What Is Investment Value?

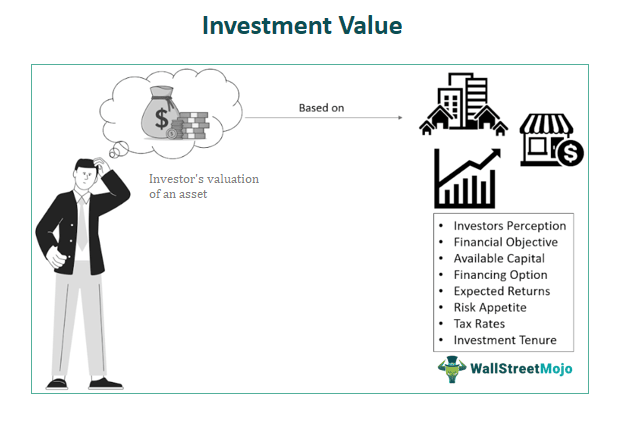

An investment value is a price an investor can willingly pay to procure an asset or investment product, assuming its worth, purpose of purchase, and potential returns. An investor gauges such value based on personal factors and perceptions like available capital, finance, expected returns, risk appetite, tax rates, etc.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Investment Value (wallstreetmojo.com)

The investors apply different methodologies to determine the worth of an investment or asset, including discounted cash flow (DCF), comparable analysis, cash-on-cash return, gross rent multiplier and direct capitalization. Hence, investors often come up with a range of different investment values. It facilitates the comparison of the asset price with its potential returns or appreciation.

Table of contents

Key Takeaways

- Investment value refers to an investor’s assessment of an asset’s worth based on personal constraints like investment objective, potential return, capital availability, etc., as opposed to its market or appraised value.

- It is affected by the investor’s perception, financial objective, available capital, financing options, expected returns, risk appetite, tax rates and investment tenure.

- Such value differs from investor to investor. It can be evaluated through discounted cash flow (DCF), comparable analysis, cash-on-cash return, gross rent multiplier and direct capitalization.

- The investment value is personalized and subjective, customized to individual investors, while market value remains objective and reflects current market conditions.

Investment Value Explained

Investment value is a real estate evaluation considering potential rental income, projected property appreciation, operational costs, and the overall return on investment (ROI). Real estate investors use this concept to analyze whether a property holds the potential to generate positive cash flow and achieve a satisfactory return on the invested capital. Investment value in real estate is typically determined based on the property’s income-generating potential and its alignment with the investor’s financial objectives.

A critical factor in gauging a particular asset’s investment value is the level of risk an investor is willing to take in the long run. An investor can decide to invest in various investments after comparing their values and returns. These include bonds, real estate, stocks, business or commodities. However, every investment involves uncertainties, and it is impossible to predict future returns accurately. Hence, it is essential to be updated with the market conditions and regularly monitor the investment performance to adjust the investment strategy as and when required.

Financial Modeling & Valuation Courses Bundle (25+ Hours Video Series)

–>> If you want to learn Financial Modeling & Valuation professionally , then do check this Financial Modeling & Valuation Course Bundle (25+ hours of video tutorials with step by step McDonald’s Financial Model). Unlock the art of financial modeling and valuation with a comprehensive course covering McDonald’s forecast methodologies, advanced valuation techniques, and financial statements.

How To Determine?

The process of determining investment value begins with collecting relevant data about investment opportunities, which may involve finding suitable real estate or examining the company’s financial records, industry trends, and prevailing market conditions. The investor must comprehensively evaluate the documents related to the prospective property, business, or asset. This assessment aids in gauging the asset’s overall financial well-being.

Investors can then use the following methods to calculate the investment value of the asset:

- Discounted Cash Flows (DCF): This method estimates future cash flows and then discounts them to the present to ascertain an intrinsic value.

- Comparable Analysis: Compare the company’s financial metrics against those of similar businesses in the industry.

- Gross Rent Multiplier: A measure that determines the gross rent as the multiple of the total price invested in real estate.

- Direct Capitalization: This method determines the percentage of capitalization acquired by dividing the net operating income from the real estate’s value and multiplying it by 100.

- Cash on Cash Return: It is estimated by dividing the cash flow before taxation of the initial year by the total initial investment.

