CSI SURVEY PROCESS

390 likes | 1.67k Views

CSI SURVEY PROCESS. C ustomer S atisfaction I nformation. The Changing Market. Product quality is the “price of entry†for today’s consumers. The “consumer movement†has produced better educated buyers who expect quality treatment as well as quality products.

CSI SURVEY PROCESS

E N D

Presentation Transcript

CSI SURVEY PROCESS CustomerSatisfaction Information

The Changing Market • Product quality is the “price of entry” for today’s consumers. • The “consumer movement” has produced better educated buyers who expect quality treatment as well as quality products. • Competition is more intense in today’s mature North American market as an increasing number of global auto companies vie for customers.

Strategic Approach to Creating Customer Enthusiasm Customer Expectations Dealer/Retailer Environment Retail Standards Measurement ROS - Retail Operating System Resources

CSI Background • In 1995, GM introduced Retail Standards based on what customers “expect” when they visit a dealership to purchase a vehicle or have it serviced. At the same time, a common CSI survey process was implemented for all US divisions and Canada (except Saturn Saab) to measure how well GM and its Retailers meet customer expectations. • The initial survey process and questionnaires were carefully developed over a two-year period, with ongoing retailer involvement and extensive consumer testing of al question wording, the format and satisfaction scale used. • Over the years, several tools have been developed to improve CSI. As a result of these efforts, GM has elevated the customer experience and substantially improved its competitive position.

CSI Background • In 2003, NADA released a White Paper challenging various aspects of CSI, and its usage by auto manufacturers. At the request of GM’s National Dealer Council (US), the RSSA Dealer Advisory Board (US) and CSI Team undertook a year-long review of the overall CSI process, questionnaires, scales and scoring as well as the GM Retail Sales and Service Standards, which CSI was designed to measure. • The result is the US will be streamlining their Standards in January 2005 to a set that is similar to the Retail Standards that GMCL is guided by. Also, in January the CSI survey will receive a fresh new look to the design and minor modifications in content. • January 2005 Saturn Saab Canada and Saturn US will join the common CSI survey process.

Customer Enthusiasm Process Customer Expectations Standards CSI ROS/Tools

Primary Objective of CSI To evaluate dealer/retailer performance to the GM/Brand Retail Standards.

CSI Usage • Monitor performance over time and gauge relative dealer /retailer performance to the zone/national • Identify improvement opportunities related to internal retail processes, procedures and personnel training • Incentive criteria • Retail pay-for-performance

CSI Survey Description • Most GM/Saturn Saab retail purchase/GMAC Lease and warranty service customers receive a CSI survey. • Each questionnaire is identified with a divisional logo and personalized with the owner’s name, address and the specific vehicle and dealership/retailer involved in the sale or service. • CSI is divided into two separate parts: • Purchase and Delivery Satisfaction (PDS) and • Service Satisfaction Survey (SSS)

Purchase & Delivery Satisfaction (PDS) Who gets a PDS survey? • Eligible Deliveries are “retail” only: • Sales to individuals (not companies) • GMAC Leases (for individuals) • Non-GMAC Leases (if owner is identified) • Option I, Option II, and PEP Employee Purchases • Bailment units (to the first retail customer) • Incomplete Vehicles (“B” for Chevy or “D” for GMC in 3rd position of VIN)

Purchase & Delivery Satisfaction Survey- PDS - What are buyers asked? Questions related to: • Dealership/ Retailer • Sales Consultant • Financial Process • Overall Purchase & Delivery Experience When are PDS surveys mailed? Surveys are mailed about 3-4 weeks after a delivery is reported

Purchase & Delivery Satisfaction Survey- PDS - When do the surveys have to be returned by the customer? Surveys are required to be returned within 30 days of the survey mail date. Survey results received in this timeframe will be included in the Dealer/Retailer scores. Surveys returned 31-45 days will have results provided but not included in the scores.

