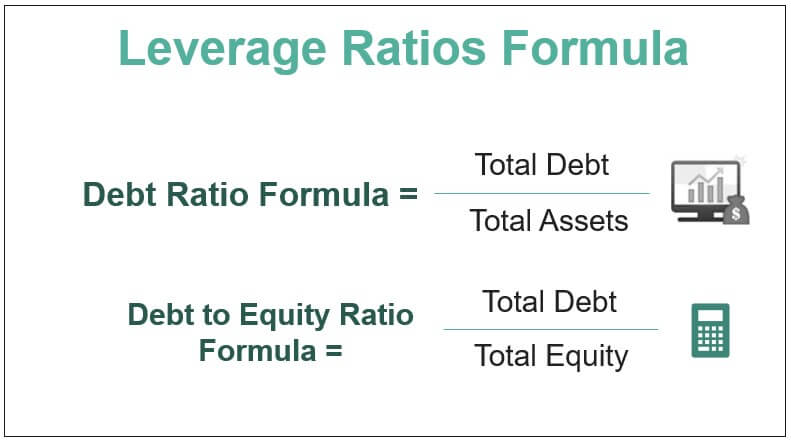

Formula to Calculate Leverage Ratios (Debt/Equity)

The formula for leverage ratios is used to measure the debt level relative to the size of the balance sheet. The calculation of leverage ratios is primarily by comparing the total debt obligation relative to either the total assets or the equity contribution of the business.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Leverage Ratios Formula (wallstreetmojo.com)

A high leverage ratio calculates that the business may have taken too many loans and is in too much debt compared to the business’s ability to service the debt with future cash flows. The two key leverage ratios are: –

- Debt ratioDebt RatioThe debt ratio is the division of total debt liabilities to the company's total assets. It represents a company's ability to hold and be in a position to repay the debt if necessary on an urgent basis. Formula = total liabilities/total assetsread more

- Debt-to-equity ratioDebt To Equity RatioThe debt to equity ratio is a representation of the company's capital structure that determines the proportion of external liabilities to the shareholders' equity. It helps the investors determine the organization's leverage position and risk level. read more

Table of contents

Key Takeaways

- Leverage ratios determine the level of debt in relation to the size of the balance sheet. Key leverage ratios include debt and debt-to-equity ratios.

- Leverage ratios compare the debt obligation to the business’s assets or equity.

- Prospective lenders use leverage ratios to assess a business’s debt-servicing capability.

- Significant leverage can be beneficial to shareholders as it indicates that the business is using equity to fund operations, potentially increasing the return on equity for existing shareholders.

Steps to Calculate Leverage Ratios (Debt and Debt-to-Equity Ratio)

Debt Ratio:

This leverage ratio formula compares assets to debt and is calculated by dividing the total debt by the total assets. A high ratio means that a huge portion of the asset purchases is debt-funded.

The formula debt ratio can be calculated by using the following steps: –

- Step #1: The total debt (includes short-term and long-term funding) and the total assets are collected and easily available from the balance sheet.

- Step #2: The debt ratio is calculated by dividing the total debt by the total assets.

Debt Ratio = Total Debt / Total Assets

Ratio Analysis Course (5+ Hours Video Series)

–>> Learn Professionally and Unleash Financial Insights! Join our Ratio Analysis Course for a dynamic 5+ hours packed with essential skills! From Profitability to Liquidity Ratios, dive into real-world case studies like Colgate. Elevate your financial prowess today!.

Debt-to-Equity Ratio:

This leverage ratio formula compares equity to debt and is calculated by dividing the total debt by the total equity. A high ratio means that the promoters of the business are not infusing an adequate amount of equity to fund the company resulting in a higher amount of debt.

One can calculate the formula of the debt-to-equity ratio by using the following steps: –

- Step #1: The total debt and the total equity are collected from the balance sheet’s liability side.

- Step #2: The debt-to-equity ratio is calculated by dividing the total debt by the total equity.

