Watch the free-preview video below extracted from the wlgc session before the market open on 14 may 2024 to find out the following:

- Is the S&P 500 showing signs of a sustainable rally, or are we headed for a pullback

- Why the volume in the past week might be a concern

- The most important signal to judge for a bearish reversal

- Analogue comparison of the current volume

Market environment

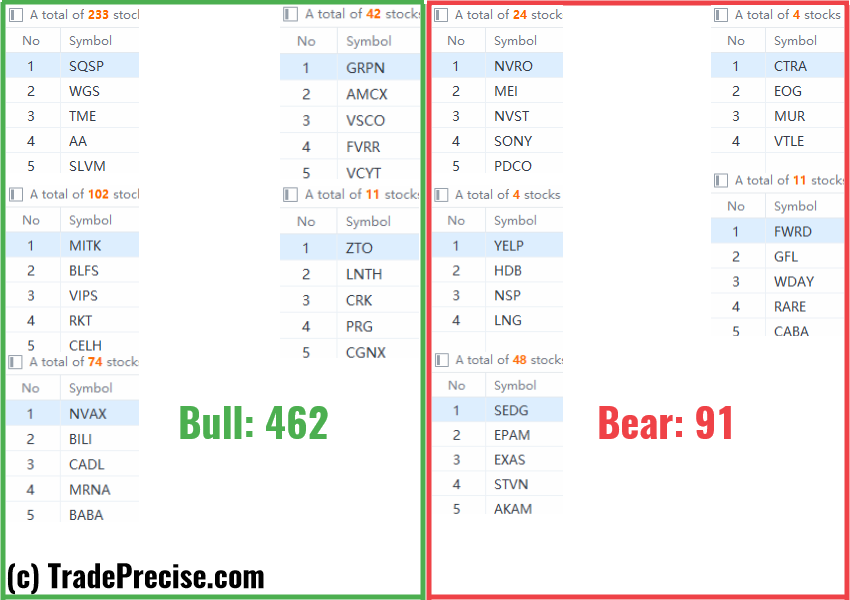

The bullish vs. bearish setup is 462 to 91 from the screenshot of my stock screener below.

There is no shortage of bullish setup while the market is still grinding up.

However, I am paying close attention to any potential reversal from the key levels due to the volume analogue as discussed in the video.

Meanwhile, enjoying the trade entry setup as they are still working well.

Market comment

8 “low-hanging fruits” (VIST, RMD) trade entries setups + 10 actionable setups (DELL) were discussed during the live session before the market open (BMO).

VIST

RMD

DELL

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD holds gains above 0.6650 after mixed Australian data

AUD/USD caught a brief bid wave and edged toward 0.6700 after Australian CPI unexpectedly ticked higher to 3.6% YoY in April. However, a surprise drop in the country's Construction Output for Q1 curbs the Aussie's enthusiasm. A cautious mood also acts as a headwind for the pair.

USD/JPY trades firmer above 157.00 amid dovish BoJ commentary

USD/JPY is trading on a positive footing, comfortable above 157.00 in the Asian session on Wednesday. The pair holds higher ground after dovish comments from BoJ's official Adachi. Broad US Dollar strength also adds to the upside in the pair amid a risk-off environment.

Gold price gives up gains amid Fed’s hawkish remarks

Gold price snaps the three-day winning streak on Wednesday amid the modest rebound of the Greenback. Additionally, the hawkish remarks from several Federal Reserve officials and stronger-than-expected US economic data diminish expectations of the Fed rate cut in September.

Bitcoin long-term holders begin re-accumulation after Semler Scientific and Mt Gox make major whale moves

Bitcoin declined briefly from the $70,000 mark on Tuesday as Semler Scientific and Mt Gox made notable whale moves. Glassnode also shared key on-chain insights that breathe clarity into the market's current state.

Inflation week: Eyes on Germany’s numbers, Eurozone and the US PCE

Today we get Germany’s numbers and on Friday, both the Eurozone and the US PCE. For the Eurozone, expectations are for core to remain the same at 2.7% and for the ECB to cut in June. This is being named a “hawkish cut,” one of those inherently self-contradictory terms.