Summary

- Michael Burry made $100 million by predicting the housing market crash in The Big Short.

- Mark Baum, based on Steve Eisman, earned $1 billion from the market crash depicted in the film.

- Jared Vennett, based on Greg Lippmann, made $47 million from swap sales as shown in the movie.

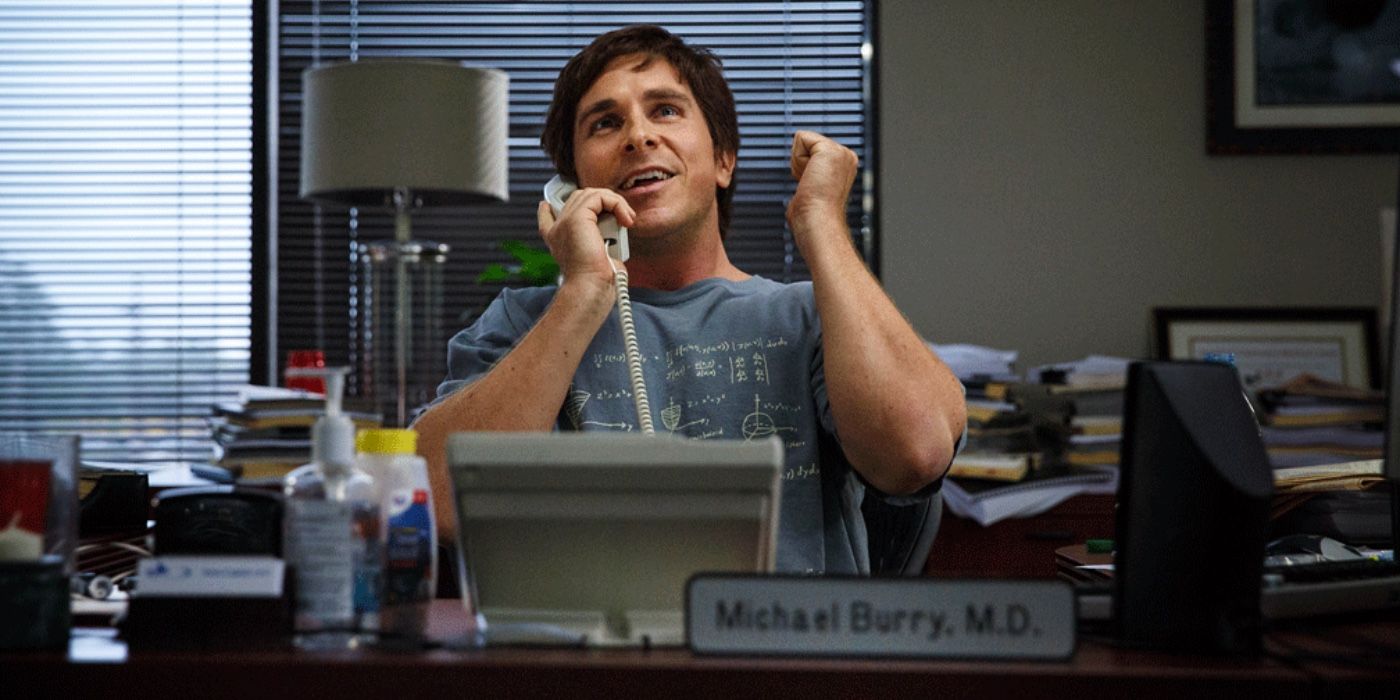

The Big Short tells the story of the 2007 housing market crash and how a few key characters, who are based on real-life people, significantly profited from the financial crisis. Michael Burry, played by Christian Bale in the 2015 biographical comedy-drama film, was at the center of it all since he was the one who predicted that the housing market would crash and used that information for his own benefit and help out his investors. Burry founded the hedge fund Scion Capital, allowing others to profit off of the crisis that resulted in millions of lost jobs and homes.

Other figures represented in The Big Short are Steve Carell as Mark Baum, Ryan Gosling as Jared Vennett, John Magaro as Charlie Geller, and Finn Wittrock as Jamie Shipley. All five characters, including Burry, made money from the housing market crash, as depicted in Adam McKay's satirical movie. However, their earnings from the late 2000s financial crisis greatly varied — some made upwards of hundreds of millions of dollars, while others earned tens of millions.

