by harveyorgan · in Uncategorized · Leave a comment·Edit

GOLD; $1738.25 UP $1.35

SILVER: $19.23 UP 3 CENTS

ACCESS MARKET: GOLD $1740.10

SILVER: $19.23

Bitcoin morning price: $20,448 UP 67

Bitcoin: afternoon price: $21,547. UP 1166

Platinum price: closing UP $19.00 to $876.95

Palladium price; closing UP $94.00 at $1916.60

END

DONATE

Click here if you wish to send a donation. I sincerely appreciate it as this site takes a lot of preparation

EXCHANGE: COMEX

EXCHANGE: COMEX

CONTRACT: JULY 2022 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,734.900000000 USD

INTENT DATE: 07/06/2022 DELIVERY DATE: 07/08/2022

FIRM ORG FIRM NAME ISSUED STOPPED

323 H HSBC 212

435 H SCOTIA CAPITAL 75

657 C MORGAN STANLEY 2

661 C JP MORGAN 1096 1032

737 C ADVANTAGE 5 6

800 C MAREX SPEC 2 7

905 C ADM 77

TOTAL: 1,257 1,257

MONTH TO DATE: 2,270

no. of contracts issued by JPMorgan: 1072/1257

_____________________________________________________________________________________

NUMBER OF NOTICES FILED TODAY FOR JULY CONTRACT 1257 NOTICE(S) FOR 125,700 Oz//3.9097 TONNES)

total notices so far: 2270 contracts for 227,000 oz (7.0606 tonnes)

SILVER NOTICES:

75 NOTICE(S) FILED 375,000 OZ/

total number of notices filed so far this month 2588 : for 12,940,000 oz

END

Russia is a major supplier of silver to London while Mexico supplies the COMEX

With the sanctions, London has no way to obtain silver other than compete with NY.

GLD

WITH GOLD UP $1.35

WITH RESPECT TO GLD WITHDRAWALS: (OVER THE PAST FEW MONTHS):

GOLD IS “RETURNED” TO THE BANK OF ENGLAND WHEN CALLING IN THEIR LEASES: THE GOLD NEVER LEAVES THE BANK OF ENGLAND IN THE FIRST PLACE. THE BANK IS PROTECTING ITSELF IN CASE OF COMMERCIAL FAILURE

ALSO INVESTORS SWITCHING TO SPROTT PHYSICAL (phys) INSTEAD OF THE FRAUDULENT GLD//

BIG CHANGES IN GOLD INVENTORY AT THE GLD: A HUGE WITHDRAWAL OF 7.61 TONNES FROM THE GLD//

INVENTORY RESTS AT 1024.43 TONNES

Silver//SLV

WITH NO SILVER AROUND AND SILVER UP 3 CENTS

AT THE SLV// ://HUGE CHANGES IN SILVER INVENTORY AT THE SLV//: A WITHDRAWAL OF 4.889 MILLION OZ FROM THE LV//

INVESTORS ARE SWITCHING SLV TO SPROTT’S PSLV

CLOSING INVENTORY: 523.262 MILLION OZ

Let us have a look at the data for today

SILVER//OUTLINE

SILVER COMEX OI FELL BY A HUGE SIZED 2862 CONTRACTS TO 137,601 AND FURTHER FROM THE NEW RECORD OF 244,710, SET FEB 25/2020 AND THE GAIN IN OI WAS ACCOMPLISHED DESPITE OUR $0.01 GAIN IN SILVER PRICING AT THE COMEX ON WEDNESDAY. OUR BANKERS WERE UNSUCCESSFUL IN KNOCKING THE PRICE OF SILVER DOWN (IT ROSE BY $0.01) BUT WERE SUCCESSFUL IN KNOCKING OFF SOME SILVER LONGS//BUT MAINLY WE HAD ADDITIONAL SPECULATOR ADDITIONS.

WE MUST HAVE HAD:

I) HUGE SPECULATOR SHORT ADDITIONS /. II) WE ALSO HAD SOME REDDIT RAPTOR BUYING//. iii) A GOOD ISSUANCE OF EXCHANGE FOR PHYSICALS iiii) A POOR INITIAL SILVER STANDING FOR COMEX SILVER MEASURING AT 15.220 MILLION OZ FOLLOWED BY TODAY’S 155,000 OZ QUEUE JUMP / // V) HUGE SIZED COMEX OI LOSS

I AM NOW RECORDING THE DIFFERENTIAL IN OI FROM PRELIMINARY TO FINAL:

THE DIFFERENTIAL FROM PRELIMINARY OI TO FINAL OI SILVER TODAY: CONTRACTS : -118

HISTORICAL ACCUMULATION OF EXCHANGE FOR PHYSICALS JULY. ACCUMULATION FOR EFP’S SILVER/JPMORGAN’S HOUSE OF BRIBES/STARTING FROM FIRST DAY/MONTH OF JULY:

TOTAL CONTACTS for 4 days, total 5662 contracts: 28.310 million oz OR 7.077MILLION OZ PER DAY. (1415 CONTRACTS PER DAY)

TOTAL EFP’S FOR THE MONTH SO FAR: 28.31 MILLION OZ

.

LAST 11 MONTHS TOTAL EFP CONTRACTS ISSUED IN MILLIONS OF OZ:

MAY 137.83 MILLION

JUNE 149.91 MILLION OZ

JULY 129.445 MILLION OZ

AUGUST: MILLION OZ 140.120

SEPT. 28.230 MILLION OZ//

OCT: 94.595 MILLION OZ

NOV: 131.925 MILLION OZ

DEC: 100.615 MILLION OZ

JAN 2022// 90.460 MILLION OZ

FEB 2022: 72.39 MILLION OZ//

MARCH: 207.430 MILLION OZ//A NEW RECORD FOR EFP ISSUANCE AND WE ARE STILL GOING STRONG THIS MONTH.

APRIL: 114.52 MILLION OZ FINAL//LOW ISSUANCE

MAY: 105.635 MILLION OZ//

JUNE: 94.470 MILLION OZ

JULY : 28.31 MILLION OZ

RESULT: WE HAD A HUGE SIZED DECREASE IN COMEX OI SILVER COMEX CONTRACTS OF 2862 DESPITE OUR $0.01 GAIN IN SILVER PRICING AT THE COMEX// WEDNESDAY.,. THE CME NOTIFIED US THAT WE HAD A STRONG SIZED EFP ISSUANCE CONTRACTS: 500 CONTRACTS ISSUED FOR SEPT AND 0 CONTRACTS ISSUED FOR ALL OTHER MONTHS) WHICH EXITED OUT OF THE SILVER COMEX TO LONDON AS FORWARDS THE DOMINANT FEATURE TODAY: /HUGE BANKER SHORT COVERING AS THEY GET OUT OF DODGE//// WE HAVE A HUGE INITIAL SILVER OZ STANDING FOR JUNE. OF 15.22 MILLION OZ FOLLOWED BY TODAY’S QUEUE JUMP OF 105,000 OZ // .. WE HAD A VERY STRONG SIZED LOSS OF 2362 OI CONTRACTS ON THE TWO EXCHANGES FOR 11.810 MILLION OZ DESPITE THE TINY GAIN IN PRICE..

WE HAD 75 NOTICES FILED TODAY FOR 375,000 OZ

THE SILVER COMEX IS NOW BEING ATTACKED FOR METAL BY LONDONERS ET AL.

GOLD//OUTLINE

IN GOLD, THE COMEX OPEN INTEREST ROSE BY A FAIR SIZED 3024 CONTRACTS TO 498,210 AND CLOSER TO THE RECORD (SET JAN 24/2020) AT 799,541 AND PREVIOUS TO THAT: (SET JAN 6/2020) AT 797,110.

THE DIFFERENTIAL FROM PRELIMINARY OI TO FINAL OI IN GOLD TODAY: —2004 CONTRACTS.

.

THE FAIR SIZED INCREASE IN COMEX OI CAME DESPITE OUR FALL IN PRICE OF $26.70//COMEX GOLD TRADING/WEDNESDAY / WE MUST HAVE HAD SOME SPECULATOR SHORT COVERING ACCOMPANYING OUR GOOD SIZED EXCHANGE FOR PHYSICAL ISSUANCE. WE HAD ZERO LONG LIQUIDATION //AND SOME SPECULATOR SHORT COVERING

WE ALSO HAD A HUGE INITIAL STANDING IN GOLD TONNAGE FOR JULY AT 2.914 TONNES ON FIRST DAY NOTICE FOLLOWED BY TODAY’S QUEUE JUMP OF 199,900 OZ

YET ALL OF..THIS HAPPENED DESPITE OUR LOSS IN PRICE OF $26.70 WITH RESPECT TO WEDNESDAY’S TRADING

WE HAD A STRONG SIZED GAIN OF 8052 OI CONTRACTS 25.045 PAPER TONNES) ON OUR TWO EXCHANGES..

E.F.P. ISSUANCE

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A STRONG SIZED 5028 CONTRACTS:

The NEW COMEX OI FOR THE GOLD COMPLEX RESTS AT 501,234

IN ESSENCE WE HAVE A STRONG SIZED INCREASE IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 8,052, WITH 3024 CONTRACTS INCREASED AT THE COMEX AND 5028 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN ON THE TWO EXCHANGES OF 8,052 CONTRACTS OR 25.045 TONNES.

