Leasehold Meaning

A leasehold is a lawful property tenure wherein the landowner (lessor) offers temporary ownership rights to the leaseholder (lessee) for a fixed term. It fulfills both short and long-term residential requirements without ownership costs. Moreover, the lease duration is a maximum of 99 years long.

The lease document comprises all essential details such as beginning and ending date, tenure, payment amount, and increasing percentage. Also, it is feasible to extend, modify, or terminate the lease term. When the lease ends, the lessorLessorA lessor is an individual or entity that leases out an asset such as land, house or machinery to another person or organization for a certain period.read more automatically obtains the leasehold property ownership.

Table of contents

Key Takeaways

- A leasehold is a legitimate property tenure between the lessor and the lessee for a predetermined period (not more than 99 years). It is also possible to end, renew, or change the lease.

- The advantages include affordability, quality amenities, tax benefits, and short-term residential facility.

- The disadvantages cover potential project delays, lessees’ financial burden, minimum liberty, and higher deposits.

- Freehold and leasehold are two different legal land ownership forms. The former allows the renting of a property, while the latter grants estate ownership.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Leasehold (wallstreetmojo.com)

Leasehold Explained

A leasehold permits an entity to legally acquire an asset (usually a property) from its owner and contrasts with a freehold wherein the lessor sells the property to the buyer. Upon the violation of its terms, the sufferer might certainly sue the guilty one and claim compensation payment. Moreover, the leasehold advisory service also comes in handy for insightful suggestions for agreements on houses or commercial land.

Please note that the renter is not compelled to leave the estate upon leaseLeaseLeasing is an arrangement in which the asset's right is transferred to another person without transferring the ownership. In simple terms, it means giving the asset on hire or rent. The person who gives the asset is “Lessor,” the person who takes the asset on rent is “Lessee.”read more expiration. Rather, both parties may prolong the leasehold on houses for a consensual duration or get recommendations from advisory services. Selling real estateReal EstateAt its most basic principle, Real Estate can be defined as properties that comprise land and its tangible attachments. The land includes the actual surface of the earth and any permanent natural objects such as water, dirt, or rock and any minerals or particulars under the surface. read more with a long-term lease period is easier than with a short-term lease period.

For leasehold property discontinuation, the landholder must get tribunal authorization as well as dispatch an official written letter to the lesseeLesseeA Lessee, also called a Tenant, is an individual (or entity) who rents the land or property (generally immovable) from a lessor (property owner) under a legal lease agreement. read more. Moreover, the latter must submit at least a 1-month notice beforehand to end the tenancy.

So, let’s discuss the lessee’s duties and rights:

- Property remodeling

- Discharge of maintenance costs

- Repairing liability

- Knowledge of insurance or additional charges, service, and management fees

- Perceiving the lessor’s name and location

- Challenging specific fees in some cases

Please note that the proprietor is legally bound to offer the stated details. Moreover, the occupants must examine contract terms before the final decision. They may also consult with the leasehold advisory service for exceptional guidance.

Accounting for Financial Analyst (16+ Hours Video Series)

–>> p.s. – Want to take your financial analysis to the next level? Consider our “Accounting for Financial Analyst” course, featuring in-depth case studies of McDonald’s and Colgate, and over 16 hours of video tutorials. Sharpen your skills and gain valuable insights to make smarter investment decisions.

Examples

Example #1

Suppose that an IT consulting firm named The Innovation Ltd. leases out a building. However, the establishment lacks the required number of cubicles and meeting rooms, faulty wiring, faded wall paint, and improper fencing.

So, the firm spends $500,000 on the structure remodeling, also called leasehold improvement. Nonetheless, the company can’t disburse the amount throughout one fiscal yearFiscal YearFiscal Year (FY) is referred to as a period lasting for twelve months and is used for budgeting, account keeping and all the other financial reporting for industries. Some of the most commonly used Fiscal Years by businesses all over the world are: 1st January to 31st December, 1st April to 31st March, 1st July to 30th June and 1st October to 30th Septemberread more. Hence, it spreads the capital over the 15-year-long lease period and the improvement amount is amortized equally throughout the lease duration.

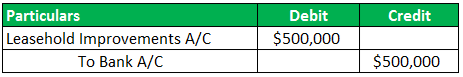

Journal entry for amount expenditure:

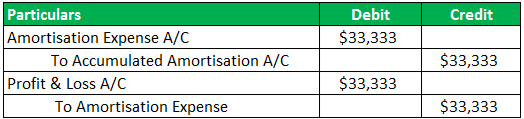

Moreover, the Journal entry for annual amortization of leasehold improvement:

The accumulated amortizationThe Accumulated AmortizationAccumulated amortization is an aggregated value of the amortization expense that has been recorded for an intangible asset based on the cost, lifetime and usefulness that has been allocated to the asset in producing the units.read more balance will surge by $33,333 per year, amounting to $500,000 by the 15th year. After that, the improvement charges would be completely amortized, nullifying the improved balance. As a result, the netbook value would also become zero.