The Big Short True Story: 8 Biggest Changes Made To The Financial Crisis Movie

The Big Short does a great job of capturing a factual account of the 2008 financial crisis. There are only a few key differences from the true story.Michael Burry Makes $100 Million In The Big Short

Christian Bales Character Walked Away Considerable Richer

Even after the backlash he faced after the 2000s financial crisis, Burry continues to make money

As depicted in The Big Short, Michael Burry, an investor and hedge fund manager, theorized that the United States housing market would crash in 2007, a couple of years beforehand. He realized that the market was unstable by looking at high-risk subprime loans. So, deciding to take matters into his own hands and bet on his prediction, Burry shorted market-based mortgage-backed securities. According to Vanity Fair, after Burry's theory came to fruition in real life, he made $100 million for himself and $725 million for his investors through Scion Capital.

Shortly following the crash, Burry shut down the hedge fund due to a tainted reputation, audits from the IRS, and to explore other investment opportunities. Despite closing Scion Capital, Burry made personal investments after The Big Short in real life. Only a few years following the housing market crash, he reopened his hedge fund and rebranded it as Scion Asset Management.

In August 2023, Burry predicted that there would be another stock market crash, so the investment firm purchased $866 million in put options against a fund tracking the S&P 500 and $739 million against a fund tracking the Nasdaq 100. So, even after the backlash he faced after the 2000s financial crisis, Burry continues to make money.

10 Best Movies Like The Big Short You Need To See

There are plenty of great movies about finance and business that are just as entertaining and sharply satirical as Adam McKay's The Big Short.The Real Mark Baum Made $1 Billion From The Housing Market Crash

Steve Carell's The Big Short Character Made Considerable More Than Christian Bale's

Steve Carell played Mark Baum in The Big Short. Baum is based on Steve Eisman, but the producers changed his name for the film. Eisman was the hedge fund manager of FrontPoint Partners, a small independent trading firm, and he is notorious for shorting collateralized debt obligations to turn a profit from the collapse of the United States housing bubble in the late 2000s.

As a result, Eisman (or Baum in the 2015 movie) and his team made $1 billion from the market crash (per Historic Cornwall and the film). It's unclear how much money Eisman took home himself, but he obviously earned millions of dollars.

The Big Short Ending Explained: Oh, So That's Why We're All F*cked

The Big Short manages to show the causes of the 2008 financial crisis while being accessible to audiences, but parts of its ending are still unclear.The Real Jared Vennett Made $47 Million From Swap Sales

Ryan Gosling's Character Walked Away With Almost $50 Million After The Big Short

Jared Vennett, played by Ryan Gosling, was another fake name used in The Big Short. In reality, Vennett was based on Greg Lippmann, a hedge fund manager and Deutsche Bank's executive in charge of global asset-backed securities trading. He learned about Michael Burry's strong theory and decided to sell swaps. He, too, was banking on the housing market crash, and Lippmann ultimately brought home $47 million due to the swap sales, as depicted near the end of The Big Short.

Steve Carell Talks the Morality and Anger of The Big Short

Screen Rant interviews Steve Carell about the ethical dilemmas and anger that underscores Adam Mckay's The Big Short.Charlie Geller & Jamie Shipley Make $80 Million In The Big Short

John Magaro And Finn Wittrock's The Big Short Characters Made Almost $100 Million Between Them

They came to learn about the prediction of the housing market crash in 2007, and just like the other significant figures depicted in the film, Jamie and Charlie took advantage of the knowledge.

The Big Short also told the story of Charlie Geller, played by John Magaro, and Jamie Shipley, played by Finn Wittrock. The film changed the two men's last names, with Jamie's real name being Mai and Charlie's being Ledley. Jamie and Charlie co-headed Cornwall Capital (Brownfield Fund in the movie), a private financial investment corporation in New York City. They came to learn about the prediction of the housing market crash in 2007, and just like the other significant figures depicted in the film, Jamie and Charlie took advantage of the knowledge.

Jamie and Charlie shorted the subprime mortgage crisis market before the late 2000s financial crisis. As a result, they made around $80 million from their efforts to profit from the crash, according to the film and Historic Cornwall. Jamie and Charlie went their separate ways after the events of The Big Short, and in 2014, Cornwall Capital was sold to H.I.G. Capital.

The Big Short

A fictionalized depiction of the events surrounding the financial crisis of 2007-2008, The Big Short employs narrative techniques such as fourth-wall breaks to succinctly explain financial concepts to its audience, using Michael Lewis's 2010 book as a template. The film features an ensemble cast that includes Christian Bale, Steve Carell, Ryan Gosling, and Brad Pitt.

- Director

- Adam McKay

- Release Date

- December 23, 2015

- Studio(s)

- Paramount Pictures

- Writers

- Adam McKay , Charles Randolph

- Cast

- Brad Pitt , Melissa Leo , Ryan Gosling , Marisa Tomei , Steve Carell , Christian Bale

- Runtime

- 130minutes