CALCULATIONS ON GAIN/LOSS ON OUR TWO EXCHANGES

WE HAD A STRONG SIZED ISSUANCE IN EXCHANGE FOR PHYSICALS (5028) ACCOMPANYING THE FAIR SIZED GAIN IN COMEX OI (3024,): TOTAL GAIN IN THE TWO EXCHANGES 8,052 CONTRACTS. WE NO DOUBT HAD 1) SOME SPECULATOR SHORT COVERING AND SOME ADDITION TO SPECULATOR SHORTS ,2.) STRONG INITIAL STANDING AT THE GOLD COMEX FOR JULY. AT 2.914 TONNES FOLLOWED BY TODAY’S 19,900 OZ QUEUE JUMP 3) ZERO LONG LIQUIDATION//SOME SPECULATOR SHORT COVERING//SOME SPECULATOR SHORT ADDITIONS //.,4) FAIR SIZED COMEX OPEN INTEREST GAIN 5) GOOD ISSUANCE OF EXCHANGE FOR PHYSICAL/

HISTORICAL ACCUMULATION OF EXCHANGE FOR PHYSICALS IN 2022 INCLUDING TODAY

JULY

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF JULY :

26,409 CONTRACTS OR 2,640,900 OZ OR 82.14 TONNES 4 TRADING DAY(S) AND THUS AVERAGING: 6602 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 4 TRADING DAY(S) IN TONNES: 82.14 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2021, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 82.14/3550 x 100% TONNES 2.30% OF GLOBAL ANNUAL PRODUCTION

ACCUMULATION OF GOLD EFP’S YEAR 2021 TO 2022

JANUARY/2021: 265.26 TONNES (RAPIDLY INCREASING AGAIN)

FEB : 171.24 TONNES ( DEFINITELY SLOWING DOWN AGAIN)..

MARCH:. 276.50 TONNES (STRONG AGAIN/

APRIL: 189..44 TONNES ( DRAMATICALLY SLOWING DOWN AGAIN//GOLD IN BACKWARDATION)

MAY: 250.15 TONNES (NOW DRAMATICALLY INCREASING AGAIN)

JUNE: 247.54 TONNES (FINAL)

JULY: 188.73 TONNES FINAL

AUGUST: 217.89 TONNES FINAL ISSUANCE.

SEPT 142.12 TONNES FINAL ISSUANCE ( LOW ISSUANCE)_

OCT: 141.13 TONNES FINAL ISSUANCE (LOW ISSUANCE)

NOV: 312.46 TONNES FINAL ISSUANCE//NEW RECORD!! (INCREASING DRAMATICALLY)//SIGN OF REAL STRESS//SURPASSING THE MARCH 2021 RECORD OF 276.50 TONNES OF EFP

DEC. 175.62 TONNES//FINAL ISSUANCE//

JAN:2022 247.25 TONNES //FINAL

FEB: 196.04 TONNES//FINAL

MARCH: 409.30 TONNES INITIAL( THIS IS NOW A RECORD EFP ISSUANCE FOR MARCH AND FOR ANY MONTH.

APRIL: 169.55 TONNES (FINAL VERY LOW ISSUANCE MONTH)

MAY: 247,44 TONNES FINAL//

JUNE: 2238.13 TONNES FINAL

JULY: 82.14 TONNES

SPREADING OPERATIONS

(/NOW SWITCHING TO GOLD) FOR NEWCOMERS, HERE ARE THE DETAILS

SPREADING LIQUIDATION HAS NOW COMMENCED AS WE HEAD TOWARDS THE NEW ACTIVE FRONT MONTH OF JUNE. WE ARE NOW INTO THE SPREADING OPERATION OF SILVER

HERE IS A BRIEF SYNOPSIS OF HOW THE CROOKS FLEECE UNSUSPECTING LONGS IN THE SPREADING ENDEAVOUR ;MODUS OPERANDI OF THE CORRUPT BANKERS AS TO HOW THEY HANDLE THEIR SPREAD OPEN INTERESTS:HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NOW INTO THE NON ACTIVE DELIVERY MONTH OF JUNE HEADING TOWARDS THE ACTIVE DELIVERY MONTH OF JULY, FOR SILVER:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST STARTS TO RISE BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JULY), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLED SERIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

First, here is an outline of what will be discussed tonight:

1.Today, we had the open interest at the comex, in SILVER, FELL BY A HUGE SIZED 2862 CONTRACT OI TO 137,719 AND FURTHER FROM OUR COMEX RECORD //244,710(SET FEB 25/2020). THE LAST RECORDS WERE SET IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD TO THAT WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 5 YEARS AGO.

EFP ISSUANCE 500 CONTRACTS

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

SEPT 500 ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE:500 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE COMEX OI LOSS OF 2862 CONTRACTS AND ADD TO THE 500 OI TRANSFERRED TO LONDON THROUGH EFP’S,

WE OBTAIN A GIGANTIC SIZED LOSS OF 2362 OPEN INTEREST CONTRACTS FROM OUR TWO EXCHANGES.

THUS IN OUNCES, THE LOSS ON THE TWO EXCHANGES 11.810 MILLION OZ

OCCURRED DESPITE OUR RISE IN PRICE OF $0.01 .

OUTLINE FOR TODAY’S COMMENTARY

1/COMEX GOLD AND SILVER REPORT

(report Harvey)

2 ) Gold/silver trading overnight Europe,

(Peter Schiff,

end

3. Egon von Greyerz///Matthew Piepenburg via GoldSwitzerland.com,

4. Chris Powell of GATA provides to us very important physical commentaries

end

5. Other gold commentaries

6. Commodity commentaries//

3. ASIAN AFFAIRS

i)WEDNESDAY MORNING// TUESDAY NIGHT

SHANGHAI CLOSED UP 9.05 PTS OR 0.27% //Hang Sang CLOSED UP 56.92 OR 0.26% /The Nikkei closed UP 382.88 OR % 1.47 //Australia’s all ordinaires CLOSED UP .78% /Chinese yuan (ONSHORE) closed UP 6.7018 /Oil DOWN TO 99.50 dollars per barrel for WTI and DOWN TO 101.66 for Brent. Stocks in Europe OPENED ALL GREEN // ONSHORE YUAN CLOSED UP AGAINST THE DOLLAR AT 6.7018 OFFSHORE YUAN CLOSED UP ON THE DOLLAR AT 6.7030: /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING STRONGER AGAINST US DOLLAR/OFFSHORE STRONGER

a)NORTH KOREA/SOUTH KOREA

outline

b) REPORT ON JAPAN/

OUTLINE

3 C CHINA

OUTLINE

4/EUROPEAN AFFAIRS

OUTLINE

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

OUTLINE

6.Global Issues

OUTLINE

7. OIL ISSUES

OUTLINE

8 EMERGING MARKET ISSUES

COMEX DATA//AMOUNTS STANDING//VOLUME OF TRADING/INVENTORY MOVEMENTS

GOLD

LET US BEGIN:

THE TOTAL COMEX GOLD OPEN INTEREST ROSE BY A FAIR SIZED 3024 CONTRACTS TO 501,234 AND CLOSER TO THE RECORD THAT WAS SET IN JANUARY/2020: {799,541 OI(SET JAN 16/2020)} AND PREVIOUS TO THAT: 797,110 (SET JAN 7/2020). AND THIS FAIR COMEX INCREASE OCCURRED DESPITE OUR LOSS OF $26.70(???) IN GOLD PRICING WEDNESDAY’S COMEX TRADING. WE ALSO HAD A STRONG SIZED EFP (5028 CONTRACTS). . THEY WERE PAID HANDSOMELY NOT TO TAKE DELIVERY AT THE COMEX AND SETTLE FOR CASH. IT NOW SEEMS THAT THE COMMERCIALS HAVE GOADED THE SPECS TO GO SHORT BIG TIME AND THEY ADDED TO THEIR SHORT POSITIONS

WE NORMALLY HAVE WITNESSED EXCHANGE FOR PHYSICALS ISSUED BEING SMALL AS IT JUST TOO COSTLY FOR THEM TO CONTINUE SERVICING THE COSTS OF SERIAL FORWARDS CIRCULATING IN LONDON. HOWEVER, MUCH TO THE ANNOYANCE OF OUR BANKERS, THE COMEX IS THE SCENE OF AN ASSAULT ON GOLD AS LONDONERS, NOT BEING ABLE TO FIND ANY PHYSICAL ON THAT SIDE OF THE POND, EXERCISE THESE CIRCULATING EXCHANGE FOR PHYSICALS IN LONDON AND FORCING DELIVERY OF REAL METAL OVER HERE AS THE OBLIGATION STILL RESTS WITH NEW YORK BANKERS. IT SEEMS THAT ARE BANKERS FRIENDS ARE EXERCISING EFP’S FROM LONDON AND NOW THEY ARE LOATHE TO ISSUE NEW ONES.

EXCHANGE FOR PHYSICAL ISSUANCE

WE ARE NOW IN THE NON ACTIVE DELIVERY MONTH OF JULY.. THE CME REPORTS THAT THE BANKERS ISSUED A STRONG SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS.,

THAT IS 5028 EFP CONTRACTS WERE ISSUED: ;: , . 0 AUG :5028 & ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 5028 CONTRACTS

WHEN WE HAVE BACKWARDATION, EFP ISSUANCE IS VERY COSTLY BUT THE REAL PROBLEM IS THE SCARCITY OF METAL AND IT IS FAR BETTER FOR OUR BANKERS TO PAY OFF INDIVIDUALS THAN RISK INVESTORS ESPECIALLY FROM LONDON STANDING FOR DELIVERY. THE LOWER PRICES IN THE FUTURES MARKET IS A MAGNET FOR OUR LONDONERS SEEKING PHYSICAL METAL. BACKWARDATION ALWAYS EQUAL SCARCITY OF METAL!

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: A HUGE SIZED TOTAL OF 10,056 CONTRACTS IN THAT 5028 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE HAD A GOOD SIZED COMEX OI GAIN OF 5028 CONTRACTS..AND THIS STRONG GAIN ON OUR TWO EXCHANGES HAPPENED DESPITE OUR FALL IN PRICE OF GOLD $26.70.

// WE HAVE A STRONG AMOUNT OF GOLD TONNAGE STANDING JULY (7.7729),

HERE ARE THE AMOUNTS THAT STOOD FOR DELIVERY IN THE PRECEDING 12 MONTHS OF 2021-2022:

DEC 2021: 112.217 TONNES

NOV. 8.074 TONNES

OCT. 57.707 TONNES

SEPT: 11.9160 TONNES

AUGUST: 80.489 TONNES

JULY: 7.2814 TONNES

JUNE: 72.289 TONNES

MAY 5.77 TONNES

APRIL 95.331 TONNES

MARCH 30.205 TONNES

FEB ’21. 113.424 TONNES

JAN ’21: 6.500 TONNES.

