Tangible net worth is the company’s total net worth that does not include the value of the company’s intangible assets like copyrights, patents, etc. It is calculated as total assets minus total liabilities and intangible assets.

Definition of Tangible Net Worth

Tangible net worth refers to the worth of the company. It includes only tangible assets of physical existence and excludes intangible, e.g., patents, copyrights, intellectual property, etc.

Examples of tangible assetsExamples Of Tangible AssetsTangible assets are assets with significant value and are available in physical form. It means any asset that can be touched and felt could be labeled a tangible one with a long-term valuation.read more include real estate, cash, plant and machinery, homes, etc. On the other hand, intangible assetsExamples Of Intangible AssetsSome of the most common intangible assets are logos, self-developed software, customer data, franchise agreements, Newspaper Mastheads, license, royalty, Marketing Rights, Import Quotas, Servicing Rights etc.read more are intellectual property, goodwillGoodwillIn accounting, goodwill is an intangible asset that is generated when one company purchases another company for a price that is greater than the sum of the company's net identifiable assets at the time of acquisition. It is determined by subtracting the fair value of the company's net identifiable assets from the total purchase price.read more, patents, copyrights, etc. Anything that is not physical and cannot be felt or touched is an intangible asset.

Table of contents

Key Takeaways

- Tangible net worth refers to the company’s net worth that includes only tangible assets after deducting liabilities and intangible assets like goodwill, patents, copyrights, and royalties.

- It is not a helpful valuation method if the company makes consecutive losses for more than three fiscal years.

- Knowing the tangible net worth may help the company evaluate its financial position regardless of its economic situation. It may also help in planning for the financial future.

- It is only a helpful metric if the company has no other entity in operations or has a non-subsidiary.

Tangible Net Worth Formula

Following is the formula:

Tangible Net Worth Formula = Total Assets – Total Liabilities – Intangible Assets

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Tangible Net Worth (wallstreetmojo.com)

- Total assets refer to the total number of asset of the balance sheetAsset Of The Balance SheetAssets in accounting refer to the organization's resources that hold specific economic value and facilitate business operations, meet expenses, and generate cash flow. They create the company's worth and are recorded in the balance sheet.read more. It refers to the total assetThe Total AssetTotal Assets is the sum of a company's current and noncurrent assets. Total assets also equals to the sum of total liabilities and total shareholder funds. Total Assets = Liabilities + Shareholder Equityread more number of that particular year in the balance sheetBalance SheetA balance sheet is one of the financial statements of a company that presents the shareholders' equity, liabilities, and assets of the company at a specific point in time. It is based on the accounting equation that states that the sum of the total liabilities and the owner's capital equals the total assets of the company.read more.

- Total liabilities refer to the total number of liabilities on the balance sheet. It refers to the total asset number of that particular year on the balance sheet.

- Intangible AssetsIntangible AssetsIntangible Assets are the identifiable assets which do not have a physical existence, i.e., you can't touch them, like goodwill, patents, copyrights, & franchise etc. They are considered as long-term or long-living assets as the Company utilizes them for over a year. read more refer to intangible assets that lack physical substance and existence.

How to Calculate Net Worth of a Company Explained in Video

Calculation of Tangible Net Worth (with Example)

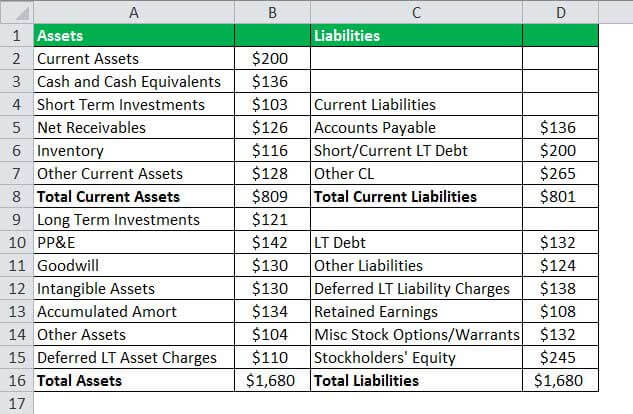

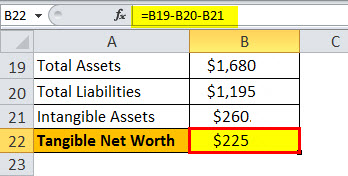

Below is the balance sheet for fiscal 2012-2013 of a company in the manufacturing industry in the United States. It prepares its finances according to U.S. GAAPGAAPGAAP (Generally Accepted Accounting Principles) are standardized guidelines for accounting and financial reporting.read more. An analyst wants to analyze the firm’s balance sheet position and calculate its tangible net worth.

