Real Estate Roundup

Performance data

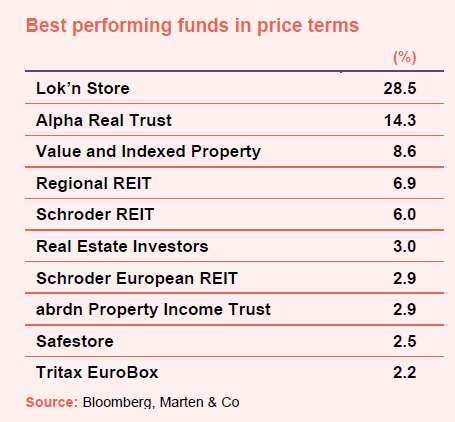

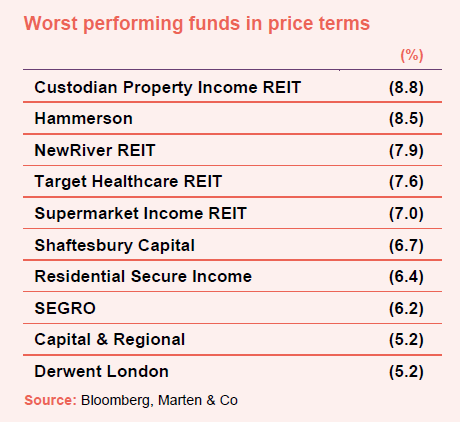

March’s biggest movers in price terms are shown in the charts below.

As the interest rates waiting game continues, the real estate sector was flat during April, with the mean average share price at 0.0% and the median average down 1.4%. Self-storage specialist Lok’n Store’s share price jumped on news that it had received a take-private bid (see page 3 for details). Alpha Real Trust’s share price rebounded following a similar sized move in the opposite direction in March after a spate of buying activity from its directors. The share price of office landlord Regional REIT responded positively to a flurry of recent letting activity (see page 4). The company is still down 36.4% this year and is trading at an extremely wide (and possibly attractive?) 60% discount to NAV. Both of Schroder’s real estate trusts – Schroder REIT and Schroder European REIT – performed well. Meanwhile, abrdn Property Income Trust sold a couple more assets above book value (see page 4), putting further confidence in its NAV as it heads towards a possible managed wind down following the aborted merger with Custodian Property Income REIT. It was another positive month for Tritax EuroBox, with the European logistics landlord now up 7.2% over three months.

Custodian Property Income REIT’s share price came under further pressure in April having initially bounced following its failed bid for abrdn Property Income Trust. Its share price is down around 15% from its level before the potential merger was announced. No fewer than five retail property-focused companies made the list of 10 worst performing funds after retail sales in the UK fell 4% in April. Fears that elevated mortgage costs and high energy bills could squeeze spending power further appears to be weighing on the share price performance of the companies. While FTSE 250 company Hammerson was worse off among its retail peers, NewRiver REIT and shopping centre owner Capital & Regional were also hit (this was despite the latter reporting an uplift in the value of its portfolio). Central London retail landlord

Shaftesbury Capital was not immune either, while Supermarket Income REIT also succumbed. At the end of the month, the company announced its first foray outside the UK with a French portfolio acquisition (see page 4). Meanwhile, SEGRO, the largest listed property company with a market cap of £12bn, is now down 4.3% in 2024.

