Credit card benefits and perks can provide major savings and make your travelling life easier. But sometimes, it can be hard to tell what kind of dollar value they’re bringing to your credit card.

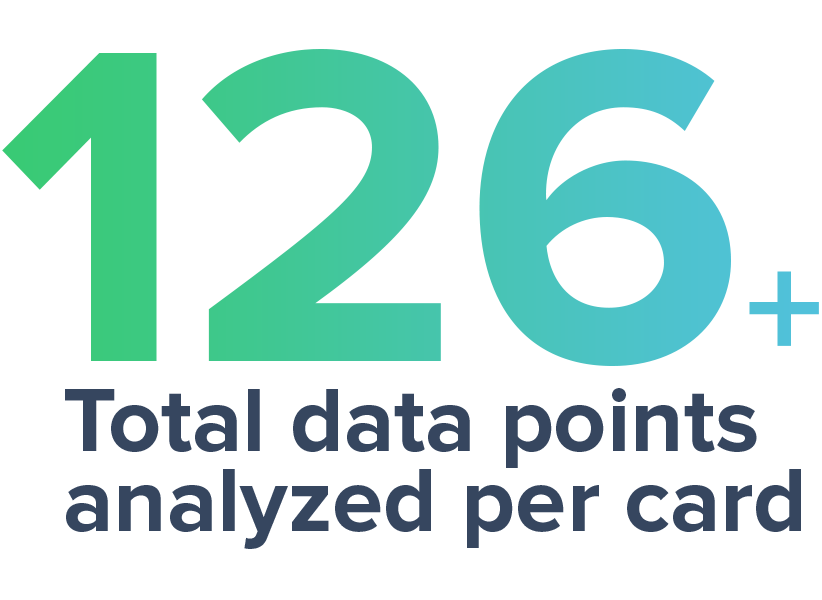

In total, we track 98 different benefits credit cards in Canada provide – but there are 9 we pay particular attention to (called major perks) that present clear and concrete value to the cardholder.

So here’s what these 9 major credit card perks are worth. We’ve made conservative assumptions, based on what kind of time you could expect to save, or what the benefits would be worth if you went out and purchased them yourself.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 42,500 other Canadians who receive our weekly newsletter – learn more.

The dollar value of 9 major credit card benefits

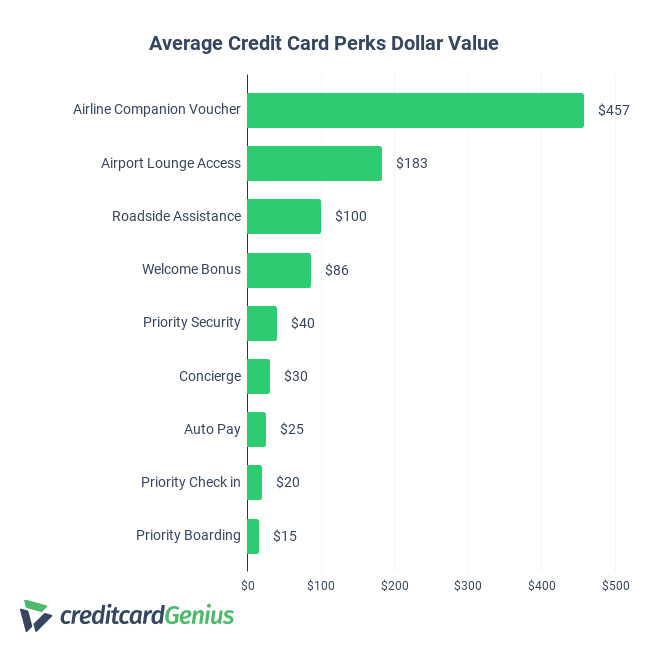

So what are the 9 major perks on Canadian credit cards? And what are they worth?

Here’s the average value of each of them.

There’s quite a range of values – all the way up to $457 for an airline companion voucher, and as little as $15 for priority boarding.

