NEW SBA Targeted EIDL $10,000 Grant Application

Step by step instruction on how to apply for the new SBA Targeted EIDL Advance / Grant of $10,000.

DISCLAIMER This video is intended for educational purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. is providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content.

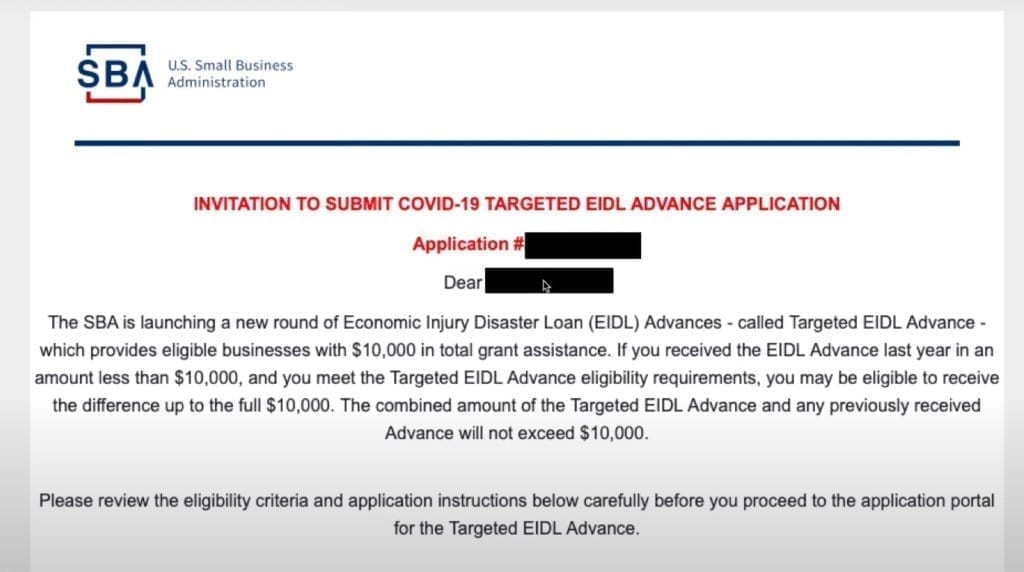

INVITATION TO SUBMIT COVID-19 TARGETED EIDL ADVANCE APPLICATION

The SBA is launching a new round of Economic Injury Disaster Loan (EIDL) Advances – called Targeted EIDL Advance – which provides eligible businesses with $10,000 in total grant assistance. If you received the EIDL Advance last year in an amount less than $10,000, and you meet the Targeted EIDL Advance eligibility requirements, you may be eligible to receive the difference up to the full $10,000. The combined amount of the Targeted EIDL Advance and any previously received Advance will not exceed $10,000.

Please review the eligibility criteria and application instructions below carefully before you proceed to the application portal for the Targeted EIDL Advance.

Businesses eligible for the Targeted EIDL Advance must meet ALL of the following eligibility criteria:

- Located in a low-income community, as defined in section 45D(e) of the Internal Revenue Code. SBA will map your business property address to determine if you are in a low-income community when you submit your Targeted EIDL Advance application.

- Suffered economic loss greater than 30 percent, as demonstrated by an 8-week period beginning on March 2, 2020, or later, compared to the previous year. You will be required to provide the total amount of monthly gross receipts from January 2019 to the current month-to-date.

- Must have 300 or fewer employees. Business entities normally eligible for the EIDL program are eligible, including sole proprietors, independent contractors, and private, nonprofit organizations. However, agricultural enterprises, such as farmers and ranchers, are not eligible to receive the Targeted EIDL Advance.

- We recommend that you have a copy of your 2019 Federal Tax Return on hand to assist you in completing the Targeted EIDL Advance application questions. You will also be asked to confirm that the information provided in your original EIDL application is still accurate. If there are any changes, you may be asked to provide documentation in order to determine if you are eligible for a Targeted EIDL Advance. Applicants that pass the initial eligibility requirements will also be required to electronically sign an IRS Form 4506-T allowing SBA to obtain tax transcripts directly from the IRS before we can approve your request for the Targeted EIDL Advance.

