Making Tax Digital (MTD) is a way for businesses to keep track of their taxes and submit their VAT returns to HMRC electronically in a compliant way. This may sound like a hassle, but trust us–it's quite straightforward once you get the hang of it.

In this article, we'll cover how to:

- Authorise QuickBooks Online to interact with HMRC

- Reauthorise the MTD connection

- Make changes to your MTD settings

- Disconnect from MTD

- Fix connection issues

Before you start

Make sure to set up VAT in QuickBooks and use the correct VAT registration number that matches HMRC's records. This is crucial for accurate reporting under MTD.

Authorise QuickBooks Online to interact with HMRC

- Go to Taxes.

- Select Set up MTD.

- Select Authorise now.

- Select Continue.

- In the window that opens, sign in with your MTD Government Gateway user ID and password. This will be in the confirmation email you receive from HMRC.

- Select Continue.

- Select Give permission.

- Once you're connected, select Continue and then Go to Taxes.

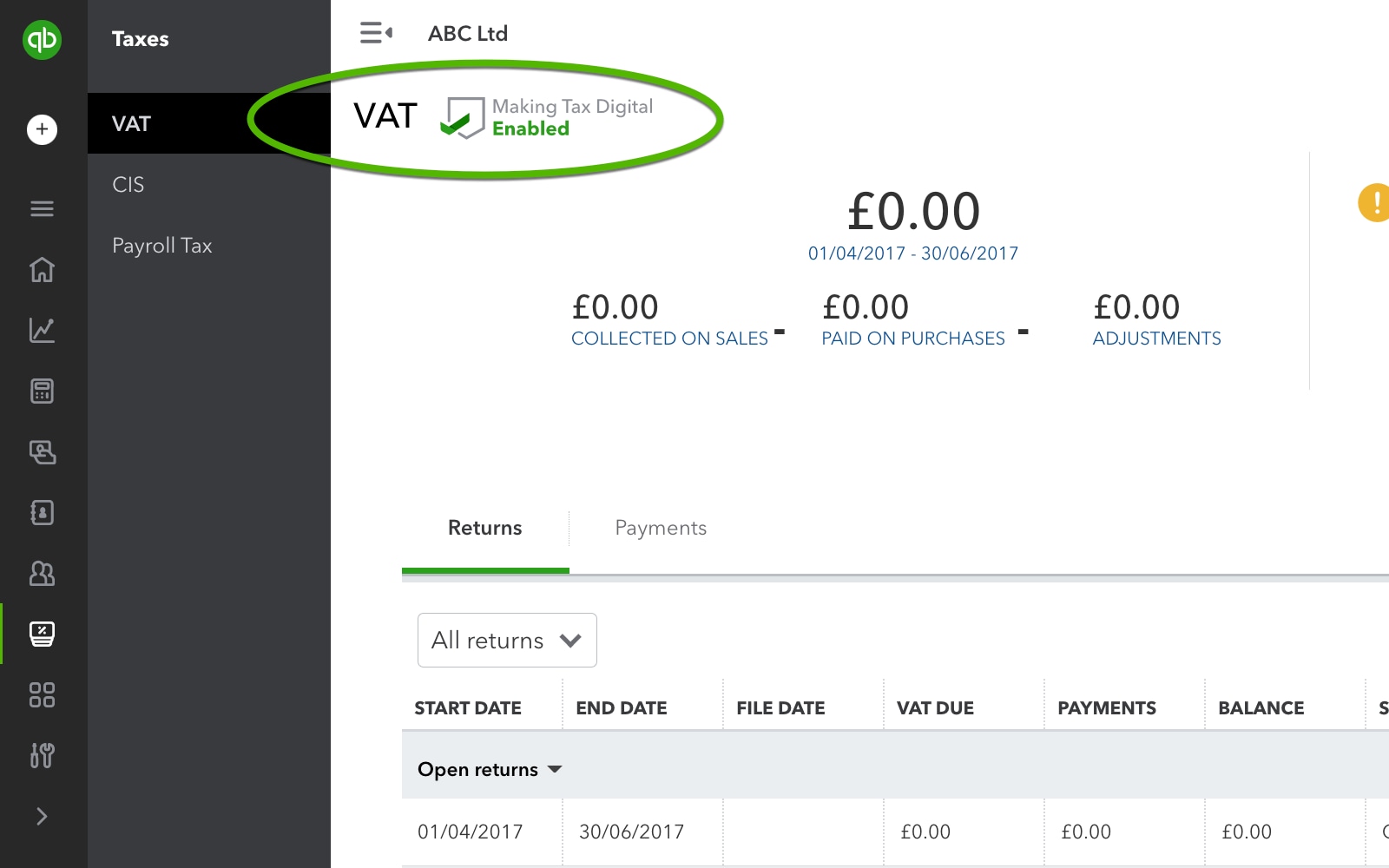

You'll see a badge appear on your taxes dashboard to indicate that MTD for VAT is enabled. Here's what it looks like:

That's it! You're ready to submit your first MTD VAT return directly to HMRC as soon as it's due.

Reauthorise the MTD connection

After connecting QuickBooks to HMRC, remember this important rule: you need to reauthorise the connection every 18 months.

This is to meet HMRC's security requirements and keep your data safe. Reauthorising is quick and easy, taking just a few moments. We'll send you a reminder when it's time, and all you have to do is enter your login details. After that, we'll take care of everything else.

Make changes to your MTD settings

- Select the gear icon, and then Account and settings.

- Select Advanced.

- Next to Making Tax Digital, select the pencil icon.

Disconnect from MTD

Before you disconnect from MTD in QuickBooks Online, there are few things to keep in mind.

- Information will no longer be shared between QuickBooks Online and HMRC.

- You will no longer be able to submit digital VAT returns.

- You can reconnect to HMRC at any time by following the authorisation steps in this article.

To disconnect QuickBooks from HMRC's digital services, follow these steps:

- Select the ⚙️ gear icon, and then select Account and Settings.

- In the Advanced section, select Making Tax Digital.

- Select Learn how to disconnect.

- Select Continue.

- Select Disconnect to confirm.

- Select Continue to return to QuickBooks Online.

Fix connection issues

No need to worry if you encounter an error message or can't connect. We've got you covered with solutions for all possible errors and common MTD issues.

We're here to help

If you have questions about MTD, or need help getting connected or fixing an error, let us know. Sign in to QuickBooks and start a discussion with a qualified QuickBooks Online expert in our community.

QuickBooks MTD software currently supports Standard, Cash and Flat Rate schemes. QuickBooks Bridging Software supports Standard and Cash schemes. Businesses whose home currency is not GBP are currently not supported for MTD.