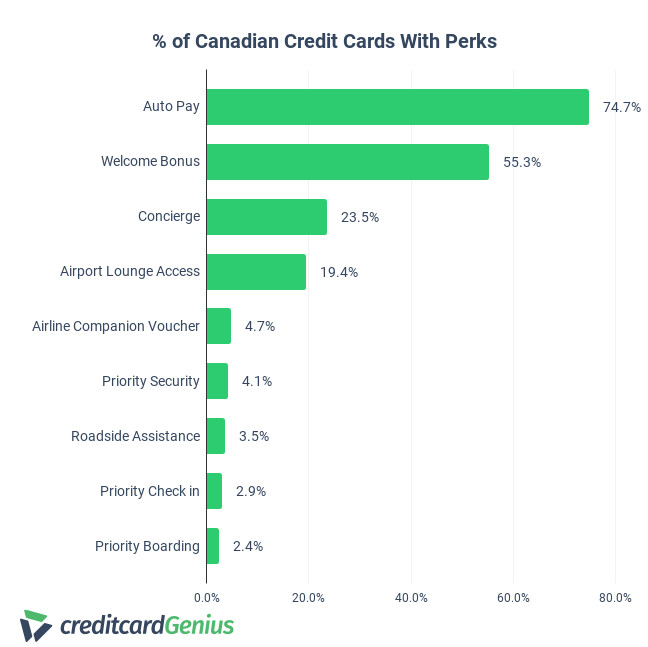

How common are these 9 major credit card perks?

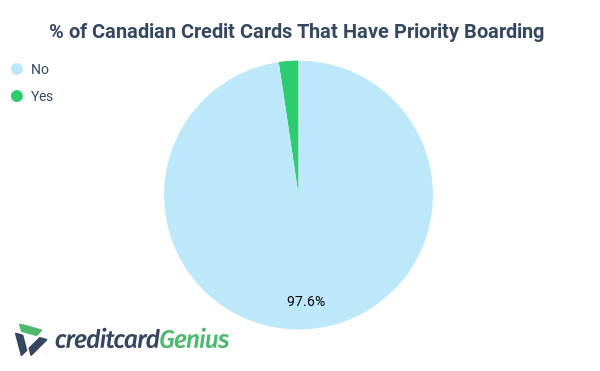

How common are these perks? Auto pay is seen on almost 75% of credit cards, while airline priority boarding is only seen on 2.4% of credit cards.

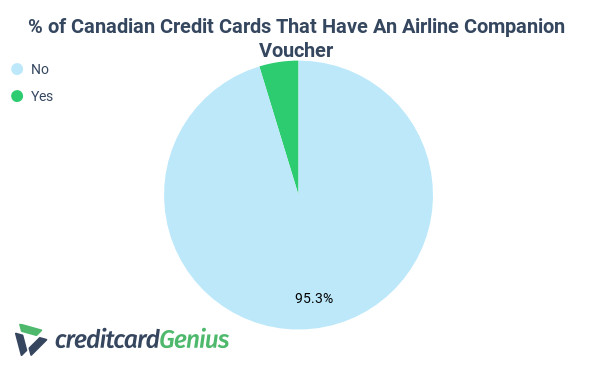

The highest value perk, an airline companion voucher, is only seen on 4.7% of credit cards – making it as rare as it is valuable.

Top 4 high-value credit card benefits and perks

Of these 9, there are 4 that really stand above the rest when it comes to value.

| High-Value Credit Card Benefits | Average Dollar Value |

|---|---|

| Airline companion voucher | $457 |

| Airport lounge access | $183 |

| Roadside assistance | $100 |

| Welcome bonuses | $86 |

The airline companion voucher is worth an impressive amount of money, single-handedly covering the annual fee of the vast majority of credit cards on the market (if they had this rare perk). There’s a significant drop off in perk value once you reach 2nd place, though lounge access and roadside assistance still bring great value to any credit card package.

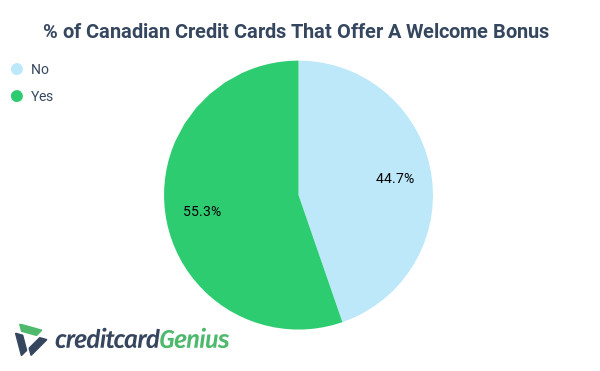

Though the average value of welcome bonuses seems low in comparison to the top 3 perks, keep in mind that it appears on more than half of Canadian credit cards. The value you see here is not only an average, but also takes into consideration that you can only get the bonus once over the lifetime of having the card. You could easily see a value over $200 in the first year for many credit cards on the market.

