The 'Secret Bank Bailout' Is Neither Secret Nor a Bailout

Free money for banks and not-so-free money for everybody else isn't such a crowd-pleaser.

In fact, it seems like welfare for the wealthy. It doesn't take much financial acumen to make a profit when you can get money for nothing from the Fed and lend it back to the government for a few hundred basis points. How can normal people get in on this? That's what former FDIC chief Sheila Bair asked in a recent tongue-in-cheek piece calling for the Federal Reserve to give everyone interest-free $10 million loans.

In fact, it seems like welfare for the wealthy. It doesn't take much financial acumen to make a profit when you can get money for nothing from the Fed and lend it back to the government for a few hundred basis points. How can normal people get in on this? That's what former FDIC chief Sheila Bair asked in a recent tongue-in-cheek piece calling for the Federal Reserve to give everyone interest-free $10 million loans.

But there is nothing special about zero interest rates.

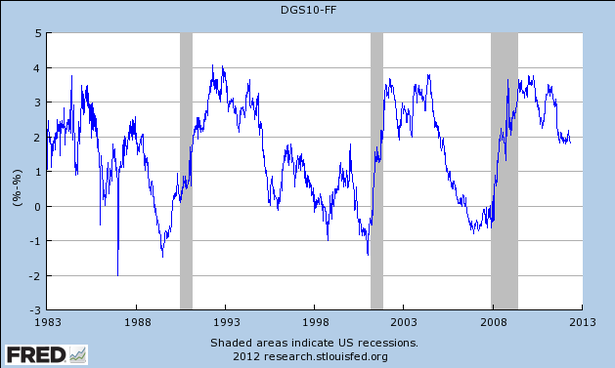

The below chart plots the difference between the 10-year Treasury yield and the Fed funds rate over the past 30 years. In other words, it's the profit that banks can make from lending risk-free. See if you can spot when the Fed pushed interest rates down to zero.

Short-term interest rates hit zero in December of 2008. The risk-free spread banks could earn jumped up then -- but it wasn't any higher than it had been in the past.

That makes sense. Long-term interest rates depend on expected short-term interest rates. When the economy looks bad, the market expects short-term interest rates to stay low -- which means that long-term rates do the same. The difference between short and long-term rates doesn't get much out of whack, even when rates are zero.

That makes sense. Long-term interest rates depend on expected short-term interest rates. When the economy looks bad, the market expects short-term interest rates to stay low -- which means that long-term rates do the same. The difference between short and long-term rates doesn't get much out of whack, even when rates are zero.

But Fed critics do have something of a point. The reason zero interest rates feel like such a giveaway is that lending standards have gotten much tougher for most everyone else. If you're not the government or a Fortune 500 company, it's hard to get a loan nowadays.

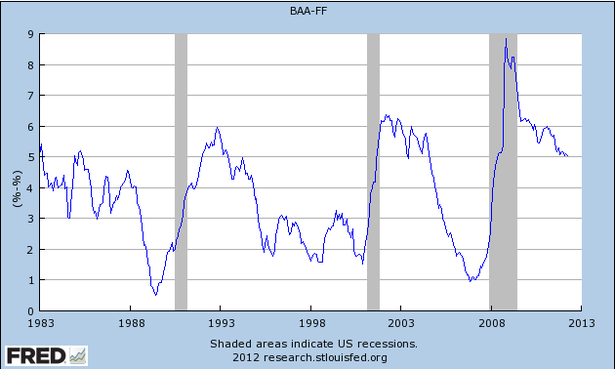

There's not great data on small business lending, but junk bond yields are a decent proxy. Here's the difference between those yields and the Fed funds rate.

Spreads skyrocketed when the crisis hit and have been slow to come down since. That the banks get free credit when everyone else is struggling to get any credit makes it galling. But it's not a "secret bailout" as some call it. The reality is more mundane: It's banks tightening credit standards -- probably too much -- after they were too loose during the bubble years.

There are plenty of things to be mad at the big banks and the Fed for over the last few years. But criticizing banks for lending for more than they borrow for, like Bair does, is triffling. That's just the definition of banking. Zero interest rates don't really change this. Our limited supply of outrage is better directed at actual outrages.

Matthew O'Brien is a former senior associate editor at The Atlantic.