Gateway to the West: Chinese investment in Southeast Asia soars amid geopolitical tensions – Dealspeak APAC

China’s growing challenges in exporting to Europe and the US have hastened discussions at its corporates over investing in Southeast Asia (SEA), in an effort to diversify production bases and capitalize on regional demographic ties, while utilizing well-established trading relationships with developed economies.

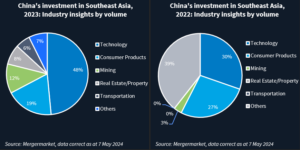

Outbound M&A from China to SEA regions rocketed to USD 7.02bn from 31 deals in 2023, a marked upswing from USD 1.12bn across 19 deals in 2022, according to Mergermarket data. This outbound investment to SEA accounted for 24% of China’s overall outbound investment by volume in 2023, up from 6% in the previous year.

In contrast to China’s ageing population, SEA’s large working-age populations, particularly in Malaysia, Vietnam and Indonesia, have significantly enhanced overall economic growth in these countries, translating into surging local GDPs. In addition, China’s long-term “Belt & Road” initiatives are a key component of its heightened attention on SEA regions.

Looking at specific geographies, Singapore remained China’s top investment destination by volume last year, according to Mergermarket data. China’s attraction has been boosted by its developed capital markets, incubation for technology startups and preferential policies for inbound investors.

Technology was the top investment sector for China in 2023, accounting for 48.49% of Beijing’s total M&A investment into SEA, per Mergermarket. Tech volume last year soared almost tenfold compared with 2022. The second-most targeted sector was consumer products, which saw Chinese investment quadruple from the previous year.

Labour-intensive sectors strongly impacted by US and European Union (EU) punitive tariffs and other trade barriers for Chinese-produced goods have driven manufacturers’ outbound investment into SEA, especially in electric vehicles (EVs), automotive components, consumer electronics and textiles. Such moves aim to de-tag “made-in-China” from products and facilitate easier access to the Western world.

According to the European Commission website, the EU has reached free trade agreements (FTAs) with Vietnam and Singapore, while negotiations continue with Thailand, Indonesia and Malaysia. During a state visit to France in March, the Thai Prime Minister said he anticipates talks completing next year.

With few signs that US and EU trade protectionism is likely to weaken, Chinese corporates are expected to continue pursuing investment opportunities across SEA for the long term.

Spreading far and wide

Thanks to its full-cycle industry chains and close trading ties with Europe, Thailand has become a hot investment location for Chinese automakers, keen to find a gateway into European markets and despite an EU regulatory probe into Chinese-manufactured EVs launched last October. China’s active auto players include SAIC [SHA:600104], BYD [SHE:002594; HKG:1211], Geely [HKG:0175] and Great Wall Motor [SHA:601633; HKG:2333].

Vietnam has seen substantial Chinese investment into its local textile and electronics supply chains, while Indonesia has primarily received Chinese capital flowing into local mining sectors thanks to its rich mineral resources.

Malaysia has welcomed Chinese investment into local e-commerce and services-oriented sectors, aided by a good command of Mandarin among local populations. Note that Malaysia is one of the few regions with a comprehensive and complete Mandarin education system.

In light of the boom in interest that began in earnest in 2023, Mergermarket reports that a growing number of Chinese corporates – primarily in manufacturing spaces – are actively seeking M&A opportunities in SEA regions this year. These include: BYD; Olympic Circuit Technology [SHA:603920], a manufacturer of printed circuit boards; Sunrise Technology [SHE:300360], a motorcycle and scooter maker; Zonergy, a solar equipment supplier; Pregis New Material, a dual carbon and temperature control solutions provider; and Lotus Health, a food enterprise.

Recent Dealspeak APAC columns you may have missed…

Power players: China set for securities consolidation to create national champions

Poll star: as the country votes, India’s economy is shining

Taking off: Japanese governance reforms + shareholder activism = PE opportunities