9 major credit card benefits in detail

Here are the details on these 9 major credit card perks – what they are, how often they occur, what they’re worth, and how we determined to their value.

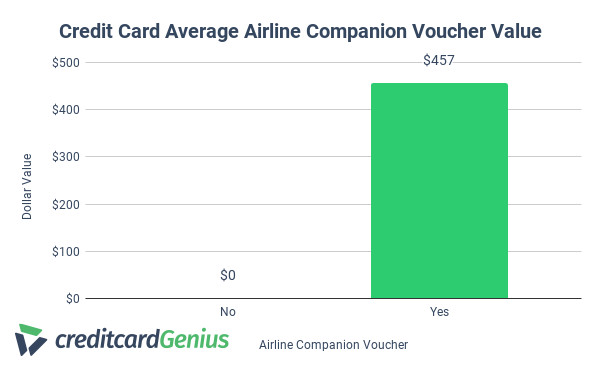

1. Airline companion voucher – $457

When it comes to being the most valuable credit card perk on the Canadian market, airline companion vouchers win – and by a landslide.

At an average value of $457, it’s worth more than double the next most valuable perk.

These airline companion vouchers can offer some significant savings. Simply book 2 seats on the same flight itinerary, and you’ll get the 2nd ticket for a low flat fee, plus taxes and fees.

Depending on the cost of the flight you chose, you could get a significantly discounted airline ticket once per year, with our average savings being $457.

It’s also an incredibly rare perk on only 4.7% of Canadian credit cards, led by cards associated with WestJet.

2. Airport lounge access – $183

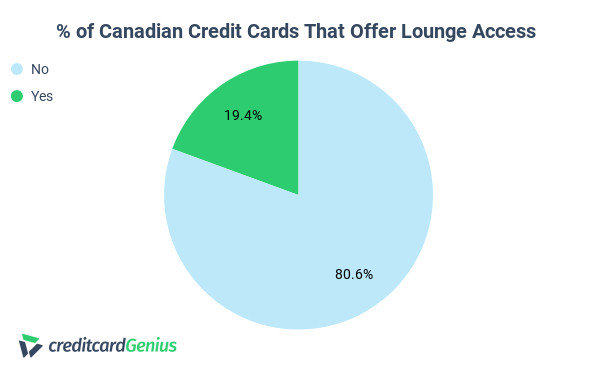

Airport lounges are a great place to relax and enjoy some food and drinks, away from the normal hustle and bustle of a crowded airport. And while they may seem exclusive, 19.4% of our credit cards provide access in some fashion.

But the value you get from this perk varies greatly by card.

There are 2 variables to consider:

- what type of access you get (unlimited, a few visits free, or none free), and

- the number of lounges you can access worldwide.

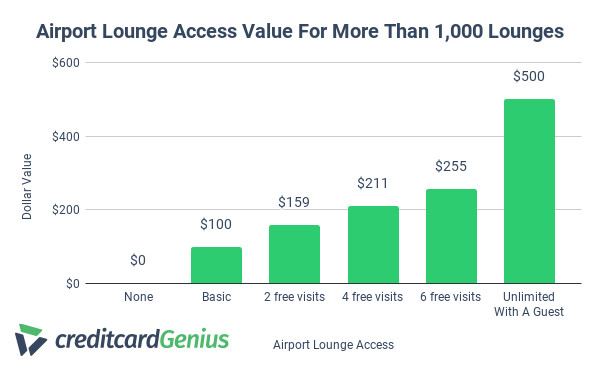

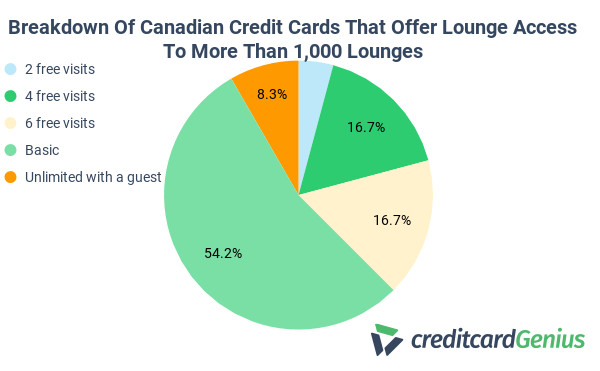

Many only offer a basic membership, which is a yearly subscription that doesn’t include free visits. Everytime you want to go to an associated airport lounge, you’ll still need to pay around US$32 per person. This is the case with both Priority Pass and Mastercard Airport Experiences and is the most common type of airport lounge access perk. Our value for this kind of membership is $100.