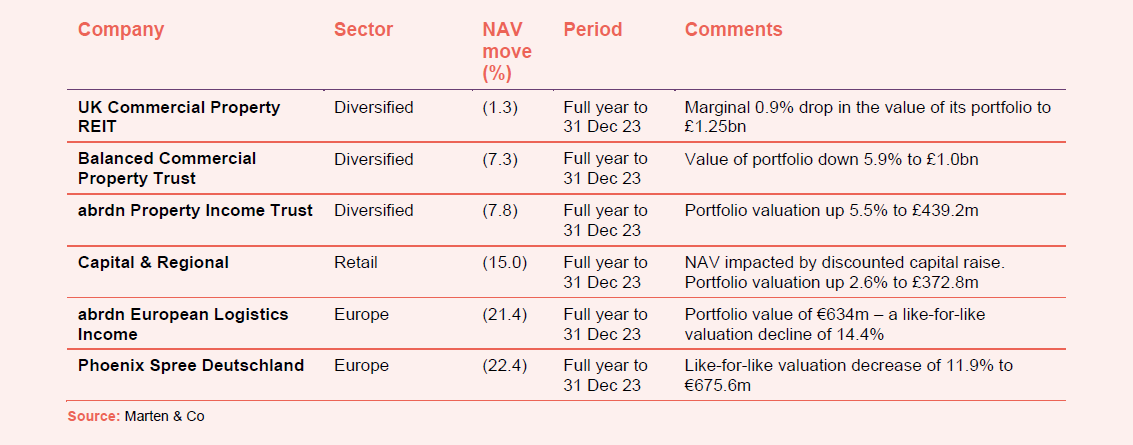

Valuation moves

Corporate activity

The board of Balanced Commercial Property Trust launched a strategic review into the future of the company, with all options – including a sale, merger, or continuing as is – on the table. The move comes as the company approaches a continuation vote later this year. The board pointed out that the company was not in discussions with any potential suitor at this time. Like many other property companies and REITs, the company has suffered from a materially wide discount in recent years as higher interest rates and other economic factors have weighed on sentiment towards the sector. The outcome of the strategic review is expected to be announced in the third quarter of 2024, just before the company’s continuation vote is held.

The board of Lok’n Store agreed the terms of a recommended cash offer from Shurgard to acquire the company. Under the terms of the acquisition, Lok’n Store shareholders will be entitled to receive 1,110 pence in cash for each share, valuing the company at £378m. This represents a premium of 15.9% to the prevailing price, 41.3% to the volume-weighted six-month average price, and a 2.3% to the all-time high closing price of 1,085 pence (on 6 January 2022). Shurgard has received irrevocable undertakings to vote in favour of the cash offer from Lok’n Store directors holding around 19% of the company.

Home REIT said that it would vigorously defend itself from legal action brought against it on behalf of shareholders by Harcus Parker Limited and at the same time intends to bring legal proceedings against the company’s former manager Alvarium Fund Managers (UK) Limited, which it considers is responsible for wrongdoing. A letter of claim from Harcus Parker alleges that the company, along with certain other parties, provided information to investors which was false, untrue and/or misleading. The company said that it denies the allegations.

Supermarket Income REIT increased its unsecured debt facility with Sumitomo Mitsui Banking Corporation by £37.5m to £104.5m. The interest-only facility matures in September 2026 and is priced at a margin of 1.55% above SONIA on the increased amount, with the existing £67m remaining at a margin of 1.40% above SONIA, and is fully hedged for the term of the facility. Following the deal, the company’s pro-forma LTV was 34%.

Schroder European REIT completed the refinancing of a €8.6m loan with existing lender Saar LB, secured against its Rennes logistics investment. The new five-year facility was based on a margin of 1.6%, a slight increase from the previous 1.4% margin, and is due to expire on 26 March 2029. The total interest cost has been fixed at 4.3% being the five-year euro swap rate of 2.7%, plus the 1.6% margin. With this new facility, the company’s third-party debt totals €82.5m across seven loan facilities. This represents an LTV of 33% against the company’s gross asset value (24% net of cash). The company’s blended all-in interest rate increased from 2.8% to 3.0%.

Major news stories

- Supermarket Income REIT enters French market with €75.3m buy

Supermarket Income REIT acquired a portfolio of Carrefour supermarkets in France – its first foray into markets outside the UK – through a sale and leaseback transaction for €75.3m, reflecting a net initial yield of 6.3%.

- Derwent London eyes on new developments after £77.35m office sale

Derwent London sold its 70,300 sq ft Publicis Group-let office in Clerkenwell, London for £77.35m to Titan Investors at a small premium to the December 2023 book value and reflecting a net initial yield of 4.9%. The proceeds will be recycled into two West End developments, 25 Baker Street W1 and Network W1, which together total 437,000 sq ft.

