What Are 1256 Contracts?

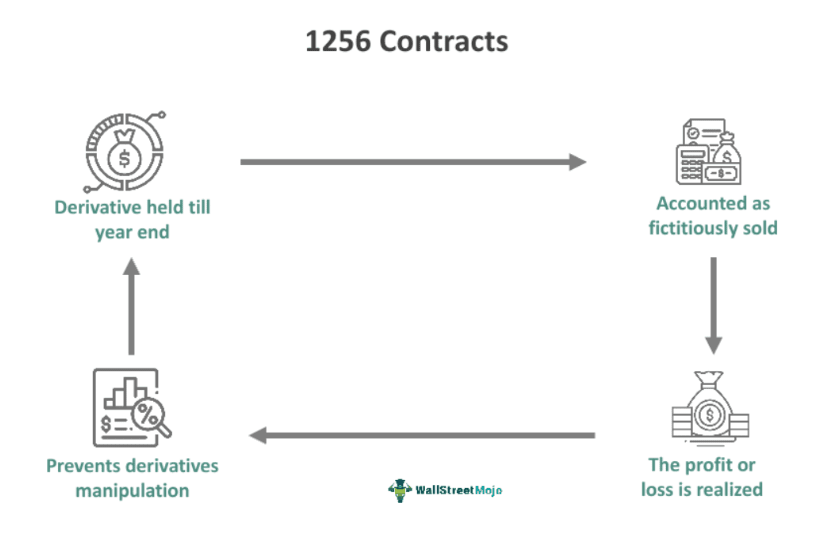

1256 Contracts are financial instruments, such as foreign currency contracts, dealer equity options, futures contracts, etc., whose trading is governed by a distinct tax treatment assigned to them under a specific section of the Internal Revenue Code (IRC). It states that investments in a derivative instrument, when retained until the end of the year, are considered sold at fair market value when the relevant year for taxation concludes.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: 1256 Contracts (wallstreetmojo.com)

The Section 1256 contracts were introduced to prevent derivatives manipulation initiated with a view to evade taxes. The profit or loss on such transactions is categorized under the heads of short-term or long-term capital gains or losses. The IRS has a separate category for the treatment of investments reported by taxpayers using Form 6781. It exempts securities futures contracts, swaps (interest rate, currency, commodity, equity index, credit default), interest rate caps, interest rate floors, etc.

Table of contents

Key Takeaways

- The 1256 contracts account for a fictional sale of derivative investments that taxpayers keep or hold on to until the year end.

- Although there are many derivatives, not every contract is eligible under this tax rule. They specifically deal with futures contracts, nonequity options, foreign currency, and debt securities futures contracts.

- The profit or loss realized from the sale of such derivatives, even when they are not exercised and retained by investors, are considered short-term or long-term capital gains or losses.

- Investors who incur losses in one year on Section 1256 contracts are allowed to carry back such losses for up to three years to offset gains in those previous years.

1256 Contracts Explained

1256 Contracts are instruments that fall under an IRC section, which is a provision offered to taxpayers in the US. It highlights the process of filing and reporting derivative contracts (futures, options, and swaps) and defines the tax treatment attributable to certain contracts in the US. The process is simple. An investor, irrespective of the time they hold on to a derivative, reports it as sold at the year-end and includes it during tax filing using Form 6781. Based on this declaration, capital gains and losses are calculated, marking the derivatives contract as sold for the purpose of the computation.

According to 1256 contracts tax reporting, if the investor has sold an eligible financial instrument, they will be required to mention the actual selling price. It will be derived using the mark-to-market technique, with the fair market value on December 31 being considered for the computation. The goal of such reporting is to prevent derivatives manipulation and simplify tax filing. It is important to note that not all contracts (futures, options, swaps, etc.) are eligible for special tax consideration under this rule. To get the right picture, investors should refer to the US government websites or consult tax professionals.

In the form, Section I covers 1256 contracts, while straddles (call and put options purchased on the same asset) are covered under Section II. The Internal Revenue Service enables taxpayers to report and file such transactions to ensure clarity and prevent the misrepresentation of assets. If an individual incurs a loss on such contracts, a 3-year carryback period is allowed to settle these losses against gains from the earlier years. For this, individuals must file a separate Form 1045, which is an Application for Tentative Refund. It allows taxpayers to include any losses, tax carrybacks or carryforwards, or any other items that make them eligible for tax refunds.