SBA’s goal is to process all requests within 21 days of receiving a completed application. All application decisions will be communicated via email. Due to limited available funds for the Targeted EIDL Advance program, SBA will not be able to reconsider applications through an appeal process, so please make sure that your information is correct when submitting your application.

If your request is approved, you will receive an email notification and an ACH deposit to the bank account you provided in your application. It is very important that you double-check your bank account information carefully before submitting it. Incorrect or incomplete information may result in an inability to approve your request or successfully disburse your funds. Carefully review the information below regarding bank account deposits.

Double-check that your account number and routing number are correct. They should be located at the bottom of your checks, if available. Log into your online banking account and locate that information there or contact your bank for confirmation. #eidlgrant #sbagrant #targetedeidladvance #sba #eidladvance

Video Transcript

The SBS has started accepting applications for their new Targeted EIDL grant. And in this video, we’re going to show you step-by-step how to complete this application so you can get your grant as soon as possible. So thank you for watching this video.

Hello from FreedomTax Accounting. We are an accounting firm where we have been providing quality tax and accounting services now for over 20 years, if you’re new to this channel, we provide strategies for small business owners, so they can achieve their financial goals.

Although for the last couple of months, we have been concentrating on the PPP and EIDL loan programs. Now we are recording this video on February 10th, and we always emphasize the date on the recording on any video related to PPP and EIDL loans, because these programs are constantly changing. So there may be things we discuss in this video that may change as soon as tomorrow. So that’s the importance of subscribing to our channel, that way you’re always up to date with the most accurate and correct information regarding these loans.

Now there is a new SBA grant. The official name is the Targeted EIDL Advance, that’s the official name that you will see on the SBA website. The most important thing that you need to know right now, is that there’s no place you can go to apply. There’s no link, there’s no website. You cannot apply for it on the SBA website, you cannot fill out a new EIDL loan application.

Basically, the only way you can apply for this advance right now is to wait for the SBA to email you. So you have to wait for an SBA agent to emails you. Why? Because the SBA started sending out emails on February 1st. And the SBA has stated that they’re going to send out emails in two waves.

The first wave is for businesses that applied for the EIDL in 2020, they got some amount of the grant, but they did not get the full $10,000. For example, if you’re an independent contractor and you applied for the EIDL in 2020, you should have received a thousand dollar ideal grant. So you are part of this first wave.

So people who applied for the EIDL in 2020 got the grant, but they did not get the full $10,000, those are the businesses that the SBA starting to email. Now then the SBA said that the second wave of emails is going for businesses that applied for the EIDL before December 27th, but they did not get EIDL Advance or grant.

Why? Because if you remember on July 11th of 2020, the funds for the EIDL grant ran out. So, if you applied for an EIDL on July 11th or later, then there were no funds available to get the grant. So for those of you who applied for the EIDL alone and they not get their grant in 2020, then you are going to be on the second wave of the emails to apply for this targeted EIDL advanced so you will get an email from the SBA.

That email is going to come from this email address.

The email address is [email protected] and we emphasize this is where the email is coming from, because right now there’s a lot of fraud and a lot of fakers sending out emails, trying to get your confidential information. So make sure that if you provide information via email for this SBA Advance. The email is coming from the [email protected] email. So watch out because there’s a lot of fraud going around and you don’t want to be a target of identity theft. The email. It looks like this.

Basically, it’s an email that says “invitation to submit the COVID 19 targeted EIDL advanced application” is going to have your application number for your first EIDL and it’s going to have your name here.

