Measures of national income and output

Last updatedA variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), gross national product (GNP), net national income (NNI), and adjusted national income (NNI adjusted for natural resource depletion – also called as NNI at factor cost). All are specially concerned with counting the total amount of goods and services produced within the economy and by various sectors. The boundary is usually defined by geography or citizenship, and it is also defined as the total income of the nation and also restrict the goods and services that are counted. For instance, some measures count only goods & services that are exchanged for money, excluding bartered goods, while other measures may attempt to include bartered goods by imputing monetary values to them. [1]

Contents

National accounts

Arriving at a figure for the total production of goods and services in a large region like a country entails a large amount of data-collection and calculation. Although some attempts were made to estimate national incomes as long ago as the 17th century, [2] the systematic keeping of national accounts, of which these figures are a part, only began in the 1930s, in the United States and some European countries. The impetus for that major statistical effort was the Great Depression and the rise of Keynesian economics, which prescribed a greater role for the government in managing an economy, and made it necessary for governments to obtain accurate information so that their interventions into the economy could proceed as well-informed as possible.

Market value

In order to count a good or service, it is necessary to assign value to it. The value that the measures of national income and output assign to a good or service is its market value – the price it fetches when bought or sold. The actual usefulness of a product (its use-value) is not measured – assuming the use-value to be any different from its market value.

Three strategies have been used to obtain the market values of all the goods and services produced: the product (or output) method, the expenditure method, and the income method. The product method looks at the economy on an industry-by-industry basis. The total output of the economy is the sum of the outputs of every industry. However, since an output of one industry may be used by another industry and become part of the output of that second industry, to avoid counting the item twice we use not the value output by each industry, but the value-added; that is, the difference between the value of what it puts out and what it takes in. The total value produced by the economy is the sum of the values-added by every industry.

The expenditure method is based on the idea that all products are bought by somebody or some organisation. Therefore, we sum up the total amount of money people and organisations spend in buying things. This amount must equal the value of everything produced. Usually, expenditures by private individuals, expenditures by businesses, and expenditures by government are calculated separately and then summed to give the total expenditure. Also, a correction term must be introduced to account for imports and exports outside the boundary.

The income method works by summing the incomes of all producers within the boundary. Since what they are paid is just the market value of their product, their total income must be the total value of the product. Wages, proprietor's incomes, and corporate profits are the major subdivisions of income.

Methods of measuring national income

Output

The output approach focuses on finding the total output of a nation by directly finding the total value of all goods and services a nation produces.

Because of the complication of the multiple stages in the production of a good or service, only the final value of a good or service is included in the total output. This avoids an issue often called 'double counting', wherein the total value of a good is included several times in national output, by counting it repeatedly in several stages of production. In the example of meat production, the value of the good from the farm may be $10, then $30 from the butchers, and then $60 from the supermarket. The value that should be included in final national output should be $60, not the sum of all those numbers, $100. The values added at each stage of production over the previous stage are respectively $10, $20, and $30. Their sum gives an alternative way of calculating the value of final output.

Key formulae are:

GDP at market price = value of output in the economy - intermediate consumption

NNP at factor cost = GDP at market price - net indirect taxes - depreciation + net factor income from abroad

NDP at factor cost = compensation of employees + net interest + rental & royalty income + profit of incorporated and unincorporated NDP at factor cost

Expenditure

The expenditure approach is basically an output accounting method. It focuses on finding the total output of a nation by finding the total amount of money spent. This is acceptable to economists, because, like income, the total value of all goods is equal to the total amount of money spent on goods. The basic formula for domestic output takes all the different areas in which money is spent within the region, and then combines them to find the total output.

where:

C = Consumption (economics) (Household consumption expenditures / Personal consumption expenditures)

I = Investment (macroeconomics) / Gross private domestic investment

G = Government spending (Government consumption / Gross investment expenditures)

X = Exports (Gross exports of goods and services)

M = Imports (Gross imports of goods and services)

Note: (X - M) is often written as XN or less commonly as NX, both stand for "net exports"

The names of the measures consist of one of the words "Gross" or "Net", followed by one of the words "National" or "Domestic", followed by one of the words "Product", "Income", or "Expenditure". All of these terms can be explained separately.

- "Gross" means total product, regardless of the use to which it is subsequently put.

- "Net" means "Gross" minus the amount that must be used to offset depreciation – ie., wear-and-tear or obsolescence of the nation's fixed capital assets. "Net" gives an indication of how much product is actually available for consumption or new investment.

