What Is Berkshire Hathaway and What Does It Do?

It may come as a surprise just how many subsidiaries Berkshire Hathaway - a multinational conglomerate and holding company led by Warren Buffett - actually owns.

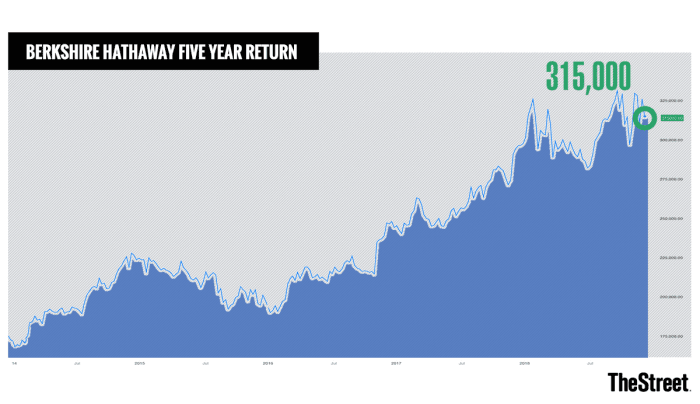

As the most expensive stock, you can own (with Class A shares at well over $300,000 (BRK.A) ), Berkshire Hathaway has certainly cemented itself into the international market as one of the biggest public companies out there. In addition to its pricey shares, Berkshire Hathaway is one of the top-performing companies in the market, and either fully owns or owns controlling interests in dozens of major companies - including the likes of Geico, Fruit of the Loom and Dairy Queen.

Growing from its beginnings in the textile industry, the company now has reached into a diverse portfolio of industries and sectors - from tech to food.

But, what is Berkshire Hathaway, and what does it do?

What Is Berkshire Hathaway?

Berkshire Hathaway is a multinational holding company and conglomerate run by the investor, chairman and CEO Warren Buffett. The company was originally a textile manufacturer, but now owns or holds controlling interests in dozens of big companies including Heinz, Benjamin Moore, Geico and more. The holding company is the most expensive stock on the market.

As a diversified holding company (and multinational conglomerate), Berkshire Hathaway has invested in or acquired dozens of companies and holdings over the years. In addition, Berkshire Hathaway also has its own subsidiaries in the insurance and home services industries.

As headed up by the prolific Buffett, Berkshire Hathaway is one of the largest and most successful conglomerates in the world - with a hefty market cap of over $516.5 billion as of April 2019.

But, how did the holding company achieve its world-class reputation (and astounding market cap)?

Berkshire Hathaway History

Founded through the merger of Massachusetts firms Hathaway Manufacturing Company (incorporated 1888) and Berkshire Cotton Manufacturing Company (incorporated 1889, later changed to Berkshire Fine Spinning Associates in 1929) in 1955, Berkshire Hathaway Inc. is based in Omaha, Nebraska.

The company was later taken over by Buffett's investment group in 1965, and quickly rose to prominence through Buffett's strategy of value investing - by buying up stock or companies that were undervalued. Buffett transformed an initially struggling textile manufacturing company into what is one of the biggest and most expensive conglomerates and stocks in the world.

Berkshire Hathaway originally (and still today) held a lot of insurance companies, including National Indemnity Company and National Fire & Marine Insurance Company (now a part of National Indemnity), acquired in 1967, as well as Geico, acquired in 1996. By 1985, Buffett liquidated the company's textile operations and solidified its transition into a holding company.

Since then, Berkshire Hathaway has kept a diverse portfolio, buying interests or whole companies in food, clothing, transportation and even tech.

So, what companies does Berkshire Hathaway own or invest in?

Berkshire Hathaway Subsidiaries

As a holding company, Berkshire Hathaway owns or has a large stake in dozens of big companies - including both public and private companies. As of 2018, Berkshire Hathaway fully owned some 50 subsidiaries.

Berkshire Hathaway Companies

Berkshire Hathaway owns several companies that bear its name, including Berkshire Hathaway HomeServices of America, Berkshire Hathaway Direct Insurance Company, Berkshire Hathaway Automotive, Berkshire Hathaway Energy Company, Berkshire Hathaway Homestate Companies and more.

In addition, the holding company owns dozens of other companies, including BNSF Railway, Duracell, MedPro Group, Geico, Clayton Homes, Benjamin Moore & Co., HomeServices of America, Lubrizol Corporation, Acme Brick Company and many more.

Apart from the companies Berkshire Hathaway actually owns, the conglomerate holds large investments in several other companies - including some of the biggest public names on the market.

Berkshire Hathaway Holdings

Berkshire Hathaway has considerable investments in various companies - from tech to transportation and more. According to the company's latest 13F-HR filing with the Securities and Exchange Commission, these include:

Apple (AAPL)

Bank of America (BAC)

Wells Fargo (WFC)

Coca Cola (KO)

Goldman Sachs (GS)

Delta Airlines (DAL)

American Express (AXP)

General Motors (GM)

Costco Wholesale Corp. (COST)

Verizon Communications Inc. (VZ)

Johnson & Johnson (JNJ)

Proctor & Gamble Co. (PG)

U.S. Bancorp (UBS)

VeriSign, Inc. (VRSN)

American Airlines Group Inc. (AAL)

Visa, Inc. (V)

JP Morgan Chase & Co. (JPM)

USG Corp. (USG)

Suncor Energy Inc. (SU)

These are just a few of the biggest companies Berkshire Hathaway owns shares of in 2019.

Berkshire Hathaway Stock

Berkshire Hathaway (BRK.A) boasts the market's most expensive stock to own - with Class A shares setting you back some $315,300 per share in April 2019.

The conglomerate also has Class B shares (BRK.B) - which are much more affordable, trading at around $210 in 2019. Both of the company's classes of stock trade on the New York Stock Exchange.

And although the stock has recently taken a bit of a hit (dropping slightly in the past six months), Berkshire Hathaway has generally performed remarkably well - climbing from around $175,000 in December 2013 to over $315,000 in April 2019. And historically, Buffett saw the company through its stock trading at just $19 in 1964 to its now astronomical $315,000-plus price tag.

Additionally, Berkshire Hathaway's stock performed over two times better than the S&P 500 index from 1965 to 2018.

But apart from the stock's steady rise over the years, Berkshire Hathaway has taken a bit of heat recently - especially over Berkshire Hathaway-owned Kraft Heinz (KHC) , which has seen about a 43% drop since October of last year. According to recent reports, Buffett acknowledged that Berkshire Hathaway may have "overpaid" for their investment in the food company.

In addition, some reports critique Berkshire Hathaway's holdings in Wells Fargo (who has also seen poor performance recently as well) as part of the company's stock's recent slight decline.

Still, the company's stock (specifically their Class B shares) has outpaced the S&P 500 for years. As of last year, the largest institutional shareholder of Berkshire Hathaway's Class A stock is FERI Wealth Management.

What Does Berkshire Hathaway Do?

Berkshire Hathaway invests in and holds dozens of major public and private companies. As part of its portfolio, the company also owns and operates several self-titled companies, including Berkshire Hathaway HomeServices of America and Berkshire Hathaway Direct Insurance Company. But apart from its branded companies, Berkshire Hathaway does quite a bit more than provide insurance.

In 2019, Berkshire Hathaway's companies and holdings contribute a variety of commodities and services to the market - including producing computers and electronic products, providing insurance, producing clothing, serving food products, automotive products and services and much more.

Although the company originally started out primarily in the textile industry, Berkshire Hathaway has grown to become a conglomerate that invests in a diverse group of major companies and provides the prime example of Buffett's famous value investing strategy.