What Are Publicly Traded Companies?

Publicly Traded Companies, also known as publicly listed companies, refer to all those companies which have their shares listed on any of the stock exchanges which allow the trading of their shares to the common public, i.e., anyone can sell or purchase the shares of these companies from the open market.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Publicly Traded Companies (wallstreetmojo.com)

It is a company that has listed itself on at least one public stock exchange and has issued securities for ownership in the company to public investors. The company makes itself public through a process known as Initial Public OfferingInitial Public OfferingAn initial public offering (IPO) occurs when a private company makes its shares available to the general public for the first time. IPO is a means of raising capital for companies by allowing them to trade their shares on the stock exchange.read more, which must be approved by any country’s Securities and Exchange Regulator.

Table of contents

Key Takeaways

- Publicly Traded Companies are listed on a stock market that permits the general public to trade their shares.

- These companies are limited by shares and are represented by suffixing ‘Ltd.’. They invite the general public to subscribe to the company’s shares and become shareholders.

- A private company can pay the shareholders dividends if they choose to. The company must also involve the shareholders in voting for several major decisions.

- Public Companies can invite the general public to buy the company’s shares through an Initial Public Offer (IPO). These shares are subsequently traded among investors on the stock exchanges.

How Do Publicly Traded Companies Work?

A publicly-traded company is a company that has listed itself on at least one public stock exchange and has issued securities for ownership in the organization to public investors. Being a public company has advantages such as access to huge capital and increased liquidity. At the same time, there are certain disadvantages, such as many regulatory scrutinies and adhering to reporting requirements.

A certain percentage of the shares are issued to the public, but generally, the controlling stake resides with the majority shareholder. Going public means the secondary marketSecondary MarketA secondary market is a platform where investors can easily buy or sell securities once issued by the original issuer, be it a bank, corporation, or government entity. Also referred to as an aftermarket, it allows investors to trade securities freely without interference from those who issue them.read more can determine the entire company’s value through trading between investors.

Private organizations go public through a method called Initial Public Offering. They take the help of investment bankers to prepare a prospectus and, if possible, underwrite the issue. The investment bankers also do their due diligence in finding out the best offer priceOffer PriceOffering Price is the price that is decided by an investment banking underwriter when a company plans to go public list shares in the stock exchange for raising capital. This price is based on the future earning potential of the company, however, the price shouldn’t be too high then the shares might not be sold in full and if it is too low then the potential to raise more capital is lost.read more

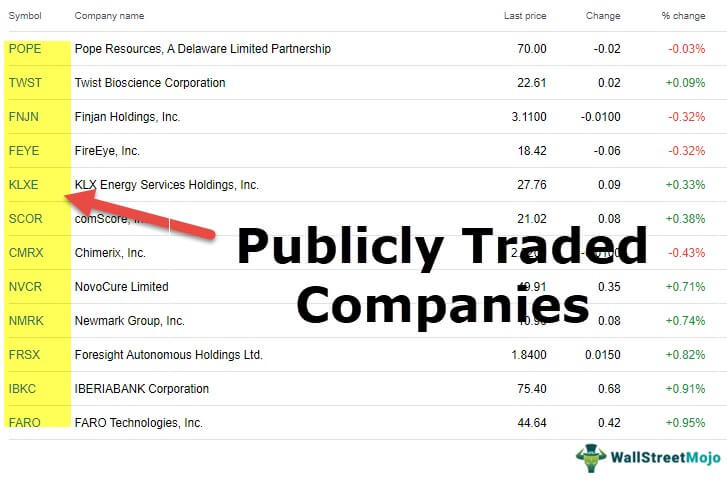

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Publicly Traded Companies (wallstreetmojo.com)

Financial Modeling & Valuation Courses Bundle (25+ Hours Video Series)

–>> If you want to learn Financial Modeling & Valuation professionally , then do check this Financial Modeling & Valuation Course Bundle (25+ hours of video tutorials with step by step McDonald’s Financial Model). Unlock the art of financial modeling and valuation with a comprehensive course covering McDonald’s forecast methodologies, advanced valuation techniques, and financial statements.

How Do They Raise Capital?

Let us understand the process of raising capital by going public, undertaken by all companies from the small to popular publicly traded companies:

- A team is formed for an external IPO which will comprise of various stakeholders such as underwriters from investment banksUnderwriters From Investment BanksThe underwriters take the financial risk of their client in return of a financial fee. Market Makers like financial institution and large banks ensure that there is enough amount of liquidity in the market by ensuring that enough trading volume is there.read more, lawyers, certified accountants, and Securities Regulator experts.

- Proper details and information such as financial performance and forecast of future results are a part of the company prospectus and reviewed by the abovementioned stakeholders.