Debt-to-Equity Ratio = Total Debt / Total Equity

Explanation of Leverage Ratio (Debt to Equity) in Video

Examples of Leverage Ratios Calculation

Example #1

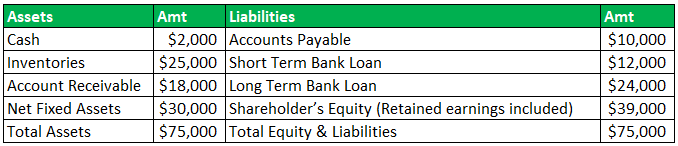

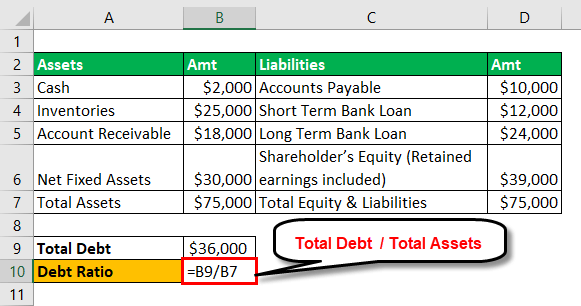

Let us assume a company with the following financials for the current year. Then, use the calculation of leverage ratios for the same.

From the above table, we can calculate the following: –

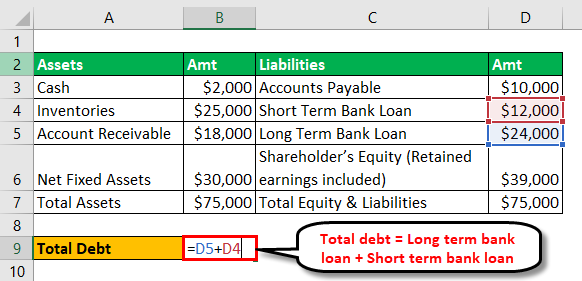

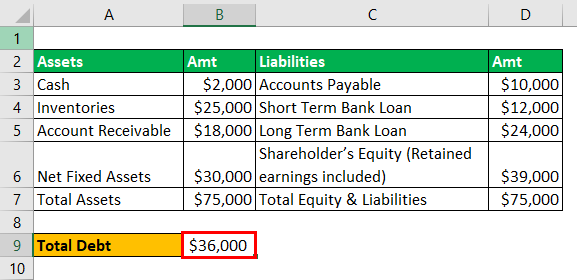

#1 – Total Debt

Total Debt = Long-term Bank Loan + Short-term Bank Loan

So, the total debt will be = $36,000.

