View:

May 27, 2024

Asia Open - Overnight Highlights

May 27, 2024 12:00 AM UTC

EMERGING ASIA

EM currencies perform mostly weaker against the USD as the greenback remains solid in earlier Asia session before slipping the the London and New York session. KRW saw the largest losses of 0.52%, followed by THB 0.44%, MYR 0.16%, PHP 0.10%, TWD 0.08%, CNH and HKD 0.05%, CNY 0.01%; the

May 26, 2024

May 24, 2024

Banxico Minutes: Unanimous Pause, Diverging Cuts

May 24, 2024 9:24 PM UTC

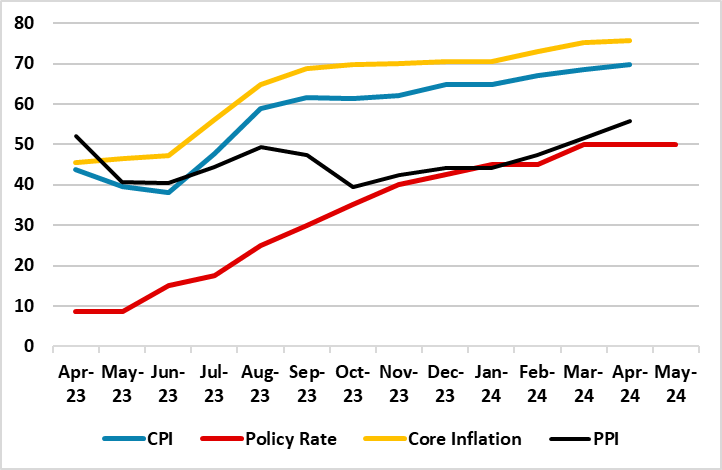

Banxico maintained the policy rate at 11%, reflecting a cautious stance amid persistent inflation and economic uncertainty. The board was unanimous in this decision but divided on the timing of future cuts. Despite expectations for a rebound in economic activity, concerns about inflationary pressure

U.S. May Final Michigan CSI - Less weak than the preliminary, with less of a bounce in inflation expectations

May 24, 2024 2:21 PM UTC

May’s preliminary Michigan CSI showed a substantial fall in confidence and a significant rise in inflation expectations. The final data shows a slightly smaller fall in confidence and less evidence of rising inflation expectations.

Canada March Retail Sales - Soft month, subdued quarter, but stronger April expected

May 24, 2024 1:26 PM UTC

Canada’s 0.2% decline in March retail sales was a little weaker than the preliminary unchanged estimate given with February’s report, and the detail looks weaker still, with sales down by 0.6% ex autos and overall sales down by 0.4% in real terms. The preliminary signal for April however is po

U.S. April Durable Goods Orders - Rise fully on defense but some underlying improvement

May 24, 2024 12:58 PM UTC

April durable goods orders are stronger than expected, and while the gains of 0.7% overall and 0.4% ex transport are moderate, they are a little above recent trend. While the overall rise came fully on defense, gains in non-defense capital ex aircraft orders of 0.3% and shipments of 0.4% suggest bus

UK Sales Weakness Curbing Pricing Power?