- External auditors then audit the financial performance mentioned in the prospectus to generate opinions.

- The company then files its prospectus with the Securities and Exchange Commission and provides any mandatory documents that the Commission requires, and sets a date for the offering.

Example

Shares of such companies are traded in the open market between retail investors and institutional investorsInstitutional InvestorsInstitutional investors are entities that pool money from a variety of investors and individuals to create a large sum that is then handed to investment managers who invest it in a variety of assets, shares, and securities. Banks, NBFCs, mutual funds, pension funds, and hedge funds are all examples.read more. Generally, due to the requirement of large amounts of capital, privately held companies opt to become public after fulfilling all regulatory requirements. Examples of popular publicly traded companies are Procter and Gamble, Google, Apple, Tesla, etc.

Advantages & Disadvantages

Top publicly traded companies choose to offer a share of ownership of their business to the public for raising capital or diversification. However, this process can have its own share of upsides and downsides. Let us discuss them through the points below:

Advantages

- Publicly traded companies have some distinct advantages over privately held companies, such as selling future stakes in equity, raising more capital by issuing stocks, more diverse investors, etc. However, being public makes such organizations vulnerable to increased regulatory scrutiny and far less control over the company’s decisions by owners and company founders.

- Additionally, companies have to release annual reportsAnnual ReportsAn annual report is a document that a corporation publishes for its internal and external stakeholders to describe the company's performance, financial information, and disclosures related to its operations. Over time, these reports have become legal and regulatory requirements.read more and other mandatory documents as instructed by the securities regulator, and shareholders also have the right to additional documents.

- Also, shareholders vote during certain company decisions, such as changing the corporate structure. Such companies can also opt to become private if the owners buy back all the sharesBuy Back All The SharesShare buyback refers to the repurchase of the company’s own outstanding shares from the open market using the accumulated funds of the company to decrease the outstanding shares in the company’s balance sheet. This is done either to increase the value of the existing shares or to prevent various shareholders from controlling the company.read more from their shareholders either at a premium or discount based on company performance.

Disadvantages

- Publicly traded companies have access to a huge amount of capital since they can issue additional stock and attract new investors. Also, they do not have any major liquidityLiquidityLiquidity is the ease of converting assets or securities into cash.read more concerns since it has access to many investors. Privately held companies do not have ready access to capital and can sell shares to venture capital and private equity players when they want to.

- While publicly traded companies have to comply with strict regulatory requirements as mandated by the securities and exchange commission of the country, privately held companies do not have any such mandatory requirements.

- Privately held companies have to report when they reach $10 million in assets and more than 500 shareholders. Publicly traded companies must file mandatory annual reports, quarterly reportsQuarterly ReportsQuarterly reports are unaudited financial reports that are summarized versions of financial statements released by public companies every three months (quarter) to comply with compliance requirements.read more, etc. Additional information must be shared with the company’s shareholders. Valuation of a publicly-traded company is much easier since there is a lot of information available. This is because of the mandatory reporting requirements by the securities regulator.

- They can be valued by DCFDCFDiscounted cash flow analysis is a method of analyzing the present value of a company, investment, or cash flow by adjusting future cash flows to the time value of money. This analysis assesses the present fair value of assets, projects, or companies by taking into account many factors such as inflation, risk, and cost of capital, as well as analyzing the company's future performance.read more, Comparable Company AnalysisComparable Company AnalysisComparable comps are nothing but identifying relative valuations like an expert to find the firm's fair value. The comparable comp process starts with identifying the comparable companies, then selecting the right valuation tools, and finally preparing a table that can provide easy inferences about the fair valuation of the industry and the company.read more, and Transaction Method. Although the valuation of privately held firms is done through the above three methods, they are less reliable due to a lack of information.

Frequently Asked Questions (FAQs)

Investors can subscribe to a public company’s initial public offer (IPO) and become the company’s initial shareholders. Subsequently, these shares can be traded in the stock exchanges, and the market forces of demand and supply, among other forces, determine their price.

A minimum of one shareholder is required. However, there is no cap on the quantity. For non-public companies, the minimum number of directors is often 1, although there is no limit. In several provinces and territories, as well as the federal government, public businesses may be obliged to have a minimum number of directors (i.e., more than one).

Revenue for the business must be steady and dependable. When a corporation fails to anticipate its earnings or misses them, the public markets do not like it. Therefore, the company must be established enough to accurately forecast the upcoming quarters and the following year’s anticipated earnings.

Recommended Articles

This has been a Guide to what are Publicly Traded Companies. We explain the example to show how they work and raise capital with advantages & disadvantages. You may learn more about our articles below on accounting –

Leave a Reply