ONGC Q4 Results Preview: Oil PSU likely to report dull earnings on flattish realisation, sales volume

JM Financial expects ONGC’s Q4FY24 net crude and gas realisation to be largely flattish sequentially. Sales volume is also expected to be flat to slightly lower on a quarter-on-quarter (QoQ) basis.

May 18, 2024 / 11:18 AM IST

Motilal Oswal expects oil realization (before windfall tax) to expand 5 percent YoY for ONGC, in line with Brent movement in Q4FY24

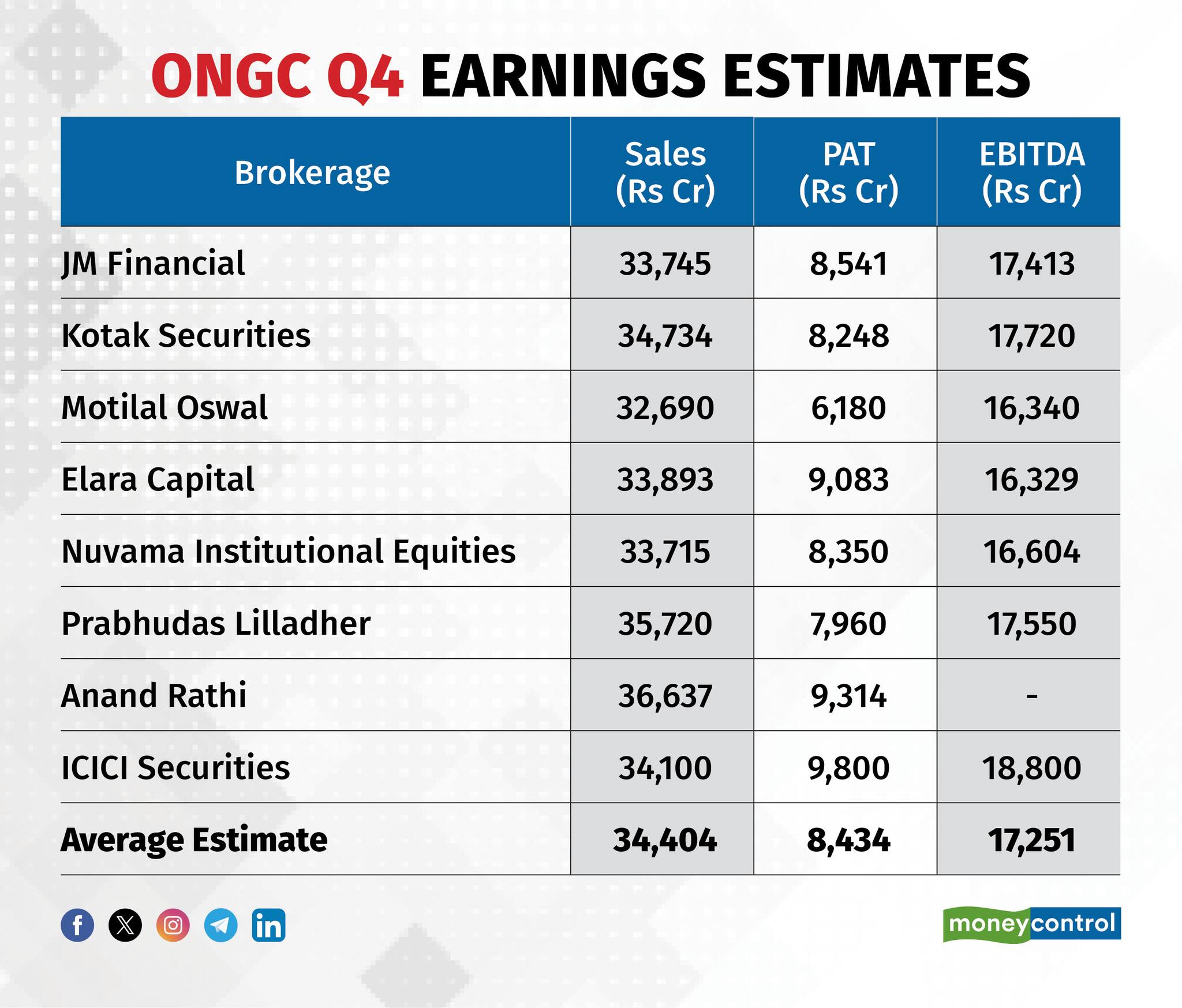

The Oil and Natural Gas Corporation (ONGC) is likely to report a fall in net profit for the quarter ended March 2024 as analysts expect limited net realisation from oil and gas, and flattish sales volume. The company will report its Q4FY24 earnings on May 20.

The upstream oil company's net profit is seen falling over 11 percent year-on-year to Rs 8,434 crore, according to the average of 8 analysts estimates surveyed by Moneycontrol. The decline in profit after tax (PAT) is expected to be on account of lower oil and gas production and a lower administered price mechanism for gas.

The company's Q4 revenue is expected to decline marginally by 1.11 percent to Rs 34,404 crore. Meanwhile, EBITDA is seen falling half a percent YoY to Rs 17,251 crore on lower administered price mechanism (APM) gas price and lower oil and gas production by ONGC but partially offset by higher crude oil realisation.

Sales volume estimates

Motilal Oswal expects oil realization (before windfall tax) to expand 5 percent YoY for ONGC, in line with Brent movement in Q4FY24. Oil sales volumes are seen rising 4 percent on-year, but gas sales volumes are expected to decline 2 percent YoY. The sales of Value Added Products (VAP) are also seen declining 4 percent YoY.

Follow our market blog to catch all the live action

Write-offs, survey expenses to hit PAT

With both oil and gas prices capped and volumes largely flat, Kotak Institutional Equities expects a modest 3-5 percent QoQ EBITDA growth for upstream firms like ONGC, led by lower operating expenses (Opex).

The PSU’s PAT is likely to decline 14 percent on a sequential basis as well due to likely higher write-offs, and survey expenses in the fiscal fourth quarter, the brokerage said.

Oil and Gas realisations estimates

JM Financial expects ONGC’s Q4FY24 net crude and gas realisation to be largely flattish sequentially. Sales volume is also expected to be flat to slightly lower on a quarter-on-quarter (QoQ) basis.

ONGC’s net crude realisation adjusted for windfall tax will continue to be capped at $72-73 per barrel with a tad lower gross crude realisation being offset by a slight cut in windfall tax, the brokerage said.

ONGC’s gas realisations are also expected to be steady QoQ with domestic APM gas realisation being capped at $6.5 per metric million British thermal unit (MMBtu).

"Hence, ONGC’s Q4FY24 EBITDA is expected to be up 1.5 percent sequentially QoQ as we expect overall crude sales volume to be largely flattish QoQ while gas sales volume could go up 1.5 prcent QoQ," said JM Financial in its preview.

Margins, key monitorables

Nomura expects Q4 margins to be at 50 percent, while Elara Capital expects margins to be at 48 percent. According to analysts at Motilal Oswal, an update on the ramp-up of gas production will be the key monitorable in the earnings report and post-result management commentary.

Also Read | JSW Steel stock gains; reports 64.5% YoY decline in net profit

ONGC stocks trigger

According to Motilal Oswal, the potential operational and financial turnaround at ONGC Videsh Ltd (OVL) can be a major share price catalyst for ONGC.

"If ONGC manages to turn around ONGC Petro additions Ltd (OPaL), we believe this can add 5-8 percent to the current market price," the brokerage said. A delay in peak oil production from KG Basin or decline in oil prices below $75 per barrel are key downside risks, it added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!