- "Domestic" means the boundary is geographical: we are counting all goods and services produced within the country's borders, regardless of by whom.

- "National" means the boundary is defined by citizenship (nationality). We count all goods and services produced by the nationals of the country (or businesses owned by them) regardless of where that production physically takes place.

- The output of a French-owned cotton factory in Senegal counts as part of the Domestic figures for Senegal, but the National figures of France.

- "Product", "Income", and "Expenditure" refer to the three counting methodologies explained earlier: the product, income, and expenditure approaches. However, the terms are used loosely.

- "Product" is the general term, often used when any of the three approaches was actually used. Sometimes the word "Product" is used and then some additional symbol or phrase to indicate the methodology; so, for instance, we get "Gross Domestic Product by income", "GDP (income)", "GDP(I)", and similar constructions.

- "Income" specifically means that the income approach was used.

- "Expenditure" specifically means that the expenditure approach was used.

All three counting methods should in theory give the same final figure. However, in practice, minor differences are obtained from the three methods for several reasons, including changes in inventory levels and errors in the statistics. One problem for instance is that goods in inventory have been produced (therefore included in Product), but not yet sold (therefore not yet included in Expenditure). Similar timing issues can also cause a slight discrepancy between the value of goods produced (Product) and the payments to the factors that produced the goods (Income), particularly if inputs are purchased on credit, and also because wages are collected often after a period of production.

Gross domestic product and gross national product

Gross domestic product (GDP) is defined as "the value of all final goods and services produced in a country in 1 year". [3]

Gross national product (GNP) is defined as "the market value of all goods and services produced in one year by labour and property supplied by the residents of a country." [4]

As an example, the table below shows some GDP and GNP, and NNI data for the United States: [5]

| Period ending | 2003 |

|---|---|

| Gross national product | 11,063.3 |

| Net U.S. income receipts from rest of the world | 55.2 |

| U.S. income receipts | 329.1 |

| U.S. income payments | -273.9 |

| Gross domestic product | 11,008.1 |

| Private consumption of fixed capital | 1,135.9 |

| Government consumption of fixed capital | 218.1 |

| Statistical discrepancy | 25.6 |

| National income | 9,679.7 |

- NDP: Net domestic product is defined as "gross domestic product (GDP) minus depreciation of capital", [6] similar to NNP.

- GDP per capita: Gross domestic product per capita is the mean value of the output produced per person, which is also the mean income.

National income and welfare

GDP per capita (per person) is often used as a measure of a person's welfare. Countries with higher GDP may be more likely to also score high on other measures of welfare, such as life expectancy. However, there are serious limitations to the usefulness of GDP as a measure of welfare:

- Measures of GDP typically exclude unpaid economic activity, most importantly domestic work such as childcare. This leads to distortions; for example, a paid nanny's income contributes to GDP, but an unpaid parent's time spent caring for children will not, even though they are both carrying out the same economic activity.

- GDP takes no account of the inputs used to produce the output. For example, if everyone worked for twice the number of hours, then GDP might roughly double, but this does not necessarily mean that workers are better off as they would have less leisure time. Similarly, the impact of economic activity on the environment is not measured in calculating GDP.

- Comparison of GDP from one country to another may be distorted by movements in exchange rates. Measuring national income at purchasing power parity may overcome this problem at the risk of overvaluing basic goods and services, for example subsistence farming.

- GDP does not measure factors that affect quality of life, such as the quality of the environment (as distinct from the input value) and security from crime. This leads to distortions - for example, spending on cleaning up an oil spill is included in GDP, but the negative impact of the spill on well-being (e.g. loss of clean beaches) is not measured.

- GDP is the mean (average) wealth rather than median (middle-point) wealth. Countries with a skewed income distribution may have a relatively high per-capita GDP while the majority of its citizens have a relatively low level of income, due to concentration of wealth in the hands of a small fraction of the population. See Gini coefficient.

Because of this, other measures of welfare such as the Human Development Index (HDI), Index of Sustainable Economic Welfare (ISEW), Genuine Progress Indicator (GPI), gross national happiness (GNH), and sustainable national income (SNI) are used. [7]

See also

- Capital formation

- Chained volume series

- Compensation of employees

- European System of Accounts

- Green national product

- Gross domestic product

- Gross national income

- Gross national happiness (GNH)

- Gross national income in the European Union

- Gross output

- Input–output model

- Intermediate consumption

- National accounts

- National Income and Product Accounts

- Net economic welfare

- Net output

- Penn World Table

- Savings identity

- United Nations System of National Accounts (UNSNA)

- Wealth (economics)

Related Research Articles

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period by a country or countries. GDP is most often used by the government of a single country to measure its economic health. Due to its complex and subjective nature, this measure is often revised before being considered a reliable indicator.