TOTAL SO FAR THIS YEAR (JAN- DEC): 601.213 TONNES

YEAR 2022:

JANUARY 2022 17.79 TONNES

FEB 2022: 59.023 TONNES

MARCH: 36.678 TONNES

APRIL: 85.340 TONNES FINAL.

MAY: 20.11 TONNES FINAL

JUNE: 74.933 TONNES FINAL

JULY 7.7729 TONNES

THE BANKERS WERE SUCCESSFUL IN LOWERING GOLD’S PRICE //// (IT FELL $26.70) BUT WERE UNSUCCESSFUL IN KNOCKING OFF SPECULATOR LONGS/COMMERCIAL LONGS BUT SPECULATOR SHORTS CONTINUED TO ADD TO THEIR POSITIONS//// WE HAVE REGISTERED A STRONG SIZED GAIN OF 25.045 TONNES ON TOTAL OI FROM OUR TWO EXCHANGES, ACCOMPANYING OUR GOLD TONNAGE STANDING FOR JULY (7.7729 TONNES)…

WE HAD -2004 CONTRACTS REMOVED FROM COMEX TRADES. THESE WERE REMOVED AFTER TRADING ENDED LAST NIGHT

NET GAIN ON THE TWO EXCHANGES 8,052 CONTRACTS OR 805,200 OZ OR 25.045 TONNES

Estimated gold volume 165,906/// poor/

final gold volumes/yesterday 334,627 /STRONG/RAID

INITIAL STANDINGS FOR JULY ’22 COMEX GOLD //JULY 7

| Gold | Ounces |

| Withdrawals from Dealers Inventory in oz | nil oz |

| Withdrawals from Customer Inventory in oz | 2,990.042 oz Int. Delaware Delaware 62 kilobars 31 kilobars |

| Deposit to the Dealer Inventory in oz | nil OZ |

| Deposits to the Customer Inventory, in oz | nil |

| No of oz served (contracts) today | 1257 notice(s) 125,700 OZ 3.9090 TONNES |

| No of oz to be served (notices) | 229 contracts 22900 oz 0.7122 TONNES |

| Total monthly oz gold served (contracts) so far this month | 2270 notices227,000 OZ 7.0606 TONNES |

| Total accumulative withdrawals of gold from the Dealers inventory this month | NIL oz |

| Total accumulative withdrawal of gold from the Customer inventory this month | xxx oz |

total dealer deposit 0

No dealer withdrawals

0 customer deposits

total deposits: nil oz

2 customer withdrawals:

i) Int. Delaware: 1993.362 (62 kilobars)

ii) Delaware: 996.680 oz (31 kilobars)

total withdrawal: 2990.042 oz

ADJUSTMENTS:2 all dealer to customer

Brinks 13,021.155 oz

JPMorgan 160,457.274 oz

CALCULATIONS FOR THE AMOUNT OF GOLD STANDING FOR JULY.

For the front month of JULY we have an oi of 1486 contracts gaining 1378 contracts . We had

621 notices filed on Wednesday so we gained a whopping 1999 contracts or an additional 199,900 oz will stand in this non active

delivery month of July.

August has a LOSS OF 12,130 contracts down to 369,806 contracts

Sept. gained 322 contracts to 1325.

We had 1257 notice(s) filed today for 125,700 oz FOR THE July 2022 CONTRACT MONTH.

Today, 0 notice(s) were issued from J.P.Morgan dealer account and 1096 notices were issued from their client or customer account. The total of all issuance by all participants equate to 1257 contract(s) of which 1072 notices were stopped (received) by j.P. Morgan dealer and 0 notice(s) was (were) stopped/ Received) by J.P.Morgan//customer account and 0 notice(s) received (stopped) by the squid (Goldman Sachs)

To calculate the INITIAL total number of gold ounces standing for the JULY /2022. contract month,

we take the total number of notices filed so far for the month (2270) x 100 oz , to which we add the difference between the open interest for the front month of (JULY 1486 CONTRACTS ) minus the number of notices served upon today 1257 x 100 oz per contract equals 249,900 OZ OR 7.7729 TONNES the number of TONNES standing in this active month of July.

thus the INITIAL standings for gold for the JULY contract month:

No of notices filed so far (2270) x 100 oz+ (1486) OI for the front month minus the number of notices served upon today (1257} x 100 oz} which equals 249,900 oz standing OR 7,7729 TONNES in this active delivery month of JULY.

TOTAL COMEX GOLD STANDING: 7.7729 TONNES (A FAIR STANDING FOR A JULY ( NON ACTIVE) DELIVERY MONTH)

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

COMEX GOLD INVENTORIES/CLASSIFICATION

NEW PLEDGED GOLD:

241,794.285 oz NOW PLEDGED /HSBC 5.94 TONNES

204,937.290 PLEDGED MANFRA 3.08 TONNES

83,657.582 PLEDGED JPMorgan no 1 1.690 tonnes

265,999.054, oz JPM No 2

1,152,376.639 oz pledged Brinks/

Manfra: 33,758.550 oz

Delaware: 193.721 oz

International Delaware:: 11,188.542 o

total pledged gold: 2,419,784.828 oz 75.26 tonnes

TOTAL OF ALL GOLD ELIGIBLE AND REGISTERED: 32,984,567.40 OZ

TOTAL ELIGIBLE GOLD: 16,293,532.012 OZ

TOTAL OF ALL REGISTERED GOLD: 16,691,035 OZ

REGISTERED GOLD THAT CAN BE SERVED UPON: 14,271,251.0 OZ (REG GOLD- PLEDGED GOLD)

END

SILVER/COMEX/JULY 7

| Silver | Ounces |

| Withdrawals from Dealers Inventory | NIL oz |

| Withdrawals from Customer Inventory | 729,554.145 oz Brinks CNT Delaware Int. Delaware |

| Deposits to the Dealer Inventory | nil OZ |

| Deposits to the Customer Inventory | 1,515,631.421 oz CNT Delaware JPMorgan |

| No of oz served today (contracts) | 75CONTRACT(S)375,000 OZ) |

| No of oz to be served (notices) | 325 contracts (1,625,000 oz) |

| Total monthly oz silver served (contracts) | 2588 contracts 12,940,000 oz) |

| Total accumulative withdrawal of silver from the Dealers inventory this month | NIL oz |

| Total accumulative withdrawal of silver from the Customer inventory this month |

And now for the wild silver comex results

i) 0 dealer deposit

total dealer deposits: 0 oz

i) We had 0 dealer withdrawal

total dealer withdrawals: x oz

We have 3 deposits into the customer account

i) Into JPMorgan: 583,128.300 oz

ii) Into Delaware: 353,864.731 oz

iii0 Into CNT: 578,638.390 oz

total deposit: 1,515,631.421 oz

JPMorgan has a total silver weight: 173.503 million oz/337.890 million =51.34% of comex

Comex withdrawals: 4

i) Out of Brinks: 600,509.850 oz

ii) out of Int. Delaware 25,261,280 oz

iii) Out of CNT 101,776.480 oz

iv) Out of Delaware 2006.280 oz

total withdrawal 729,554.145 oz

adjustments: 0/

the silver comex is in stress!

TOTAL REGISTERED SILVER: 68.732 MILLION OZ

TOTAL REG + ELIG. 337.860 MILLION OZ

CALCULATION OF SILVER OZ STANDING FOR JUNE

silver open interest data:

FRONT MONTH OF JULY OI: 400 CONTRACTS HAVING LOST 590. WE HAD 621 NOTICES FILED

ON WEDNESDAY, SO WE GAINED 31 CONTRACTS OR AN ADDITIONAL 155,000 OZ WILL STAND FOR METAL AT THE COMEX.

AUGUST LOST163 CONTRACTS TO STAND AT 1300

SEPTEMBER HAD A LOSS OF 2771 CONTRACTS DOWN TO 114,756 CONTRACTS.

.

TOTAL NUMBER OF NOTICES FILED FOR TODAY: 75 for 375,000 oz

Comex volumes:42,772// est. volume today// poor

Comex volume: confirmed yesterday: 70,191 contracts ( GOOD )

To calculate the number of silver ounces that will stand for delivery in JULY we take the total number of notices filed for the month so far at 2588 x 5,000 oz = 12,940,000 oz

to which we add the difference between the open interest for the front month of JULY(400) and the number of notices served upon today 75 x (5000 oz) equals the number of ounces standing.

Thus the standings for silver for the JULY./2022 contract month: 2588 (notices served so far) x 5000 oz + OI for front month of JULY (400) – number of notices served upon today (75) x 5000 oz of silver standing for the JULY contract month equates 14,565,000 oz. .

the record level of silver open interest is 234,787 contracts set on April 21./2017 with the price on that day at $18.42. The previous record was 224,540 contracts with the price at that time of $20.44

END

GLD AND SLV INVENTORY LEVELS:

JULY 7/WITH GOLD UP $1.35: BIG CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 7.61 TONNES FORM THE GLD///INVENTORY REST AT 1024.43 TONNES

JULY 6/WITH GOLD DOWN $26.70: BIG CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 9.86 TONNES FROM THE GLD//INVENTORY REST AT 1032.04 TONNES

JULY 5/WITH GOLD DOWN $36.55//BIG CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 8.41 TONNES FROM THE GLD///INVENTORY RESTS AT 1041.90 TONNES

JULY 1/WITH GOLD DOWN $5.40: BIG CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 2.32 TONNES//INVENTORY RESTS AT 1050.31 TONNES

JUNE 30/WITH GOLD DOWN $9.20: big CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 1.74 TONNES FROM THE GLD///INVENTORY RESTS AT 1052.63 TONNES//

JUNE 28/WITH GOLD DOWN $3.05//BIG CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 4.64 TONNES FROM THE GLD///INVENTORY RESTS AT 1056.40 TONNES

JUNE 27/WITH GOLD DOWN $4.90 CENTS TODAY: BIG CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 2.03 TONNES FROM THE GLD///INVENTORY RESTS AT 1061.04 TONNES

