Connect with and learn from others in the QuickBooks Community.

Join now- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- FFCRA and CARES Acts including the PPP

- :

- How to submit PPP Loan Forgiveness Application to ...

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

This is the answer I was given this morning:

"We understand you are eager to submit your loan forgiveness application, and we apologize for the delay. Our team is diligently working to provide you with a user-friendly online forgiveness experience soon that complies with the quickly evolving guidance from the SBA. Our online forgiveness experience will help explain the complex PPP forgiveness rules, help you navigate each step of the application process and, where possible, will give you access to import information or documents from our records to help you complete your application. You will receive a notification in your account and/or via email as soon as we are ready to accept your loan forgiveness application online. You may wait to apply for loan forgiveness through our online experience or, alternatively, you may manually submit your paper loan forgiveness application and corresponding forgiveness documentation via mail to:

QuickBooks Capital

Attn: PPP Loan Forgiveness Processing

2700 Coast Avenue

Mountain View, CA 94043

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

They just told me you can email the application to [email address removed].

Ridiculous a company the size of Intuit has still not setup their online payroll when these are soon going to due.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

I just got off of the phone with someone with QB Capital.

Fill out the appropriate form for your loan forgiveness application, be it the 3508, 3508EZ or 3508S. You will need your loan # and the Lender # (which for QB capital is 529029. You will find all of this in the promissory note filed for the PPP. Send your forgiveness application to:

[email address removed]

In the subject line write: ATTN: PPP forgiveness loan application

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

I just called the number that someone else listed. They said if I didn't want to wait for their application, I can submit form 3508 to [email address removed]. Hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

Where we have to submit this form?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

Ppp at intuit dot.com

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

Hello,

I have been trying to submit the PPP loan foregiveness application for several months now. When will the PPP loan forgiveness application be available or can I submit the application directly to SBA? If I can submit directly to SBA, please provide an email address or contact info for me to do so.

Thanks

[email address removed]

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

Thanks for the mailing address!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

the email address is removed from your respond, could you pls share it again with blanks in between maybe so it doesn't get removed again. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

Could you pls share the email address again, it is removed from your response. Maybe add space somewhere so that it doesn't get removed again. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

I appreciate you for joining the thread, @UygurVisuals.

The Community page is a public place that everyone can search and look for information. Thus, Personal Identifiable Information (PII) such as email address is removed from any thread of this forum for security reasons.

As a workaround, you can ask the previous users to send you a personal message with the email information.

Here's a sample way of sending a private message here on the Community forum:

- Click on the user's name.

- Tap on Send a message.

- Enter the details of the email.

- Select on the Send Message tab.

On the other hand, you can review the details from these links for more hints about PPP:

- Prepare for Paycheck Protection Program loan forgiveness

- Paycheck Protection Program loan forgiveness

For additional resources about QuickBooks or payroll, you can also check out the topics from our help articles.

If you have any other questions about submitting a PPP loan forgiveness application, let me know by adding a comment below. I'm always here to help. Keep safe!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

I want to add to my comments in January about Intuit not providing info or accepting the forgiveness application. I called QB Capital [removed phone number] in early April as my year of having the PPP was up in early May and they accepted my application for forgiveness to send on to the SBA. Shame on intuit for not providing this information.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

Has anyone been able to apply for forgiveness through quickbooks yet

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

You can apply for the PPP Loan Forgiveness Application through QuickBooks, @cleannewyork.

If you received a loan within QuickBooks Capital, visit the PPP Center. The PPP support team can provide further information about loan forgiveness.

Here's how:

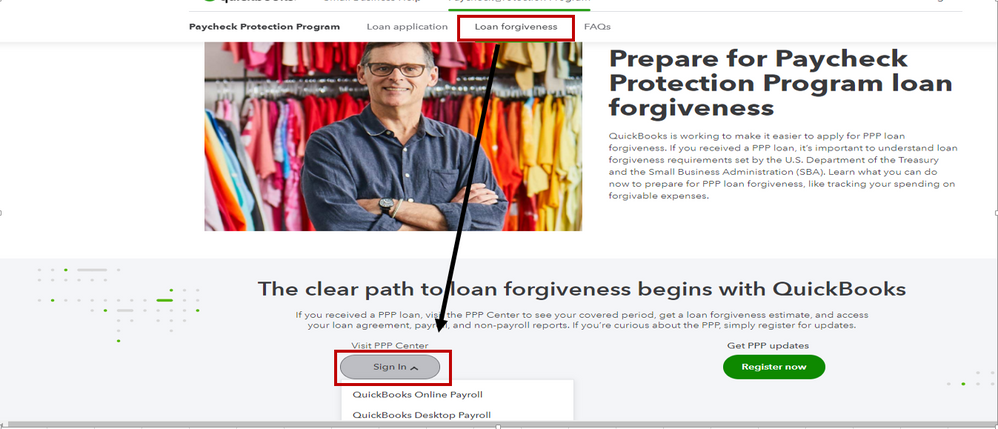

- Go to this site: Paycheck Protection Program.