In economics, the GDP deflator is a measure of the money price of all new, domestically produced, final goods and services in an economy in a year relative to the real value of them. It can be used as a measure of the value of money. GDP stands for gross domestic product, the total monetary value of all final goods and services produced within the territory of a country over a particular period of time.

The Bureau of Economic Analysis (BEA) of the United States Department of Commerce is a U.S. government agency that provides official macroeconomic and industry statistics, most notably reports about the gross domestic product (GDP) of the United States and its various units—states, cities/towns/townships/villages/counties, and metropolitan areas. They also provide information about personal income, corporate profits, and government spending in their National Income and Product Accounts (NIPAs).

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It specifies the amount of goods and services that will be purchased at all possible price levels. Consumer spending, investment, corporate and government expenditure, and net exports make up the aggregate demand.

The national income and product accounts (NIPA) are part of the national accounts of the United States. They are produced by the Bureau of Economic Analysis of the Department of Commerce. They are one of the main sources of data on general economic activity in the United States.

The gross national income (GNI), previously known as gross national product (GNP), is the total domestic and foreign output claimed by residents of a country, consisting of gross domestic product (GDP), plus factor incomes earned by foreign residents, minus income earned in the domestic economy by nonresidents. Comparing GNI to GDP shows the degree to which a nation's GDP represents domestic or international activity. GNI has gradually replaced GNP in international statistics. While being conceptually identical, it is calculated differently. GNI is the basis of calculation of the largest part of contributions to the budget of the European Union. In February 2017, Ireland's GDP became so distorted from the base erosion and profit shifting ("BEPS") tax planning tools of U.S. multinationals, that the Central Bank of Ireland replaced Irish GDP with a new metric, Irish Modified GNI. In 2017, Irish GDP was 162% of Irish Modified GNI.

National accounts or national account systems (NAS) are the implementation of complete and consistent accounting techniques for measuring the economic activity of a nation. These include detailed underlying measures that rely on double-entry accounting. By design, such accounting makes the totals on both sides of an account equal even though they each measure different characteristics, for example production and the income from it. As a method, the subject is termed national accounting or, more generally, social accounting. Stated otherwise, national accounts as systems may be distinguished from the economic data associated with those systems. While sharing many common principles with business accounting, national accounts are based on economic concepts. One conceptual construct for representing flows of all economic transactions that take place in an economy is a social accounting matrix with accounts in each respective row-column entry.

Consumption of fixed capital (CFC) is a term used in business accounts, tax assessments and national accounts for depreciation of fixed assets. CFC is used in preference to "depreciation" to emphasize that fixed capital is used up in the process of generating new output, and because unlike depreciation it is not valued at historic cost but at current market value ; CFC may also include other expenses incurred in using or installing fixed assets beyond actual depreciation charges. Normally the term applies only to producing enterprises, but sometimes it applies also to real estate assets.

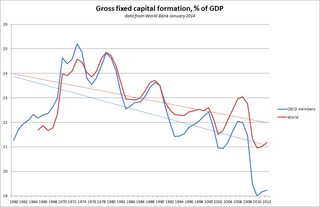

Gross fixed capital formation (GFCF) is a component of the expenditure on gross domestic product (GDP) that indicates how much of the new value added in an economy is invested rather than consumed. It measures the value of acquisitions of new or existing fixed assets by the business sector, governments, and "pure" households minus disposals of fixed assets.

Intermediate consumption is an economic concept used in national accounts, such as the United Nations System of National Accounts (UNSNA), the US National Income and Product Accounts (NIPA) and the European System of Accounts (ESA).

In economics, gross output (GO) is the measure of total economic activity in the production of new goods and services in an accounting period. It is a much broader measure of the economy than gross domestic product (GDP), which is limited mainly to final output. As of first-quarter 2019, the Bureau of Economic Analysis estimated gross output in the United States to be $37.2 trillion, compared to $21.1 trillion for GDP.