JUNE 24/WITH GOLD UP 45 CENTS TODAY: HUGE CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 8.70 TONNES FROM THE GLD//INVENTORY RESTS AT 1063.07 TONNES

JUNE 23/WITH GOLD DOWN $8.60:HUGE CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 2.03 TONNES FROM THE GLD//INVENTORY RESTS AT 1071.77 TONNES

JUNE 22/WITH GOLD UP 15 CENTS:BIG CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 1.74 TONNES FROM THE GLD////INVENTORY RESTS AT 1073.80 TONNES

JUNE 21/WITH GOLD DOWN $2.00: NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 1075.54 TONES

JUNE 17/WITH GOLD DOWN $11.25: HUGE CHANGES IN GOLD INVENTORY AT THE GLD: A DEPOSIT OF 11.60 TONNES INTO THE GLD.///INVENTORY RESTS AT 1075.54 TONNES

JUNE 16/WITH GOLD UP $28.95: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 1063.74 TONNES

JUNE 15/WITH GOLD UP $6.50/BIG CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 1.65 TONNES FROM THE GLD////INVENTORY RESTS AT 1063.74 TONNES

JUNE 14/WITH GOLD DOWN $18.80/NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 1065.39 TONNES

JUNE 13/WITH GOLD DOWN $41.55: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 1065.39 TONNES

JUNE 10/WITH GOLD UP $21.40: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 1065.39 TONNES

JUNE 9/WITH GOLD DOWN $3.50: HUGE CHANGES IN GOLD INVENTORY AT THE GLD: A DEPOSIT OF 2.32 TONNES OF GOLD INTO THE GLD////INVENTORY RESTS AT 1065.39 TONNES

JUNE 8/WITH GOLD UP $4.75: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 1063.07 TONNES

JUNE 7/WITH GOLD UP $7.45: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 1063.07 TONNES

JUNE 6/WITH GOLD DOWN $5.85: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 1066.04 TONNES

JUNE 3/WITH GOLD DOWN $19.75//A BIG CHANGE IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 1.16 TONNES FROM THE GLD//INVENTORY RESTS AT 1066.04 TONNES

JUNE 2/WITH GOLD UP $22.50: HUGE CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 1.64 TONNES FROM THE GLD//INVENTORY RESTS AT 1067.20 TONNES

JUNE 1/WITH GOLD UP $1$ HUGE CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 1.45 TONNES FROM THE GLD///INVENTORY RESTS AT 1068.36 TONNES

GLD INVENTORY: 1024.43 TONNES

Now the SLV Inventory/( vehicle is a fraud as there is no physical metal behind them

JULY 7/WITH SILVER UP 3 CENTS TODAY: BIG CHANGES IN SILVER INVENTORY AT THE SLV: A WITHDRAWAL OF 4.889 MILLION OZ FROM THE SLV//INVENTORY RESTS AT 523.262 MILLION OZ/

JULY 6/WITH SILVER UP ONE CENT: HUGE CHANGES IN SILVER INVENTORY AT THE SLV: A WITHDRAWAL OF 12.558 MILLION OZ FORM THE SLV///INVENTORY RESTS AT 528.151 MILLION OZ

JULY 5/WITH SILVER DOWN 55 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 540.709MILLION OZ//

JULY 1/WITH SILVER DOWN 61 CENTS TODAY: A SMALL CHANGE IN SILVER INVENTORY AT THE SLV: A WITHDRAWAL OF 553,000 OZ//INVENTORY RESTS AT 540.709 MILLION OZ//

JUNE 30/WITH SILVER DOWN 41 CENTS : SMALL CHANGES IN SILVER INVENTORY AT THE SLV: A WITHDRAWAL OF 738,000 OZ FROM THE SLV//INVENTORY RESTS AT 541.262 MILLION OZ//

JUNE 28/WITH SILVER DOWN 26 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 542.00 MILLION OZ..

JUNE 27/WITH SILVER DOWN 4 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 542.000 MILLION OZ

JUNE 24/WITH SILVER UP 10 CENTS TODAY: HUGE CHANGES IN SILVER INVENTORY AT THE SLV: A WITHDRAWAL OF 3.137 MILLION OZ FROM THE SLV////INVENTORY RESTS AT 542.000 MILLION OZ

JUNE 23/WITH SILVER DOWN 41 CENTS TODAY; HUGE CHANGES IN SILVER INVENTORY AT THE SL: A WITHDRAWAL OF 2.029 MILLION OZ FROM THE SLV//INVENTORY RESTS AT 545.137 MILLION OZ//

JUNE 22/WITH SILVER DOWN 14 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 547.166 MILLION OZ.

JUNE 21/WITH SILVER UP 9 CENTS TODAY: HUGE CHANGES IN SILVER INVENTORY AT THE SLV: A DEPOSIT OF 3.506 MILLION OZ INTO THE SLV///INVENTORY RESTS AT 547.166 MILLION OZ//

JUNE 17/WITH SILVER DOWN 15 CENTS TODAY: SMALL CHANGES IN SILVER INVENTORY AT THE SLV/: A WITHDRAWAL OF 739,000 OZ FROM THE SLV./:INVENTORY RESTS AT 543.660 MILLION OZ/

JUNE 16/WITH SILVER UP 46 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 544.399 MILLION OZ

JUNE 15/WITH SILVER UP 44 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 544.399 MILLION OZ

JUNE 14/WITH SILVER DOWN 32 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 544.399 MILLION OZ//

JUNE 13/WITH SILVER DOWN 62 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 544.399 MILLION OZ//

JUNE 10.WITH SILVER UP 13 CENTS TODAY: HUGE CHANGES IN SILVER INVENTORY AT THE SLV: A WITHDRAWAL OF 830,000 Z FROM THE SLV//INVENTORY RESTS AT 544.399 MILLION OZ//

JUNE 9/WITH SILVER DOWN 27 CENTS TODAY:HUGE CHANGES IN SILVER INVENTORY AT THE SLV: A DEPOSIT OF 923,000 OZ INTO THE SLV////INVENTORY RESTS AT 545.229 MILLION OZ

JUNE 8/WITH SILVER DOWN 8 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 544.306 MILLION OZ//

JUNE 7/WITH SILVER UP 6 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 544.306 MILLION OZ/

JUNE 6/WITH SILVER UP 20 CENTS TODAY: A HUGE CHANGE IN SILVER INVENTORY AT THE SLV: A WITHDRAWAL OF 6.459 MILLION OZ FROM THE SLV///INVENTORY RESTS AT 547.167 MILLION OZ//

JUNE 3/WITH SILVER DOWN $.34: A SMALL CHANGES IN SILVER INVENTORY AT THE SLV: A WITTHDRAWAL OF 246,000 OZ FORM THE SLV//INVENTORY RESTS AT 553.626 MILLION OZ..

JUNE 2/WITH SILVER UP 57 CENTS TODAY: HUGE CHANGES IN SILVER INVENTORY AT THE SLV: A WITHDRAWAL OF 2.261 MILLION OZ FORM THE SLV.//INVENTORY RESTS T 553.872 MILLION OZ

JUNE 1/WITH SILVER UP 19 CENTS TODAY: HUGE CHANGES IN SILVER INVENTORY AT THE SLV//: A WITHDRAWAL OF 2.538 MILLION OZ FROM THE SLV//INVENTORY RESTS AT 556.133 MILLION OZ//

CLOSING INVENTORY 523.262 MILLION OZ//

PHYSICAL GOLD/SILVER STORIES

1.PETER SCHIFF

Is The Chinese Yuan Beginning To Chip Away At Dollar Dominance?

WEDNESDAY, JUL 06, 2022 – 10:45 PM

China appears to be chipping away at dollar dominance.

While there is no indication that the dollar is in imminent danger of toppling from its perch as the global reserve currency, more central banks are warming up to the yuan.

According to UBS Asset Management’s annual reserve manager survey, about 85% of central banks said they are invested in or are considering investing in the Chinese yuan. That’s up from 81% a year earlier.

USB surveyed 30 top central banks.

On average, central bank foreign exchange managers plan to hold about 5.8% of reserves in yuan within the next 10 years. That would represent a sharp increase from the 2.9% level of global reserve yuan holdings reported by the International Monetary Fund in late June.

Meanwhile, the average share of US dollar holdings dropped to 63% as of June 2022, according to the survey. That was down from 69% in the previous year.

According to Business Insider, the response to the invasion of Ukraine “has increased talk about a ‘multipolar’ world, in which the US is no longer the overwhelmingly dominant force.

There is some speculation that the weaponization of the dollar to punish Russia for the invasion of Ukraine has motivated some countries to diversify away from the dollar. Less exposure to the greenback means less exposure to diplomatic and economic pressure from Washington DC.

Declining confidence in the dollar started long before recent events in Ukraine. The Federal Reserve printed trillions of dollars out of thin air in response to COVID-19. This devalued the dollar as evidenced by the surge in prices over the last year. This was the predictable result of creating money out of thin air and handing it out to spend. More money chasing the same amount (or with governments shutting down economies fewer) goods and services will always lead to a general rise in prices.

The only reason the US can get away with this policy to the extent that it does is its role as the world reserve currency. There is a built-in global demand for dollars that helps absorb the money printing. But what happens if that demand drops? What happens if China and other countries decide they don’t want to hold a currency that is losing value every day?

After Russia invaded Ukraine, the US cut some Russian banks, including the central bank, off from the SWIFT payment system.

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication. The system enables financial institutions to send and receive information about financial transactions in a secure, standardized environment. Since the dollar serves as the world reserve currency, SWIFT facilitates the international dollar system.

SWIFT and dollar dominance gives the US a great deal of leverage over other countries.

And the US went a step further. In an unprecedented move, the Federal Reserve froze Russia’s dollar reserves. In effect, Russia’s dollar assets are valueless to the country. It can’t use them at all.

Even if you think Russia deserves these draconian economic sanctions, it’s important to remember that they could come at a cost.

