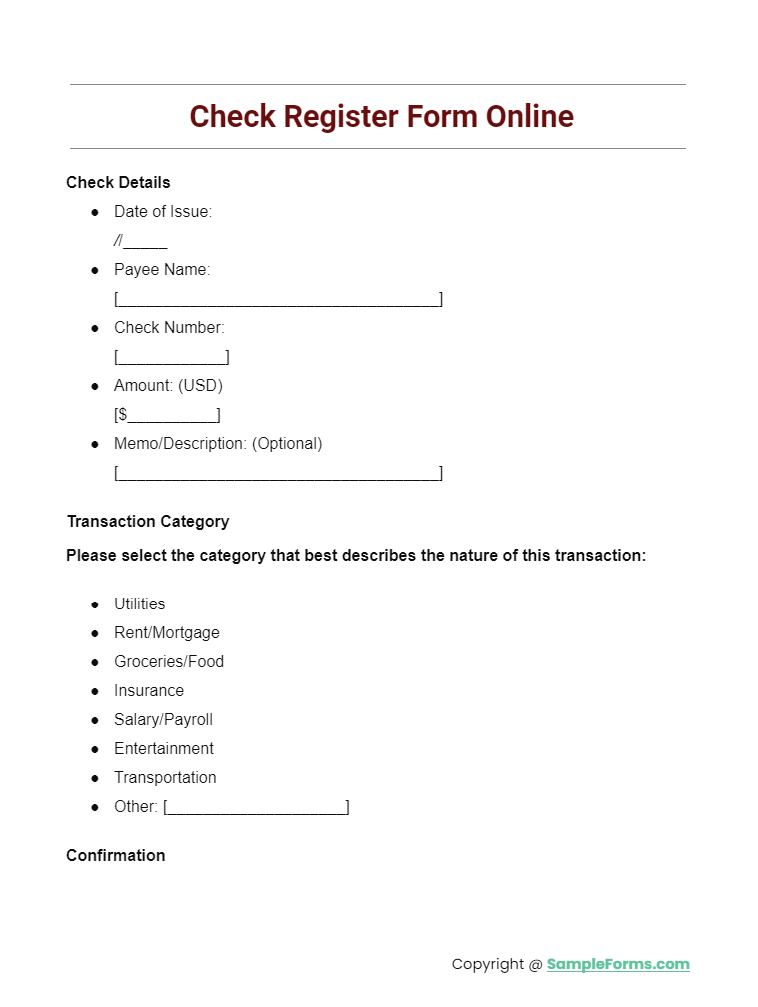

Check Register Form Online

Online Check Register Forms offer a digital solution for tracking your financial transactions. They’re accessible, easy to use, and provide instant updates to your balance, enhancing your budgeting and financial planning.