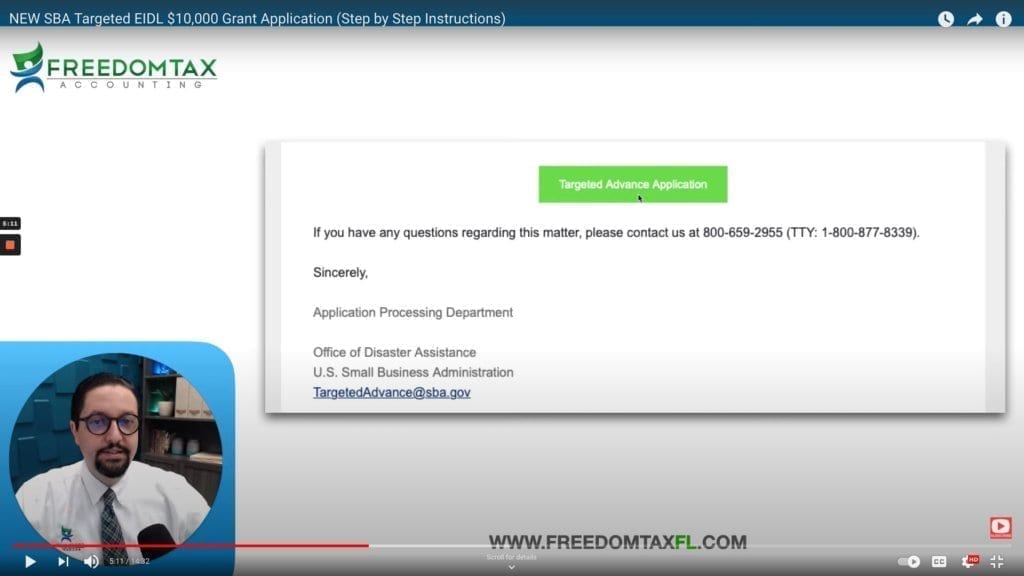

So this is what the email looks like at the bottom of the email. There’s a green button that says “Targeted Advanced Application“.

You click that green button and that’s the start of the application process.

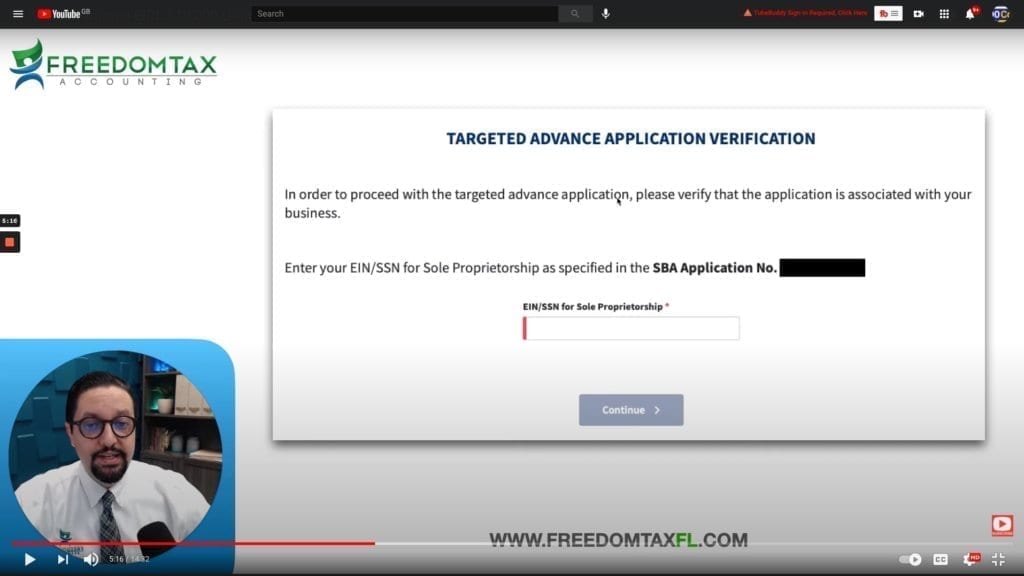

The first thing you will see is that they’re going to ask for the EIN or your social security number that you used to apply for the EIDL in 2020, if you’re working under an LLC, a corporation, a business, then in this box, you put your business EIN number.

If you’re a sole proprietor, independent contractor that. Then here, you will put your social security number.

