- The Mexican Peso rallies following Thursday’s Bank of Mexico policy meeting.

- Banxico decided to keep interest rates unchanged but upwardly revised its inflation forecasts.

- USD/MXN broke below the floor of a short-term range following the news and is tipped to decline further.

The Mexican Peso (MXN) breaks higher in its most heavily traded pairs in the aftermath of the Bank of Mexico (Banxico) policy meeting on Thursday, at which the board unanimously voted to keep interest rates unchanged and substantially revised up its inflation forecasts in the light of stubbornly high price pressures.

The Banxico is now not seen cutting interest rates in the near future – a positive for its currency since higher rates attract more foreign capital inflows.

USD/MXN is exchanging hands at 16.74, EUR/MXN at 18.04 and GBP/MXN at 20.97, at the time of publication.

Mexican Peso appreciates after Banxico meeting, inflation revision

The Mexican Peso strengthened by between roughly a quarter and three quarters of a percent in its most heavily traded pairs on Thursday, after the Bank of Mexico held its May policy meeting and decided unanimously to keep the policy rate unchanged at 11.00%. This strength broadly holds up into Friday’s European trading session, with the MXN retreating only marginally.

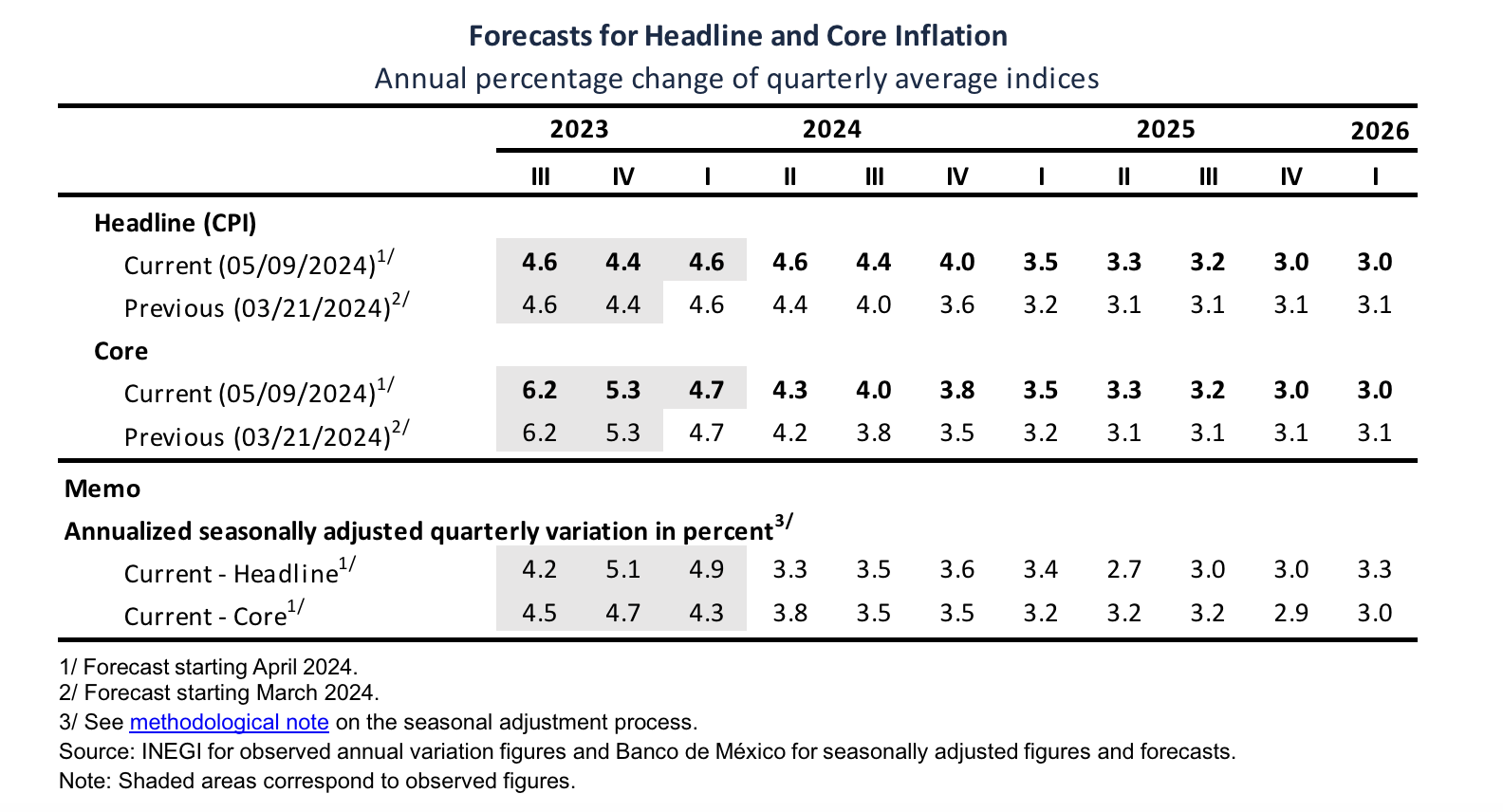

The Banxico revised up its inflation forecasts over the next year and a half, indicating it expected inflation to be stickier than previously anticipated. It forecast inflation to now fall more slowly to its 3.0% target, which it did not foresee reaching until Q4 of 2025.

Previously Banxico had expected inflation to fall more swiftly, reaching 3.1% in Q2 of 2025, and remaining at that level for the rest of the year (see table below). Banxico made similar revisions for core inflation.

In its accompanying statement, Banxico said, “..considering that inflationary shocks are

foreseen to take longer to dissipate, the forecasts for headline and core inflation have been revised upwards for the next six quarters. In particular, services inflation is foreseen to show more persistence, as compared to what had been previously anticipated.”

Technical Analysis: USD/MXN breaks below floor of short-term range

USD/MXN – the cost of one US Dollar in Mexican Pesos – has decisively broken below the bottom of a short-term range at 16.86 and is now expected to continue falling towards the target for the breakout.