Other vital factors to consider are:

- Carefully evaluate the potential risks associated with the investment, like market volatility, competition, regulatory shifts, and broader economic conditions.

- Analyze the company’s growth prospects, capacity for innovation, competitive advantages, and strategic expansion plans.

- Scrutinize qualitative aspects such as the quality of management, organizational culture, and the company’s long-term sustainability.

- Gauge how the investment fits into the overall portfolio strategy, thereby managing risk and optimizing potential returns.

- Determine the intended holding period of the investment, recognizing that different investments may offer varied potential returns over distinct time frames.

- Consider broader market trends, prevailing interest rates, and geopolitical factors that could influence the investment’s performance.

Examples

Individual investors often seek assistance in choosing investments that align with their long-term financial goals. Evaluating the investment value is crucial in selecting the most suitable assets or real estate. Here are a few examples:

Example #1

Suppose an investor is observing a stock for investment and decides to assess its intrinsic value. This involves evaluating the company’s fundamentals, such as earnings, growth potential, and financial health. If the calculated intrinsic value exceeds the market price, the stock might be considered undervalued, presenting an investment opportunity. This method allows the investor to focus on the inherent worth of the asset, incorporating the concept of investment value rather than solely relying on market fluctuations.

Example #2

Consider the case of investing in real estate. Factors like potential rental income, property appreciation, and the overall return on investment would determine the investment value. If the property aligns with one’s financial goals and exhibits strong income-generating potential, it becomes an attractive investment opportunity. This showcases how investment value can guide decisions beyond stock investments, offering a versatile approach to wealth creation.

Importance

The investment value plays a pivotal role in an individual’s investment decision-making for the following reasons:

- Realizes Financial Objectives: It determines an investor’s ability to attain desirable returns and meet their financial objectives.

- Well-informed Decision Making: Through a comprehensive evaluation of variables like growth potential, associated risks, and the capacity to generate income, individuals can make well-informed investment choices tailored to their unique goals and risk appetite.

- Wealth Management: A strategic approach aids in accumulating and protecting wealth over an extended period.

- Facilitates Comparison: Investors can strategically compare the price of an investment with its rate of return.

Investment Value vs Market Value

Investment value and market value play pivotal roles in investment decision-making; the former facilitates customized choices, while the latter provides a more extensive assessment of an asset’s value within the market. When comparing the two, the following vital distinctions become evident:

| Basis | Investment Value | Market Value |

|---|---|---|

| Definition | Perceived worth to an individual investor based on goals, finances, risk tolerance, and circumstances. | The prevailing price in the open market. |

| Subjectivity | Subjective and varies among investors due to unique preferences. | Objective, derived from widely accepted market conditions. |

| Factors Considered | Investor’s financial position, risk willingness, investment horizon, and potential advantages. | Current asset sales, macroeconomic factors, interest rates, and market sentiment. |

| Applicable | Determines buying, retaining, or selling based on perceived value. | Used for trading, buying, selling, or overall asset assessment in a broader market context. |

| Longevity | Prone to change over time as investor situations and aspirations evolve. | Susceptible to frequent alterations due to market fluctuations. |

| Calculation | Utilizes methods like DCF, comparable analysis, cash-on-cash return, gross rent multiplier, and direct capitalization. | Derived by multiplying total outstanding shares by the current market price. |

| Significance | Tailors decisions to an investor’s specific objectives. | Gauges an asset’s present value within the broader market framework. |

Frequently Asked Questions (FAQs)

Although the estimation of an investment’s worth depends on the type of investment, some of the common factors that influence it are as follows:

– Investor’s objectives

– Cash flow estimates

– Available Capital

– Financing options

– Potential returns

– Risk-taking capacity

– Tax rates

Investment value refers to the asset’s worth to a specific investor, considering their unique goals and circumstances. It’s relevant when an investor intends to buy, hold, or sell investments based on their needs. In contrast, Net Present Value (NPV) is the value that excludes the initial investment from the present value of the future cash flows. It facilitates companies to make decisions for business investments.

Investment value is a stock’s intrinsic value in the share market. It is estimated along with the net present value emanated employing the discounted cash flow method to decide whether to buy or sell the security.

Recommended Articles

This article has been a guide to what is Investment Value. Here, we compare it with market value, explain its examples, how to determine it, and importance. You may also find some useful articles here –

Leave a Reply