4 Factors Point to a Sunny Future in Solar

Solar stocks began a massive bull market during the panic lows of the COVID-19 pandemic in March 2020. The Invesco Solar ETF (TAN), a basket of solar stocks and a proxy for the industry, rallied for ten straight months from a low of $21.14 to a high of $125.98! However, since then, the sector has melted lower and has retraced back to the $40s, never recovering from the 2022 equity bear market and suffering from a more “hawkish” Fed.

Though solar stocks have been brutal to investors recently, they are worth watching because when they trend, they trend better than almost any other industry on Wall Street. Recently, solar stocks are beginning to show several signs that a turnaround is near and the next big bull market may be around the corner, including:

Potential Rate Cuts

The solar industry is one of the most interest rate-sensitive industries on Wall Street because:

Projects Require a Large Upfront Investment: When interest rates are high, it becomes less economical for solar companies to borrow money for expansion.

Consumer Liquidity: With Higher rates, consumers have less disposable income to spend on solar.

Valuations: Hawkish Fed policy weighs on high valuation/growthy areas of the market.

One of the hottest debates and the biggest uncertainty on Wall Street is how the Fed will handle interest rates moving forward. Inflation is stubborn, but growth is slowing. However, Friday’s weaker-than-expected jobs data gives investors a vital clue that the Fed will cut rates this year. The U.S. Fed Fund Futures are pricing in a 78% likelihood of a rate cut in September. A rate cut would be extremely bullish for the industry.

Data Center

AI and cloud projects are causing insatiable demand for energy-sucking data centers. With climate concerns still at the forefront of policy maker’s minds, solar will play an essential role in powering data centers. In fact, Friday morning, a Goldman Sachs (GS) research report projects First Solar (FSLR) has 50% upside due to soaring demand from data center growth.

Insider Buying

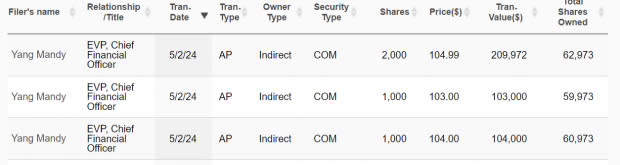

Earlier this week, Mandy Yang, the CFO and EVP of Enphase Energy (ENPH), purchased more than $400k worth of ENPH stock. The sizable transaction shows that insiders have high conviction that the low is in for solar stocks.

Image Source: Zacks Investment Research

IRA is a Long-Term Catalyst

The Inflation Reduction Act (IRA) is less about inflation and more about clean energy incentives. According to the EPA, “The IRA is the most significant climate legislation in U.S. history, offering funding, programs, and incentives to accelerate the transition to a clean energy economy and will likely drive significant deployment of new clean electricity resources.” The IRA will be a bullish long-term catalyst for the space.

Bottom Line

After years of frustrating action, the solar industry is poised to move higher. Bullish signs include insider buying, lower interest rates ahead, and data center energy demand.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

Invesco Solar ETF (TAN): ETF Research Reports