By: Tony Traficante, a Contributing Editor for ISDA

Sounds like an anomaly, doesn’t it? A “poor man’s banker,” but that’s what thousands of disenfranchised immigrants called the gracious Amadeo Pietro Giannini.

His contemporaries referred to him as “America’s Banker.”

The son of Italian immigrants, Virginia and Luigi, Amadeo was born on a farm in San Jose, California on May 6, 1870.

At 7, he was traumatized by the murder of his father, and at 14 he went to work in his stepfather’s produce business. The hardworking Giannini — who earned a partnership in the business — found success, sold the company to his employees and “retired” at the young age of 31.

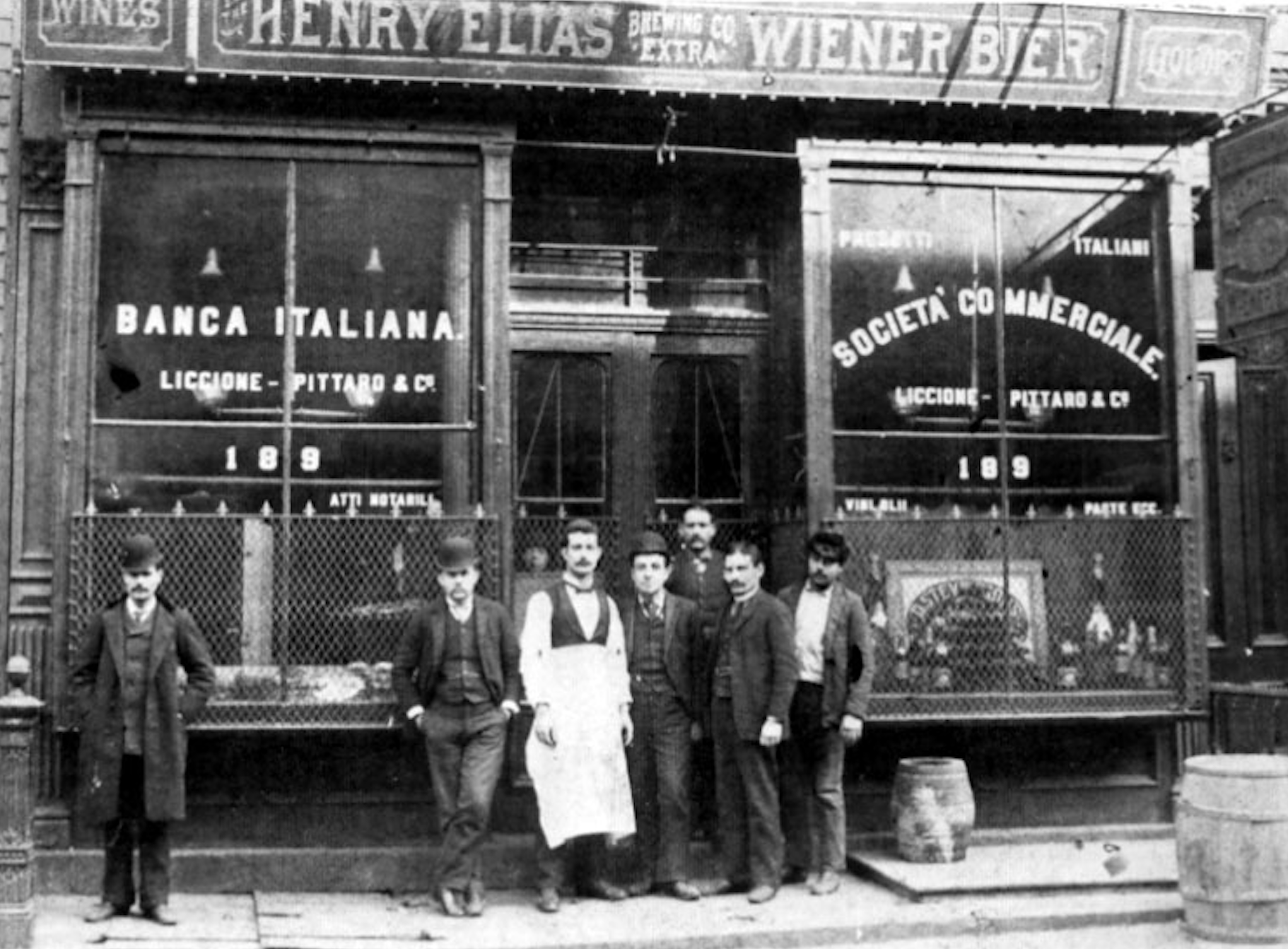

Giannini’s reputation as an astute and talented businessman quickly spread, and he was enticed to join the Board of Directors of the Columbus Savings Loan Society, a small bank in San Francisco’s Little Italy.

Mr. Giannini, thrilled with the offer, saw an opportunity to provide banking services to immigrants and the underprivileged. But, he was too often at odds with the policies of the Board, which had little interest in servicing the hardworking immigrant class, so he resigned.

In 1904, he opened his own Bank of Italy directly across the street from his former employer, the Columbus S&L.

Giannini intended to provide banking for “the little fellow”: the farmers, merchants and laborers — many of whom were immigrants.

He visited homes of the less fortunate and convinced them it was safe to move their small savings from their mattresses to his bank.

Giannini’s banking operations took off, but unfortunately in 1906, disaster struck San Francisco. The infamous earthquake disaster destroyed many of the banks, including the Bank of Italy.

But Giannini was determined to continue banking, especially at a time when his customers would need it most.

Borrowing a produce wagon, Giannini raced to North Beach — battling the fires and rubble — and brought the bank’s valuables and records back to his home.

He set up shop in front of his house, using a plank stretched across a couple of beer barrels, and amid all the rubble, he continued to offer loans to customers.

When some of his more destitute customers apologized for having no security as collateral, he replied: “Your face is sufficient security for me!”

Giannini was a gracious practitioner, but he was also a genius who revolutionized banking in the United States.

In 1909, he pioneered the concept of “branch banking,” after he noticed customers traveling long distances to do business. His first of hundreds of branches was opened in San Jose. When most banks closed at 3 p.m., Giannini kept his banks open until 9 or 10 at night for workers.

In 1928, Giannini negotiated a takeover of the Bank of America and merged it with the Bank of Italy. He became Chairman of the Board, and by 1945 the Bank of America was the largest bank in the United States.

He supported large and small businesses, with significant financial assistance. He helped finance the construction of the Golden Gate bridge, and he provided financial backing to the California wine and movie industries.

Giannini was a philanthropist of the most significant magnitude; a man of great compassion and generosity.

He gave much of his money to charitable foundations. When he died, his estate was valued at a rather modest $500,000. His philosophy was “personal wealth was not a priority.”

Amadeo Pietro Giannini died on June 3, 1949 at the age of 79. He was a giant in the banking industry; a man of great vision and business acumen.

Proud of his Italian heritage, Giannini gave extensively to Italian-American causes, and to all Americans.

Make the pledge and become a member of Italian Sons and Daughters of America today!