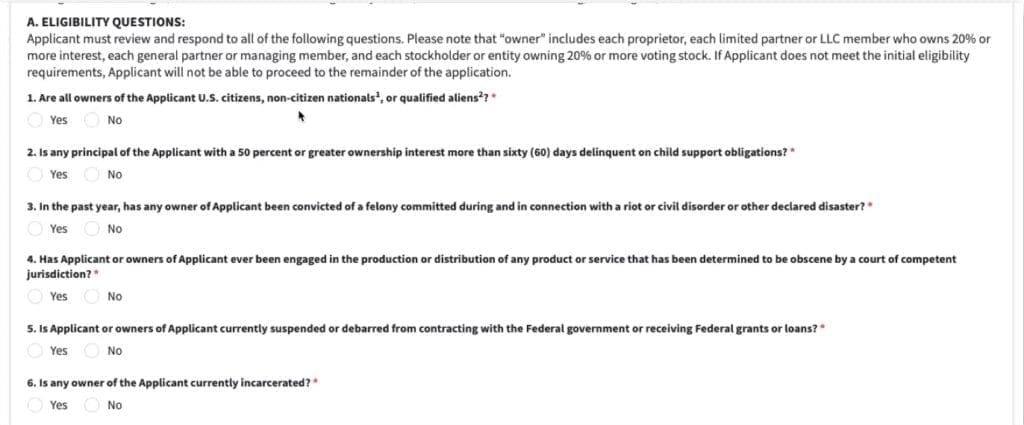

You click continue, and then it’s going to ask you a bunch of questions. There are like 15 questions. So read through them carefully and answer them correctly. For most of you, basically, number one is going to ask.

If the owners are us citizens, non-citizens nationals or qualified aliens, most of you are going to answer. Yes. And then the rest of the, of the questions, most of you are going to answer. No, because the rest of the questions answer if you’re in bankruptcy if you are doing illegal business. So, but reef read through them carefully and answered them correctly.

Once, but at the bottom of the questions, one important question is “how many employees does applicant have as of the date of this targeted E I D L advanced application“. If you’re self-employed independent contractors and you don’t have employees, then here, you’re going to put one because that’s you, the owner now, remember that if you are self-employed independent contractors or any business, people who you pay with 1099 who are independent contractors. Those are not considered employees. Employees are people that you have on payroll that you give them a w2 at the end of the year. So I wanted to emphasize that little detail when you answered this question at the end of all the questions you have to answer.

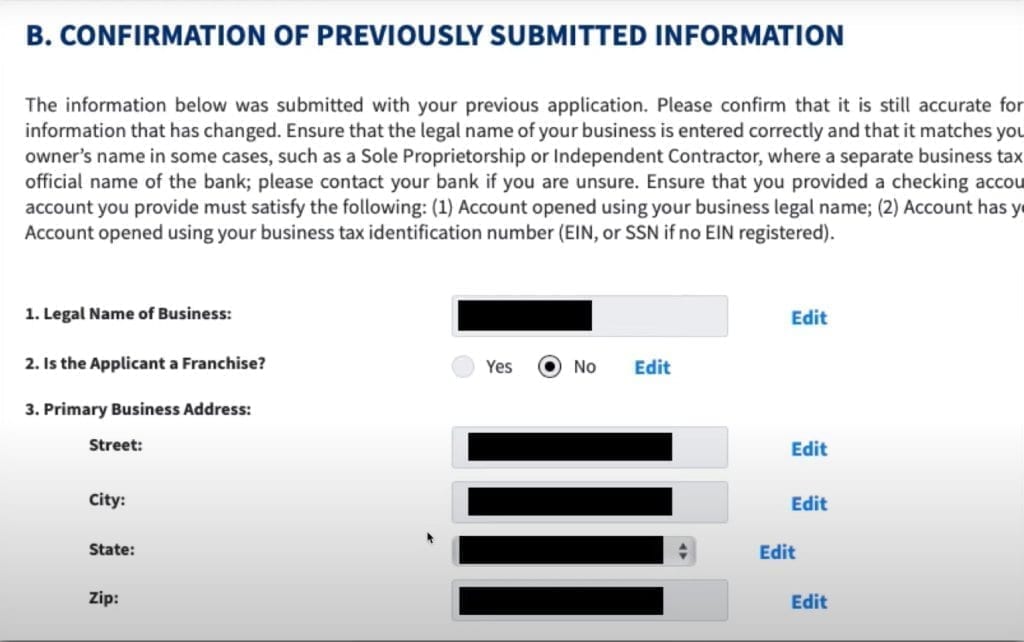

Now later, then you have to confirm your business information is good. You have to confirm your business name, your business address.