At the upper end of the scale, 8.3% of cards with this perk offer unlimited access for the cardholder to over 1,200 Priority Pass lounges. This membership is worth $320, and increases to $500 if you can also bring a guest.

In between, about 48% of cards with this perk offer a membership and a set number of free passes per year (between 2 and 6 visits). A typical number of free passes is 4, which has a value of $211.

At the very bottom end of lounge access, 6 cards only offer membership to a handful of lounges. These are led by Aeroplan credit cards that only offer access to 16 Maple Leaf lounges.

To make sure we’re looking at the cards with the most valuable perks, we’ll focus on the 24 credit cards that offer access to over 1,000 lounges. Here’s a breakdown of their value:

And here’s the distribution of whether it’s just a basic membership, a handful of free passes, or unlimited access.

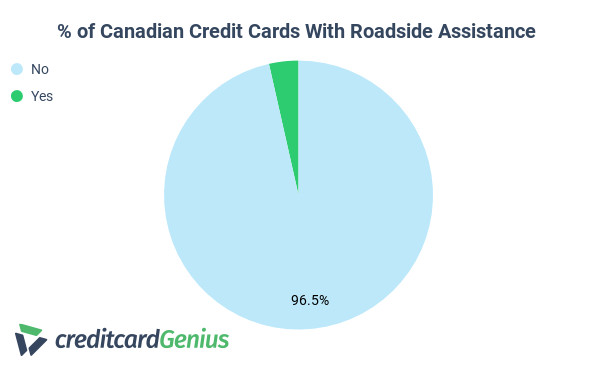

3. Credit card roadside assistance – $100

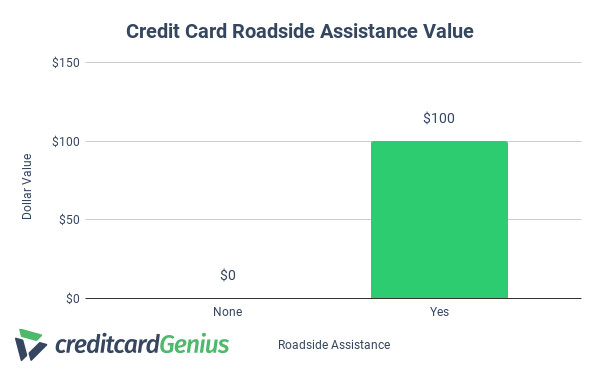

A rare credit card benefit only on 3.5% of credit cards, roadside assistance can save you the cost of a CAA membership. If you need a tow, battery boost, or get a flat tire, credit card roadside assistance can give you a hand when you’re stuck.

The actual coverage varies between the credit cards, but we estimate you can save $100 over an annual paid roadside assistance membership.

Credit cards that provide this rare but valuable insurance include a selection from BMO, TD, Home Trust, and Canadian Tire.

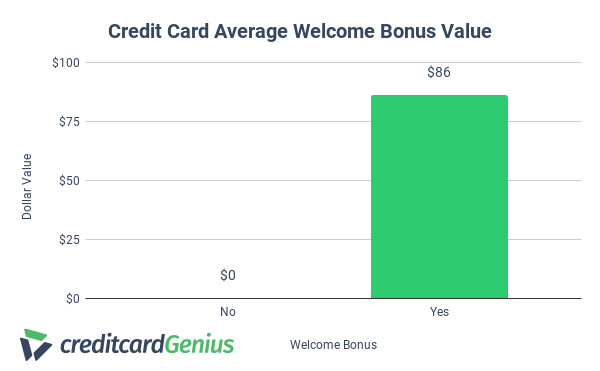

4. Welcome bonuses – $86

It may seem surprising to see them here, but we classify welcome bonuses as a perk. It’s basically a reward for getting a new credit card.

You’ll only get them once, but they’re generally quite valuable, with an average of $258 in bonus first year rewards.

However, to get our value of $86, we assume most people keep their credit cards for 3 years, to give an average per year value of the welcome bonus. If you change your credit cards more frequently, you’ll get a better yearly value from them.

