10 High-Yield Dividend Stocks With 20% Annual Returns to Buy Now

Many conservative dividend investors like to review the Dividend Aristocrats and Dividend Kings lists for investment ideas, but most of these dividend stocks don't offer high yields.

High-yield stocks usually come with high risks. However, the 10 companies identified here have all trounced the market over the past five years by delivering returns of at least 20% annually.

Finding such a combination of high yield and capital appreciation is rare, but each of these companies has been successful and offers a dividend yield ranging from 3% to 8%.

Many of these dividend stocks are of interest for our Conservative Retirees Dividend Portfolio, which seeks to deliver a dividend yield between 3.5% and 4.5% while preserving capital.

Let's take a look at these high dividend stocks that have delivered at least 20% annual returns over the past five years.

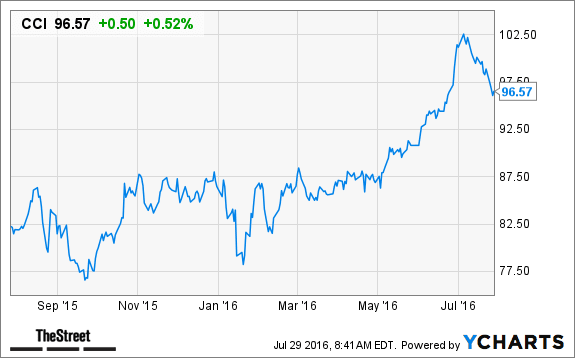

1.Crown Castle International

(CCI)

To paraphrase the movie Field of Dreams, build it, and they will come. In Crown Castle International's case, the field is a series of 1,700 wireless communications towers in Australia and 39,600 towers in the United States.

In urban areas, the company leases rooftops everywhere they can be found and provides a variety of antenna and cell network services.

When the company was founded in 1994, the high initial capital cost and relatively limited wireless usage made the cellular tower business attractive only to long-term dreamers. Today, these towers and their rooftop partners are the gatekeepers of wireless communication.

Crown Castle International is the largest operator in the industry, with an 18.5% market share. It has 40% more towers than its nearest rival, America Tower. The company's largest customer is Verizon Communications, which has just 1,400 of its own towers.

Those who are concerned about new entrants shouldn't be.

The odds of getting a new tower built are 0.8% because of regulations and carrier relationships, and then each one costs $150 million on average, according to StatisticBrain.com.

That is about as many barriers to entry as are needed.

The company's annual dividend payout of $3.54 a share offers an above-average yield of 3.7% and is very safe, thanks to Crown Castle International's recurring cash flow and healthy dividend payout ratio.

Earnings leverage is the key metric and should allow the 46% payout ratio to be increased. That suggests a baseline dividend growth of at least 8% to 10% per annually over the next few years.

This isn't simply a high return, but Crown Castle International also fits nicely into portfolios for dividend investors looking forward to retirement.

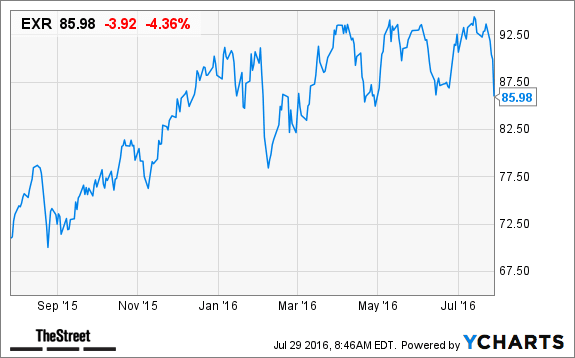

2. Extra Space Storage

(EXR)

Real estate experts will remind say: "There is only so much land to go around."

As prices rise, homes and apartments shrink in size, and storage becomes a premium. One person's junk is another's precious possessions.

This simple premise is what Extra Space Storage is all about.

The company operates 1,347 locations in 21 states throughout the country, with about 10% in the largest market of California. Occupancy is the key to return on investment, and last year the company posted a 90%-plus level.

Extra Space Storage ranks second in the industry behind market leader Public Storage, with 2,266 locations.

Extra Space Storage appears to be the fastest-growing in the sector, based on the $1.8 billion invested in more than 173 new locations last year. The combined properties increased the total square footage of Extra Space Storage by 24%.

The company paid a dividend of $2.36 a share last year, according to its annual report.

This is a ratio of 75% of the company's adjusted earnings.

The quarterly dividend was raised 32% on May 25 to an annual level of $3.12 a share, offering a yield of 3.6%.

So long as Extra Space Storage continues finding opportunities for growth and acquisitions, its dividend should keep rising.

A healthy dividend yield and continued earnings growth to drive stock appreciation is a recipe for enhanced returns. In the case of Extra Space Storage, it has created substantial value for shareholders.

The stock's annual total return of 24.4% over the past 10 years more than tripled the market's annual return of 7.4%. With continued growth in demand for storage, Extra Space Storage continues to offer attractive long-term income growth and capital appreciation potential.