Recent dollar strength compared to other world currencies suggests that the dollar remains in a strong position. But things could shift quickly. How much more borrowing and printing will the world tolerate before they become wary of holding dollars? And will the US propensity to use the dollar as a foreign policy weapon undermine trust in the greenback?

The world is watching.

END

How Long Will The Fed Hawks Keep Flying?

THURSDAY, JUL 07, 2022 – 01:05 PM

Authored by Michael Maharrey via SchiffGold.com,

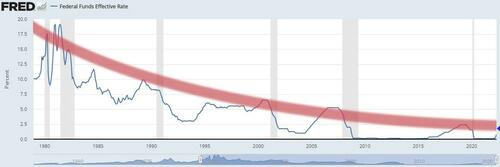

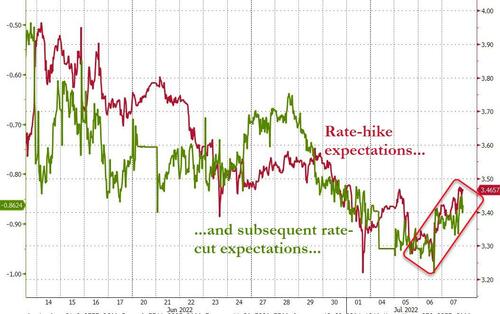

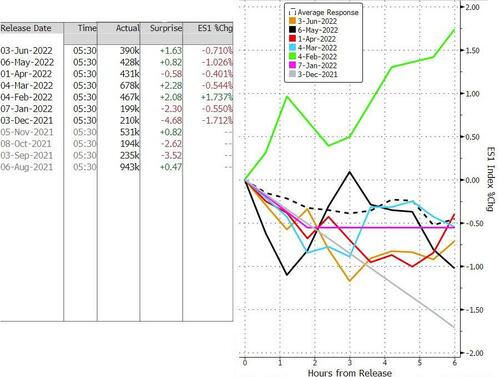

After the June FOMC meeting and the Fed’s 75-basis-point interest rate hike, I argued that the central bank is totally winging it. Reading between the lines in the minutes from that June meeting seems to bear this out. The Fed appears to be in reaction mode. The question becomes what will it react to next? How long will the hawks keep flying as the economy tanks?

It’s pretty clear that the big rate hike was a knee-jerk reaction to hotter-than-expected May inflation data. You’ll recall that just weeks before the June meeting, a 3/4% rate hike wasn’t even on the table.

Then it was.

Near-term policy rate expectations shifted markedly toward the end of the period, particularly after the release of the May consumer price index (CPI) report. Ahead of the release of the report, market expectations reflected a broad consensus that there would be 50 basis point rate increases at both the June and July FOMC meetings. After the release of the higher-than-expected inflation data, policy-sensitive rates pointed instead to a considerable probability of 75 basis point moves at both the June and July meetings.”

In a nutshell, Powell & Company hoped inflation had peaked earlier in the spring, but with the “surprising” increase in CPI, the central bankers felt compelled to go big. Why? Because they are suddenly concerned about their credibility.

Many participants judged that a significant risk now facing the Committee was that elevated inflation could become entrenched if the public began to question the resolve of the Committee to adjust the stance of policy as warranted.”

In other words, the Fed is like a kid in the schoolyard concerned that if he doesn’t act tough, everybody will think he’s a chicken. The problem is, he’s not a tough guy. As my dad used to say, “He’s writing checks his body can’t cash.”

The minutes indicate the FOMC expects another big hike in July.

In discussing potential policy actions at upcoming meetings, participants continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate to achieve the Committee’s objectives. In particular, participants judged that an increase of 50 or 75 basis points would likely be appropriate at the next meeting.”

But the central bank has a problem. It has already driven rates very close to the limit. If rates go much higher, there is every reason to believe the economy will completely implode. In 2019, 2.5% was the max. At that point, the economy got shaky, the stock market crashed, and the Fed went right back to loose monetary policy. (Not that 2.5% interest rates are particularly tight.) In 2019, the Fed cut rates three times and had already gone back to QE – even before the pandemic.

So, what makes anybody think the Fed can push rates to 3 or 3.5% today with even more debt in the economy?

And again, the Fed seems to be in reaction mode. There is no long-term plan. My guess is if we see any relief in the June CPI data, the Fed will start signaling that they’ve tightened enough. And some inflation relief seems likely. Commodity prices have dropped – most significantly the price of oil – in anticipation of a recession. This will likely relieve some of the price pressures in the economy.

But the relief will be temporary if the Fed pivots back to rate cuts and quantitative easing.

Speaking of quantitative easing, the Fed seems to have completely forgotten all about balance sheet reduction. The FOMC had signaled quantitative tightening would start in June.

It didn’t.

The Fed managed to shed less than $1 billion from its balance sheet during the first month of QT. Meanwhile, the Fed’s mortgage-backed security holdings actually increased by over $1 billion.

So while the tone coming out of the Fed might be hawkish – the reality is much less so.

And it will likely get even less so once the economic realities set in.

Federal Reserve Chairman Jerome Powell has been running around insisting the economy is strong enough to handle rate hikes.

But if you look at the strength of the economy, households are in very strong financial shape, they’ve still got a lot of excess savings – from forced saving of not being able to travel and things like that – and fiscal transfers. The same thing is true with business, with very low rates of default and lots of cash on the balance sheet. The labor market is also tremendously strong, still averaging very high job growth per month. Overall, the US economy is in the position to withstand tighter monetary policy, we think.”

Keep in mind that this message is brought to you by the same guy who gave us “transitory” inflation.

And this messaging seem just as dubious.

The Atlanta Fed has downgraded its Q2 GDP forecast to -2.1%. That would mean the economy has been in an official recession since the first of the year.

That brings us back to the burning question – will the hawks keep flying if it turns out we really are in a recession? Will the Fed be willing to go 50 or 75 basis points with the economy sliding and inflation seemingly cooling?

I don’t think so. As Rick Rule put it, the Fed will almost certainly chicken out in this inflation fight. The Fed is in reaction mode, and the reaction will likely be — run!

END

2. Lawrie Williams//Pam and Russ Martens/Jim Rickards/Mathew Piepenburg/Von Greyerz

Rickards: Welcome To 1984

THURSDAY, JUL 07, 2022 – 11:45 AM

Authored by James Rickards via DailyReckoning.com,

I’ve been addressing the war on cash lately, and for good reason. While everyone’s attention is focused on the war in Ukraine, inflation and the Supreme Court, government plans to eliminate cash are accelerating.

For example, central bank digital currencies (CBDCs) are coming even faster than many anticipated. The digital yuan is already here; it was introduced in China last February during the Winter Olympics.

Visitors to the Olympics were required to pay for meals, hotels, transportation, etc., using QR codes on their mobile phones that linked to digital yuan accounts. Nine other countries have already launched CBDCs. Europe is not far behind and is testing the digital euro under the auspices of the European Central Bank.

The U.S. was lagging, but is catching up fast.

The Federal Reserve was studying a possible Fed CBDC at a research facility at MIT. Now the idea has moved from the research stage to preliminary development.

Fed Chair Jay Powell said, “A U.S. CBDC could… potentially help maintain the dollar’s international standing.”

But this has little to do with technology or monetary policy and everything to do with herding you into digital cattle chutes where you can be slaughtered with account freezes, seizures, etc.

NOT Crypto

First off, CBDCs are not cryptocurrencies. The CBDCs are digital in form, are recorded on a ledger (maintained by a central bank or finance ministry and the message traffic is encrypted. Still, the resemblance to cryptos ends there.

The CBDC ledgers do not use blockchain, and CBDCs definitely do not embrace the decentralized issuance model hailed by the crypto crowd. CBDCs will be highly centralized and tightly controlled by central banks.

The CBDC ledger can be maintained in encrypted form by the central bank itself without the need for bank accounts or money market funds. Payments can be done with an iPhone or other device, with no need for credit cards or costly wire transfers.

Who needs bank accounts, checks, account statements, deposit slips and the other clunky features of a banking relationship when you can go completely digital with the Fed?

CBDCs are a technological advance, but they do not replace existing reserve currencies.

Not a New Currency

It’s important to understand that a CBDC is not a new currency. It’s just a new payment channel. A digital dollar is still a dollar. A digital euro is still a euro. It’s just that the currency never exists in physical form. It is always digital, and ownership is recorded on a ledger maintained by the central bank.

You will have an account showing how many digital dollars you own. They are transferred by an app on a smartphone or a desktop computer.

Of course, in many ways, dollar transactions are already digital. Most people receive money by wire transfer, go shopping with credit cards and pay bills online. All of those transactions are digital and encrypted. The difference with CBDCs is that you don’t need banks or credit card companies or even PayPal.

Again, everything can be done through the Fed with a single account for payment and receipt. CBDCs could disintermediate the entire banking and credit card sectors to a great extent.

Welcome to 1984

The other big difference is that it will give the government control of your money and the ability to put you under constant surveillance. In a world of CBDCs, the government will know every purchase you make, every transaction you conduct and even your physical whereabouts at the point of purchase.

It’s a short step from there to negative interest rates, account freezes, tax withholding from your account and even putting you under FBI investigation if you vote for the wrong candidate or give donations to the wrong political party.

If that sounds like a stretch, it’s not.

China is already using its CBDC to deny travel and educational opportunities to political dissidents. Canada seized the bank accounts and crypto accounts of nonviolent trucker protesters last winter.

These kinds of “social credit scores” and political suppression will be even easier to conduct when CBDCs are completely rolled out.

How does this relate to what is sometimes called the Great Reset? This would be the movement toward a single global reserve currency.

CBDCs and the Great Reset

Displacing the dollar would involve a meeting and agreement similar to the original Bretton Woods agreement of 1944. The agreement could take many forms. Still, the process would conform to what many call the Great Reset.

Still, things don’t happen that quickly in elite circles. Even Bretton Woods took over two years to design and another five years to implement even under the duress of World War II. The transition from sterling to the U.S. dollar as the leading reserve currency took 30 years from 1914 to 1944.

