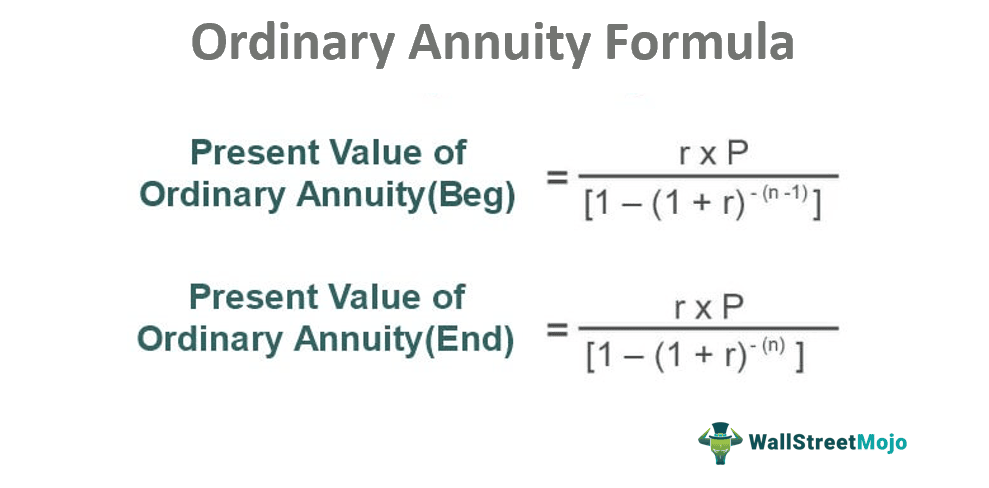

Formula to Calculate PV of Ordinary Annuity

Ordinary Annuity Formula refers to the formula that is used to calculate the present value of the series of an equal amount of payments that are made either at the beginning or end of the period over a specified length of time. As per the formula, the present value of an ordinary annuity is calculated by dividing the Periodic Payment by one minus one divided by one plus interest rate (1+r) raise to the power frequency in the period (in case of payments made at the end of period) or raise to the power frequency in the period minus one (in case of payments made at the beginning of period) and then multiplying the resultant with the rate of interest.

Table of contents

Key Takeaways

- The ordinary annuity formula determines the present value of a series of equal payments made at the beginning or end of each period over a defined length of time.

- The ordinary annuity formula is paramount in finance as it enables precise calculations of the present value of recurring payments, aiding investors and analysts in accurately valuing various financial instruments such as bonds, preferred shares, and pension plans.

- Ordinary annuities can include interest payments from bond issuers. These payments can be quarterly or semi-annual, and they often comprise regular dividends issued by a firm that has maintained a consistent distribution over the years.

The formula is given below

Present Value of Ordinary Annuity (Beg) = r * P / {1 – (1+r)-(n-1)}

Present Value of Ordinary Annuity (End) = r * P / {1 – (1+r)-(n)}

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Ordinary Annuity Formula (wallstreetmojo.com)

Where,

- P is the Periodic Payment

- r is the interest rate for that period

- n will be a frequency in that period

- Beg is Annuity due at the beginning of the period

- The end is Annuity due at the end of the period

Explanation

The present value of ordinary annuity Ordinary AnnuityAn ordinary annuity refers to recurring payments of equal value made at regular intervals for a fixed period. The frequency of these consecutive payments can be weekly, monthly, quarterly, half-yearly or yearly.read more takes into account the three major components in its formula. PMTPMTPMT function is an advanced financial function to calculate the monthly payment against the simple loan amount. You have to provide basic information, including loan amount, interest rate, and duration of payment, and the function will calculate the payment as a result.read more, which is nothing but r*P, which is the cash payment, then we have r, which is nothing, but the prevailing market interest rate, P is the present value of initial cash flow, and finally, n is the frequency or the total number of periods. Then there are two types of payment: one annuity, which is due at the beginning of the period, and the second one is due at the end of the period.

Both the formulas have a slight difference in that in one, we compound by n, and in another, we compound by n-1; that’s because the payment 1st that is made will be made today, and hence no discounting is applied to the 1st payment for the beginning annuity.