Service Satisfaction Survey (SSS) Who gets a SSS survey? A. Eligible retail service events include: • Any retail service that occurs during the vehicle warranty period in effect, plus two years beyond warranty for campaign • Only one service visit in 90-day period (a maximum of 3 per year) • None during the first 60 days of purchase

Service Satisfaction Survey (SSS) Who gets a SSS survey? B. Eligible vehicle types; • Retail • Mileage greater than 3 km - PEP vehicles - Retail demos - Bailment units (to the first retail customer) - Incomplete vehicles (“B” for Chevy or “D” for GMC in 3rd position of VIN)

Service Satisfaction Survey (SSS) Who gets a SSS survey? (cont’d) C. Eligible Warranty Claim Types: • “blank” (regular warranty claims) • “J” (Campaigns) • “M” (Deductible overrides on warranty claims) D.Eligible Labor Codes: All Labor Codes except: • All “Tnnn” (technical bulletins, etc.) • All “Znnn” (special, NVI, etc.) • All “S0000” through “S49999”

Service Satisfaction Survey - SSS - What are service customers asked? Questions related to: • Service Department • Service Consultant • Service Delivery • Overall Service Visit When are SSS surveys mailed? Surveys are mailed about 3-4 weeks after a warranty event is reported

Service Satisfaction Survey - SSS - When do the surveys have to be returned by the customer? Surveys are required to be returned within 30 days of the survey mail date. Survey results received in this timeframe will be included in the Dealer/Retailer scores. Surveys returned 31-45 days will have results provided but not included in the scores.

CSI Reporting and Usage • Dealer/Retailer scores are aggregated monthly for sales and service and made available on the CSI website in a common format for all franchises. • Daily images of all returns are uploaded to DealerPulse(the CSI analytic tool) for review and handling. • Dealers/Retailers are able to monitor their performance over time and gauge their performance relative to the district/zone/national. • CSI helps identify improvement opportunities related to internal retail processes, procedures and personnel training. • CSI results also are used for incentive criteria and retail compensation.

CSI Scale Research • Thousands of customers evaluated 18 scale alternatives. • Scale wording, anchoring, direction and the number of answer categories were tested • CSI scale clearly outperformed all others • The scale was so successful that it has been incorporated into other GM surveys, including product and competitive research.

Survey Content Scales • YES and NO. • From “Completely” to“Not At All Satisfied” • From “Definitely would recommend” to “Definitely would not recommend.. • Focus on behaviors and observable conditions - Related to GM Retail Standards • Dealership/Retailer Sales and Service Department. • Sales/Service Consultant & Technician • Sales/Service Delivery.

CSI Scales Satisfaction Levels Very Satisfied Completely Satisfied Somewhat Satisfied Not At All Satisfied Satisfied Recommendation Levels Probably Not Probably Would Definitely Not Definitely Would Might/ Might Not

Why Index and Top Box? Index and Top Box reporting serve specific purposes. In combination, you have the most complete picture.

Index Scores • Reflect dealer/retailer performance among allcustomers • Provide greater differentiation among dealers/retailers • Beneficial for diagnostics, dealer/retailer incentives and consultation • Account for incremental improvements (reflect changes at levels less than Top Box)

Calculating Index Scores Aggregate Score = 534 Total Responses = 164 = 3.26

Responses Responses for Dealer A for Dealer B Completely Satisfied 25 45 Very Satisfied 30 -- Satisfied -- 5 Somewhat Satisfied -- -- Not At All Satisfied -- 5 Total Responses 55 55 Average CSI 3.45 3.45 Interpreting Index Scores

Completely Very Somewhat Not At All Satisfied Satisfied Satisfied Satisfied Satisfied “Completely Satisfied” Responses Total Responses % Top Box = What is “% Top Box” Top Box Scores represent the percentage of customers who respond “Completely Satisfied” to a scaled question.

Top Box Scores • Easy to understand and communicate • Closely associated with loyalty • Support GM’s vision of Total Customer Enthusiasm • CSI data substantiate expert findings that completely • satisfied customers are considerably more loyal.