As they say, it’s complicated. Still, there are some huge changes that could emerge from the Great Reset.

For example, a new global currency regime would be an opportunity to devalue all major currencies in order to steal wealth from savers.

All currencies cannot devalue against all other currencies at the same time; that’s a mathematical impossibility. Yet all currencies could devalue simultaneously against gold. This could easily drive gold prices to $5,000 per ounce or much higher to increase the “inflation tax” (I’m sure you agree that you’re paying more than enough already!).

The Surveillance State on Steroids

Another change would be that CBDCs make it much easier to impose negative interest rates, confiscations and account freezes on some or all account holders.

This can be used for simple policy purposes or as a tool of the total surveillance state. Surveillance of incorrect behavior as defined by the Communist Party is the real driver of the digital yuan more than any aspirations to a yuan reserve currency role.

All of these shifts are now underway. The U.S. won’t adopt its own CBDC overnight, but it’s coming sooner or later.

The endgame for CBDCs would closely resemble George Orwell’s dystopian novel Nineteen Eighty-Four. It would be a world of negative interest rates, forced tax collection, government confiscation, account freezes and constant surveillance.

You might not be able to fight back easily in the world of CBDCs, but there is one nondigital, nonhackable, nontraceable form of money you can still use.

It’s called gold.

END

3. Chris Powell of GATA provides to us very important physical commentaries

Inflation is still with us even though it eases somewhat

(Lee/Yahoo News/GATA)

Prices don’t drop when inflation eases

Submitted by admin on Tue, 2022-07-05 22:47Section: Daily Dispatches

By Medora Lee

USA Today, McLean, Virginia

via Yahoo News, Sunnyvale, California

Tuesday, July 5, 2022

When it comes to prices during inflation what goes up doesn’t always come down.

When talking about inflation, it’s important to remember that inflation is a rate that measures how fast prices are rising. If the consumer inflation rate drops from its 40-year high of 8.6% in May, prices are still rising — just not as fast.

Consumers won’t feel immediate relief even as the inflation rate slows because many of those elevated prices are likely here to stay, said Michael Ashton, managing principal at Enduring Investments in Morristown, New Jersey.

“The price level has permanently changed,” Ashton said. “Until your wages catch up, it will continue to hurt.”

And wages have a long way to climb to catch up.

In May inflation-adjusted average hourly earnings decreased a seasonally adjusted 3% from a year ago. When combined with a decrease in weekly hours worked, that resulted in a 3.9% decrease in real wages, the Bureau of Labor Statistics says. …

… For the remainder of the report:

https://www.yahoo.com/finance/news/prices-dont-drop-inflation-eases-090014063.html

END

Peter Hambro has finally come a long way and now admits that gold is being manipulated

(Peter Hambro/Manly/Bullion star)

Bullion Star’s Ronan Manly: Peter Hambro’s declaration is a big deal

Submitted by admin on Wed, 2022-07-06 16:42Section: Daily Dispatches

4:40p ET Wednesday, July 6, 2022

Dear Friend of GATA and Gold:

Bullion Star’s Ronan Manly thinks it’s remarkably important that gold mining and bullion banking veteran Peter Hambro this week came out flatly declaring that central banks and their agent investment banks operate a largely surreptitious system of suppressing international gold prices.

Hambro’s declaration came in an essay called to your attention by GATA on Monday:

Manly writes: “While Hambro has previously been known to understand and discuss gold price manipulation, his latest comments may be coming now as he senses a geopolitical shift in the monetary role of gold.”

Yes, Hambro’s statement is encouraging, but the Financial Times, The Wall Street Journal, Bloomberg News, Reuters, and all other major mainstream financial news organizations almost certainly will ignore it, since the reality of the gold market remains a prohibited subject for them, even a matter of national security.

Manly’s analysis is headlined “Peter Hambro – BIS, Central Banks Are Rigging Gold Market Using Bullion Banks’ Paper Gold” and it’s posted at Bullion Star here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

4. OTHER GOLD COMMENTARIES

Special thanks to Doug C for sending this to us:

JPMorgan’s ‘Big Hitters’ of Gold Market Face Trial Over Spoofing – Bloomberg

Inbox

| douglas cundey |

JPMorgan’s ‘Big Hitters’ of Gold Market Face Trial Over Spoofing

Three face prison if convicted of rigging prices for years JPMorgan dominates precious metals US says were manipulated

Tom SchoenbergJuly 7, 2022, 8:30 AM EDT

Photographer: Lisi Niesner/Bloomberg

Michael Nowak was once the most powerful person in the gold market.

The former JPMorgan Chase & Co. managing director ran the bank’s precious metals business for more than a decade, making hundreds of millions of dollars in profit trading everything from silver to palladium. Now, he and two of his former colleagues face a federal jury in Chicago on criminal charges for thousands of so-called spoofing trades, which prosecutors say were used for years to generate illicit gains for JPMorgan and its top clients.

JPMorgan’s ‘Big Hitters’ of Gold Market Face Trial Over SpoofingThree face prison if convicted of rigging prices for years JPMorgan dominates precious metals US says were manipulatedTom Schoenberg July 7, 2022, 8:30 AM EDTMichael Nowak was once the most powerful person in the gold market.The former JPMorgan Chase & Co. managing director ran the bank’s precious metals business for more than a decade, making hundreds of millions of dollars in profit trading everything from silver to palladium. Now, he and two of his former colleagues face a federal jury in Chicago on criminal charges for thousands of so-called spoofing trades, which prosecutors say were used for years to generate illicit gains for JPMorgan and its top clients.

If Inflation Doesn’t Rapidly Dissipate, Gold Prices Will Prove Dramatically Undervalued

THURSDAY, JUL 07, 2022 – 02:24 PM

Authored by Jesse Felder via The Felder Report,

Volatility in the markets this year has largely been driven by the rise in inflation.

So if rapidly rising price pressures are going to quickly dissipate, taking inflation back below 2%, then perhaps the moves in markets this year will be seen in hindsight as, “filled with sound and fury, signifying nothing,” to quote Shakespeare.

Certainly, this is what markets are still discounting even after their recent ructions. Equity prices remain extremely elevated while gold prices remain relatively depressed.

Episodes of rising inflation typically see just the opposite.

Therefore, if inflation proves more durable than markets currently discount, the recent volatility may be merely prelude to a more significant repricing across a number of asset classes.

In fact, the level of CPI today already suggests that gold, relative to equities, may be just about as undeservedly cheap as it was a half century ago, the last time inflation really became a problem.

And if inflation remains elevated, gold prices could have a terrific amount of upside ahead, especially relative to stock prices.

END

.

5.OTHER COMMODITIES:

END

COMMODITIES IN GENERAL/

END

6.CRYPTOCURRENCIES

7. GOLD/ TRADING

Your early currency/gold and silver pricing/Asian and European bourse movements/ and interest rate settings THURSDAY morning 7:30 AM

ONSHORE YUAN: CLOSED UP 6.7018

OFFSHORE YUAN: 6.7030

HANG SANG CLOSED UP AT 56.92 PTS OR 0.26%

2. Nikkei closed UP 382.88 OR 1.47%

3. Europe stocks CLOSED ALL GREEN

USA dollar INDEX DOWN TO 106.72/Euro RISES TO 1.0192

3b Japan 10 YR bond yield: RISES TO. +.247/ !!!!(Japan buying 100% of bond issuance)/Japanese yen vs usa cross now at 135.76/JAPANESE FALLING APART WITH YEN FALTERING AS WELL AS LONG TERM YIELDS RISING BREAKING THE JAPANESE CENTRAL BANK.

3c Nikkei now ABOVE 17,000

3d USA/Yen rate now well ABOVE the important 120 barrier this morning

3e Gold UP /JAPANESE Yen UP CHINESE YUAN: UP -// OFF- SHORE UP

3f Japan is to buy the equivalent of 108 billion uSA dollars worth of bond per month or $1.3 trillion. Japan’s GDP equals 5 trillion usa./“HELICOPTER MONEY” OFF THE TABLE FOR NOW /REVERSE OPERATION TWIST ON THE BONDS: PURCHASE OF LONG BONDS AND SELLING THE SHORT END

Japan to buy 100% of all new Japanese debt and by 2018 they will have 25% of all Japanese debt. EIGHTY percent of Japanese budget financed with debt.

3g Oil DOWN for WTI and DOWN FOR Brent this morning

3h European bond buying continues to push yields lower on all fronts in the EMU. German 10yr bund DOWN TO +1.271%/Italian 10 Yr bond yield RISES to 3.35% /SPAIN 10 YR BOND YIELD RISES TO 2.38%…

3i Greek 10 year bond yield RISES TO 3.54//

3j Gold at $1743.90 silver at: 19.42 7 am est) SILVER NEXT RESISTANCE LEVEL AT $30.00

3k USA vs Russian rouble;// Russian rouble UP 0 AND 1/2 roubles/dollar; ROUBLE AT 62.95

3m oil into the 99 dollar handle for WTI and 100 handle for Brent/

3n Higher foreign deposits out of China sees huge risk of outflows and a currency depreciation. This can spell financial disaster for the rest of the world/

JAPAN ON JAN 29.2016 INITIATES NIRP. THIS MORNING THEY SIGNAL THEY MAY END NIRP. TODAY THE USA/YEN TRADES TO 135.76DESTROYING JAPANESE CITIZENS WITH HIGHER FOOD INFLATION

30 SNB (Swiss National Bank) still intervening again in the markets driving down the FRANC. It is not working: USA/SF this morning 0.9723– as the Swiss Franc is still rising against most currencies. Euro vs SF 0.9909well above the floor set by the Swiss Finance Minister. Thomas Jordan, chief of the Swiss National Bank continues to purchase euros trying to lower value of the Swiss Franc.

