What Was the South Sea Bubble?

What is an Asset Bubble?

An asset bubble is not as difficult to understand as other financial occurrences. An asset bubble occurs when the true market value of shares is forgotten and the investors’ perception of the value escalates sharply and to an unsustainable level. Confidence drops, shares are sold and the value plummets, very often to below its original true value.

https://www.thebalance.com/asset-bubble-causes-examples-and-how-to-protect-yourself-3305908

The result: Boom-bust. Recent global asset bubbles include the dotcom companies of the 1990’s and the Bitcoin bubble of 2017. The South Sea Bubble financial disaster of 1720 was the most spectacular example of an asset bubble’s implosion in British history.

The South Sea Company and the Bank of England

The hysteria caused by the South Sea Company’s asset bubble affected all tiers of society. Servants became rich and poor again within a few days. Titles and stately homes offered no protection. Few investors prospered. Lives were destroyed and lost in its wake.

The South Sea Company was established in 1711 by Robert Harley, the Chancellor of the Exchequer in the Earl of Sunderland’s government. It was a finance and trading company formed to clear the £9 million national debt. The Bank of England, established in 1694, was the country’s only official bank but Harley removed their monopoly to give the task of government debt management to the South Sea Company.

The Bold National Debt Plan

Harley placed lawyer and unofficial banker John Blunt at the unregulated company's head. The firm was a joint-stock company so shares could be bought and sold between shareholders.

The government’s creditors were instructed to place their debts with S.S.C. because the government assumed that the monopoly to trade in the South Seas, South America and the surrounding waters, would be awarded to the company. The plan was to create shares totalling £9 million and these would be sold to the public. The government’s creditors would receive repayment through share dividends. To facilitate this the treasury agreed to pay a sum to the company each year at 6% interest.

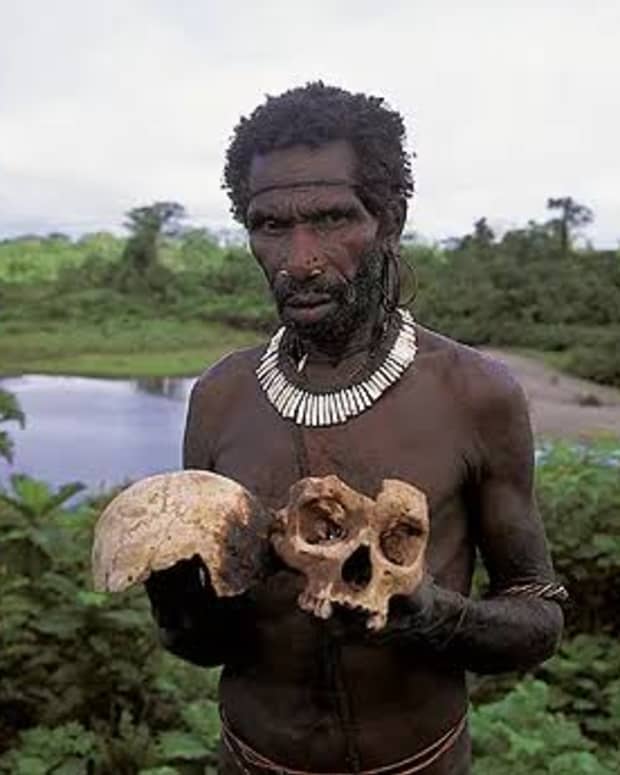

Slave Transportation

At the conclusion of the War of the Spanish Succession, the Treaties of Utrecht dated 1713 and 1714 left Spain to dominate the trade routes in the South Seas. Trying to salvage something from this development Britain signed the Assiento de Negros, a thirty year agreement for the South Sea Company to undertake slave transportation to the Spanish colonies in the South Seas. Other trading there was limited to one British ship per annum. The company failed to make a profit year after year.

The South Sea Bill Gets Royal Approval

John Aislabie was appointed the Chancellor of the Exchequer in 1718. Two wars meant Britain’s national debt reached approximately £50 million by the end of 1719. In January 1720 the South Sea Company’s directors proposed to underwrite £30 million of the British national debt by converting it into shares available to the public. A £7 million loan from the company to the government with an interest rate of 5% until 1727, 4% thereafter was agreed in the South Sea Bill. Robert Walpole and some other members of parliament voiced concerns but were ignored. John Aislabie pushed the vote through and it swiftly received royal assent.

The public was relentlessly encouraged to purchase shares as the South Sea Company’s management peddled the impossible dream of significant investment returns. King George I and the future George II acted as governors of the company and this helped to create a false sense of confidence. Excitement soared at the potential of life changing windfalls.

F.O.M.O.: Fear Of Missing Out

Money lenders and goldsmiths loaned money to hopeful investors in expectation of substantial repayments. Blunt gained approval for the South Sea Company to offer loans to hopeful investors. Today’s “Fear of Missing Out” or F.O.M.O. prevailed.

Investors were tempted by a multitude of illegal investment schemes, including one for “carrying-on an undertaking of great advantage but no-one to know what it is.” This scheme’s conman fled to Europe after one day with £2000 of punters money in his pocket.

Robert Walpole to the Rescue?

On the 12th July 1720 the South Sea Company received its royal charter from George I. Share prices rose. Wiser investors and John Blunt decided to sell their shares at a profit before the price dropped. In early August 1720 the shares peaked at £1000 each. More shareholders sold their interests.

The share value fell to £700 in early September. The Bank of England refused to help their rival. The South Sea Company’s share prices continued to fall and more investors sold.

Robert Walpole was chosen to persuade the Bank of England’s governor John Hanger to aid a recovery. He received a blunt refusal but public opinion demanded that the bank take action so Hanger conceded. A contract was drawn up but it remained unsigned. In it, the Bank of England offered a £3 million rescue package including an immediate payment of £400000. The S.S.C. shares devalued further. Hanger refused to continue with the rescue plan.

Boom-Bust: The South Sea Bubble Bursts

In December 1720 the share value was just £150 and it was clear that there was no hope of a positive outcome. The public blamed the Bank of England for inaction as much as the South Sea Company directors. The investors’ angrily rejected accusations that their greed, mania or misplaced dreams of a better life were equally liable for the disaster that delivered devastation, ruination and shame.

Numerous unauthorised banks, goldsmiths and money lenders were bankrupted and the creditors were left unpaid. Compensation was demanded.

Further Information

Was Justice Served?

Robert Walpole, considered as Britain’s first Prime Minister, launched an official inquiry in to the “South Sea Bubble” but he saved several of his colleagues reputations by ignoring their unwise or illegal actions. At least three government ministers had accepted bribes from the South Sea Company’s directors. Despite public outcries only a few men received punishment. The Chancellor of the Exchequer John Aislabie resigned in January 1721 and he was incarcerated in the Tower of London for “most notorious, dangerous and infamous corruption.” He’d received £20000 of South Sea Company shares in return for his support.

James Craggs the Younger, the Secretary of State for the Southern Department (Today’s Foreign Office) died from smallpox on 16th February 1721. His father, Craggs the Elder was the joint Postmaster General during the South Sea crisis. He poisoned himself on 16th March 1721. We don’t know if this related to shame, grief or both.

The 3rd Earl Sunderland and 1st Earl Stanhope, the joint First Lords of the Treasury, were acquitted of wrongdoing but Sunderland was forced to retire. The public despised him. The South Sea Company directors were dismissed, some were arrested and their wealth was confiscated.

The South Sea Company remained in operation but it had no interests in the South Seas after the 1750’s. Financial stability was slow to materialise and the outstanding sum of the South Sea Company related government debt, almost three hundred years old, was finally paid in March 2014 by David Cameron’s Conservative government.

Sources

- South Sea Bubble | Encyclopedia.com

- The South Sea Bubble of 1720 - The National Archives blog

- South Sea Bubble | British history | Britannica

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2021 Joanne Hayle