Examples

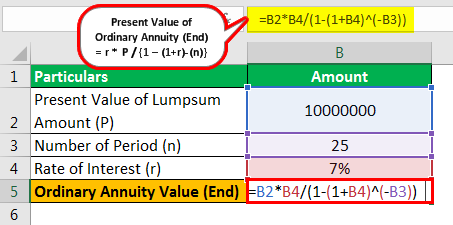

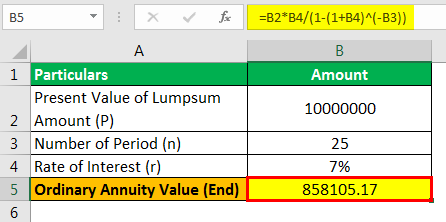

Example #1

Keshav has inherited $500,000 as per the agreement. However, the agreement stated that the payment would be received as an annuity for the next 25 years. You are required to calculate the amount that shall be received by Keshav, assuming the interest rate prevailing in the market is 7%. You can assume that the annuity is paid at the end of the year.

Solution

Use the following data can be used for the calculation

- Present Value of Lumpsum Amount (P): 10000000

- Number of Periods (n): 25

- Rate of Interest (r): 7%

Therefore, the calculation of the ordinary annuity (end) is as follows.

=500,000* 7% /{1-(1+7%)-25}

Ordinary Annuity Value (end) will be –

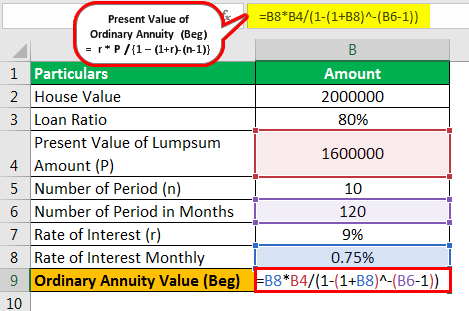

Example #2

Mr. Vikram Sharma has just settled in his life. He got married to a girl he wished for and got the job he had been looking for for a long time. He has done his graduation from London, and he has also inherited $400,000 from his father, who is his current savings.

He and his wife are looking to buy a house in the town worth $2,000,000. Since they don’t own that much funds, they have decided to take a bank loan whereby they will be required to pay 20% from their pocket, and the rest would be taken care of by the loan.

The Bank charges an interest rate of 9%, and the installments need to be paid monthly. They decide to go for a ten years loan and have confidence that they shall repay the same sooner than the estimated ten years.

You are required to calculate the present value of the installments that they will be paying monthly starting at the month.

Solution

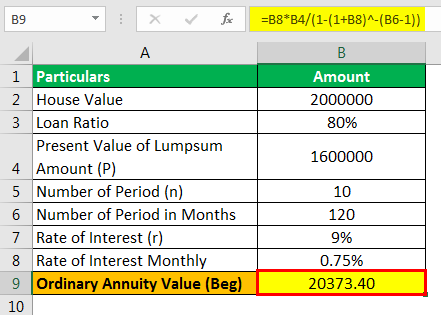

Use the following data for the calculation of ordinary annuity due at a beginning period.

- House Value: 2000000

- Loan Ratio: 80%

- Present Value of Lumpsum Amount (P): 1600000

- Number of Periods (n): 10

- Number of Periods in Months: 120

- Rate of Interest (r): 9%

- Rate of Interest Monthly: 0.75%

Here, Mr. Vikram Sharma and his family have taken a housing loan, which equals $2,000,000 * (1 – 20%) to $1,600,000.

Now we know the present value of the lump sum amount that shall be paid, and now we need to calculate the present value of monthly installments using the below start of the period formula.

The interest rate per annum is 9%. Therefore the monthly rate shall be 9%/12 is 0.75%.

Therefore, the calculation of the ordinary annuity (Beg) is as follows.

= 0.75%*1,600,000/{1-(1+0.75%)-119}

Ordinary Annuity Value (Beg) will be –

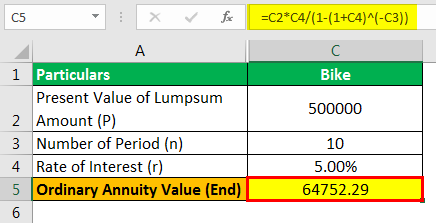

Example #3

Motor XP has been recently made available in the market, and to promote its vehicle, the same has been offered at a rate of 5% for the initial three months of launch.

John, who is aging 60 years now, is eligible for an annuity that he purchased 20 years ago. Wherein he made the lump sum amount of 500,000, and the annuity will be paid yearly till 80 years of age, and the current market rate of interest is 8%.

He is interested in buying the model XP motor and wants to know whether the same would be affordable for the next ten years if he takes it on EMI, payable yearly. Assume that the price of the bike is the same as the amount he invested in the annuity plan.

Are you required to advise John where his annuity will meet the EMI expenses?

Assume both are incurred at the end of the year only.