May 24, 2024 7:05 AM UTC

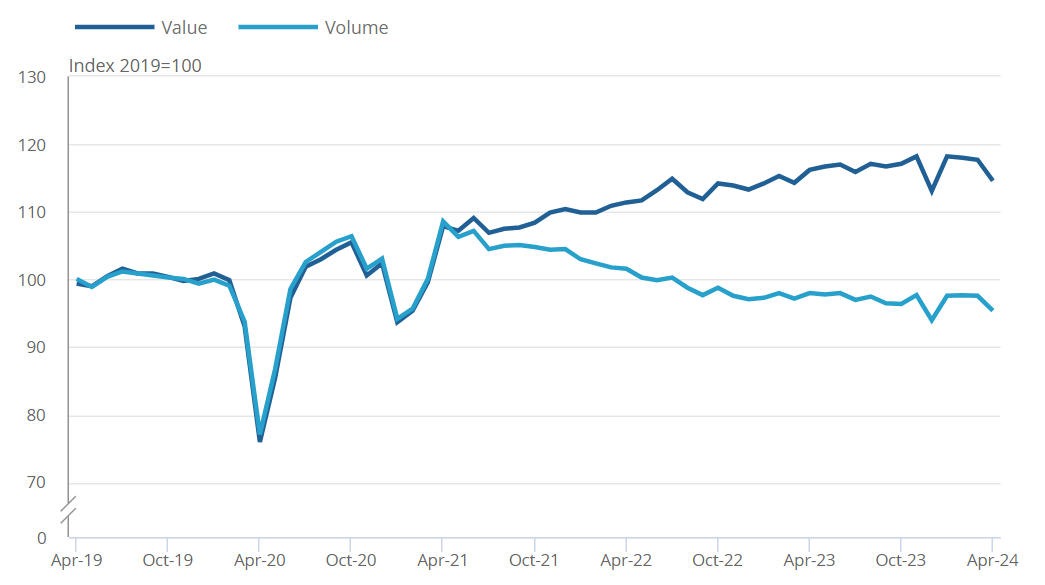

Ending an interesting week of UK data, retail sales slumped in April, partly due to what was a wet month. Notably, sales volumes fell by 2.3% m/m following a broadly flat February and March 2024 and were down by 2.7% y/y and 3.8% below their pre-pandemic level. This weaker-than-expected outcome

Asia Open - Overnight Highlights

May 24, 2024 12:00 AM UTC

EMERGING ASIA

EM currencies perform mostly weaker against the USD as the greenback is gained further traction after stronger PMI data. THB saw the largest losses of 0.57%, followed by MYR 0.15%, PHP 0.12%, SGD 0.07%, CNH 0.05%, CNY and HKD 0.02%; the only winners are TWD 0.14% and KRW 0.04%.

USD/CNH i

May 23, 2024

As Expected, CBRT Kept Key Rate Unchanged at 50%

May 23, 2024 7:30 PM UTC

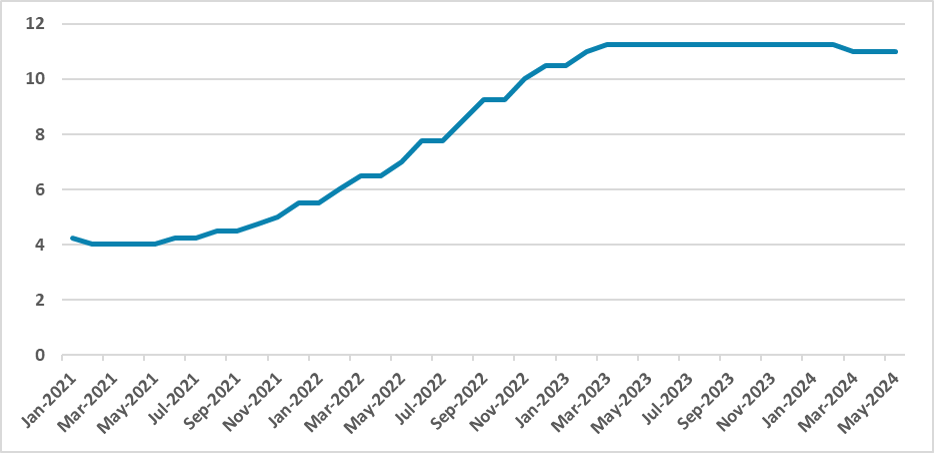

Bottom Line: As predictions were centred around no change, Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% on May 23 despite galloping inflation which edged up to 69.8% in April, up from 68.5% in March. CBRT said in a statement on May 23 that "(...)considering the lagged effects of

U.S. April New Home Sales - Losing momentum

May 23, 2024 2:18 PM UTC

April new home sales at 634k are weaker than expected, with March’s unexpectedly strong 693k outcome revised down to 665k, with April down 4.7% after a revised 5.4% March increase. While the decline does not fully reverse March’s increase housing data mostly is suggesting a loss of momentum.