Welcome bonuses are quite popular, but not as many credit cards have them as you may think. They’re only provided on 55% of the credit cards we track.

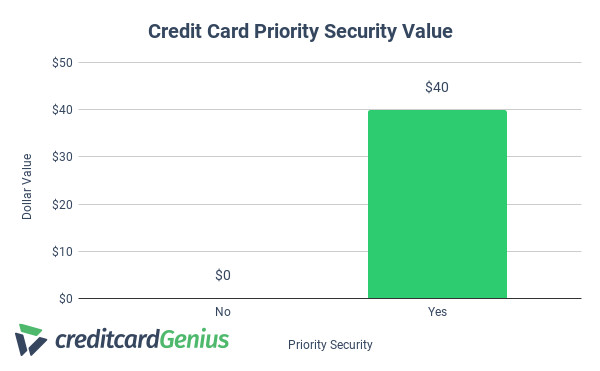

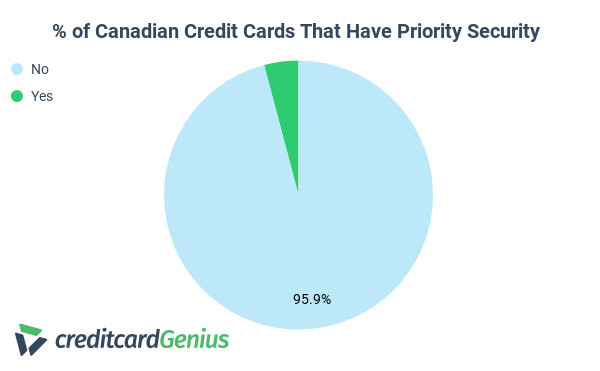

5. Priority airport security – $40

Depending on the airport and the time of day you travel (hello Toronto-Pearson in the early morning!), getting free access to the front of the security line is a great time saver, and gets you through sooner so you can get settled before you fly.

We place a value of this at $40, which is based on the value of time you saved instead of standing in line. It’s also important to note that the perk is often associated with a specific airport or airline, so likely won’t be available for every flight you take.

It’s not offered by many credit cards – only 4.1%.

A couple of networks stand out in this regard. If you fly frequently from Toronto-Pearson, Amex’s high end cards (think annual fee of $299 or more) get you front of the line access.

If Montreal, Ottawa, and Vancouver airports are your game, all Visa Infinite Privilege cards have priority security screening at these airports. Their annual fees start at $399, with a high household income requirement of $200,000.

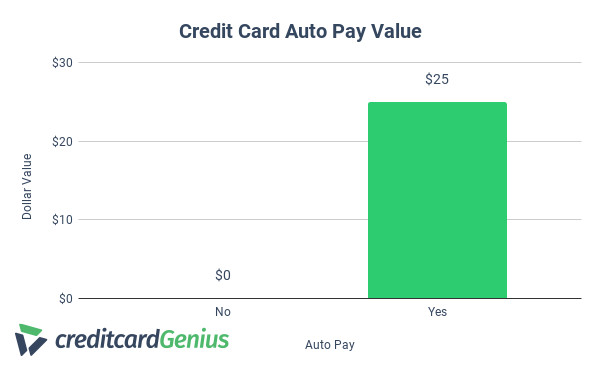

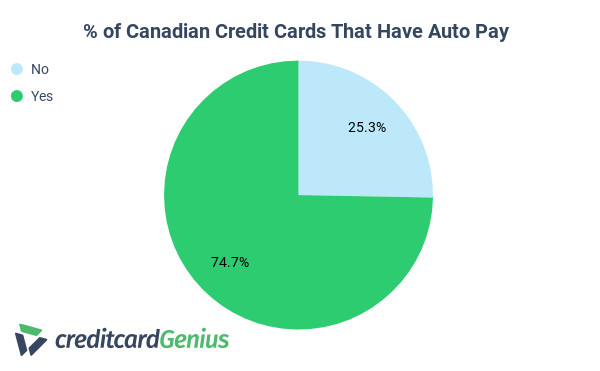

6. Auto pay – $25

It may not seem like a valuable perk, but if your credit card has auto pay, you’re saving yourself the hassle of:

- signing in to your credit card account,

- seeing what you owe,

- then going to your bank account, and

- setting up the online payment.

It also keeps you from missing bill payments, which can potentially save you from interest charges as well.