- CLS Holdings sells office-to-residential asset

CLS Holdings sold Westminster Tower, Albert Embankment, for £40.8m, in-line with its 31 December 2023 valuation. The asset was sold to the London Square Group, which intends to convert the property from an office space into residential (planning permission for which was obtained by CLS).

- Picton disposes of £29.6m London office

Picton Property completed the disposal of its second largest office asset at Angel Gate, London EC1, for £29.6m, representing a 5% premium to the 31 December 2023 valuation. A proportion of the proceeds will be used to fully repay the £16.4m outstanding balance on the company’s revolving credit facility, with the remainder available for investment.

- Regional REIT lets 30,000 sq ft in Glasgow

Regional REIT leased over 30,000 sq ft of space at Lightyear, a Grade A office near Glasgow Airport, bringing the property to over 90% let with a contracted rental income of £1.3m per annum and in-line with its estimated rental value. Heathrow Airport Ltd (15,121 sq ft) and Rolls-Royce (15,116 sq ft) have signed leases at Lightyear for 15 and 10 years, respectively. They join existing tenants Loganair, Taylor Wimpey UK Ltd and Cefetra Ltd.

- abrdn Property Income Trust sells duo of assets at premium to book value

abrdn Property Income Trust completed on the sale of two assets for a combined price of £13.2m, reflecting a 1.5% premium to the December 2023 valuation. It sold Unit 4, Monkton Business Park in Hebburn for £5.3m and King’s Business Park, Bristol for £7.9m.

- Great Portland Estates signs up REPRESENT to flagship London store

Great Portland Estates signed up British luxury retail brand, REPRESENT, for its new London flagship store at 135/141 Wardour Street on a 10-year lease.

- Home REIT auctions off further chunk of portfolio

Home REIT sold a further 65 properties at auction for a total of £15.9m. Since August 2023, the company has completed on the sale of 533 properties and exchanged on a further 240 properties for gross proceeds of £111.4m.

- Palace Capital mulls tender offer after fresh sales

Palace Capital said that it was likely to conduct a tender offer having built up more than £20m in cash following its disposal programme. During the month it sold five properties for £15.3m and an office in Manchester for £8.75m.

- Custodian Property Income REIT unloads car showroom

Custodian Property Income REIT completed the disposal of a vacant car showroom in Redhill for £2.35m, representing a 15% premium to the 31 December 2023 valuation.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Retail

Capital and regional

Lawrence Hutchings, chief executive:

We have continued to see the impact of rising inflation and debt costs on business and consumer confidence. This is being mitigated by high employment, salary growth and higher levels of household savings. We have seen the early signs of respite in inflation and the cost of debt, along with some erosion in consumer savings. In previous economic cycles, these times of reduced consumer confidence have typically favoured sales of grocery and non-discretionary retail and services. Based on feedback from our retailers and our own footfall data we are seeing an increase in retail sales across much of our anchor store and speciality tenant base. Many have been able to pass on the full impact of inflation into prices and this will, over time, assist us in unlocking rental growth for our locations. The improvement in non-discretionary retailer performance is driving occupier demand.

Another feature of last year was the continued evolution in distribution of goods and services in the UK. The UK has one of the most mature online retail markets, with a share of just under 30% according to ONS data. Online sales as a percentage of total retail sales have been on a downward trend for the last two years, which is a sharp reversal from the Covid era which naturally accelerated channel shift in retail spending.

The store remains an important part of the majority of retailers’ distribution strategies as customers support store-based retailing and retailers benefit from lower costs per transaction. The new model prioritises the seamless integration of both channels.

Whilst the overall market share is high, non-discretionary and grocery sectors have online penetration of around 10%, despite the length of time this has been part of the retail landscape. Pharmacy and value retailers are often lower still, as these categories have lower margins and consumers have indicated a preference to use the proliferation of convenience store formats at transport interchanges and in town and city centres locally, especially in highly urbanised areas. These retailers are amongst the most expansionary and we continue to work closely with an increasingly wide cross section of non-discretionary and value based retailers wishing to locate or expand in our centres.