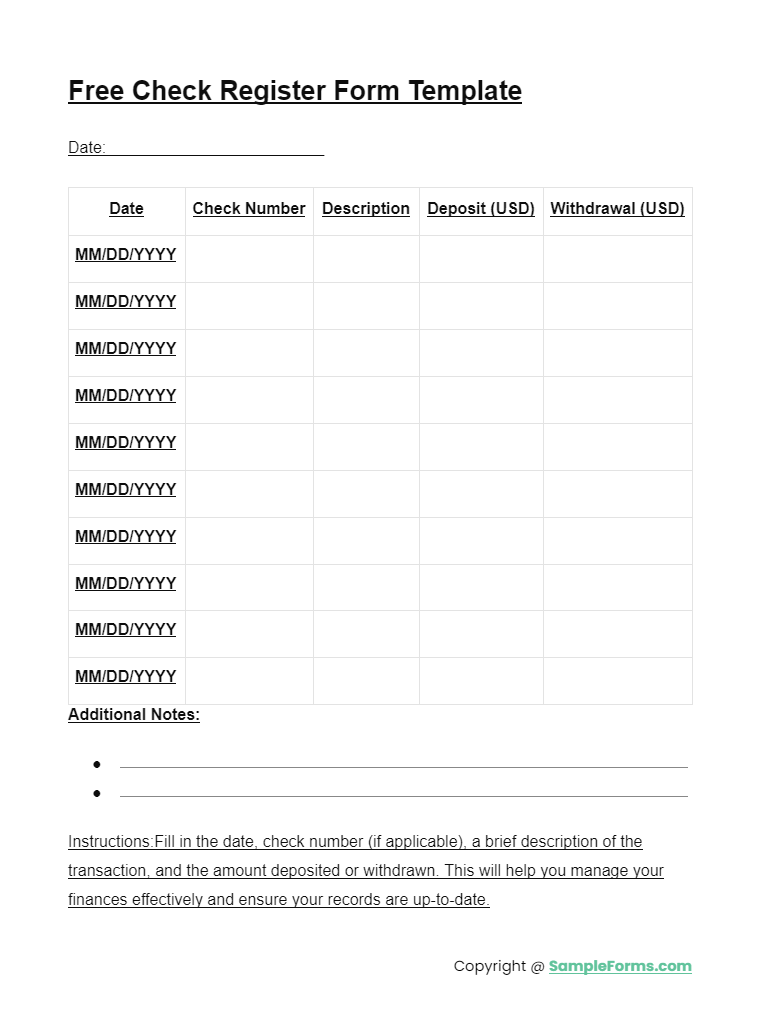

Free Check Register Form Template

Free Check Register Form Templates are available for download on various financial websites. These templates are customizable, allowing users to easily monitor deposits, withdrawals, and balances without cost.

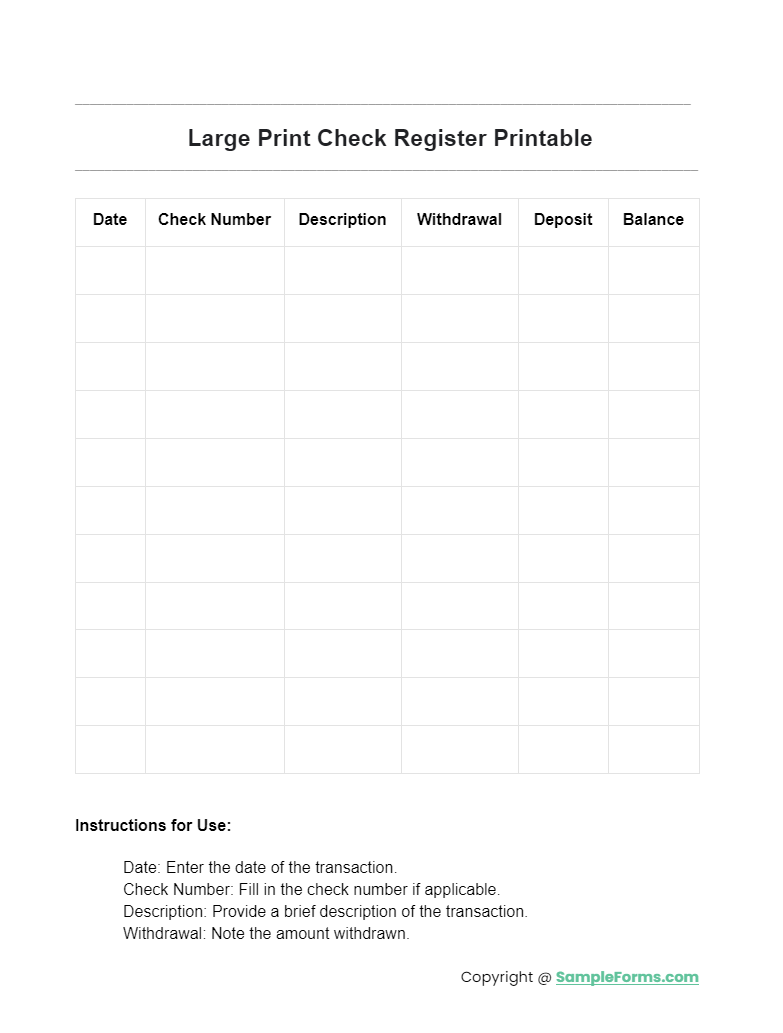

Large Print Check Register Printable

More Check Register Form Samples

Printable Check Register Form

Free Printable Check Register

Checkbook Register Printable

Check Register Form PDF

Printable Check Register With Running Balance

Sample Checkbook Register Form

Printable Full Page Check Register Form

How to Fill Out Printable Check Register Forms

Printable check register forms enable businesses to keep track of every transaction they made and compare it with their bank statements. So in reading this, it also makes you want to have one and assure yourself of keeping your finances aligned and in order. So without too much ado, here are the steps on how to make a printable check register form.

