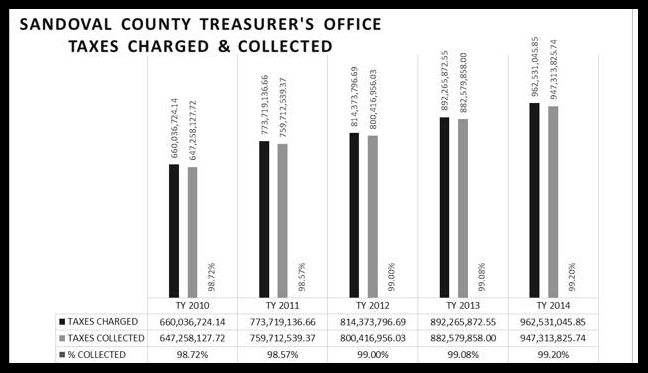

The Sandoval County Treasurer’s Office has shown a steady increase in the amount of property taxes collected over the past five years. The overall collection rate has improved, thanks in part to a new emphasis on pursuing delinquent accounts before they are transferred to New Mexico Department of Taxation and Revenue’s Property Tax Division (PTD).

In the Tax Year 2011, the Treasurer’s office had an overall collection rate of 98.72%. In Tax Year 2013, the Treasurer’s office collected 99% of the property taxes owed to the county. The percentage rose again in Tax Year 2014 to 99.08, which is approximately an additional $8 million dollars. The upward trend continued in 2015, with a collection rate of 99.20%. The graph below gives you a visual of the taxes charged and taxes collected by dollar amount and percentage.

Sandoval County Treasurer Laura M. Montoya said these numbers are even more impressive when considering the office staff has not increased over this period though the tax roll has increased by over $300 million in just five years. “We have changed our collection strategy,” Treasurer Montoya said. “We have worked diligently on cleaning up the tax roll and removing any uncollectible accounts. We continue to work closely with taxpayers who are in jeopardy of having their property auctioned and we have placed a special emphasis on closing delinquent accounts before they hit the three-year mark.”

That timeline is important because once an account has been delinquent for more than three years, by statute, county Treasurers must turn the property over to PTD. At that point, any penalty, interest and cost to state is reverted to PTD.

“If we collect on delinquent accounts before they are transferred to the state, the money collected can be used to fund services for the citizens of Sandoval County,” Montoya said. “It is important for us to maintain a high overall collection rate to ensure that all property owners are paying their fair share of taxes. It would be unfair to those property owners who diligently pay their taxes on time for us not to pursue delinquent accounts.”

The data shows that this strategy is a productive method to continue to collect taxes. Montoya further states, “Though the tax roll has increased every year, my staff has continued to increase the percentage of collection, making this year the best collection rate in the history of Sandoval County. I am honored to work with a team that is able to produce these results with compassion and respect toward our taxpayers. I’d also like to thank our taxpayers for assisting us in this continued effort.”

The 2015 Tax Bill will be sent out Monday, November 2, 2015. The 2005 tax year will be removed from the tax roll and the taxes charged to the Treasurer for 2015 total $118,878,983.27. The Treasurer is responsible for collecting taxes for ten consecutive years. The total taxes charged for the current 10-year obligation amount to $1,030,529,519.12. Tax dollars are distributed on a monthly basis to support county programs such as Fire and 911 services, Public Safety, Senior Programs and Roads and Infrastructure. We also distribute tax dollars on a monthly basis to libraries, medical facilities and programs, municipalities, schools, special assessments; and water and conservancy districts.