Planet vs. plastics: solutions to end pollution

The scourge of plastic on our planet and health has been well documented in recent years but despite global efforts to reduce plastic production and consumption, the industry continues to grow.

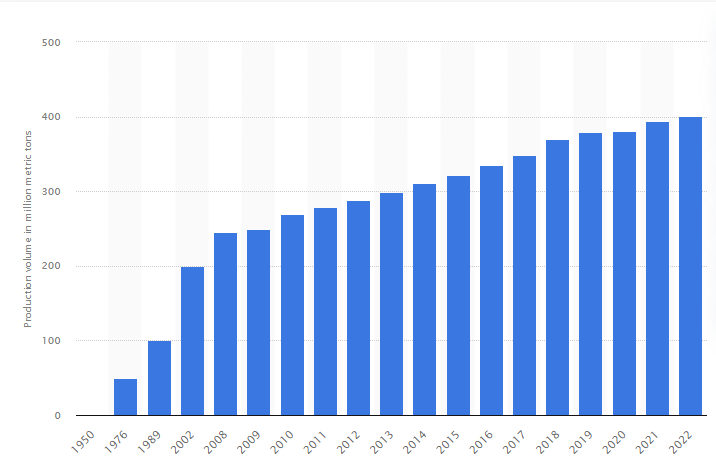

More plastic has been consumed in the past 10 years than in the entire 20th century. According to the OECD, production has grown to more than 400 million tons per year, driven by growth in emerging markets. Most of the plastic we use comes from applications with lifetimes of below five years, including packaging, consumer products and textiles. Only nine percent of plastic produced is successfully recycled, 50 percent ends up in landfill, 19 percent is incinerated and 22 percent is mismanaged, going into uncontrolled dumpsites or entering our oceans.

This not only has implications for biodiversity but also for human health, as microplastics (tiny pieces of plastic) enter our food chain and even the water we drink.

Annual production of plastics worldwide from 1950 to 2022 (in million metric tons)

Source: Statista, Global Production of Plastics Since 1950

This Earth Day, on Monday 22 April, the theme Planet vs. Plastics advocates for widespread awareness on the health risk of plastics, the rapid phase out all single use plastics, a strong UN Treaty on Plastic Pollution and an end to fast fashion, most of which contains synthetic materials such as polyester which are made from fossil fuels.

Earthday.org is demanding a 60 percent reduction in the production of all plastics by 2040. This would require producers and retailers of plastics to be liable for the cost of any environmental or health-related damages in accordance with the “producer pays” principle, along with public and private sector investments in innovation to replace all fossil fuel-based plastics.

Implications for companies and investors

The global push for a more circular economy which encourages less waste has the potential to benefit businesses and those who invest in them.

Analysis by ISS EVA shows circular economy-related businesses are returning above their cost of capital, delivering true economic profit. Further, research by the EMF has analysed the relationship between the circular economy and investment risk and return. The analysis found that the more circular a company is, the lower its risk of defaulting on debt over both one and five-year periods.

For companies in the plastic value chain that fail to evolve, the push for a more circular economy potentially means greater risk, as companies are increasingly forced to pay for their environmental impacts in the form of taxes from governments and legal challenges. The transition, liability and reputational risks these companies face warrants serious consideration by investors.

Contributing to change

Within the Uniting Financial Services investment portfolios, we adhere to an Ethical and ESG Investment Policy which seeks to avoid investing in companies which derive five percent or more of their revenue from harmful practices. These include damaging human health, damaging the environment and the destruction or wastage of natural resources for which viable alternatives exist.

We also invest in companies that promote positive change to the environment through their initiatives in reducing and recycling packaging waste. Companies like HP, Microsoft, and Proctor and Gamble have strong recycling operations and have ambitious goals in minimising their manufacturing waste, reducing their plastic footprint and moving towards 100% circularity for their products and packaging.

Our Investment Policy is aligned with the Uniting Nations Sustainable Development Goals (UNSDGs), which are widely recognised as the standard for developing a better and more sustainable future for all.

In addition to excluding certain industries, our investment managers also actively engage with companies and governments on their practices.

One of our managers, AXA Investment Managers (AXA), worked with the World Wildlife Fund in 2019 to raise awareness of biodiversity loss in the report Into the Wild – Integrating Nature into Investment Strategies.

Its recommendations included the creation of a global Taskforce on Nature Related Financial Disclosures (TNFD), with the ambition of creating the conditions to transition towards protection, restoration, and promotion of biodiversity. AXA called for an open dialogue among private and public sectors, including policymakers, with the objective of promoting cross-sectorial and international engagement. AXA is a current member of the TNFD, which was formally launched in 2021.

Another of our managers, Mirova, also recently became an early adopter of the TNFD.

As part of its commitment, Mirova regularly meets with companies to encourage circular economy principles in their processes and in the design of their products.

This includes engaging in eco-design to develop lightened products which require a limited number of raw materials that could be reused and recycled with a maximised lifespan; as well as using recycled materials in production and developing take-back initiatives to work with stakeholders to ensure effective recycling.

Conclusion

Plastic is, in many ways, a valuable resource but as a society we have developed a ‘disposable’ way of using it. Society, rather than the companies that produce plastic, has been bearing the burden of plastic pollution, with most plastic ending up in landfill, being incinerated or leaking into our oceans.

However, this is gradually changing and companies in the plastics value chain are being forced to innovate or face ongoing risks to their operating models.

While the war on plastic still has a long way to go, what is clear is that solving the issue will involve a sustained effort with close collaboration between companies, investors, and governments.

Amanda Taylor

Communications Manager, UFS

- Categories: Climate Action, Features