- Select the Sign In drop-down to visit the PPP Center.

- Choose the QuickBooks program you're using.

- Sign in using your login credentials.

Once you're able to log in, you can get a loan forgiveness estimate, and access your loan agreement, payroll, and non-payroll reports. You can use these documents in applying for loan forgiveness. For more insights, feel free to open this article: Paycheck Protection Program loan forgiveness.

Know that you're always welcome here if you need other QuickBooks-related concerns. I'll make sure to help you right away. Have a great day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

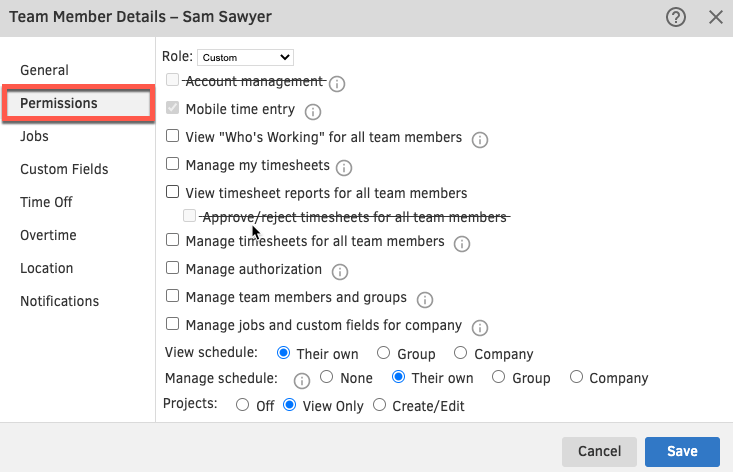

I use Quickbooks Pro 2019 Desktop. I cannot find the "PPP Notification" option in the Payroll Center after restarting the software or the computer.

How to visit the PPP Center with QuickBooks Desktop Payroll:

- If you received a PPP loan within QuickBooks Capital, simply restart your QuickBooks Desktop and select the PPP notification in the Payroll Center.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

I’m here to help you find the PPP notification option in the QuickBooks Payroll Center, @FinneyQuip.

Besides restarting QuickBooks Desktop, you’ll want to make sure also you’re up-to-date with our latest release. This way, you have uninterrupted access to the product features and other services.

You can follow these steps below to update within QuickBooks:

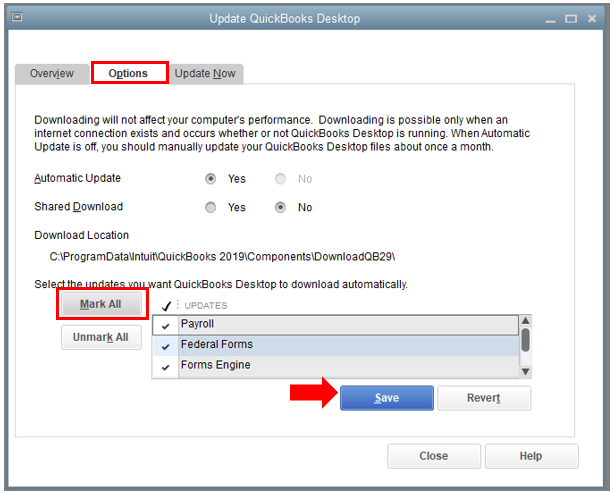

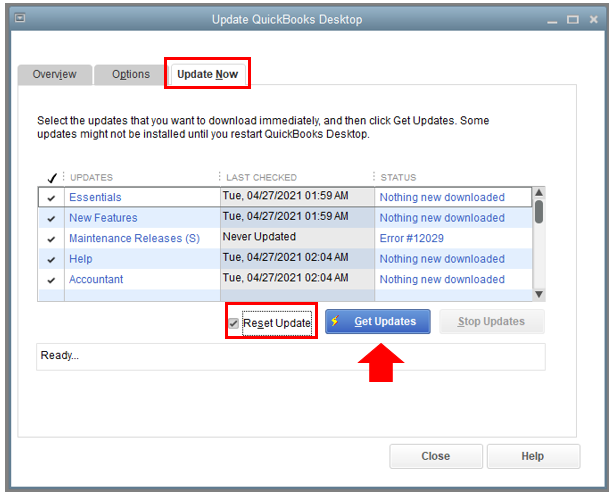

- Go to the Help menu and select Update QuickBooks Desktop.

- Click the Options tab.

- Select Mark All and then press Save.

- Go to the Update Now tab and select the Reset Update checkbox.

- When you're ready, select Get Updates.

