Updated December 18, 2023

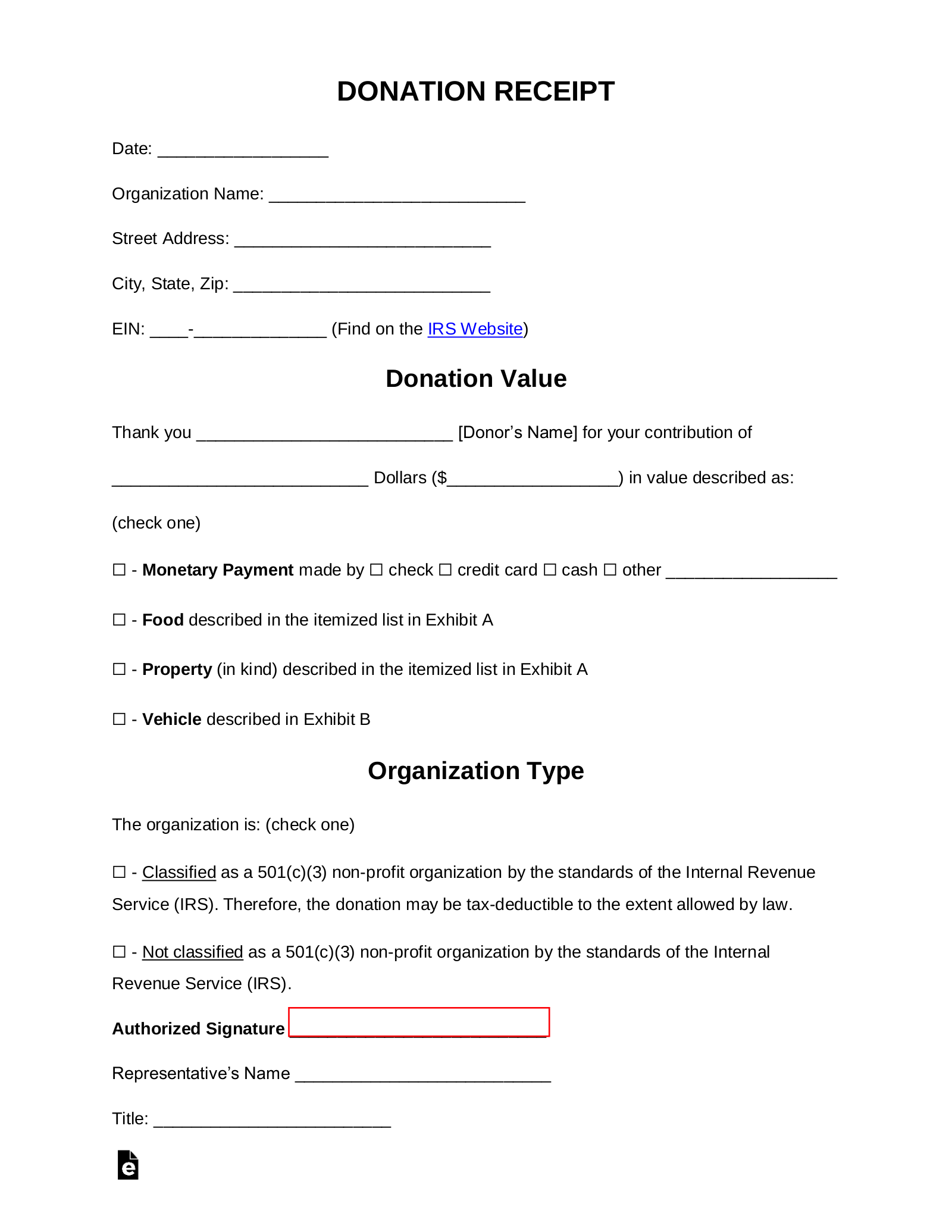

A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their State and Federal (IRS) income tax.

If the donor decides to make a deduction for a fiscal tax year, the receipt must be kept for a period of 2 years from the date the tax was paid or 3 years from the date the original return was filed, whichever is later.

Table of Contents |

By Type (8)

- 501(c)(3) Charity Donation

- Cash Donation

- Clothing Donation

- Church Donation

- Food Donation

- In-Kind (Property) Donation

- Political Donation

- Vehicle Donation

How Much ($) Can You Claim?

In accordance with IRS Publication 526, an individual may deduct a maximum of up to 50% of their Adjusted Gross Income (AGI) for the tax year the donation was given (other limitations may apply).

Depending on current legislation, there may be ways to deduct more the limited amount, for example, in 2017 there was no restriction on how much a filer could deduct for donations given to “disaster area contributions”.

What Qualifies as a Charity to the IRS?

Before making a tax-deductible contribution, it’s best to Verify a 501(c)(3) Charity before deciding to donate to ensure the organization is eligible under IRS rules.