Step 1. Choose and Download a Printable Check Register Form

First, pick a printable check register form from a list of samples we laid in the middle of this article. These pre-made samples are easy to use and highly customizable, and these don’t take a rocket scientist to fill them out. To complete the step and get you started with the actual filling out of the form, click the download button beside the sample.

Step 2. Prepare Checks, Bills, Receipts, and Invoices

Then, prepare the necessary documents—bills, receipts, checks, and invoices—to help you in filling out the printable check register form. These documents contain important facts that you’ll need to register in the form. These important facts are the check numbers, dates of the transaction, the nature of the transaction (such as deposits and withdrawals), and the amount debited and credited. These pieces of information are what you will write on your printable check register form. Our Blank Forms is also worth a look at

Step 3. Fill out the Printable Check Register Form

Next, fill out the printable check register form after gathering the necessary documents that’ll help you finish this task. To fill out the printable check register, start filling the spaces from left to right, up to bottom. Start with the section under the check number, then the nature of the transaction, and followed by the amount deposited, withdrawn, and finally, the amount of the balance.

Step 4. Save and Store the Finished Form

Save and store the finished check request form on your computer after successfully filling it out. And to do it, create a new folder and name it as “printable check registers.” This folder will serve as the main directory of the sub-folders that you’ll create subsequently. Also, don’t forget to save and store a blank version of the form, as well, for future use.

Step 5. Compare it with your Bank Statement

Lastly, compare your complete printable check register form with your bank statement. Making comparisons between the facts and figures in your bank statement and check register lets you spot errors and discrepancies in them. In turn, it allows you room to bring such erroneous information to your bank’s attention and adjust it immediately.

How do you Complete a Check Register?

Completing a Check Register is a straightforward process that helps you maintain an accurate record of your financial transactions. It involves tracking every transaction that affects your checking account, including checks written, deposits made, and electronic transfers. Here’s how to do it effectively, incorporating elements like the Bank Verification Form and Bank Affidavit Form:

- Start with the Basics: Enter the date of the transaction in the designated column of your check register.

- Transaction Details: For each transaction, provide a brief description, including the payee for checks or the source for deposits.

- Record Amounts: Enter the amount of the transaction in the withdrawal or deposit column, depending on the nature of the transaction.

- Update the Balance: After each entry, calculate and record your new balance. Subtract withdrawals from and add deposits to your previous balance.

- Bank Verification Form: Occasionally, you’ll need to verify bank transactions, especially for significant or unusual activities. Attach a Bank Verification Form to confirm the authenticity of these transactions.

- Bank Affidavit Form: In case of discrepancies or disputes, a bank affidavit form may be required. This form serves as a sworn statement of the transaction details, useful for rectifying errors in your bank records.

- Regular Reconciliation: Periodically, compare your check register against your bank statements to catch any discrepancies or fraudulent transactions early.

By using a Check Register Form consistently, you can maintain a clear and accurate financial record, avoid overdraft fees, and manage your budget more effectively. You may also be interested in our Printable Forms.

What is the Purpose of a Check Register

A Check Register serves multiple critical functions in personal and business finance management. It’s not just a record-keeping tool but a fundamental component of financial oversight and security. Including elements like the Reference Check Form and Complaint Register Form broadens its utility:

- Tracking Spending: It provides a real-time overview of your financial activities, helping you understand where your money is going.

- Preventing Overdrafts: By keeping an accurate balance, you can avoid overdraft fees and manage your funds more efficiently.

- Fraud Detection: Regularly updating and reviewing your check register can help you spot unauthorized transactions quickly.

- Financial Planning: Analyzing your spending patterns can aid in better budgeting and financial planning.