Inflation has had a significant impact on the cost of doing business as a retailer. Increases in staff costs and petrol, and therefore distribution, together with a higher percentage of product returns, has disproportionately impacted online retailers with several high profile business failures during the year. The lower unit cost store based retailing model still accounts for the majority of retail sales and informs or prompts purchasing decisions. In addition, consumers are increasingly drawn to the convenience of store based collection and returns which, in turn, are a lower cost last mile logistics solution for a retailer. This also provides retailers with the added benefit of a guest potentially buying something, or seeing something they then buy online later, whilst they are in store.

Several of the larger pure play online retailers are now seeking to create bricks & mortar store networks to better compete with those traditionally physical retailers who are successfully embracing both retailing channels. This benefits us as retailers take new, or reconfigure and right size existing, stores to ensure they are able to meet the demands of consumers in a competitive retailing landscape.

After 10 years of structural change, these are exciting times for physical retail with significant opportunities for retail platforms such as ours that understand and can capitalise on the operational intensity needed to evolve existing centres to reflect this new seamless commerce retailing dynamic.

Europe

Phoenix Spree Deutschland

Property advisor:

The long-term outlook for Berlin residential property remains well underpinned. The current landscape of the residential construction industry across Germany suggests a significant decrease in new construction activity in the coming years which will exacerbate the existing market dynamics. Despite a longstanding shortage of housing, there has been a notable reduction in the initiation of new residential projects, with many existing projects facing postponement or cancellation. The ifo Institute estimate the number of residential construction companies operating in Germany, and building residential units, experiencing the termination of development projects in 2023 to be the highest since records began in 1991. As a result, the ifo Institute projects a decrease in apartments completed in Germany to 175,000 per annum by 2025, versus a Federal Government target of 400,000.

The economics of new construction are being challenged, following a 25% increase in construction costs over the past three years. This contrasts with sales prices for new-build residential, which have risen by an average of only 7% over the same period. These dynamics have resulted in a situation where, in many parts of Germany, tenanted multi-family properties are trading at values which are up to 40% lower than the cost of new construction. To the extent that new build is occurring, it is highly polarised, with a focus on high-end buildings commanding rental values that are out of reach for most tenants, or on social housing initiatives. The larger “middle-market” in central Berlin continues to be poorly served by new construction activity.

Absent a significant shift in German government policy to incentivise new build for the mid-market PRS sector, the supply-demand imbalance which currently exists will only grow wider. In a constrained Berlin rental market, characterised by positive net inward migration and vacancy which is currently near record lows, investors can be confident of the enduring stability of their rental income.

By contrast, a combination of “higher-for-longer” interest rates and a weakening German economy have presented significant headwinds for real estate values and transaction volumes. The Covid pandemic and the war in Ukraine heralded the onset of monetary tightening across the globe and prime residential yields have risen, from a starting point of below 2% in 2021, to 3.7% currently. Rental yields during the era of low interest rates had fallen to a lower level in Germany than in most European countries, and the adjustment in pricing as interest rates have risen has consequently been more pronounced. Notwithstanding the health of the rental market, growth in rental income has been insufficient to offset a broad-based decline in asset values.

Whilst consensus expert opinion now predicts that monetary tightening has come to an end, soon to be replaced by interest rate cuts, current transaction volumes and observed transaction values across the residential market have yet to recover. Real estate owners generally remain “net sellers” of assets as they seek to deleverage following asset value declines and refinance at rates which are likely to remain at more elevated levels than before the onset of the current real estate downturn. At the same time, uncertainty about the extent and duration of the interest rate cycle and associated correction in property values continues to weigh on capital deployment decisions for most potential institutional buyers.