Charitable Organizations DO include:

- Religious organizations such as churches, synagogues, temples, and mosques;

- To a government endeavor such as a grant, fund, or thing that serves the general public (for example, giving to a public park);

- Non-profit educational and medical facilities;

- Veterans’ groups; and

- General non-profit organizations (Goodwill, Salvation Army, Red Cross, United Way, etc.).

Charitable Organizations DO NOT include:

- Sports clubs;

- Civic or local groups;

- Labor unions;

- Political contributions; and

- Gifts to other individuals.

Donation Types

Depending on the donation type, a donor may need to obtain a receipt with the required information from the IRS if they would like to receive a tax deduction on their return at the end of the year (IRS Form 1040 – Schedule A). A receipt is required for all donation types in excess of $250.

Cash ($) Payment

If payment is made by cash, credit card, or bank transfer the non-profit will be required to give a receipt if it’s over $250. Otherwise, it is not required by the IRS. If a receipt is given, there are no other additional requirements or procedures by the IRS.

Personal Property (in-kind)

Personal property donations, most commonly in the form of clothing, can be made in addition to furniture, household items, art, antique collectibles, boats, equipment, etc. In the event an individual would like to claim a donation in excess of $500 but less than $5,000, the property will need to be professionally appraised in order to be recognized by the IRS. The appraisal must be completed no later than 60 days from the donation date and the appraiser will need to authorize IRS Form 8283 – Section A.

If the property is in excess of $5,000 the donor will be required to complete IRS Form 8283 – Section B.

Vehicle

If a vehicle with a value of more than $500 is donated to a 501(c)(3) charitable organization, the following forms must be issued and filed with the IRS at the end of the fiscal year:

- For Charities – IRS Form 1096 attached with IRS Form 1098-C. In addition, the charity is mandated to provide a written receipt to the donor in accordance with IRS Publication 4302.

- For Donors (View IRS Publication 4303) – Schedule A of IRS Form 1040. In addition, the donor must receive a written receipt from the charity.

In both cases, the following vehicle information should be provided on the written receipt:

- Donor’s Name

- Charity’s Tax ID Number

- 17-character Vehicle Identification Number (VIN)

- Vehicle’s Odometer Reading

- Description of Vehicle

- Year

- Make

- Model

- Color

- Body Type

- Date of the Contribution

- *If sold, gross proceeds from the sale.

Samples (3)

- Sample 1 – Cash Donation Receipt

- Sample 2 – Property (In-Kind) Donation Receipt

- Sample 3 – Vehicle Donation Receipt

Sample 1 – Cash Donation Receipt

DONATION RECEIPT

Date: March 14, 2019

Name of the Non-Profit Organization: Combat Wounded-Purple Heart Veterans Association

EIN: 47-1764985

DONATION INFORMATION

Donor’s Name: Francis Wilson

Donor’s Address: 41 Notchwoods Drive, Boiling Springs, SC 29316

Donation Value: $2000.00

Donation Description: Two-Thousand Dollars ($2000) Cash Donation, paid by check

I, the undersigned representative, declare (or certify, verify, or state) under penalty of perjury under the laws of the United States of America that there were no goods or services provided as part of this donation. Furthermore, as of the date of this receipt the above-mentioned organization is a current and valid 501(c)(3) non-profit organization in accordance with the standards and regulations of the Internal Revenue Service (IRS).

Sincerely,

Sample 2 – Personal Property Donation Receipt

DONATION RECEIPT

Date: May 2, 2019

Name of the Non-Profit Organization: Denzil O Neal Trust Fbo The Salvation Army

EIN: 01-0284340

DONATION INFORMATION

Donor’s Name: Beverly Hutchins

Donor’s Mailing Address: 415 Center Street, Evansville, IN 47715

Donation Value: $1040.00

Donation Description: 1 medium-size leather couch, 4 speakers, 1 subwoofer, 1 stereo receiver, 1 coffee table, assorted clothing (24 items), and 1 coffee maker

I, the undersigned representative, declare (or certify, verify, or state) under penalty of perjury under the laws of the United States of America that there were no goods or services provided as part of this donation. Furthermore, as of the date of this receipt the above-mentioned organization is a current and valid 501(c)(3) non-profit organization in accordance with the standards and regulations of the Internal Revenue Service (IRS).

Sincerely,

Sample 3 – Vehicle Donation Receipt

DONATION RECEIPT

Date: April 29, 2019

Name of the Non-Profit Organization: Cars 4 Change

EIN: 82-2723451

DONATION INFORMATION

Donor’s Name: Judith Blumenthal

Donor’s Mailing Address: 34 First Street, Gig Harbor, WA, 98332

Donation Value: $3988.00

Donation Description: 2001 Kia Sedan 4D, Blue

I, the undersigned representative, declare (or certify, verify, or state) under penalty of perjury under the laws of the United States of America that there were no goods or services provided as part of this donation. Furthermore, as of the date of this receipt the above-mentioned organization is a current and valid 501(c)(3) non-profit organization in accordance with the standards and regulations of the Internal Revenue Service (IRS).

Sincerely,