- Reference Check Form: This form is crucial for verifying the details of checks issued, enhancing the security and accuracy of your financial records.

- Complaint Register Form: If there are any discrepancies or unauthorized transactions, a complaint register form can be used to formally address the issue with your bank.

Updating your Check Register Form promptly ensures that you have a real-time understanding of your available funds, which helps in budgeting and prevents overdrafts. In addition, you should review our Check-In Forms.

10 Tips for Writing Check Register Form

- Be Consistent: Use the same format for dates and amounts to avoid confusion.

- Detail Oriented: Provide clear, concise descriptions for each transaction.

- Stay Current: Update your register immediately after each transaction.

- Regular Reconciliation: Compare your register with bank statements monthly.

- Keep Receipts: Retain transaction receipts until the check register is reconciled with your bank statement.

- Secure Documents: Store your check register, bank verification, and affidavit forms securely.

- Digital Backup: Consider maintaining a digital copy of your register for added security and convenience.

- Review Regularly: Schedule regular reviews of your check register to catch and rectify any errors promptly.

- Educate Yourself: Understand how to use bank verification and affidavit forms to support your financial management practices.

- Customize Your Register: Tailor your check register to meet your specific needs, whether for personal or business use, incorporating relevant forms like reference checks and complaint registers for comprehensive financial tracking.

When should you write in your Check Register Form?

You should write in your Check Register Form every time there is activity in your checking account. Here are specific instances when you should update your register:

- After Writing a Check: Record the check number, date, payee, and amount.

- Making a Deposit: Note the date, source, and amount of the deposit.

- Withdrawing Cash: Include ATM withdrawals, noting the date and amount.

- Electronic Payments: Record any automatic debits or online bill payments.

- Debit Card Transactions: Write down each purchase made with your debit card.

- Bank Fees: Document any fees charged by the bank.

- Interest Earned: If your account earns interest, add this to your register.

- Adjustments or Corrections: Sometimes banks make corrections; these should be recorded too.

Does Excel have a Checkbook Register Form?

Yes, Excel offers templates for a variety of financial documents, including a Checkbook Register Form. Users can easily find and use these templates to manage their financial records.

Why do you get a Check Register Form?

You get a Check Register Form to keep a personal record of all your checking account transactions, which helps in managing your finances, avoiding overdraft fees, and detecting unauthorized transactions.

Does Google have a Checkbook Register Template?

Yes, Google offers checkbook register templates through Google Sheets. These templates are customizable, allowing users to track their financial transactions easily.

Can I print my own Checkbook Register?

Yes, you can print your own checkbook register. Include a Bank Authorization Form with your printed register for added security and authorization purposes.

Is there an app that works like a Checkbook Register?

Yes, there are several apps designed to function like a digital checkbook register, offering features for tracking spending, scheduling payments, and monitoring account balances.

Can you buy a Checkbook Register?

Yes, checkbook registers can be purchased at office supply stores or banks. Ensure you also get a Bank Loan Application Form and Checklist Form for comprehensive financial management.

Why would you want to use a Checkbook Register?

Using a checkbook register helps in managing finances, tracking spending, avoiding overdraft fees, and reconciling bank statements. Including a Payroll Register Form aids in managing salary transactions.

Related Posts

FREE 5+ Account Code Request Forms in PDF

FREE 39+ Estimate Forms in PDF | Ms Word

FREE 17+ Sample Printable Accounting Forms in PDF | MS Word | Excel

FREE 3+ Loan Application Review Forms in PDF | MS Word | Excel

FREE 5+ Travel Expense Reimbursement Forms in PDF | MS Word | Excel

FREE 5+ Wire Transfer Instructions Forms in PDF | MS Word

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

FREE 8+ Budget Transfer Forms in PDF | Excel

FREE 5+ Petty Cash Register Samples in Excel | PDF

FREE 5+ Journal Format Forms in Excel

FREE 5+ Gross Profit Margin Forms in Excel

FREE 6+ Contribution Margin Forms in Excel

FREE 5+ Handyman Business Estimate Forms in MS Word | PDF

FREE 5+ Landscaping Business Estimate Forms in MS Word | PDF