The disequilibrium between investor sentiment on the one hand, and the robust health of the rental market on the other, will inevitably come to an end at some point. However, whilst declining interest and risk-free rates will be helpful, the precise timing of this remains difficult to predict.

abrdn European Logistics Income

Tony Roper, chairman:

December 2023 saw the end of seven consecutive months of falling Eurozone inflation figures, resulting in the money markets adjusting their expectations. However with the deposit rate held at 4%, valuations continue to come under pressure. Looking forward, our Investment Manager believes that the most significant value correction is behind us and the negative pressure on yields, which has lagged the UK, will plateau later this year.

Future occupational demand looks set to be determined by two key trends: stabilising growth amongst eCommerce operators and a continued trend towards onshoring amongst manufacturers. The logistics market is characterised by rising occupier demand, limited supply in core markets and high barriers to developing new assets in prime locations.

The onshoring of operations should be a long-term trend over the next decade. While it could lead to a tangible boost in take-up in the near term, we do not believe it will result in the same explosive growth that the increase in online shopping led to over the last decade. Data from a European Central Bank survey points to an increasing number of firms expecting to increase their sourcing of production inputs from within the EU, compared to a declining number of firms sourcing their inputs externally.

The prime logistics markets in Germany, Netherlands, France, and Spain, where the majority of the portfolio is focused, continue to witness near-historically low vacancy rates. With speculative development expected to remain low due to increased costs and regulation, we expect vacancy rates to remain tight, which will keep upward pressure on indexed rents.

Diversified

abrdn Property Income Trust

Jason Baggaley, fund manager:

We expect the UK real estate market to bottom out in 2024 and start to improve in the latter part of the year and into 2025. A catalyst for an improvement in the fortunes for UK real estate will be the start of the interest rate cutting cycle, matched with lower prices, and the prospect of a far more positive real estate yield margin.

While the macro environment will continue to dominate in 2024, sector allocation will remain crucial. Polarisation in performance from both a sector and asset-quality perspective will remain a key differentiator for performance. Real estate refinancing poses a risk to our outlook in 2024, but we believe that the risk is more heavily skewed towards the office sector, given the amount of outstanding debt and lack of appetite for lending to this sector.

Sectors that benefit from longer-term growth drivers, such as the industrial and logistics sector, will continue to garner the most interest from investors. It is unlikely that there will be a material change in investor sentiment towards the office sector, but more attractively priced re-positioning opportunities will emerge over the course of 2024, with debt re-capitalisation and funds working through redemptions the most likely source of value. However, underwriting assumptions, particularly around capital expenditure, are crucial. Long income assets now look more attractively priced, and we anticipate there will be some good buying opportunities in this area of the market in 2024.

Balanced Commercial Property Trust

Richard Kirby, fund manager:

2023 was a challenging year for UK real estate due to the macro-economic environment and a 15 year high in interest rates. Volatility in financial markets, uncertainty as to the interest rate outlook and persistently high inflation dampened investor appetite and the relative attractiveness of real estate.

UK real estate investment volumes totalled circa £40bn in 2023, a fall of 40% year on year. Despite the negative headlines around offices, they were the second most traded sector in 2023, accounting for approximately 24% of deal volume. The tentative emergence of counter-cyclical and opportunistic strategies has been supported by an occupational market that continues to display resilience and even growth, albeit this is increasingly nuanced by micro-location and asset fundamentals.

As income has driven returns, we have seen an increasing divergence in performance across the sub-sectors due to differing rental growth prospects. As a result, weaker office segments have lost market share to ‘beds, sheds, and meds’, being the sectors delivering rental growth founded on structural undersupply and positive thematic support. Industrials generated the highest rental growth over the year at 7.1% and were unsurprisingly the most traded sector. Retail warehousing, underpinned by low vacancy and a negligible development pipeline, supported positive rental growth over the year of 1.8% and is expected to gain further momentum in 2024.

All this is to say that delivering relative outperformance has become a more nuanced pursuit founded on disciplined management of both portfolio composition and the standing asset base. The notable absence of the distressed (or even motivated) selling of real estate assets has put the onus on returns being generated through proactive asset management and diversification of income streams. Crystallising rental growth through leasing initiatives, driving capital growth through refurbishments, enhancing occupational and investment prospects through asset repositioning relies heavily on expertise to leverage strong underlying asset and portfolio fundamentals.