- Close and reopen the program, then click Yes to install the updates.

- When the install finishes, restart your computer.

You can use this guide to learn more about the QuickBooks PPP Center. This contains helpful resources to improve your navigation experience.

I appreciate you for joining this thread. If you need further assistance with the notification, don’t hesitate to leave a message below. We’re always here. Take care!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

This is does not allow submission of the application for PPP loan forgiveness. I have contacted the SBA and will be filing a complaint with them regarding QuickBooks Capital if this is not resolved prior to the end of the week, May7, 2021.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

Hello, rita58.

I appreciate your time in giving us an update on the results of the steps you've done.

I understand that you wanted to submit PPP loan forgiveness, However, the steps that we provide are not working.

I recommend you to contact them thru PPP loan website.

For future reference, read through this article to learn more about PPP:

- Prepare for Paycheck Protection Program loan forgiveness

- Paycheck Protection Program loan forgiveness

If you have questions or clarifications about PPP loans, please post in the Community, We are always here to help.

l

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

Hello--I'm actually on another thread; those of us who use QB's for payroll, and need them to simply verify that they are our third party payroll provider (because they have a cover on our 941's). QB's says they have no way to "generate a cover letter." (???) Furthermore, the report we need does not populate if you didn't get the loan through QB's.

So, did anyone look into getting legal representation?

OR...where can we go with these issues? FTC? The press? Our congress people? I'm at my wits end.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

Hi amccall,

I know the importance of creating a cover letter and reports for your PPP Loan. I would recommend getting in touch with our Payroll Support Team, so they can help you with these requirements. In this way also, they can create a ticket if they need to check this further.

You can always go back to this thread if you have other questions.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

I submitted my paperwork via USPS this week (QuickBooks Capital, Attn: PPP Loan Forgiveness Process, 2700 Coast Avenue, Mountain View, CA 94043); and also sent to the email address listed in one of the threads "ppp at intuit dot com". (As stated by others it is spelled out because Intuit will delete the address.) Also, I contacted the SBA this week, and was told the lender has 60 days to submit the document to the SBA and then the SBA has 90 days to respond to the application. If the lender is not responsive, I was told to contact the individual at SBA after the 150 days. So the clock is ticking! Hope this helps a little! This is most FRUSTRATING! None of Intuit's links do anything useful!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

I was told by the SBA that you cannot submit the documents directly to the SBA. So obviously Intuit gave you wrong information. :( You must actually go through the lender to achieve forgiveness.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

Just an update on our PPP loan forgiveness application sent April 6, 2021 via email.

We received an email a few days ago that our loan has been forgiven by the SBA.

To anyone that still needs the info, I sent our application form 3508S to:

PPP at intuit dot com

I included the supporting documents (total of 7mb file) and received a confirmation of receipt from them.

We received the confirmation that our loan has been forgiven from this email:

quickbookscapital at intuit dot com

I hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

The link you provided does not work. I went into QB Desktop and opened the payroll center. Followed your instructions to the PPP report center. There I see the page you have a screen shot of. The java script "Register now" button is broken. Now a year and a half later are there any clear instructions on submitting the forgiveness application? DO NOT continue to post information on preparing for or calculating forgiveness. We do want to APPLY for forgiveness.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Email to a Friend

- Report Inappropriate Content

How to submit PPP Loan Forgiveness Application to Intuit Financing

Hello,

I was one of the frustrated customers too. I tried contacting several different departments of Quickbooks. They directed me to tech support, QB Payroll, Intuit Capital, etc. Nothing worked. Today, I finally figured out how to get to the application page. The links that were supposed to be showing under "Payroll Center" in QB Desktop never showed up for me even after doing all updates.

Here's the instructions:

- Search your E-mail Inbox for an e-mail titled: "Your Paycheck Protection Program loan is ready for review", which you received when you were approved for the 1st batch application. It was sent from [email address removed]

- Click on the "CONTINUE" button under the text

You've been approved for up to $XX,XXX.XX in a Paycheck Protection Program loan

That will open your browser and ask you to login to your Intuit account.Your offer must be accepted within XX days of this approval notice.

- Once you logged in, you will see your 1st and 2nd batch PPP loan info on the screen. Under the 1st batch, click on the button that says "Apply for forgiveness" and follow the on-screen instructions.

- You will only need to login to QB Desktop to download your PPP Cash Compensation and Tax Reports for the covered period you select.

Hope you can submit your applications with this information. Mine has gone through as I have received an-mail confirmation showing it has been received.

Featured

Welcome to our brand new series: Quick Help with QuickBooks. In this

series...

We've put together a few videos to help with QuickBooks reports. Click

on y...

With all of the resources available here in the Community, it can be

hard t...

Sign in for the best experience

Ask questions, get answers, and join our large community of QuickBooks users.

Sign In / Sign Up

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.