British Pound Outlook:

- The British Pound is experiencing heightened volatility as the UK Gilt market has seen yields rise rapidly in recent days.

- BOE Governor Bailey has warned that recent intervention efforts will end on Friday, October 14, as planned, suggesting that recent volatility is here to stay.

- Recent changes in retail trader positioning suggest a mixed bias for GBP/JPY and GBP/USD rates, while EUR/GBP rates have a bullish bias.

Back into the Woods

Bank of England Governor Andrew Bailey spooked financial markets yesterday when he said that the emergency bond buying efforts announced last month would conclude as scheduled this Friday. The UK Gilt 30-year yield topped 5% again, while the UK Gilt 10-year yield moved back above 4.5%. Turmoil in UK government bond markets is putting focus back on the UK pension system, which (apparently) barely avoided a collapse in recent weeks.

While the British Pound initially swung lower on yesterday’s proclamation by BOE Governor Bailey, conflicting reporting from The Financial Times suggests that the BOE may provide support beyond the end of this week. The scant hope for sustained intervention is providing a temporary reprieve for the British Pound, which otherwise continues to face significant challenges in the near-term. Despite today’s rebound, there’s little reason to think the worst is over for GBP-crosses.

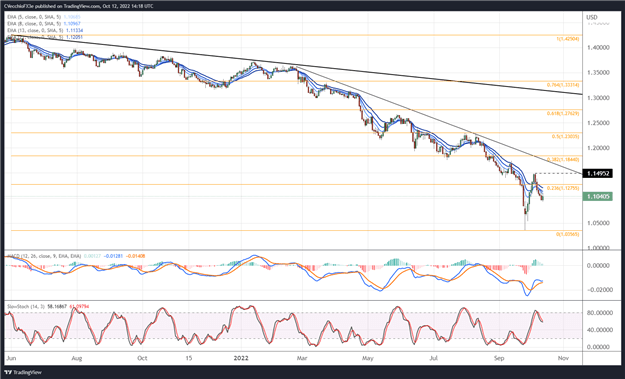

GBP/USD RATE TECHNICAL ANALYSIS: DAILY CHART (June 2021 to October 2022) (CHART 1)

Despite the rebound today, GBP/USD rates retain a generally bearish technical structure. The pair remains below the 23.6% Fibonacci retracement from the 2021 high/2022 low range. Likewise, momentum is starting to rollover. GBP/USD rates are back below their daily 5-, 8-, 13-, and 21-EMAs, and the EMA envelope is in bearish sequential order. Daily MACD’s move higher below its signal line continues to fade, while daily Slow Stochastics are falling towards their median line. It remains the case that “a ‘sell the rally’ mindset remains appropriate.”

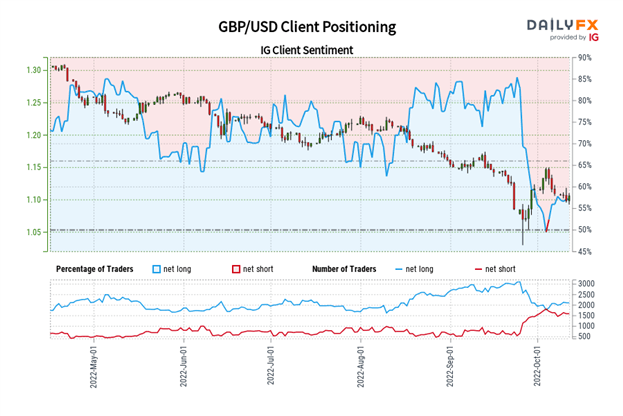

IG Client Sentiment Index: GBP/USD RATE Forecast (October 12, 2022) (Chart 2)

GBP/USD: Retail trader data shows 54.87% of traders are net-long with the ratio of traders long to short at 1.22 to 1. The number of traders net-long is 4.31% lower than yesterday and 12.30% higher from last week, while the number of traders net-short is 0.59% lower than yesterday and 13.92% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

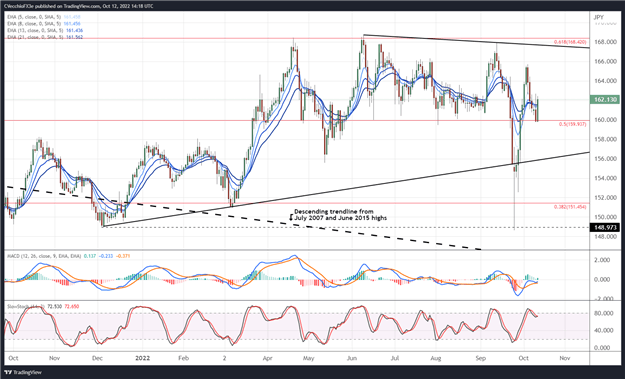

GBP/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (October 2021 to October 2022) (CHART 3)

GBP/JPY rates have rebounded sharply off of the 50% Fibonacci retracement of the 2015 high/2020 low range around 159.94, which previously served as support from June through late-September. A drop below this area is necessary for a sustained sell-off. Renewed focus on a potential intervention by the Japanese Ministry of Finance weighs heavily on the ability of GBP/JPY rates to make a meaningful drive higher. Among the GBP-crosses, GBP/JPY rates have the most volatile outlook in the near-term; wide, ultimately directionless price swings should be anticipated for the foreseeable future.