UK Commercial Property REIT

Peter Pereira Gray, chairman:

The improvement in property returns recorded in 2023 (whilst still overall negative) was led by the industrial and living sectors, both of which posted positive total returns for the year, counterbalancing the office sector which continued its decline as thematic headwinds remained. The lack of uniformity across the sectors has been notable and offered opportunities for diversified portfolio managers to orientate toward those sectors which would prospectively perform well.

The industrial market rebounded from a bruising second half of 2022, posting a positive annual total return of 4.1% by the end of the year according to the MSCI Quarterly Index. Yields stabilised so that capital value growth levelled out on an annual basis at the All Industrial level at –0.4%. London and the Southeast posted total returns of 3.2% and 4.0% respectively, and all regions posted positive capital value changes on an annual basis. Market rental growth has decelerated from the positive growth seen in 2022 as levels of supply and demand became more balanced.

The retail sector posted an annual total return of –0.1% to December 2023 according to the MSCI Quarterly Index. The sector enjoyed something of a year of two halves, with a relatively robust total return of 2.2% in the first half but reducing again in the second half as the cost-of-living pressures cemented themselves in consumer psychology. Consequential consumer spending habits and structural changes in the market continue to influence performance. Typically, value-conscious consumers have propelled discount retailers to the forefront of UK retail sales and much of the recovery was influenced by strong performance within the high-yielding shopping centres and resilient retail warehousing sub-sectors, with the latter posting consistent month-on-month rental growth over the year.

The office sector continued to underperform, delivering an annual total return of –10.2% to December 2023 according to the MSCI Quarterly Index. Weakening capital values led this decline, with the deterioration accelerating over 2023 as the Bank of England raised interest rates. An uneven performance across the sector was experienced as London West End offices were substantially stronger at –2.4% total annual return than the –13.9% and –15.4% for the City of London and wider South East respectively. Market rental value growth was also uneven with Midtown and West End offices leading the pack with an annual 4.8% and 4.4% respectively, compared to 2.4% for the year for all offices.

The alternatives sector, or ‘Other’ as categorised by MSCI, saw an annual total return of –0.3% over 2023. Notable within these returns were a resilient living sector, benefitting from a supply demand imbalance. Purpose Built Student Accommodation (PBSA) delivered strong total returns of 2.7%, with a return of 1.4% delivered solely in the fourth quarter. Elsewhere, the hotel market reversed its recent fortunes in the face of sustained cost of living pressures and delivered above All Property total returns at 0.8% to December 2023.

2024 has started with a renewed confidence and whilst ‘caution’ is the watchword, the market is displaying the hallmarks of producing a positive annual return for the year which would be welcomed by many. The Real Estate Investment Trust market is seen by some as a leading indicator of the direct market, and share prices have moved ahead in recent months, triggered by clear anticipation of an improving macroeconomic picture and the consequent potential for corporate transaction activity. The direct property market is expected to follow later in the year and should continue to improve into 2025 if lower interest rates result from inflation stabilising. At the time of writing, oil and commodity prices are rising which suggests the path to lower interest rates and uninterrupted economic growth might not be straightforward.

Real estate research notes

An annual overview note on Grit Real Estate Income Group (GR1T). Its latest act of corporate engineering has opened the door for new NAV and earnings accretive developments.

An update note on Tritax EuroBox (EBOX), which is sailing in calmer waters as demonstrated by a portfolio valuation that has changed little and a 30% uplift in earnings that now fully covers its 8.6%-yielding dividend.

An annual overview note on Urban Logistics REIT (SHED). The company appears to be a re-rating candidate as values stabilise and management extracts the rental reversion in the portfolio.

An update note on Lar España Real Estate (LRE SM). The company continues to defy the doom and gloom surrounding the retail sector, posting strong financial and operational numbers.

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.