What Is The Modigliani Miller (M&M) Theorem?

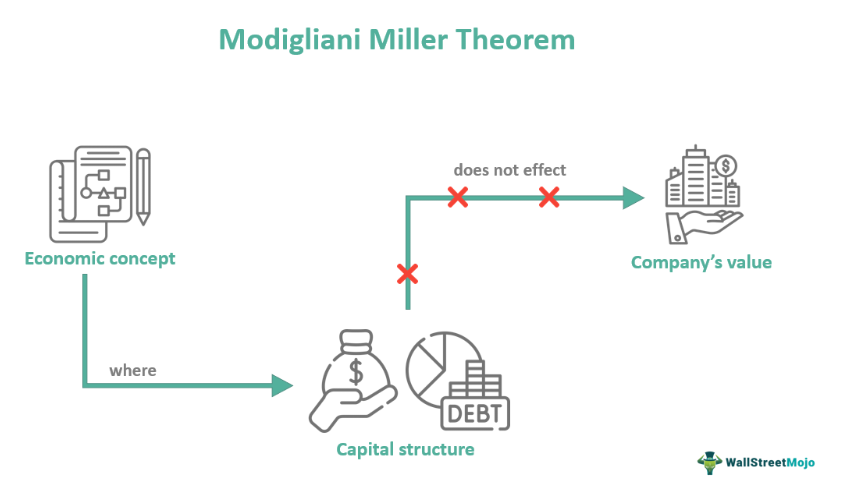

Modigliani Miller theorem (M&M) is an economic concept that states no or zero effect of capital structure on the value of the concept. It aims to determine the relationship between a company’s asset structure, dividend policy, and cost of capital.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Modigliani Miller Theorem (wallstreetmojo.com)

Economists Franco Modigliani and Merton Howard Miller proposed this theory in the mid-20th century. It acts as an essential concept of modern finance. In addition, the Modigliani-Miller theorem approach assumes no risk of uncertainty. As a result, this model prevailed in a world without taxes. However, limitations of Modigliani Miller’s theorem, like transaction costs and taxes, fail the theory.

Table of contents

Key Takeaways

- Modigliani Miller Theorem, or M&M model, is a modern finance concept that states the nil relationship between capital structure and a company’s valuation.

- The theory originated in the mid-20th century (i.e., 1958) by Italian and American economists Franco Modigliani and Merton Miller.

- Certain assumptions stated a perfectly efficient market, rational behavior, no taxes, and a similar capital structure.

- However, limitations like zero taxes led to a newly proposed theory by similar authors having two new propositions on capital structure (WACC) and company value.

Modigliani Miller’s Theorem Explained

Modigliani Miller’s theorem is a modern finance concept that states the relationship between capital structure and a company’s value. Italian American economist Franco Modigliani and American economist Merton Howard Miller proposed this theory in 1958. Besides, they explained how capital borrowing does not relate to the company’s valuation model.

Moreover, to understand this theorem, it is essential to consider the concept of a company’s cost of capital. Hence, this theory assumes a perfect market where no taxes are implied on the company. According to the authors, the company’s capital structure has no relationship with its value. So, if a company borrows money through IPO (Initial Public Offering) or debt, it remains unaffected. Thus, the debt-to-equity ratio has less importance on the company’s valuation.

Modigliani Miller’s theorem hypothesis depends on the leverage of two firms (U and L). Out of which, Firm U is unleveraged, and Firm L is leveraged. It means that the former is wholly dependent on equity. In contrast, the latter’s capital includes debt and equity. Accordingly, the Modigliani-Miller theorem hypothesis states that both firms will have the same enterprise value regardless of their capital structure. As a result, it is a neutral factor for both.

However, the proof of arbitrage for this theory is another essential element for this argument. Here, the authors state that the shareholders will try to arbitrage (hedge) in this case. So, if they wish to sell their stake in an overvalued firm and invest in an undervalued one, this process will continue until they both reach the same level. Thus, in the end, the enterprise value of both firms will be equal. However, certain limitations of the Modigliani-Miller theorem led to another theory. It includes similar capital costs, negligence of corporate taxes, institutional investors, transaction costs, and others.

Financial Modeling & Valuation Courses Bundle (25+ Hours Video Series)

–>> If you want to learn Financial Modeling & Valuation professionally , then do check this Financial Modeling & Valuation Course Bundle (25+ hours of video tutorials with step by step McDonald’s Financial Model). Unlock the art of financial modeling and valuation with a comprehensive course covering McDonald’s forecast methodologies, advanced valuation techniques, and financial statements.