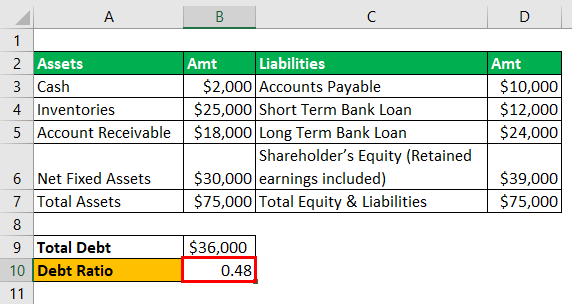

#2 – Debt Ratio

Debt Ratio = Total Debt / Total Assets

So, the calculation of the debt ratio will be as follows: –

The debt ratio will be: –

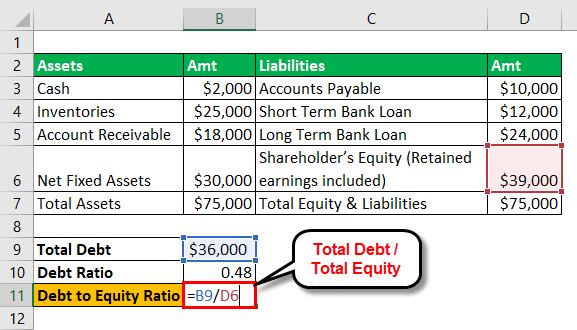

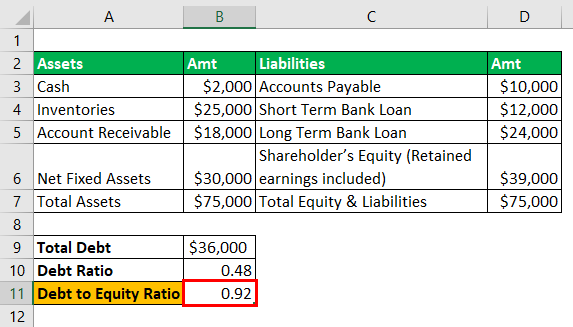

#3 – Debt-to-Equity Ratio

Debt-to-Equity Ratio = Total Debt / Total Equity

So, the calculation of the Debt-to-equity ratio will be as follows: –

The debt-to-equity ratio will be: –

Example #2

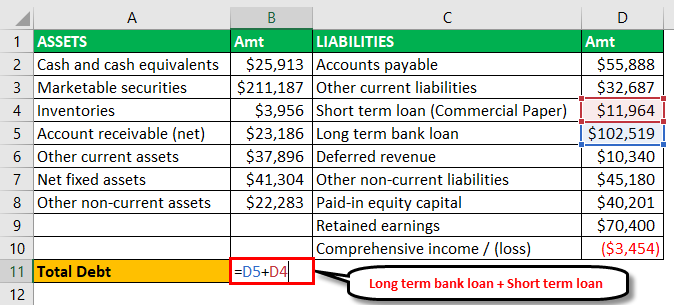

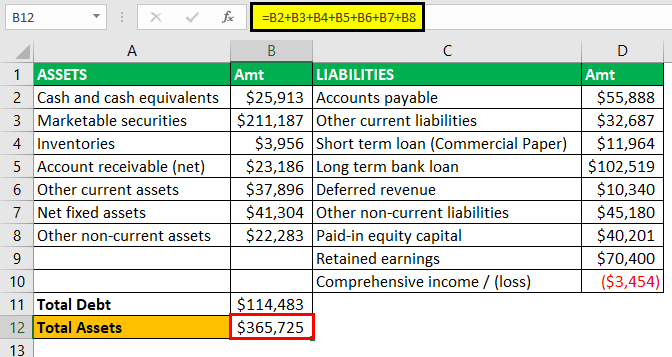

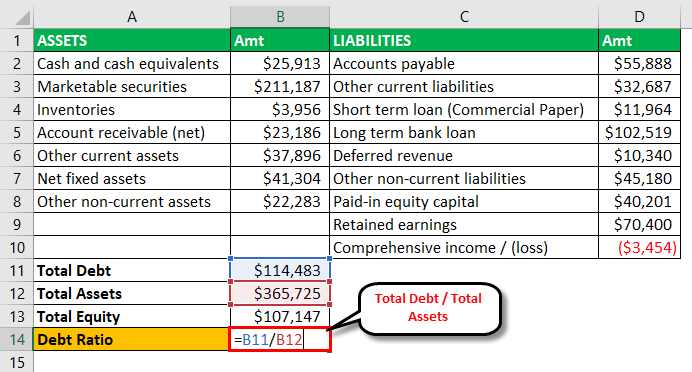

Let us take an example of Apple Inc. with the following financials for the year ended on September 29, 2018 (all amounts in USD millions).