Financial Modeling & Valuation Courses Bundle (25+ Hours Video Series)

–>> If you want to learn Financial Modeling & Valuation professionally , then do check this Financial Modeling & Valuation Course Bundle (25+ hours of video tutorials with step by step McDonald’s Financial Model). Unlock the art of financial modeling and valuation with a comprehensive course covering McDonald’s forecast methodologies, advanced valuation techniques, and financial statements.

How To Report?

Reporting gains and losses on 1256 contracts and straddles is quite simple. Under normal circumstances, an investor holding an investment for more than a year does not need to report any gains or losses. However, for 1256 investments, the IRS requires investors to report their actual and would-be gains and losses at the year end.

- Investors report the gains and losses by the actual sale value or the fair market value by December 31 every year.

- They are required to complete and submit Form 6781, even if they decide to hold on to their investments without exercising them in the relevant tax filing period.

- Investors must follow the mark-to-market rules while reporting the gains and losses from 1256 contracts.

- The gains and losses are treated as 60% long-term and 40% short-term, irrespective of the time an investor holds the eligible financial instruments. This is precisely why the special tax consideration benefits investors.

- Form 6781 has three parts:

- Part I: It records the gains or losses on Section 1256 investments on the actual sale price or the mark-to-market value on December 31 if the derivative instrument is still in an investor’s possession.

- Part II: It helps report the gains or losses on straddles, where Section A records the losses, and the gains are recorded in Section B.

- Part III: Any unrecognized gains an investor has on trading positions held at year-end are recorded here. However, investors are required to complete Part III only if they incur a recognized loss on a related trading position.

Examples

Here are two examples of 1256 contracts.

Example #1

Ryan is a trader who purchased a futures contract on June 10 for $27,000. At the year-end on December 31, he still has it in his portfolio. It is now valued at $36,000. The mark-to-market profit is $9,000, and he reports it using Form 6781. According to the rule, it is treated as 60% long-term and 40% short-term capital gain.

On January 29 of the following year, Ryan sold his long position for $33,000. However, he has already recognized a $9,000 gain on last year’s tax return. Therefore, the IRS will record a $3,000 loss (36000 – 33000) in his present year’s tax return. This time, it will be treated as 40% short-term and 60% long-term capital loss.

Example #2

According to a 2020 Barron’s article, investors prefer investing in tax-advantaged products, such as government bonds or stocks with qualified dividends. Yet only a handful of people choose 1256 contracts, which are quite beneficial, especially for retirees.

Although section 1256 contracts are typically linked to futures, they also cover index options such as S&P 500 and VIX, allowing investors to employ clever investment strategies and enjoy reasonable tax rates. Since they are taxed at a blended rate of 60% long-term and 40% short-term rate, they are meant to benefit professional traders and small investors, particularly retirees trading with their accounts. The reason it proves advantageous is that the standard tax rates are usually higher than the special long-term capital gains tax rate applied to these financial instruments.

Tax Treatment

The 1256 contracts are taxed in line with a special tax treatment of 60/40. It indicates that no matter how long an investor holds on to a derivative instruments, they will be eligible for a tax rate of 60% long-term and 40% short-term capital gains or losses. It works in the taxpayer’s favor as the holding period is immaterial during tax computation and reporting.

Section 1256 contracts lists are exempted from the wash sales rules that apply to equities, and the net profit and losses are carried over to Schedule D (capital gains and losses). The loss can be carried back to offset the current or previous year’s profit. Form 6781 has a separate section for straddles to let investors identify the specific investment type.

*Wash sales rules refer to the restriction imposed on the deduction of losses in situations where an investor purchases similar securities before or after 30 days of incurring such losses.

Frequently Asked Questions (FAQs)

Mark-to-market applies to options and futures, where the daily change in the underlying asset’s value is measured at the end of the day. If a 1256 contract is being marked to market, it is done on December 31 (the year end) every year. The gains and losses on these contracts are calculated based on this price.

Net losses on 1256 contracts, which have not been fully offset in a given year, can be carried forward to future tax years for settlement against future gains or losses. It must be noted that maintaining accurate records and correctly filing taxes is crucial to benefit from such adjustments.

The benefits of the tax rule under 1256 contracts are:

– The 60/40 rule works in the favor of the taxpayer.

– The exemption does not include all swaps and equity options, allowing an investor to enjoy tax-free profit on some instruments.

– The 1256 contracts allow the investor to carry back losses for settlement (or offset).

– From the IRS’ perspective, this provision promotes tax collection and controls tax evasion, as traders or investors find manipulating derivatives challenging under this system.

Recommended Articles

This article has been a guide to what are 1256 Contracts. Here, we explain it with its tax treatment, how to report it, and examples. You may also find some useful articles here –

Leave a Reply