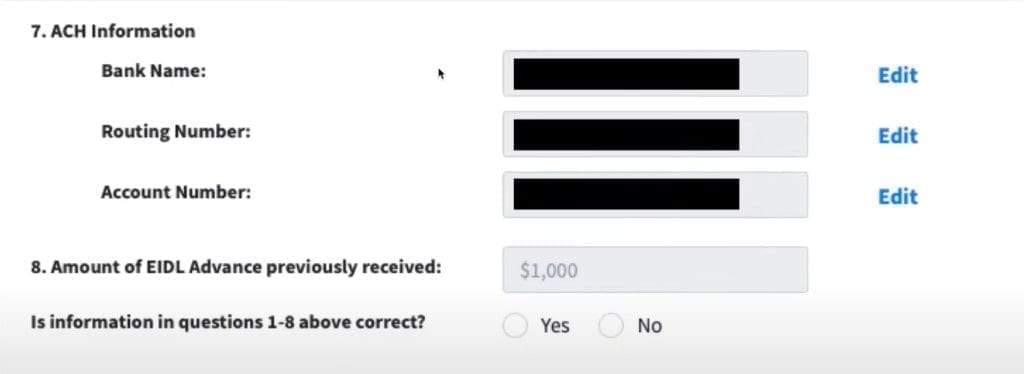

You’re going to have to confirm your bank information. So make sure that the SBA has your correct bank information. If you applied for an EIDL last year and you have a new bank account now then update your bank information is going to ask you the amount of the EIDL Advance that you received in 2020. In this case, this business received a thousand dollars EIDL grant in 2020.

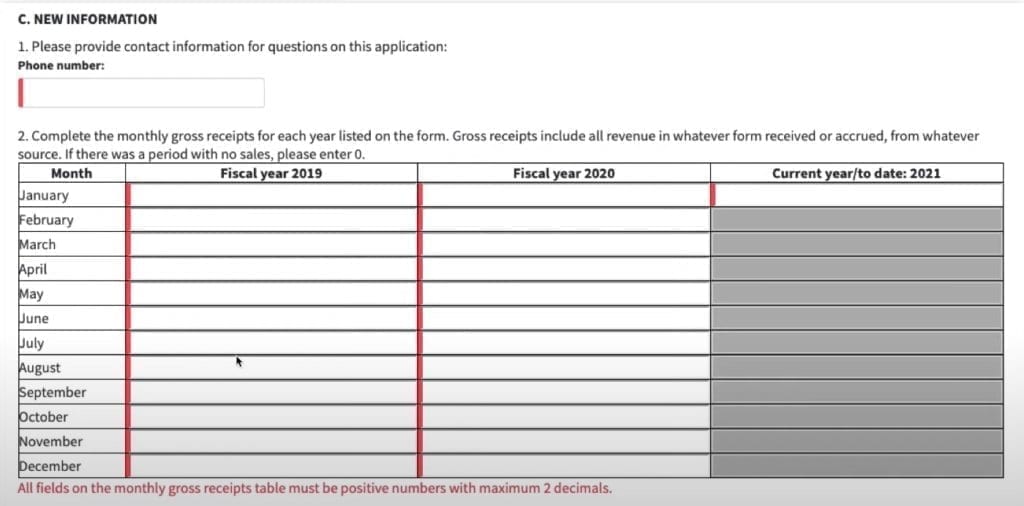

So here it says a thousand dollars. You, you continue answering thE documentations and then this is where basically most of you, or this is where you’re going to have to spend most of your time doing this application on the top, you’re going to put your phone number. And then it’s asking from 2019, 2020, and January, 2021 per month, you have to put your monthly gross receipts or your monthly.

Revenue for every month. So you’re going to have to go through your financial statements through your bank statements and put the amount of grocery seats month by month for 2019, 2020, and January of 2021. If you had a month that you were not operational, or you had zero sales, then you put zero.

For example, if you opened in July of 2019, then for the month prior to that, you’re going to put zero. Then you have to click and certified that the information provided is true, because then if you are lying on this application and they find out, then you can get into legal trouble with the federal government, you submit the application, and at the end you get a new confirmation number.