Example #2

The UK home builder Taylor Wimpey has decided to discontinue contract regulations forcing lessees to pay doubled rent every ten years. The decision was taken after the Competition and Markets Authority (CMA) started the investigation in September 2021.

The ground rent of the affected lessees won’t increase and will sustain the same amount charged initially upon home purchase. Moreover, Britain’s no. 3 homebuilders stated in a separate statement that the price of dropping the provision is within the regulations reserved in 2017 for the same coverage.

CMA has also lodged cases against Countryside Properties Plc., Persimmon Plc., and Barratt Development Plc.

Advantages And Disadvantages Of Leasehold

To clarify, buying estates on lease has its pros and cons. Let’s consider both in detail.

Advantages

- Regarding freehold and leasehold, the latter is more budget-friendly and also protects the firms from vast capital expenditureCapital ExpenditureCapex or Capital Expenditure is the expense of the company's total purchases of assets during a given period determined by adding the net increase in factory, property, equipment, and depreciation expense during a fiscal year.read more and operating expensesOperating ExpensesOperating expense (OPEX) is the cost incurred in the normal course of business and does not include expenses directly related to product manufacturing or service delivery. Therefore, they are readily available in the income statement and help to determine the net profit.read more through genuine advisory services.

- Generally, the immediate vicinity has superior connectivity and infrastructureInfrastructureInfrastructure refers to fundamental physical and technological frameworks that a region or industry establishes for its economy to function properly.read more.

- The earned interest is certainly a good revenue source with a tax benefitTax BenefitTax benefits refer to the credit that a business receives on its tax liability for complying with a norm proposed by the government. The advantage is either credited back to the company after paying its regular taxation amount or deducted when paying the tax liability in the first place.read more for retirees gaining a specified income amount.

- The lessee can claim an estate without bearing the actual ownership costs.

- Above all, it fulfills short-term residentiary requirements.

- Some leased properties also cover additional facilities like a gym, parking area, swimming pool, library, etc.

Disadvantages

- Probable project incompletion or postponement because of inadequate capital for construction.

- To clarify, the lessee or tenant bears the load of consistently surged ground rent and other expensesOther ExpensesOther expenses comprise all the non-operating costs incurred for the supporting business operations. Such payments like rent, insurance and taxes have no direct connection with the mainstream business activities.read more.

- Above all, the tenant receives minimal independence.

- Leasehold on houses mandates higher deposits as compared to freehold premises.

- In addition, the lessee does not benefit from an increased land value.

- It is equally disadvantageous for the lessorLessorA lessor is an individual or entity that leases out an asset such as land, house or machinery to another person or organization for a certain period.read more due to consistent obligations like insurance and repairing charges.

Leasehold vs Freehold

| Particulars | Leasehold | Freehold |

| Definition | The landlord rents the premises to the buyer for a set period. | The buyer owns the premises. |

| Buyer status | Lessee | Landlord |

| Pricing | Low-priced | High-priced |

| Sale of property | More paperwork | Less paperwork |

| Ownership | Renewed after the lease expiration date | Indefinite |

| Tenure | Maximum 99 years | According to town planning officials |

| Financing | Complicated financing | Easier financing |

| Deposit requirements | Higher deposits | Lower deposits |

| Benefits | Renewable by the end of the term | Full ownership |

| Liberty of land renovation | ||

| Lessor is mainly responsible for property maintenance | Transferable through generations |

Frequently Asked Questions (FAQs)

A leasehold is a type of lawful land ownership that allows the buyer (lessee) to acquire the realty from the landlord (lessor) for a predetermined period. The lease term is certainly not more than 99 years. Once the lease expires, the buyer may request its renewal to the lessor for a given duration.

The landlord primarily owns leasehold improvements on houses or commercial properties. However, if the lessee refurbishes the leased space, the lessor may offer an allowance for the same. It may be an approximate payment, decreased future rental amount, or both. The Internal Revenue Service (IRS) allows the capitalization of these improvements amounting to at least $50,000.

The IRS permits the lessee to depreciate any permanent capital modifications made to the estate. Moreover, the qualified leasehold improvement property whose original usage begins with the taxpayer is eligible for 30%, 50%, or 100% bonus depreciation. It is depreciated over ten years or the remaining lease period, whichever comes first.

Recommended Articles

This article has been a guide to Leasehold and its meaning. Here we explain leasehold on houses, the pros & cons, examples, and how it differs from freehold. You can learn more from the following articles –

Leave a Reply