USA 10 YR BOND YIELD: 2.930 UP 2 BASIS PTS

USA 30 YR BOND YIELD: 3.131 UP 1 BASIS PTS

USA DOLLAR VS TURKISH LIRA: 17.25

Futures Extend Gains, Escape Technical Bear Market After China Hints At Massive Stimulus

THURSDAY, JUL 07, 2022 – 08:07 AM

US equity futures rose for a 3rd day, rising above the -20% clutches of a technical bear market, and validating the best period of the year for risk assets…

… as investor fears about surging inflation were assuaged by the cooling of the oil rally and comments from the Federal Reserve about taking a tougher stance to cool price increases. Nasdaq 100 futures rose 0.4% by 730 a.m. ET, while S&P 500 contracts added 0.3%. Both indexes finished Wednesday’s session higher following the minutes from the Fed’s latest policy meeting, which showed officials considered raising interest rates for longer to tame runaway inflation.

Global stocks also rose as did bond yields, adding to cheapening pressure on Treasuries after a Bloomberg report that China is weighing a $220 billion stimulus plan. Europe’s Estoxx50 gained 1.7%; Asia stocks closed higher led by Nikkei’s 1.5% rise as a revenue surge by Samsung assuaged fears about weakening consumer demand and soaring material costs. That sparked a rally in chipmakers, helping MSCI Inc.’s Asia-Pacific share index add more than 1%. The British pound gained after sources report PM Boris Johnson plans to resign.

Among notable premarket movers, Freeport-McMoRan Inc. advanced 4.3%. Copper rebounded from a five-day selloff in London, heading for the biggest gain since September 2018. Shares of US semiconductor companies rose in premarket trading on Thursday after Samsung Electronics reported a better-than-anticipated 21% jump in revenue. Bed Bath & Beyond shares jumped 9% after the home furnishings retailer’s interim chief executive officer and a pair of directors bought shares in the firm. GameStop shares surged 9.8% in premarket trading on Thursday after the video game retailer announced a four-for-one stock split in the form of a dividend. Other notable premarket movers:

- US biotech stocks, especially those involved in developing cancer-related treatments, could be active following a Wall Street Journal report that Merck and Co. (MRK US) is said to be in advanced talks to buy Seagen (SGEN US) for above $200 a share. Watch shares in Iovance Biotherapeutics (IOVA US), Mirati Therapeutics (MRTX US), Arcus Biosciences (RCUS US), ALX Oncology (ALXO US), Cullinan Oncology (CGEM US). Seagen rises 5.4% in premarket trading; Merck slides 1%

- Watch Endeavor Group (EDR US) and Lamar Advertising (LAMR US) shares as they were upgraded to buy from neutral at Citi, which in note says that even with new lower estimates, both stocks have attractive risk/reward at current levels.

- Keep an eye on Consolidated Communications Holdings (CNSL US) as it was cut to sell at Citi, with the bank citing outperformance compared to some wireline pure-play peers, which leaves the stock trading on a “meaningful” valuation premium.

Fears of a recession have haunted US stocks this year, sending S&P 500 Index into a bear market, although as of this morning futures are once again out of the -20% drawdown. And with the FOMC minutes indicating the Fed remains on hiking autopilot for now, investors are now looking to the second-quarter earnings season to gauge whether the company profits are holding up against the surge in prices and supply constraints.

“Global equities bounce as pressure points such as rates, oil and the dollar begin to ease,” Stephen Innes, managing partner at SPI Asset Management, wrote in a note. “Momentum has swung higher, with tech-heavy benchmarks outperforming after Samsung’s revenue was better than feared.”

European equities trade well. Euro Stoxx 50 rises as much as 1.9%, completely erasing Tuesday’s rout. Miners, autos and energy names outperform within the Stoxx 600 which rose 1.4%, while UK mid-cap shares slightly increased gains following a report that Boris Johnson plans to resign as prime minister. Miners outperformed the rising Stoxx Europe 600 index amid a rebound in metals and iron ore on news China is mulling $200 billion stimulus package to boost economy, while iron ore and metals rebound after recent declines; energy stocks also outpace broader market gains this morning after losing almost 8% over the last two sessions. Iron ore in Singapore and copper in London rose about 2%, recovering some ground after recent declines. Citigroup expects iron ore to outperform base metals amid China policy easing, while UBS downgraded its 2022-2023 estimate for the raw material, pointing to a demand slowdown. The Stoxx Energy sub- index rises 2.2% as oil edged higher with investors weighing concerns about a potential global slowdown against signs of still-tight physical markets. Carmakers posted some of the biggest gains in the benchmark Stoxx 600 index, which gained for a second day. Here are the most notable European movers:

- Tenaris shares advance as much as 8.8% as Jefferies analysts upgraded the stock to buy, noting that they prefer Oil Country

- Tubular Goods exposure among steel sector. Analysts upgrade OCTG steel price forecasts, while cutting stainless and carbon prices.

- Drax jumps as much as 7.2% following an update that saw the power company forecast adjusted Ebitda for 2022 that’s above analyst expectations and an agreement to support the security of UK electricity supplies during the winter.

- Nordex shares gain as much as 7.6% after reporting stronger than expected 2Q order volumes. Jefferies expects an acceleration of order volumes for the remainder of the year, mainly driven by additional onshore installations in the European market.

- Storytel shares soar as much as 15% after the Swedish audiobook company released a 2Q streaming update that DNB’s analyst calls a “step in the right direction.”

- Semiconductor equipment makers lead a rally in European chip stocks after Samsung posted preliminary 2Q sales that were slightly above expectations, easing fears that global chip demand might have already started tapering off. ASML rises as much as 4.9%, ASM International +5%, BE Semi +5%

- Persimmon drops as much as 6.7% after it reported revenue for the first half that missed the average analyst estimate. Citi said home completions missed its estimate amid planning delays and labor shortages.

- Chr. Hansen falls as much as 11% after narrowing its topline growth guidance. Based on quarter’s performance, company narrows organic revenue growth target for 2021/22 to 8-10%, from previous outlook of 7-11%.

- SAS saw its share price fall 5% on Thursday as the airline revealed a drop in bookings toward the end of June due to notice of a pilot strike that became a reality on July 4.

- SUSE shares slide as much as 11% before paring losses, after the software firm cuts its growth target for the annual contract value in the emerging segment. Jefferies says the 2Q results are in-line with expectations, but the outlook references macro impacts

Earlier in the session, Asian stocks rose, recovering most of their losses from yesterday, as semiconductor shares rallied and investors assessed the outlook for oil prices. The MSCI Asia Pacific Index climbed as much as 1.3%, hauled up by chip shares after Samsung Electronics reported a better-than-expected jump in revenue in the latest quarter. A gauge of chip stocks soared nearly 4%, on track for its best day since March. The surge in tech shares helped benchmarks in Taiwan and South Korea lead gains in the region. Meanwhile, Hong Kong shares reversed losses as an easing of travel curbs in the city overshadowed broader concerns about a resurgence of Covid outbreaks in China. Traders in Asia also took some solace in lower oil prices with the West Texas Intermediate futures trading below $100 a barrel, supporting the outlook for earnings in the oil-importing region. “We are seeing short squeezes in tech,” said Jessica Amir, a strategist at Saxo Capital Markets. Meanwhile, there’s optimism that a retreat in oil prices will allow people to spend less at the pump and more on retail goods, she said. Still, higher input costs and worries about a global slowdown have pushed Asia’s stock benchmark down more than 18% this year, with traders debating over the scope of future US interest-rate hikes and the outlook for inflation. The record of the Fed’s June meeting showed the potential for even more restrictive policy to curb inflation. “The market correction over 1H2022 has improved the valuation proposition of equities, and the key going forward is for companies to better manage their profit margins,” Tai Hui, chief Asia market strategist at JPMorgan Asset Management, wrote in a note. “Value and quality should remain in favor until there is a clear peak in interest rates.”

Japanese stocks gained amid lower commodity prices, which could ease inflationary pressures moving forward and potentially lead to a softer stance from the Federal Reserve. The Topix Index rose 1.4% to 1,882.33 as of market close Tokyo time, while the Nikkei advanced 1.5% to 26,490.53. Sony Group Corp. contributed the most to the Topix Index gain, increasing 3.7%. Out of 2,170 shares in the index, 1,550 rose and 526 fell, while 94 were unchanged. “The situation has changed since the June FOMC meeting. With weaker economic indicators and the price of crude oil falling below $100 per barrel, some believe that perhaps the hawkish stance may not be as strong as it was in June at this point,” said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management.

Australia’s S&P/ASX 200 index rose 0.8% to close 6,648.00, boosted by banks and rebounding mining shares as iron ore prices rose. The index was still trading near a seven-month low. Australia’s trade surplus skyrocketed to a record high in May, driven by stronger prices of its key export – coal -while imports surged too in a sign of solid domestic demand. In New Zealand, the S&P/NZX 50 index fell 0.3% to 11,112.16.

In FX, Bloomberg dollar spot index falls 0.3%. JPY and CHF are the weakest performers in G-10 FX, AUD and NZD outperform. Cable pops higher, stalling just shy of a 1.20-handle after news of PM Johnson’s resignation. The dollar fell versus most of its Group-of-10 currency peers as risk assets advanced. Antipodean currencies led gains while the Swiss franc and the yen underperformed. The euro fluctuated around $1.02. The pound rose by as much as 0.6% to $1.1999 on UK Prime Minister Boris Johnson’s plans to resign, following an unprecedented wave of resignations from his government over the past two days. He will stay on as caretaker prime minister until October, with a new Conservative leader set to be installed in time for the party’s annual conference. Gilts fell, led by shorter maturities. The Aussie and kiwi strengthened in risk-on price action as rising stocks and a weaker US dollar fuel a position squeeze. Aussie was also boosted by a report showing the trade surplus widened to a record high in May.