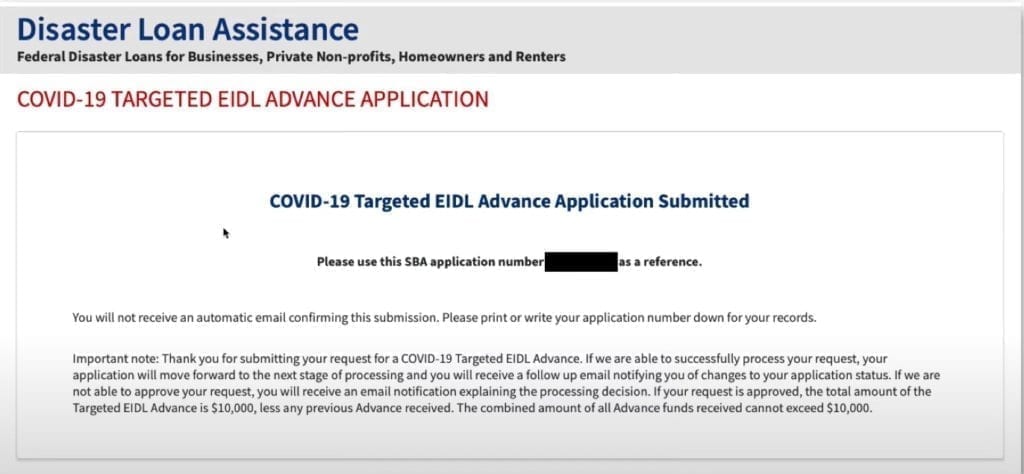

They give you a new targeted EIDL advanced application confirmation number. They give you the number here. You do not get a confirmation email. So once you get to this page, take a screenshot, take a picture because they will not send you this application number via email.

And basically, you’re done. Now that the SBA email says that once you submit this part of the application, the SBA is going to check if you are eligible to be eligible for this Targeted EIDL Advance, you have to meet three eligibility requirements.

- The first one is that your business is located in a low-income community. The SBA says that they will map your business address and they will determine if you are in a low-income community.

- Also, you’re going to have to show that you suffered economic loss greater than 30%. That’s why they ask you to put the monthly gross receipts. For 2019 and 2020, because they’re going to check your sales and see if you’re eligible for the grant because you have to show a reduction of revenue of at least 30%.

Now we suggest that you have your monthly bank statements or your monthly financials, like your profit and loss. Ready because we feel they are going to ask for these to confirm that the information you put on the application is correct.

- And also you must have 300 or if your employees. Once the applicants pass the initial eligibility requirements, that’s BA says that they will ask for further documentation.

Most probably they’re going to ask for your monthly bank statements or your monthly profit and losses because they are going to want to check that the amount of sales of monthly sales that you put in the application are accurate. And also most probably they’re going to ask for some kind of documentation to confirm your business address they may ask for a phone bill utility, bill, something to confirm. That the address you put in the application is actually your business address. And they say you will be also required to sign an IRS Form 4506T. This is a document that you need to send to the SBA so they can ask for the IRS transcript.

Most so basically the IRS, the SBA is making sure that the information that you put on the application is accurate? So it’s not that as easy as it was in 2020. Now the SBA also says that the SBAs goal is to process the applications, we then 21 days, that decision will be communicated to you via email.

Unfortunately, if you get denied, you will not be able to ask for reconsideration. So if you get denied, there’s no way of telling the SBA. “Please reconsider my application”. The SBA will make the payment via ACH payment to your bank account. So make sure that you provide the SBA with the correct bank information and the amount you’re going to get is the remaining balance of EIDL Advance you got in 2020 up to $10,000.

So if you got a thousand dollars grant in 2020, you’re going to get the remaining $9,000. Or if you did not get an EIDL grant in 2020, you’re going to get the full $10,000 EIDL Advance. So basically that is it remembered that we are a full-service accounting firm.

If you need any help with your personal or business taxes, this is our contact information.

- Address: 1016 E Osceola Parkway, Kissimmee, 34744, Florida, United States

- Telephone: 407-502-2400

- E-mail: [email protected]

Also, we are part of Freedom Group where we are our group of four companies,

So we can help you in many ways.