From the above table, one can calculate the following: –

#1 – Total Debt

Total Debt = Long-term Bank Loan + Short-term Bank Loan

Total assets will be: –

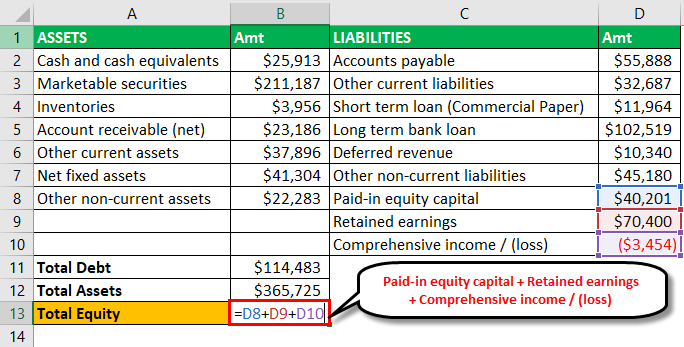

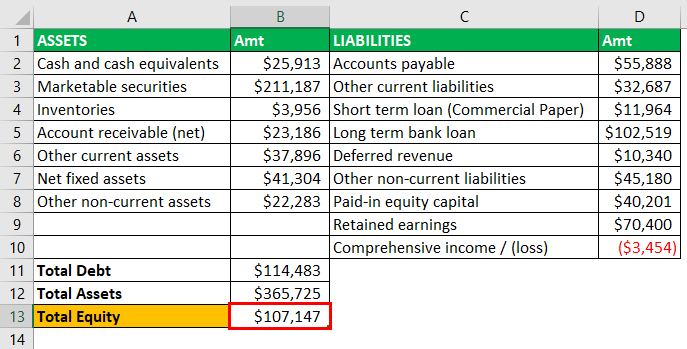

#2 – Total Equity

Total Equity = Paid-up capitalPaid-up CapitalPaid in Capital is the capital amount that a Company receives from investors in exchange for the stock sold in the primary market, including common or preferred stock. This considers the sale of stock that an issuer directly sells to the investor & not the sale of stock on the secondary market between investors. read more + Retained earningsRetained EarningsRetained Earnings are defined as the cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the company. It is shown as the part of owner’s equity in the liability side of the balance sheet of the company.read more + Comprehensive Income / (loss)