The Importance of % Top BoxPurchase & Delivery Satisfaction Survey Overall DealershipSatisfaction (Q.14) Percent Responding 80% 14% 4% 1% 1% 100% Percent “Definitely” Recommend Dealership (Q.15) Source: Data received Jan-Dec 2004 for Total GM of Canada

The Importance of % Top BoxService Satisfaction Survey Overall DealershipSatisfaction (Q.16) Percent Responding 61% 21% 11% 4% 3% 100% Percent “Definitely” Recommend Dealership (Q.17) Source: Data received Jan-Dec 2004 for Total GM of Canada

The Rewards for Achieving Complete Customer Satisfaction The following apply equally to GM and its dealers/retailers: • Increased customer loyalty • Higher sales of vehicles, service and parts • Greater market penetration • Improved profits

Dealership/ Retailer Responsibilities • Strive to achieve CompleteCustomer Satisfaction • Maintain CSI integrity and avoid “interference” • Report new vehicle deliveries accurately and promptly • Report warranty, campaign and policy events accurately and promptly • Maintain complete and up-to-date employee names and personal identification numbers in WINS for accurate Personnel Performance Summaries (both service andsales) • Analyze CSI score performance and create action plans for continuous improvement.

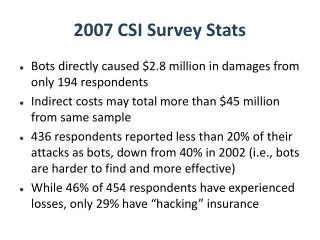

CSI Scope • Largest survey process in GM’s history - 9 Million surveys mailed annually (PDS & SSS combined) • CSI response rates (on average): 54% PDS/34% SSS • Nearly half of all surveys have comments (positive or negative) • In January ’03, DealerPulse was launched - An optional, online tool for analyzing CSI data - Endorsed as the best CSI tool for diagnostics by Dealer Communications Team.

Continuous CSI Feedback • Timely feedback to dealers/retailers/divisions: • Surveys requiring ‘immediate’ attention faxed to dealers/retailers within 24-hours of receipt • Daily online images of all survey returns available on DealerPulse (responses as well as any customer comments provided) • Daily electronic delivery of ‘select’ surveys with comments to General Motors Customer Communication Centre • Monthly website reporting of summary scores and individual customer responses to dealers /wholesale • Prior to January ’03, CSI data reported by “event” month • Now, all survey returns are processed in month received

CSI Monthly Wholesale Reporting* • North American Summary – Division • North American Summary - Region • National Summary - Includes National, Region, and Zone scores • Zone/Dealer/Retailer Summary • National/Zone Impact • Vehicle Line Summary • Trend Graphs * Online Base Program Reports. Each for PDS and SSS.

CSI Monthly Dealer/Retailer Reporting* • Point Summary • Scores for “key” questions by division(s) at site and a location point total • Division Summary - all questions • Dealership/Retailer scores relative to Zone, and National • Personnel Performance Summaries • Sales Consultant • Service Consultant • Service Technician • Response Detail Summary - by customer • Batch Download of all monthly CSI reports for a Dealer/Retailer • Dealer/Retailer Bar Charts *Online Base Program Reports. Each for PDS and SSS.

GM DealerPulse Overview What is it? • DealerPulse is a powerful, online CSI diagnostics tool. Currently, 74% of all GMCL dealers are enrolled. • It employs up-to-date, dealer specific CSI information that empowers dealers to quickly pinpoint customer satisfaction issues. • It assists dealers in focusing resources on highest CSI-impact areas. What are the benefits? • Dealerships that use DealerPulse show greater improvement in their two overall CSI scores than dealerships that don’t • Dealerships that are “heavy users” (20 or more unique logins per month) show even greater improvement in the two primary CSI Top Box scores than dealers who log in less often.

CSI Tools & Web Addresses • GM DealerPulse • www.gmdealerpulse.com • GM CSI website • www.gmnacsi.com • GM Retail Operating System (ROS) • https://www.autopartners.net/apps_can/gminfonet/en/infonet/domestic/shared/gmros/index.html • GMInfonet – Customer Satisfaction Information • https://www.autopartners.net/apps_can/gminfonet/en/infonet/domestic/shared/csi/index.html

CSI gmnacsi.com How to access the site? First Time Set Up • Go to www.gmnacsi.com • User ID = Dealer code/Retailer code • Password = Dealer code/Retailer code • Prompts to change to a specific password