Thank you for watching this video. Remember to subscribe to this channel and if you have received value out of this information like this video and share it with someone that can take advantage of this information.

Thank you for watching. God bless you. Bye-bye.

FAQ

Application Process

1. Can I apply now?

Applicants must wait until they receive an email invite from the SBA to apply for the new Targeted EIDL Advance. In accordance with the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues Act (Economic Aid Act), businesses and nonprofit organizations that received a previous EIDL Advance in an amount less than $10,000 will have first priority to apply for the Targeted EIDL Advance and will be the first group to receive email invites to the application portal. The second priority group are businesses and nonprofit organizations that applied for EIDL assistance before December 27, 2020 but did not receive an EIDL Advance because available funding was exhausted in mid-July 2020. [Note: Businesses and nonprofit organizations with COVID-19-related losses can still apply for an Economic Injury Disaster Loan (EIDL), if they have not done so already. More information about the loan program can be found at www.sba.gov/coronavirusrelief .]

2. When will the SBA begin sending email invites to the first priority group?

The SBA will begin sending email invites to businesses and nonprofit organizations that received the EIDL Advance in an amount less than $10,000 starting on February 1, 2021. It may take several weeks before all emails are sent to businesses in the first priority group so please do not be alarmed if you do not receive your email invite right away. The invite to apply will be sent to the primary contact email address associated with your original EIDL application. All communications from SBA will be sent from an official government email with an @sba.gov ending. Please do not send sensitive information via email to any address that does not end in @sba.gov.

3. When will the SBA begin sending email invites to the second priority group?

The SBA will closely monitor the rate of applications and approvals for the first priority group and will announce a projected start date for the second priority group at a later date.

4. Does the SBA plan to open up the program to new applications beyond the first two priority groups?

Currently, there are no plans to open the Targeted EIDL Advance program to new applicants beyond the first two priority groups. The SBA’s ability to accept new applications for the Targeted EIDL Advance program will depend on the availability of funds, which the SBA will closely monitor. Any changes to application availability will be announced on www.sba.gov/coronavirusrelief.

5. Do I have to re-apply if I received less than the $10,000 limit of Advance funds?

No. The Targeted EIDL Advance is a different program than the original EIDL Advance and has a different process. Here, the SBA will reach out directly to EIDL applicants who received an EIDL Advance of less than the $10,000 maximum and provide instructions to the business owners about how to provide the SBA with the required information to determine eligibility, and how to submit documentation for any additional grant funds.

6. Should I re-apply if I didn’t receive the original EIDL Advance funds because those funds were exhausted?

No. The Targeted EIDL Advance is a different program than the original EIDL Advance and has a different process. Here, the SBA will reach out to applicants who applied for SBA COVID-19 EIDL funding before December 27, 2020 and did not receive any EIDL Advance funds because all available Advance funding was already exhausted. The SBA will email instructions on how to provide the SBA information to determine eligibility and how to submit the necessary documentation. These businesses must also have 300 or fewer employees, in addition to being located in a federally designated low-income community and meet the reduction in revenue requirements.

7. While I am waiting for the SBA invitation to apply for the Targeted EIDL Advance, what are some things I can do to prepare to apply?

If you have not yet filed your 2019 Federal Tax Return, you should complete that process. You will also be required to provide the business’ monthly gross receipts for each month from January 2019 through the most recent month-to-date period. This information will be used to determine that your business meets the greater than 30 percent reduction in revenue requirement during an 8-week period beginning on March 2, 2020.

8. What documentation will I need to provide?

Applicants who meet the low-income community criteria will be asked to provide gross monthly revenue for January 2019 through the most recent month-to-date period (all forms of combined monthly earnings received, such as profits or salaries) to confirm the reduction in revenue. They may also be asked to provide an IRS Form 4506-T to allow the SBA to request tax information on the applicants’ behalf. Tax verification process and requirements for businesses in U.S. territories may differ.

9. My business is located in a U.S. territory. What documentation does the SBA require from us?

Virgin Islands, American Samoa, Guam, and CNMI: Businesses must provide an e-signed IRS Form 4506-T to the SBA via the application portal. Puerto Rico: The SBA will send required forms via email to the applicant. Please complete the forms and send them back to the SBA.