It’s a small thing, but it can add up every month. We’ve estimated that this perk is worth $25 in time savings.

It’s also the most common credit card perk, with almost 75% of Canadian credit cards offering it.

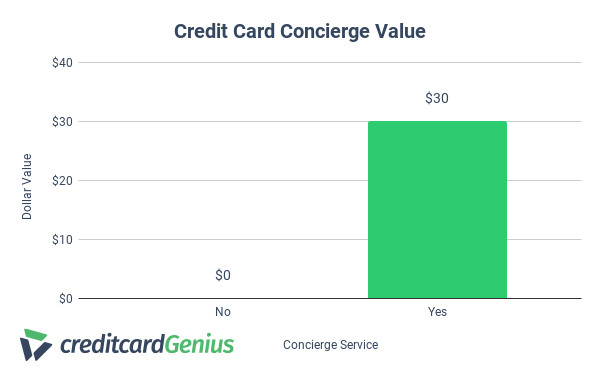

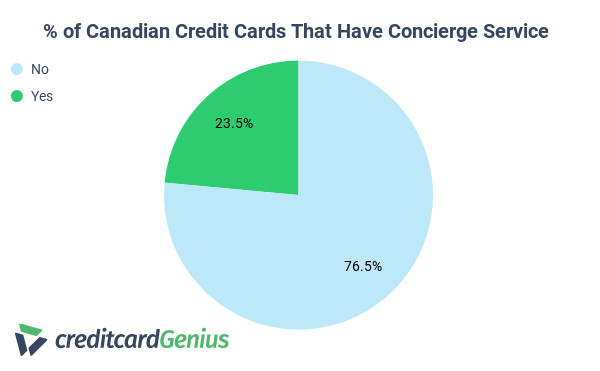

7. Concierge – $30

Most premium credit cards offer a concierge service. These services aren’t used much, but can help with things like:

- restaurant reservations,

- travel plans, and

- getting event tickets.

What exactly you can use the concierge service for varies from network to network. These credit cards are the ones that offer concierge service:

- World and World Elite Mastercards,

- Visa Infinite and Infinite Privilege cards, and

- select Amex Platinum and Reserve credit cards.

We give an estimated dollar value of $30 if your credit card provides concierge services.

This perk is available on 23.5% of credit cards we cover.

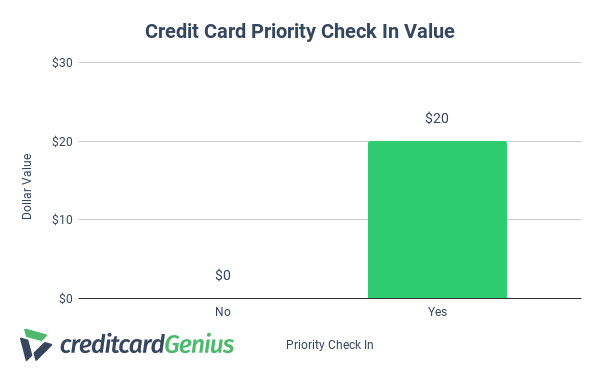

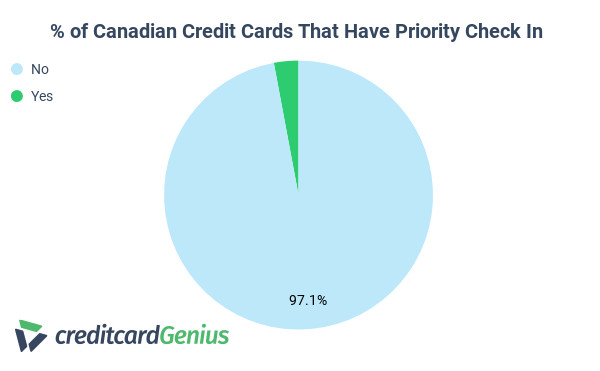

8. Priority check-in – $20

If you’re the kind of person who doesn’t check bags at the airport and always checks in online, this perk won’t help you much.

But if you do, with this perk you’ll get access to the dedicated priority line that airlines offer.

Our average value of $20 is simply based on the time you save doing this twice per year.

It’s only offered on 2.9% of credit cards, and they’re all Aeroplan branded credit cards. And a couple of them only offer it when travelling on a rewards flight.