In rates, Treasuries were cheaper across the curve, extending Wednesday’s aggressive bear-flattening move following release of FOMC meeting minutes. 10Y TSYs traded around 2.93% after rising 12bp in Wednesday’s selloff; 10-year bund yields are higher by 8.6bp, gilts by 3.9bp. US curve spreads are within a basis point of Wednesday’s close, which for inverted 2s10s was -7.6bp, approaching YTD low. The IG dollar issuance slate remains empty so far; just two names priced $4.2b Wednesday, paying more than 20bps in concessions on demand just shy of 3 times covered. Bunds extended their bear flattening move as haven buying waned and money markets raised wagers on the pace of ECB tightening. Short-dated German bonds lead a pronounced sell off with 2y yields rising over 13bps near 0.53%. Gilts follow with both curves bear-flattening. Peripheral bonds are mixed: tighter to core at the short end, wider in long-dates. Red pack euribor futures drop 18-19 ticks as money markets raise wagers on the pace of ECB tightening.

In commodities, WTI trades within Wednesday’s range, adding 1% to trade near $99.48. Base metals trade in the green; LME copper and tin rise over 4%. Spot gold rises roughly $6 to trade near $1,745/oz.

Looking at the day ahead now, data releases include the US trade balance for May and the weekly initial jobless claims, as well as German industrial production for May. Meanwhile from central banks, we’ll get the ECB’s minutes from their June meeting, and hear from the Fed’s Waller and Bullard, the ECB’s Lane, Stournaras, Centeno and Herodotou, and the BoE’s Mann and Pill.

Market Snapshot

- S&P 500 futures up 0.4% to 3,864.25

- STOXX Europe 600 up 1.4% to 413.23

- German 10Y yield little changed at 1.29%

- Euro up 0.3% to $1.0209

- Brent Futures little changed at $100.77/bbl

- MXAP up 1.1% to 157.65

- MXAPJ up 1.1% to 521.21

- Nikkei up 1.5% to 26,490.53

- Topix up 1.4% to 1,882.33

- Hang Seng Index up 0.3% to 21,643.58

- Shanghai Composite up 0.3% to 3,364.40

- Sensex up 0.7% to 54,101.85

- Australia S&P/ASX 200 up 0.8% to 6,647.96

- Kospi up 1.8% to 2,334.27

- Gold spot up 0.2% to $1,741.73

- U.S. Dollar Index down 0.22% to 106.86

Top Overnight News from Bloomberg

- Gone are the days when investors would be buying cheap euro options on a relative basis ahead of this month’s meetings by the European Central Bank and the Federal Reserve. The relative premium to own exposure is now near 200 basis points on both the two-week tenor, that captures the ECB decision, and the three- week tenor, that envelopes the Fed meeting

- The French government’s new round of measures to combat surging inflation will cost about 20 billion euros ($20.4 billion), according to Finance Minister Bruno Le Maire

- The Bank of Japan is likely to consider revising its inflation and growth forecasts later this month as a weaker yen and cost-push inflation force more companies to pass on higher costs to consumers, according to people familiar with the matter

- Treasury yields surged after minutes of the most recent Federal Reserve meeting underscored commitment to tighten aggressively to keep inflation from becoming entrenched

- European electricity prices broke new records Thursday as gas futures soared, further squeezing households and businesses across the continent and forcing politicians to find ways to ease the pain of relentless cost increases

- Hungary’s biggest interest rate increase since 2008 failed to stem the forint’s plunge as policy makers sought to support the weakest currency in emerging markets

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mostly positive but with gains capped following the choppy performance on Wall St and after an uneventful FOMC Minutes which noted participants judged a rate increase of 50bps or 75bps would likely be appropriate at the July meeting. ASX 200 was kept afloat alongside strength in the mining and materials sectors, as well as encouraging trade data. Nikkei 225 was underpinned amid reports the BoJ was said to be completely committed to its easing policy. Hang Seng and Shanghai Comp. were mixed with Hong Kong pressured by tech weakness, while the mainland was initially subdued after the PBoC drained liquidity and with Beijing to impose China’s first-ever COVID-19 vaccine mandate, although Chinese bourses then pared losses as markets also digested MOFCOM’s announcement to rollout measures to support auto consumption.

Top Asian News

- China Builder CIFI Says No Perp-Bond Talks as USD Notes Tumble

- China Official Reserves Drop to Lowest Since June 2020

- China’s Cabinet Urges Greater Cybersecurity After Data Leak

- Tokyo Reports 8,529 New Covid Cases, Most Since April

European bourses are firmer across the board, Euro Stoxx 50 +1.7%, in a continuation of the constructive APAC handover though action remains choppy. Stateside, futures are firmer across the board but the magnitudes more contained that European peers after yesterday’s choppy action; note, relatively brief upside was sparked on China stimulus reports, via BBG. Within Europe, sectors feature noted outperformance in Basic Resources and Autos while some of the more defensively-inclined components are in the red.

Top European News

- UK PM Johnson is to resign today (expected around 12:00-13:00BST/07:00-08:00ET), according to multiple reports. As it stands, it appears that Johnson wants to remain in place as a caretaker until a new Conservative Party leader can be assigned, which is likely to occur around the autumn given the impending summer recess. However, MPs are seemingly divided on whether they want to allow Johnson to remain, with some calling for the immediate appointment of an alternative caretaker such as current Deputy PM Raab.

- Hungarian PM Orban’s Chief of Staff says discussions with the EU have progressed re. funds, adopted the Commission’s stance on four issues. Accepted the proposal that funds must be spent on energy independence, via Reuters.

- Pound Rises on Report UK Prime Minster Johnson Plans to Resign

- Sanctions Act as ‘Weapons of Mass Destruction,’ Says Melnichenko

- France’s Public Finances Are a Risk for Euro Zone, Auditor Says

Central Banks

- ECB’s Enria (supervisory board) says conservative capital trajectories should be utilized by banks when announcing distribution plans; from the point of view of capital adequacy, we are asking individual banks to review their capital trajectories.

- BoJ is expected to increase its FY22 inflation forecast marginally to slightly above 2% from 1.9% in its quarterly outlook due on July 21st, according to Reuters sources. Expected to lower economic growth forecast (currently 2.9%). BoJ will likely maintain ultra-low interest rates and dovish policy bias.

FX

- Pound perks up as UK PM prepares to stand down in face of mass ministerial and party mutiny, Cable back over 1.2000 vs low 1.1900 base, EUR/GBP closer to 0.8500 than 0.8550.

- Aussie rebounds with risk sentiment and on back of record trade surplus, AUD/USD approaching 0.6850 from recent lows near 0.6760.

- Greenback fades after forging further gains in advance of hawkish line from Fed minutes, DXY pivoting 107.000 within range below 107.270 high on Wednesday.

- Loonie regroups with WTI ahead of Canadian trade and Ivey PMIs as USD/CAD probes 1.3000 from 1.3050+, Euro regains sight of 1.0200 level amidst retreat in EGBs pre-ECB minutes.

- Yen slips on rate dynamics and digests source reports suggesting BoJ may tweak inflation forecast a fraction above 2% and trim growth projection in quarterly outlook next week, USD/JPY rebounds towards 136.00 from around 135.55.

- Forint gets fleeting fillip from 200bp 1-week depo rate hike by NBH, while Zloty awaits 75bp tightening move from NBP; EUR/HUF tops 415.00, while EUR/PLN holds near 4.7850.

Fixed Income

- Bonds back under pressure as risk sentiment continues to improve and most Central Banks remain hawkish

- Bunds reverse from 151.65 to 150.15 before finding underlying bids, Gilts from 115.60 to 114.66 and the 10 year T-note from 119-05 to 115-15

- Curves flatter or more inverted after FOMC minutes flag potential for even more restrictive policy

Commodities

- WTI and Brent are modestly bid benefiting from stimulus reports and the relative reprieve in the USD’s recent ascension; benchmarks firmer by USD ~0.80/bbl.

- US Private Inventory Data: Crude +3.8mln (exp. -1.0mln), Cushing +0.5mln, Gasoline -1.8mln (exp. -0.5mln), Distillate -0.6mln (exp. +1.1mln)

- Dutch Minister says gas storage is 58% full, therefore the 80% winter target is achievable. Groningen gas field could be tapped in a emergency scenario

- BofA says copper prices could slip below USD 6,000/tonne in the coming months. Click here for the full list of price forecasts from BofA.

- Spot gold is, in a similar vein to crude, modestly supported on the USD breather, and steady between touted resistance/support at USD 1750.70/oz and USD 1735-37/oz respectively.

US Event Calendar

- 07:30: June Challenger Job Cuts YoY, prior -15.8%

- 08:30: June Continuing Claims, est. 1.33m, prior 1.33m

- 08:30: July Initial Jobless Claims, est. 230,000, prior 231,000

- 08:30: May Trade Balance, est. -$84.7b, prior -$87.1b

Central Banks

- 13:00: Fed’s Bullard to Discuss US Economy and Monetary Policy

- 13:00: Fed’s Waller Interviewed During NABE Event

DB’s Jim Reid concludes the overnight wrap

If you’re in any doubt about inflation I must say I was bowled over with shock at how much the tooth fairy left Maisie overnight as the first baby tooth in our household fell out yesterday. My wife told me over dinner that the tooth fairy was going to come tonight and I asked her what the going rate was? I mentioned 20p or maybe a bit more as it’s the first one. My wife replied that the tooth fairy and her had agreed ten pounds. I nearly choked on my dinner and made it quite clear that this was a dangerous precedent to set one tooth into a three child settlement period. Inflation expectations can get ingrained this way. However this is one way of solving the intergenerational wealth divide I suppose.

If you’re looking for positives in a world as wobbly as my daughter’s front teeth, in spite of all the bleak newsflow this week, the S&P 500 (+0.36% last night) has been up for three days in a row. However sentiment is bad enough that you’d be forgiven for not noticing. Indeed fears of a recession continue to abound in markets, with yesterday seeing another round of commodity price declines (outside of Euro Gas and electricity), further inversions of the Treasury yield curve, rising US yields with 2yr yields up an astonishing +24.5bps from the European afternoon lows, and continued concerns about a European energy crisis that left the Euro at its weakest level against the US Dollar since 2002. Some stronger US data was the bright spot that may have helped equities but it’s been a bit of a random walk of late as weaker data has also recently helped equities by reining in Fed expectations. So tough markets to find a consistent narrative in at the moment. Makes calling the market reaction to payrolls tomorrow hard.