Operating surplus is an accounting concept used in national accounts statistics and in corporate and government accounts. It is the balancing item of the Generation of Income Account in the UNSNA. It may be used in macro-economics as a proxy for total pre-tax profit income, although entrepreneurial income may provide a better measure of business profits. According to the 2008 SNA, it is the measure of the surplus accruing from production before deducting property income, e.g., land rent and interest.

Net output is an accounting concept used in national accounts such as the United Nations System of National Accounts (UNSNA) and the NIPAs, and sometimes in corporate or government accounts. The concept was originally invented to measure the total net addition to a country's stock of wealth created by production during an accounting interval. The concept of net output is basically "gross revenue from production less the value of goods and services used up in that production". The idea is that if one deducts intermediate expenditures from the annual flow of income generated by production, one obtains a measure of the net new value in the new products created.

Aggregate income is the total of all incomes in an economy without adjustments for inflation, taxation, or types of double counting. Aggregate income is a form of GDP that is equal to Consumption expenditure plus net profits. 'Aggregate income' in economics is a broad conceptual term. It may express the proceeds from total output in the economy for producers of that output. There are a number of ways to measure aggregate income, but GDP is one of the best known and most widely used.

Material Product System (MPS) refers to the system of national accounts used by 16 Communist countries for different lengths of time, including the former Soviet Union and the Eastern Bloc countries, Cuba, China (1952–1992) and several other Asian countries. The MPS has now been replaced by the UNSNA accounts in most countries that used MPS, although some countries such as Cuba and North Korea have continued to use MPS alongside UNSNA-type accounts. Today it is difficult to obtain detailed information about accounting systems which are an alternative to UNSNA, and therefore few people know that such systems exist and have been used by various countries.

In economics, gross value added (GVA) is the measure of the value of goods and services produced in an area, industry or sector of an economy. "Gross value added is the value of output minus the value of intermediate consumption; it is a measure of the contribution to GDP made by an individual producer, industry or sector; gross value added is the source from which the primary incomes of the System of National Accounts (SNA) are generated and is therefore carried forward into the primary distribution of income account."

The Keynesian cross diagram is a formulation of the central ideas in Keynes' General Theory of Employment, Interest and Money. It first appeared as a central component of macroeconomic theory as it was taught by Paul Samuelson in his textbook, Economics: An Introductory Analysis. The Keynesian cross plots aggregate income and planned total spending or aggregate expenditure.

The annual United Kingdom National Accounts records and describes economic activity in the United Kingdom and as such is used by government, banks, academics and industries to formulate the economic and social policies and monitor the economic progress of the United Kingdom. It also allows international comparisons to be made. The Blue Book is published by the UK Office for National Statistics alongside the United Kingdom Balance of Payments – The Pink Book.

This glossary of economics is a list of definitions of terms and concepts used in economics, its sub-disciplines, and related fields.

The Gross National Income Regulation (EU) 2019/516 is a Regulation in EU law that sets out methods for calculating "Gross Domestic Product" and "Gross National Income" in EU accounts and for member states.

References

- ↑ Australian Bureau of Statistics, Concepts, Sources and Methods, Chap. 4, "Economic concepts and the national accounts", "Production", "The production boundary". Retrieved November 2015.

- ↑ E.g., William Petty (1665), Gregory King (1688); and, in France, Boisguillebert and Vauban. Australia's National Accounts: Concepts, Sources and Methods, 2000. Chapter 1; heading: Brief history of economic accounts (retrieved November 2009).

- ↑ Australian Council of Trade Unions, APHEDA, Glossary Archived 2008-04-15 at the Wayback Machine , accessed November 2009.

- ↑ United States, of the United States], p 5; retrieved November 2009.

- ↑ U.S Federal Reserve, the link appears to be dead as of late 2009

- ↑ "Penn State Glossary". Archived from the original on 2008-05-06. Retrieved 2008-03-11.

- ↑ England, R. W. (1998). Measurement of social well-being: alternatives to gross domestic product. Ecological Economics, 25(1), 89-103.

Bibliography

- Australian Bureau of Statistics, Australian National Accounts: Concepts, Sources and Methods, 2000. This fairly large document has a wealth of information on the meaning of the national income and output measures and how they are obtained.

External links

| Library resources about National income |

- Historicalstatistics.org: Links to historical national accounts and statistics for different countries and regions

- World Bank's Development and Education Program Website

- Quandl - GDP by country - data available in CSV, Excel, JSON or XML formats

Text is available under the CC BY-SA 4.0 license; additional terms may apply.

Images, videos and audio are available under their respective licenses.