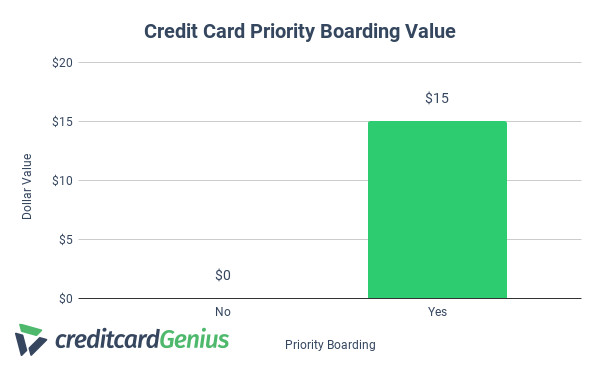

9. Priority boarding – $15

The last airline perk is priority boarding. It’s the least valuable of them all at $15, as it just gets you to the front of the boarding line so you can sit on the plane instead of in the airport.

Like priority check-in, it’s only offered on Aeroplan credit cards with only 2.4% of all credit cards offering it.

Related: Fly Like A VIP With Air Canada

Which bank offers the best value for credit card perks?

So which bank offers the best value when it comes to credit card perks?

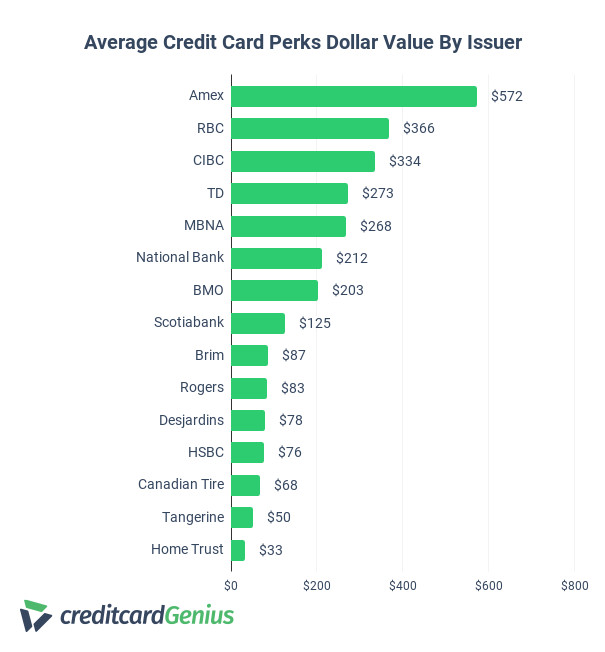

Here are the major issuers and their average perks value, based on our data.

Average vs. median dollar value

Those average numbers you see above get skewed higher by the premium credit cards that offer plenty of these perks.

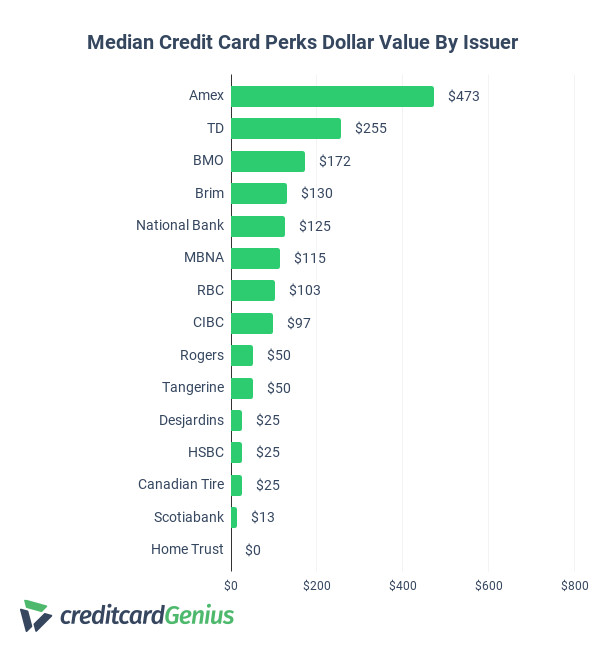

So, let’s also look at the median value of each issuer, which is the middle value of each issuer’s credit card perk package.

For the most part, the values are lower, and there’s a noticeable change in the order, most notably RBC falling 5 spots.

And while these values are lower, remember that half of each issuer’s credit cards provide higher value than this number.

Here are some notes on these graphs.