We have taken liabilities of the company to expect the shareholder equityShareholder EquityShareholder’s equity is the residual interest of the shareholders in the company and is calculated as the difference between Assets and Liabilities. The Shareholders' Equity Statement on the balance sheet details the change in the value of shareholder's equity from the beginning to the end of an accounting period.read more, retained earningsRetained EarningsRetained Earnings are defined as the cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the company. It is shown as the part of owner’s equity in the liability side of the balance sheet of the company.read more, and ESOP’s.

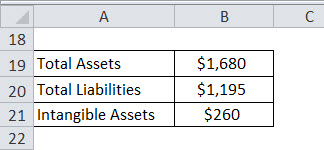

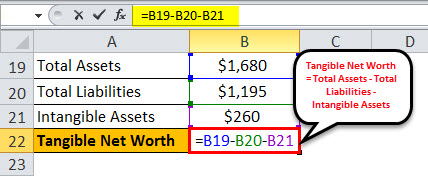

Solution:

Tangible net worth can be calculated as follows,

= $1,680 – $1,195 – $260

Tangible Net Worth = $225.

Financial Modeling & Valuation Courses Bundle (25+ Hours Video Series)

–>> If you want to learn Financial Modeling & Valuation professionally , then do check this Financial Modeling & Valuation Course Bundle (25+ hours of video tutorials with step by step McDonald’s Financial Model). Unlock the art of financial modeling and valuation with a comprehensive course covering McDonald’s forecast methodologies, advanced valuation techniques, and financial statements.

Advantages

- It is also a valuation method. If the company is making constant profits, we can judge the company’s net worth.

- Calculating it is quite simple.

- Reviewing the net worth statements over time can help determine its strategic initiatives. It also helps to determine how much liquidityLiquidityLiquidity is the ease of converting assets or securities into cash.read more does the business has to start the initiatives.

Disadvantages

- Tangible net worth is a very generic term.

- It is only useful metrics if the company has no other entity in operations or has non-subsidiary, etc.

- It is not a useful valuation methodMethod Of The ValuationDiscounted cash flow, comparable company analysis, comparable transaction comps, asset valuation, and sum of parts are the five methods for valuing a company.read more if the company makes consecutive losses for more than three fiscal yearsFiscal YearsFiscal Year (FY) is referred to as a period lasting for twelve months and is used for budgeting, account keeping and all the other financial reporting for industries. Some of the most commonly used Fiscal Years by businesses all over the world are: 1st January to 31st December, 1st April to 31st March, 1st July to 30th June and 1st October to 30th Septemberread more.

Conclusion

Knowing the tangible net worth can help a company evaluate its current financial health regardless of its economic situation. It also helps plan for the financial future. Knowing where it stands financially will make a company more mindful of its financial activities. As a result, it would be better prepared to make sound financial decisions and more likely to achieve short-term and long-term financial goals.

Frequently Asked Questions (FAQs)

If a company’s liabilities exceed its assets, its net worth can be negative. In contrast, its net worth will be positive if the assets are more significant than the liabilities, its net worth will be positive.

The tangible net worth is essential because it helps to determine the actual net worth with the help of the tangible assets. In addition, it can be helpful if the company/business wants to evaluate the liquidation value if they ever want to sell or end the business operations.

One should not include the subordinated debt while calculating the tangible net worth if the property value on which any company or person holds subordinated debt is insufficient to go off the debt along with the debt payable to prime and senior debt holders.

Recommended Articles

This article has been a guide to Tangible Net Worth and its definition. Here, we discuss its formula for tangible net worth with an example of calculation, advantages, and disadvantages. You can learn more about accounting from the following articles: –

Leave a Reply