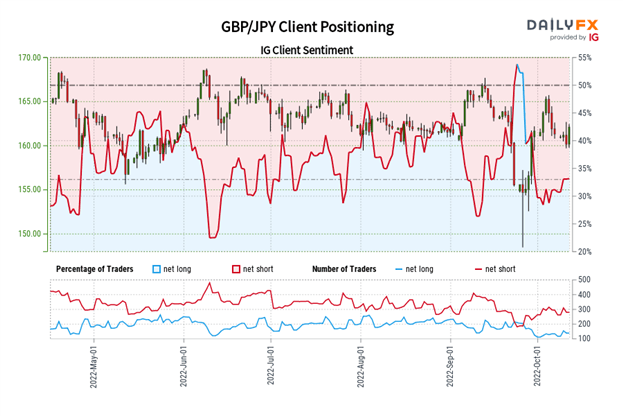

IG Client Sentiment Index: GBP/JPY Rate Forecast (October 12, 2022) (Chart 4)

GBP/JPY: Retail trader data shows 31.59% of traders are net-long with the ratio of traders short to long at 2.17 to 1. The number of traders net-long is 8.28% lower than yesterday and 4.32% lower from last week, while the number of traders net-short is 3.36% lower than yesterday and 11.11% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/JPY prices may continue to rise.

Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/JPY trading bias.

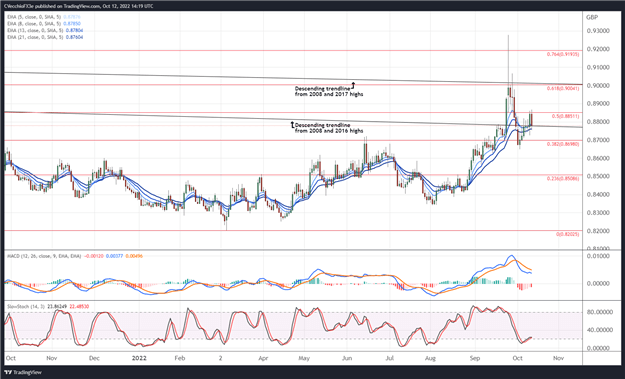

EUR/GBP RATE TECHNICAL ANALYSIS: DAILY CHART (October 2021 to October 2022) (CHART 5)

EUR/GBP rates have reversed lower after hitting resistance in the form of the 50% Fibonacci retracement of the 2020 high/2022 low range at 0.8851. The pair is seeing bullish momentum gather pace regardless, as it remains its daily EMA envelope, which is in bullish sequential order. Daily MACD is declining but is still above its signal line, while daily Slow Stochastics have emerged from oversold territory. Resistance lies above at 0.8851 (the 50% Fibonacci retracement of the 2020 high/2022 low range) and near 0.9004 (the descending trendline from the 2008 and 2017 highs as well as the 61.8% Fibonacci retracement of the 2020 high/2022 low range).

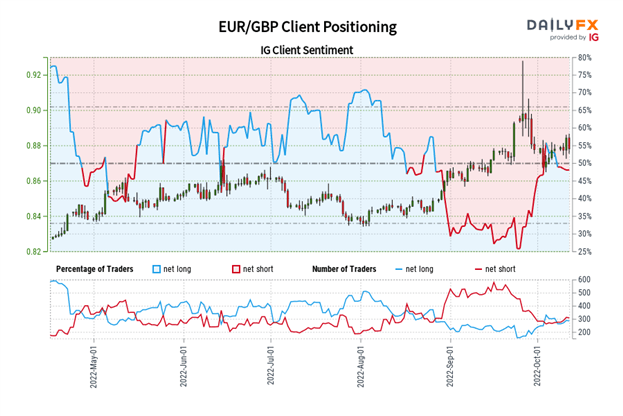

IG Client Sentiment Index: EUR/GBP Rate Forecast (October 12, 2022) (Chart 6)

EUR/GBP: Retail trader data shows 57.67% of traders are net-long with the ratio of traders long to short at 1.36 to 1. The number of traders net-long is 17.05% higher than yesterday and 16.29% higher from last week, while the number of traders net-short is 17.35% lower than yesterday and 6.43% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBP prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bearish contrarian trading bias.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Christopher Vecchio, CFA, Senior Strategist