Assumptions

Let us look at the assumptions of the Modigliani miller theorem approach for a better understanding:

#1 – Perfectly Capital Market

The M&M theory assumes that the firms operate in a perfectly efficient capital market. As a result, there are no transaction costs in such a market. In addition, there is no flotation cost or other fees included. Here, in this market, all information is readily available. Therefore, an investor’s purchase or sale does not affect the firms.

#2 – Firms Operate With the Same Risk

Another assumption of the theory is that the firms have equal risk within themselves. It means the risk factors of both firms will remain the same.

#3 – No or Zero Taxes

The authors suggest that this theory does not consider taxes. So that investors can freely trade securities without incurring any tax liabilities.

#5 – Full Dividend Payout Policy

The theory assumes that the company pays all its earnings dividends to the shareholders. Also, all the investors believe in a similar future rate of return.

Propositions

The M&M theory had various limitations to it. Among them, zero taxes dominated the discussion. Therefore, Modigliani and Miller again worked on it and proposed it. As a result, there were two propositions: I and II. So, let us look at the propositions of the Modigliani miller theorem for a better understanding:

#1 – Preposition I (Without Taxes)

In the first proposition, the authors assumed the company’s valuation is unaffected by the capital structure. Here, the cost of capital and the company’s market value is independent of the capital structure. As a result, the value and leverage of both firms are the same.

Therefore,

VL = VU

Where,

VL refers to the value of a leveraged firm. In contrast, VU is the value of an unleveraged firm.

#2 – Proposition I (With Taxes)

After Modigliani and Miller proposed the theory again, taxes also played an essential role in the capital structure. As a result, the company with debt had a more excellent value when the tax rate was multiplied by it.

Therefore,

VL = VU + Td

where,

Td is the tax rate multiplied by the firm’s debt (leverage).

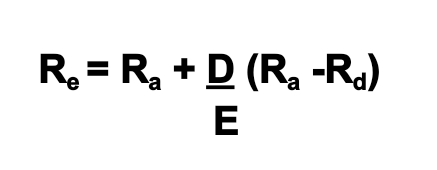

#3 – Proposition II (Without Taxes)

The previous or original theory stated that the cost of a levered firm is directly proportional to the cost of debt of an unlevered firm. Here, the equity cost rises faster as no taxes are involved. Also, shareholders get a higher return. This formula is more similar to the WACC or Weighted Average Cost of Capital formula. As a result, the formula is derived as follows:

where,

Re refers to the cost of equity of a leveraged firm.

Ra refers to the cost of unlevered equity.

Rd is the cost of debt. In contrast, D/E refers to the debt-equity ratio of the leveraged firm.

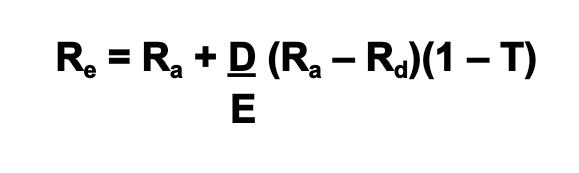

#4 – Proposition II (With Taxes)

When Modigliani and Miller restated the purpose of taxation in the model, a new formula was developed. In the earlier case, the cost of equity was proportional to the debt levels. However, here, a specific risk is involved with the entry of taxes. As a result, when debt increases, the level of WACC will surely fall. But, the cost of equity will continue rising at a slower rate compared to the former case.

where,

T refers to the tax rate prevailing in the economy.

Frequently Asked Questions (FAQs)

The central ideology of the whole M&M theory revolves around the statement that despite all factors, capital structure (mixture of either debt or equity) does not affect the company’s enterprise value. Instead, it is only impacted by the operating income or net present worth of future earnings (NPV).

This theory serves as an important concept in modern finance. For example, it helps in the valuation of leveraged and unlevered companies. Also, it holds equal importance in the field of corporate finance.

Before the propositions published by the authors Modigliani and Miller in 1958, the theory did not consider tax implications. As a result, the capital structure and its effect on the company’s value were zero. The idea assumed the capital market to be perfectly homogeneous, where the government imposed no taxes on corporations.

Arbitrage is when investors or shareholders try to profit by hedging their risk. Likewise, they perform the same by buying stakes in undervalued companies at a lower price and selling them once they reach the maximum.

Recommended Articles

This article has been a guide to what is Modigliani Miller Theorem. Here, we explain the topic in detail, including its propositions, and assumptions. You may also find some useful articles here –

Leave a Reply