Updated August 03, 2023

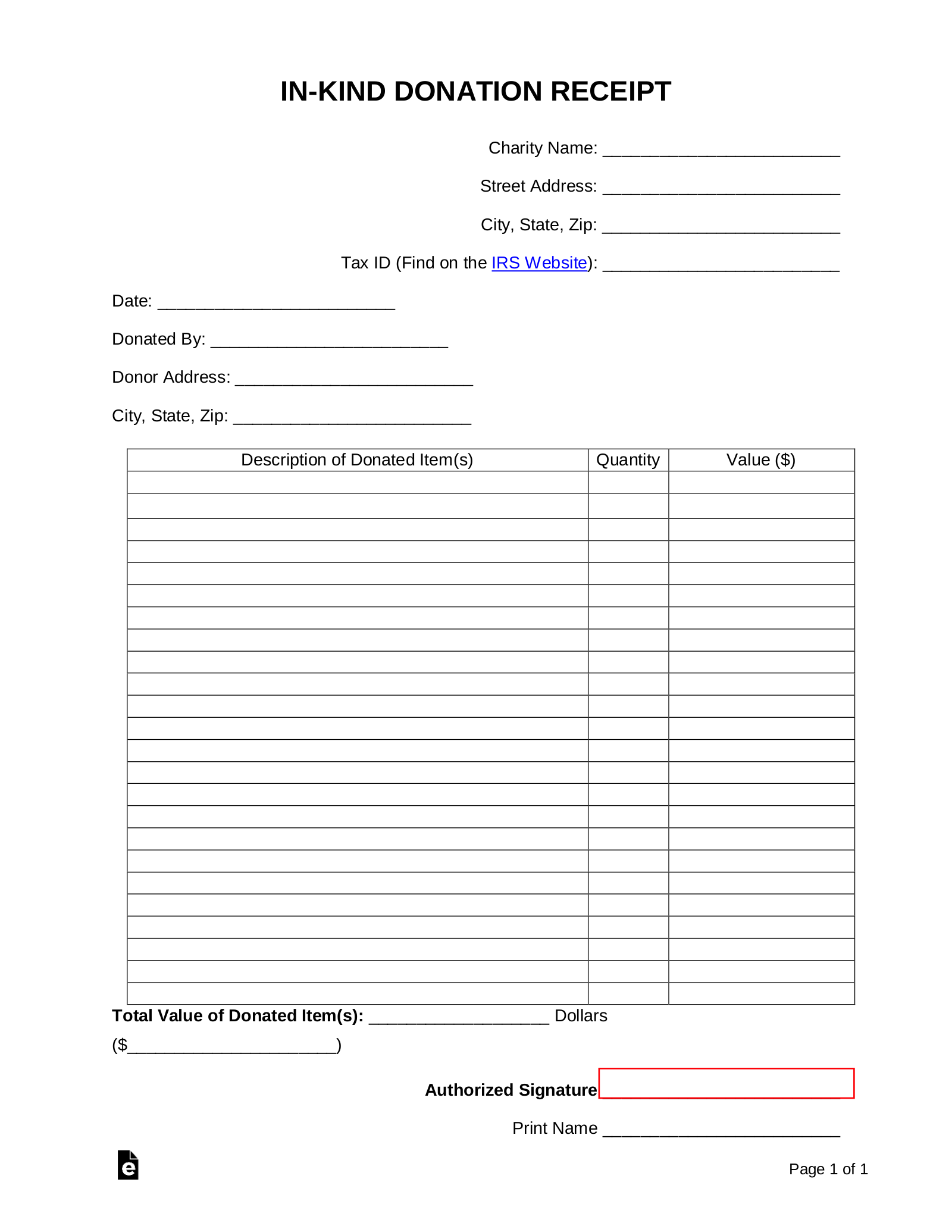

An in-kind donation receipt is used for the donation of any type of property or goods that has an undistinguished value such as clothing, furniture, appliances, or related items. For example, a business may choose to donate computers to a school and declare that donation as a tax deduction. To receive a tax deduction, the donor must obtain a receipt for their in-kind donation. Furthermore, it is the donor’s responsibility to specify the value of the donated items. If the value of the donated items is in excess of $5,000 an appraisal from the IRS may be required. The donation of services cannot be claimed as an in-kind tax-deductible donation.