It’s an American Express world, and the rest are just living in it

Credit card perks are Amex’s game, and their frontrunner is the

One thing they all have is a great welcome bonus – you’ll be rewarded every time you get approved for a new Amex card.

And among their premium cards, the perks they offer include:

- airport lounge access,

- priority security,

- companion vouchers, and

- concierge.

Great perks are just one reason we love Amex cards.

TD provides great value, mostly courtesy of their Aeroplan credit cards

TD stands out, and it’s their Aeroplan cards that lead the charge.

With the new Aeroplan program coming November 2020, these credit cards (along with Amex’s Aeroplan cards) will be gaining even more value.

Credit card benefits valuation: our methodology

Our valuations are on the conservative side when it comes to credit card perks. For most, credit cards offer a more basic service than what you’d get if you purchased it yourself. However, for some perks, additional assumptions have to be made. These include:

- auto pay,

- priority check in,

- priority security, and

- priority boarding.

These were calculated using the estimated time saved and the value of that time based on an average wage.

Let’s briefly explore the methodology behind each perk mentioned in this article.

Companion vouchers: This is a big-ticket item where you can save considerable amounts of money on a flight for someone you’re travelling with. Obviously, such an amazing perk can often only be used once a year. Our study uses the dollar amount the voucher saves you on the cost of your flight, which can range from $200 to $700.

Lounge access: This is another big-ticket item for travel cards, as lounge memberships can typically cost anywhere between $100 to $400 per year. Lounge access varies depending on the card, and the dollar value is based on visitation limits (with diminishing returns, as some have unlimited visits), whether or not you can include a guest, as well as the number of lounges available (also subject to diminishing returns). Some card lounge access memberships are so comprehensive that there’s no equivalent even available on the market.

Roadside assistance: Most credit card roadside assistance packages offer somewhere between Basic and Plus retail coverage (closer to basic in most cases), which are valued at $90/year and $130/year. Our study assumes a value of roughly $100/year.

Welcome bonus: To get our welcome bonus value, we take all the initial one time bonuses available with the credit card and the spending level required. If it requires more than our standard $2,000 monthly spend, it wasn’t included for this study. For credit cards that have points, we multiply the total number of points earned by our assumed value the program provides. For cash back credit cards that offer big multipliers, we remove what you’d normally be earning to get the true welcome bonus value.

Concierge service: This service is not often used, but could yield considerable value for those who make regular use of it. Market value of concierge services can range from $25/hr to $125/hr and typically do smaller things, like event/dinner reservations or scheduling services for children. Our study assumes that the overall concierge usage results in work taking about 30 minutes to an hour of the cardholder’s time.

Auto pay: This is a feature that allows you to schedule automatic payments. It’s a common option on most credit cards and can save you time (and possibly fees if you’re forgetful). Our study values this at $25, mostly due to the time it saves (potentially about an hour per year at $25/hr) and possibly interest on a payment you forget to make.

Priority check in, security, and boarding: Our study places a value of $20, $40, and $15 for priority check in, security, and boarding respectively. This is mainly due to the time often spent doing each activity. Check ins (especially with the availability of online check in) have become relatively quick (which is why it’s only valued at $20), while security has typically been the most arduous phase of air travel for the past 20 years (so we value priority security at $40). Priority boarding often only means the difference between standing in a line and sitting in a cramped airplane seat (which is why it’s only valued at $15). The price is based on how much time you’d save waiting in line at a rate of $40/hr for one round trip per year. While the average wage is $27/hr, it’s evident that people often value convenience in captive environments more than their wages.

Conclusion

Credit card benefits are great features for savings, comfort, and convenience. And like many things, when you put a dollar value to it, you can appreciate them a little more.

What are your thoughts on credit card perks? Which ones do you like to use?

Let us know in the comments below.

FAQ

Which credit card offers the maximum benefits?

Our #1 ranked perks credit card is the American Express Platinum card, which offers a whole suite of perks beyond these 9 benefits.

Which credit card offers the best airport lounge access?

The American Express Platinum card offers the best airport lounge access of all credit cards, with unlimited access to both Priority Pass and Amex Centurion lounges for the cardholder and a guest.

How can I find the right credit card for me?

Our creditcardGenius Quiz can help you find the right credit card. Simply complete our 3 minute quiz, and we’ll find a better credit card for you. If we do, you’ll be able to refer friends and earn up to $25.

creditcardGenius is the only tool that compares 126+ features of 213 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 213 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments