|

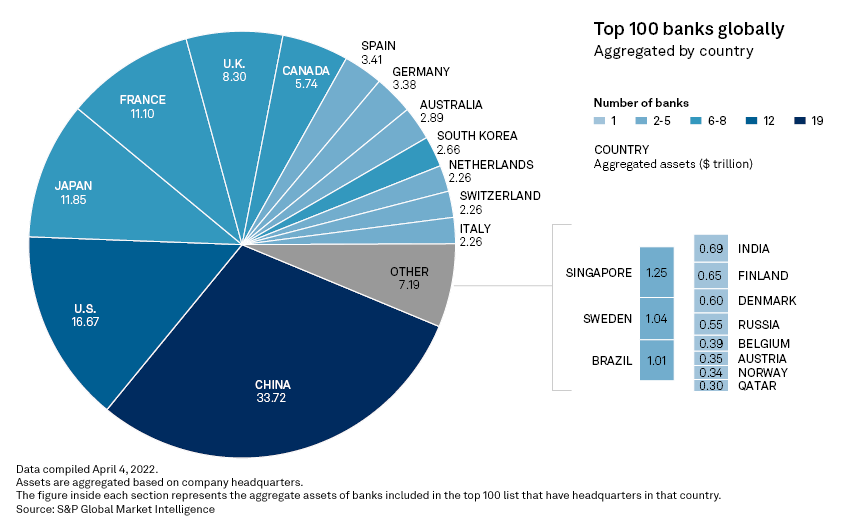

European banks lost some of their dominance in global asset size rankings in 2021, while major Chinese lenders maintained their lead as the world's biggest financial institutions.

Twenty-six of the 37 European lenders on the list of the world's 100 largest banks slid down the rankings by between one and nine notches as of 2021-end from a year prior, according to S&P Global Market Intelligence. The total assets of all European banks on the list contracted 2.16% to $36.890 trillion in 2021 from $37.707 trillion a year earlier.

Some of the European lenders saw their balance sheets shrink after scaling back their stateside operations amid competition from major U.S. lenders. Spain's Banco Bilbao Vizcaya Argentaria SA, for instance, slid one place to No. 47 after selling a 639-branch business in the U.S. with about $103 billion in total assets. HSBC Holdings PLC, however, maintained its position and asset size as its pivot to Asia's wealth management business helped offset the impact of the sale of its retail banking operations in the U.S. and France.

A resurgence in COVID-19 infections in several parts of the world and the impact of the Russia-Ukraine conflict are likely to drag on the global economy this year. Growth was already expected to slow from 2021, when output in most countries recovered from the pandemic. These two factors are expected to complicate monetary policy normalization as global central banks get cautious about not hurting economic recovery by tightening too soon while facing high inflation.

Follow this link to download the above chart in Microsoft Excel.

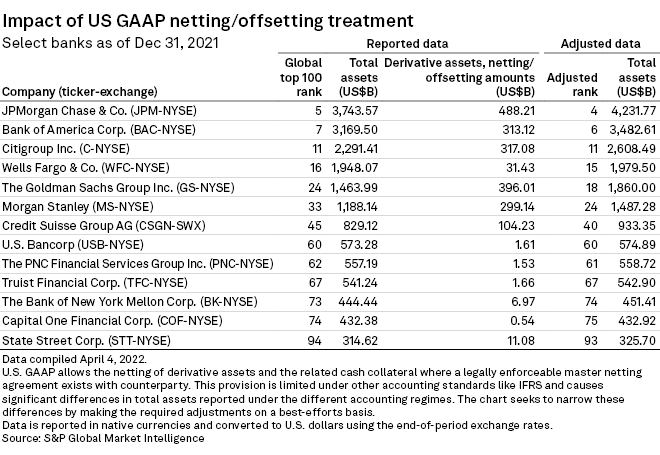

For the latest ranking, company assets were adjusted on a best-efforts basis for pending mergers, acquisitions and divestitures as well as M&A deals that closed after the end of the reporting period through March 31. Assets reported by non-U.S. dollar filers were converted to dollars using period-end exchange rates. Total assets were taken on an "as-reported" basis, and no adjustments were made to account for differing accounting standards. The majority of the banks were ranked by total assets as of Dec. 31, 2021. In the previous ranking published April 12, 2021, most company assets were as of Dec. 31, 2020, and were adjusted for pending and completed M&A as of March 31, 2021.

Entering 2022, BNP Paribas SA, which saw its ranking drop to No. 9 from No. 7 in 2021, could see its total assets contract further after it completes the sale this year of its U.S. retail business with about $105 billion in total assets. Banco Santander SA, which slid to No. 19 from No. 16 in 2021, has outlined moves to simplify its U.S. retail unit this year, including exiting mortgage and home equity loans and paring commercial and industrial lending.

Benign economic recovery across the EU also led to the balance sheets of some banks contracting, particularly in France and Italy. Groupe BPCE, Société Générale SA, Intesa Sanpaolo SpA and UniCredit SpA slid by between one and five places in 2021.

Chinese banks retain top slots

Meanwhile, major Chinese banks kept their top four positions with an expanded balance sheet, widening their lead over most other banks in the world.

Industrial & Commercial Bank of China Ltd., China Construction Bank Corp., Agricultural Bank of China Ltd. and Bank of China Ltd. saw their aggregate assets expand 10.2% to $19.081 trillion in 2021 from $17.321 trillion a year ago.

"Beijing has been pushing banks to lend more to infrastructure projects and small businesses while cutting key interest rates to free up more liquidity for lending," said Nathan Stovall, principal analyst at Market Intelligence. "The policy goal was to speed up economic recovery, which started slowing again in the second half of 2021 amid a wave of bond defaults by property developers."

US banks improve in rankings

Major U.S. banks such as JPMorgan Chase & Co., Bank of America Corp. and The Goldman Sachs Group Inc. saw an expansion in their balance sheets in 2021, pushing their asset size rankings higher. JPMorgan and Bank of America moved up the ranks by one and two notches to No. 5 and No. 7, respectively.

The asset growth was driven by government efforts to stimulate the pandemic-hit economy, including a massive expansion in the Federal Reserve's balance sheet as a result of quantitative easing, and the private sector's preference for holding large amounts of liquidity.

"The absence of government stimulus and the Fed’s efforts to combat elevated inflation, including through the reduction of its $9 trillion balance sheet, will lead to slower balance sheet growth in the future," said Stovall.