USD/MXN 4-hour Chart

The break below the range floor generates an initial, conservative target at 16.54. This is the 0.681 Fibonacci ratio of the height of the range extrapolated lower, and it is followed by 16.34, the full height of the range extrapolated lower.

The short-term trend is now probably bearish following the breakdown from the range, which given the old adage that the “trend is your friend”, suggests the odds favor more downside.

The Moving Average Convergence Divergence (MACD) momentum indicator has crossed below its signal line, further indicating bearishness. However, the momentum accompanying the breakdown move itself was not particularly strong.

Given the medium and long-term trends are bearish, the odds further favor more downside for the pair in line with those trends.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD defends 1.0800 amid risk-aversion

EUR/USD is holding ground above 1.0800 in European trading on Friday. The pair, however, stays undermined by the recent strength in the US Dollar on strong US PMI data and hawkish Fed expectations. Mid-tier US data and Fedspeak are next on tap.

GBP/USD recovers to 1.2700 after downbeat UK Retail Sales-led dip

GBP/USD is trading close to 1.2700 in the European session on Friday, recovery ground after a brief dip, fuelled by a bigger-than-expected decline in the UK Retail Sales data for April. The pair remains on a corrective decline from two-month highs of 1.2761 on resurgent US Dollar demand.

Gold eyes $2,310 support, as rising wedge remains in play

Gold price is nursing losses while flirting with two-week lows near $2,327 in the Asian session on Friday. Gold price extends its losing streak into the fourth straight day, remaining on track to book the first weekly loss in three weeks.

Why is Pepe meme coin rallying? What’s next after PEPE’s ATH? Premium

Pepe price shows signs of continuing its uptrend, but it might come after a correction. This short-term pullback could be used by sidelined buyers to accumulate PEPE for the next leg up.

Waning reflation appetite?

The week hasn’t been pleasant for the market bulls. On Wednesday, the FOMC minutes showed the disturbing truth that ‘many’ Fed members wondered whether keeping the rates ‘high for longer’ was sufficiently restrictive to tame inflation.