Solution

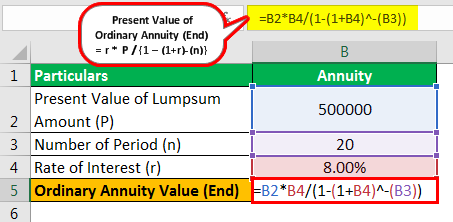

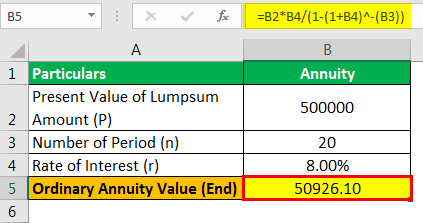

In this case, we need to calculate two annuities: one is a normal one, and another is a loan annuity.

| Particulars | Annuity | Bike |

|---|---|---|

| Present Value of Lumpsum Amount (P) | 500000 | 500000 |

| Number of Period (n) | 20 | 10 |

| Rate of Interest (r) | 8.00% | 5.00% |

Annuity

Therefore, the calculation of the ordinary annuity (end) is as follows

= 500,000 * 8%/{1-(1+8%)-20}

Ordinary Annuity Value (end) will be –

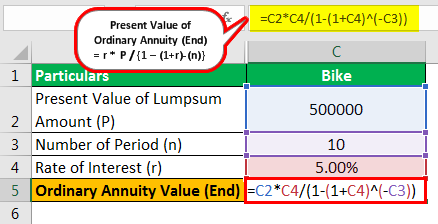

Motor XP

Therefore, the calculation of the ordinary annuity (end) is as follows

= 5%*500,000/{1-(1+5%)-10}

Ordinary Annuity Value (end) will be –

There is a gap of 13,826.18 between the Annuity payment and Loan payment, and hence either John should be able to take out from pockets, or he should extend the EMI till 20 years, which is the same as an annuity.

Relevance and Uses

In real-life examples, ordinary annuities could be interest payments from bond issuers. Those payments are generally paid monthly, quarterly, or semi-annually and further dividends are paid quarterly by a firm that has maintained a stable payout for years. PV of an ordinary annuity will be majorly dependent upon the current market interest rate. Due to the TVMTVMThe Time Value of Money (TVM) principle states that money received in the present is of higher worth than money received in the future because money received now can be invested and used to generate cash flows to the enterprise in the future in the form of interest or from future investment appreciation and reinvestment.read more, in case of rising interest rates, the present value will decrease, while in the scenario of declining interest rates, it shall lead to an increase in the annuities present value.

Frequently Asked Questions (FAQs)

The ordinary annuity formula rests upon a foundation of specific suppositions that underpin its calculations. It hinges on the notion of unwavering payment amounts, reiterated uniformly at consistent intervals throughout the designated period. Moreover, the formula demands a steadfast interest rate that remains constant across the duration under scrutiny.

The ordinary annuity formula calculates the present value of a series of future payments. It’s particularly useful for determining the current value of fixed-payment assets like bonds, preferred shares, and certain types of financial plans.

The formula assumes a constant interest rate and payment amounts, which might not reflect real-world scenarios. Additionally, it doesn’t consider factors like inflation or changes in interest rates over time. The formula’s simplicity might lead to inaccuracies for complex financial instruments or fluctuating interest rates.

Recommended Articles

This has been a guide to the Ordinary Annuity Formula. Here we discuss the formula to calculate the present value of the ordinary annuity and a downloadable excel template. You can learn more about financing from the following articles –

- Formula of Annuity DueFormula Of Annuity DueAnnuity Due can be defined as those payments which are required to be made at the start of each annuity period instead of the end of the period. The payments are generally fixed and there are two values for an annuity, one would be future value, and another would be present value.read more

- Present Value of an Annuity CalculationPresent Value Of An Annuity CalculationThe present value of an annuity formula depicts the current value of the future annuity payments. Present Value of an Annuity=C×(1−〖(1+i)〗^(−n))/i, where C is the cash flow per period, i is the interest rate, and n is the frequency of payments.read more

- Future Value of Annuity Due CalculationFuture Value Of Annuity Due CalculationThe future value of annuity due is the amount to be received in future where each payment is made at the beginning of each period. FVA due = P * [(1 + r)n – 1] * (1 + r)/rread more

- Net Change FormulaNet Change FormulaNet Change formula calculates the change in the value of anything from its previous values. It derives the difference in the closing price of the stocks, mutual funds, bonds from its closing price on the previous day. Net Change Formula = Current Period’s Closing Price – Previous Period’s Closing Price read more