So, from the above calculation, the total equity will be: –

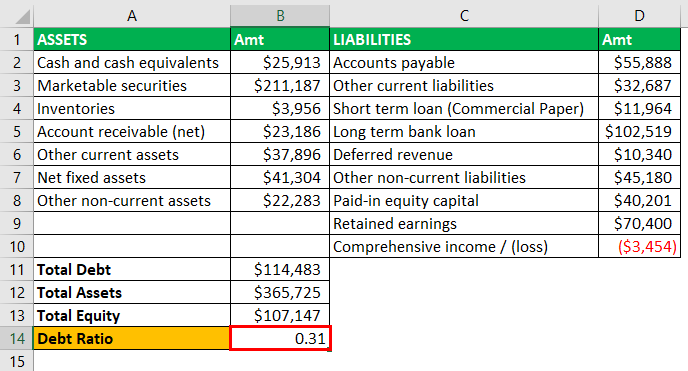

#3 – Debt Ratio

Debt Ratio = Total Debt / Total Assets

The calculation of the debt ratio will be: –

So, from the above calculation, the debt ratio will be: –

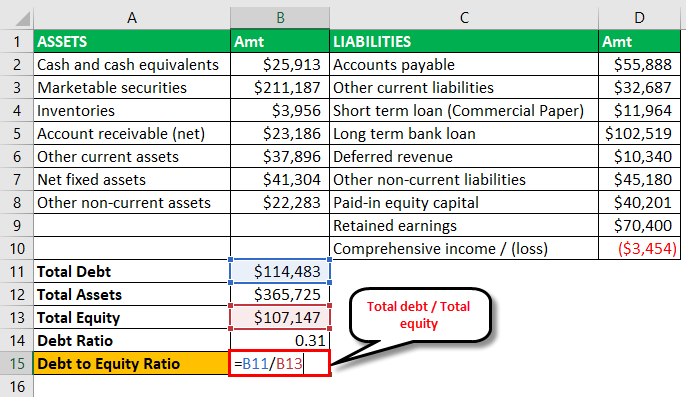

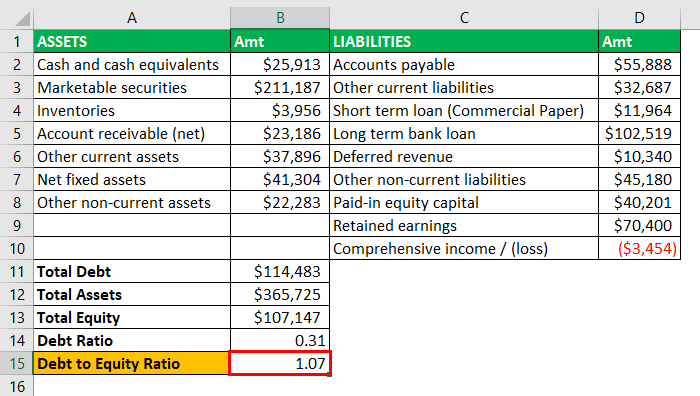

#4 – Debt-to-Equity Ratio

Debt-to-Equity Ratio = Total Debt / Total Equity

The calculation of the debt-to-equity ratio will be: –

Debt-to-equity ratio = $114,483 / $107,147

The calculation of debt-to-equity ratio: –

So, from the above calculation, the debt-to-equity ratio will be: –

Relevance and Use

The concept of leverage ratios is essential from a lender’s vantage point as it is a measure of risk to check if a borrower can pay back its debt obligations. However, a reasonable amount of leverage can be seen as advantageous to the shareholders since it indicates that the business is optimizing its use of equity to fund operations, which eventually increases the return on equityReturn On EquityReturn on Equity (ROE) represents financial performance of a company. It is calculated as the net income divided by the shareholders equity. ROE signifies the efficiency in which the company is using assets to make profit.read more for the existing shareholders.

The assessment of the leverage ratios form is an important part of a prospective lender’s analysis of whether to lend to the business. However, the leverage ratios formula per share does not offer sufficient information for a lending decision. It is a relative indicator and has to be seen with absolute figures. The lender must review the income statementThe Income StatementThe income statement is one of the company's financial reports that summarizes all of the company's revenues and expenses over time in order to determine the company's profit or loss and measure its business activity over time based on user requirements.read more and cash flow statementCash Flow StatementA Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business.read more to check if the business generates adequate cash flows to pay back the debt. The lender must also examine the projected cash flows to check if the company can continue to support debt payments in the future. As such, the leverage ratios formula is used as a part of the analysis to determine whether it is safe to lend money to the business, given its debt servicing ability.

Frequently Asked Questions (FAQs)

Higher leverage ratios indicate higher financial risk, suggesting a greater reliance on borrowed funds. Increased debt levels can amplify the impact of market downturns, interest rate changes, and operational challenges, making the company more vulnerable.

Leverage ratios can impact a company’s cost of capital. Higher leverage ratios may result in higher interest rates demanded by lenders and a higher cost of debt. This can increase the overall cost of capital for the company.

Leverage ratios have certain limitations. They provide a snapshot of a company’s financial position at a specific point in time and may not capture the full picture of its financial health. Additionally, different industries have varying leverage norms, making direct comparisons challenging.

Recommended Articles

This article is a guide to the Leverage Ratios Formula. We discuss the leverage ratio calculation, practical examples, and a downloadable Excel template. You can know more about financial analysis from the following articles: –

- Leverage Ratios for BanksLeverage Ratios For BanksLeverage ratios for banks depict a bank's overall financial health and efficiency, including its debt-paying capacity and fund management ability. The financial institution evaluates the Tier 1 leverage ratio, debt to equity ratio and debt to capital ratio for this purpose.read more

- ROE Ratio

- Formula of Financial LeverageFormula Of Financial LeverageFinancial Leverage is defined as a Company’s degree of dependency on debt financing to enhance its Return-On-Investment. The formula for its calculation is the ratio of Total Debt to Shareholders Equity. read more

- Leveraged FinanceLeveraged FinanceLeveraged finance is the process by which a company raises funds through debt instruments or from outside the entity rather than through equity. It usually has a fixed periodic repayment schedule and an agreed-upon interest rate.read more

Leave a Reply