Eligibility

10. My business moved since I originally applied for EIDL assistance. Am I still eligible for the Targeted Advance?

The SBA will reach out to you directly to confirm your address. If your address has changed, the SBA will request additional documentation to confirm the location. Once the location is confirmed, the SBA will determine if the location is located within a low-income community.

11. Who is eligible for the new Targeted EIDL Advance?

Businesses that have 300 or fewer employees, are located in federally identified low-income communities and can demonstrate a reduction in revenue of more than 30 percent during an 8- week period beginning on March 2, 2020 or later. This includes small business entities normally eligible for the SBA EIDL program, including non-farm businesses and corporations, sole proprietors, independent contractors, and private nonprofit organizations.

12. We have not filed a 2019 Federal Tax return. Are we still eligible?

In most cases, SBA requires a 2019 Federal Tax Return to be filed with the IRS to verify your eligibility. Certain organizations that were not required to file a 2019 Federal Tax Return are still eligible, such as churches.

13. Are Agricultural Enterprise businesses eligible for the new Targeted EIDL Advance?

No. Under the Targeted EIDL Advance, Agricultural enterprises are not eligible except for agricultural cooperatives, businesses engaged in aquaculture and certain types of nurseries. Nurseries that derive less than 50 percent of annual receipts from the production and sale of ornamental plants and other nursery products that they grow are eligible. Agricultural Enterprise businesses include businesses engaged in the legal production of food and fiber, ranching, and raising of livestock, and all other farming and agricultural related industries (as defined by section 18(b) of the Small Business Act (15 U.S.C. 647(b)).

14. What types of businesses are NOT eligible?

Some examples of ineligible businesses include those engaged in illegal activities, loan packaging, speculation, multi-sales distribution, gambling, investment or lending.

Program Criteria

The Economic Aid Act, signed into law on December 27, 2020, authorized the SBA to provide additional EIDL Advance funds to certain small businesses that meet specific eligibility criteria. Currently, these Targeted EIDL Advance funds are only available to businesses with 300 or fewer employees that had previously applied to the SBA for EIDL assistance before December 27, 2020 and where the business address is located in a low-income community. Businesses must also demonstrate a reduction in revenue greater than 30 percent and must meet the same eligibility requirements applicable to COVID-EIDLs.

16. How do you determine whether a business is located in a low-income community?

We use the definition of low-income communities outlined in the subparagraphs (1), (3), (4) and (5) of 26 USC §45D(e). The SBA will determine if your business is located in a low-income community based on the applicant business address.

17. Do I have to repay any Targeted EIDL Advance funds that I receive?

No. As with the EIDL Advance funds under the CARES Act, these Advances do not have to be repaid.

18. How much can my business receive from the Targeted EIDL Advance funds?

Businesses can receive a maximum of $10,000 in EIDL Advance funds. That includes any Advance funds already received plus the Targeted EIDL Advance.

19. What can I use the EIDL Advance funds for?

EIDL Advance funds can be used for working capital and normal operating expenses that could have been met had the disaster not occurred. Those include (but aren’t limited to) continuation of health care benefits, rent, utilities and fixed-debt payments.

20. How long will it take to receive the Advance funds once my information is submitted to the SBA?

Once the SBA has received all requested documentation, we will process the information and issue any additional funds as quickly as possible. The SBA’s goal is to process all requests within 21-days of receiving a completed application. All application decisions will be communicated via email.

21. Will the Targeted EIDL Advance funds I receive be subtracted from my Paycheck Protection Program (PPP) loan forgiveness amount?

No. The Economic Aid Act has eliminated that requirement.

22. How does the SBA define “gross receipts” for the EIDL Targeted Advance Program?

Gross receipts include all revenue in whatever form received or accrued (in accordance with the entity’s accounting method) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees or commissions, reduced by returns and allowances for the applicant business.

23. Who should business owners contact with additional questions about these Targeted Advances?

Business owners can contact SBA’s Customer Service Center at 1-800-659-2955 or by email at [email protected] if they have questions about the Targeted EIDL Advance program.

Subscribe to my channel

Subscribe to my channel