Pitch Perfect: How to Master Pitching VCs and Investors

Get the insider’s guide on how to master a pitch that grabs investor attention, secures funding, and open up new opportunities for your startup.

If you’re looking to raise capital for your startup, you’re going to have to know how to pitch investors.

Unfortunately, for most of us mere mortals who aren’t comfortable with public speaking, pitching falls somewhere on the spectrum of “moderately terrifying” to “outright paralyzing.”

But never fear. Harry McLaughlin, Sam Eisenberg and Ari Bencuya had some fantastic advice on how to tackle learning this skill.

Your Featured Mentors

3x Founder and Start-up Mentor

🤖 Adopting AI |💰 Capital Raising | 👨👩👧👦 Building Teams | 💣 Avoiding Landmines

Your Best Route: Get Introductions

Before you start thinking about cold outreach and traditional pitches, consider trying for introductions through your network first.

We know, it sounds like a tall order. But, even if you’re starting from scratch, you can build your network so you can land those intros.

The first rule? Get involved in the startup space well before you need funding.

If you’re new to startups, Ari recommended exploring entrepreneurship groups and meetups either online or in person. This lets you expand your network without the pressure of needing introductions immediately. As he explained:

“You have to try to build up a network of people who are willing to listen to your idea and like you enough to make introductions. As time goes on, you’re just going to be in that network of space enough that you’re going to get introductions to some VCs.”

If your network is more mature (i.e. you’ve been in the space for a while), Ari had an alternate approach:

“Look at the VC’s portfolio companies and see if you have any CEOs from their portfolio companies in your network as well. And then try to reach out to them for mentorship on your product and those kinds of things.”

In the end, it comes down to finding “your” people who understand you and support your ideas.

And remember, since you’re networking before you need funding, you don’t want to push for introductions immediately. Build your relationships naturally, be helpful wherever you can, and it makes asking for those introductions down the road much easier.

Cold Calling

Inevitably, you’re going to run out of VCs to chat with in your network, whether you’ve reached the end of your network or need to talk to VCs who raise for a different maturity tier.

This is where cold-calling comes into play.

We’ll start with not what to do:

DON’T: Cold outreach en masse

VCs are inundated with tens to hundreds of pitches daily. The last thing you want is for your outreach to be yet another generic form letter (even worse: one with “Hi {First Name}” as a greeting.)

DON’T: Drop your deck through LinkedIn

The days of cold outreach to VCs on LinkedIn are over. Harry joked: “That well got poisoned with all of the automations, and I may have helped kill it back in the day.”

In short, it’s an outdated, ineffective channel.

DON’T: Lie

This one should seem obvious. But, plenty of people tend to stretch their metrics in their pitches. Which is a recipe for getting black-balled. The VCs talk and any exaggeration in metrics will be sussed out during due diligence.

DON’T: Hire someone to pitch for you

Our mentors had a long discussion about this point that’s definitely worth the watch. At worst, you risk getting scammed. At best, these pitching middlemen are difficult to make work, even with a legitimate go-between. As Sam pointed out,

“I do get pitched by a lot of people, ‘Hey, could you go out and help me raise my round?’ And I said, no, because I’m not you. Your investors want to invest in you. And if you can’t pitch, if you can’t sell, then they don’t want to invest in your company either. And it just won’t work.”

So with those don’ts out of the way, let’s cover what you should be doing:

Do: Send Personalized Outreach

If you want to stand out, you need to show you’ve done your research. Mention the areas a VC has invested in, show you’ve looked into their website and that you understand their investment thesis. Ari had a great template to use as a base:

Your fund previously invested in X company, which means that you have a thesis that focuses on these kinds of businesses.

Well, I’m that kind of business.

Here’s what I’ve achieved:

Here’s who I am:

Here’s what I’m raising:Are you interested? Let’s chat.

Do: Be Persistent

Harry’s biggest advice regarding pitching: stay persistent.

“VCs will, if you reach out to them, even cold, if you do it properly, they will put you in their funnel and they’ll give you a chance a lot of the time. Most people go: ‘I reached out to 10 investors and I didn’t get any responses.’ Like don’t stop. It’s gonna be your life for the next three months.”

Do: Keep the Real Goal in Mind

Our mentors all agreed: the goal of your outreach is not about funding. Your goal is to get 15 minutes of the VC’s time so they can hear your pitch. Because the VCs are going to want to invest in you as much as your startup.

Do: Be Prepared to Play the Volume Game

The more you do outreach, the better you’ll get. And over time, you’ll start to find the script that works and the talking points that get the most interest from your investors.

Once you’ve secured your meetings, it’s time to start pitching.

How to Survive Pitching Your Idea

Pitches, for better or worse, are the one skill that you can only get better at with practice.

It’s intimidating for a lot of founders. But it’s a skill you have to master, as Sam pointed out:

“It’s not about being like a Toastmaster perfect pitch, but you do need to be able to speak to an audience. You need to be able to pitch investors. You need to be able to pitch customers. You need to be able to pitch future employees.”

There are, fortunately, ways to make it easier. Sam recommended:

- Practicing on your own in front of a computer

- Recording videos to pitch colleagues async

- Pitching live to fellow community members (like the ones you meet in the GrowthMentor Slack!) where the pressure is minimal

Once you’re comfortable with the mechanics of pitching, you’ve gotta prep yourself for the grind…and the rejections.

Harry put it this way:

“Pitch everybody. Even if you’re pitching to the wrong person, they’re going to give you probably some valuable feedback. It’ll give you the ability to refine your pitch and just get better and better and better and smoother at it.”

But, Harry also warned, “it’s a grind. A terrible grind.”

In his case, one of the earliest startups he was with took:

- 3 founders

- Doing pitches for 8 hours a day

- For 4-6 weeks

…before they even got their first check. By the end of the day, their CEO was hoarse from pitching so much.

So don’t be fooled by stories of overnight funding successes. Sam discussed one company who was celebrated for raising their series A in a week. Their pre-seed round, however? Took a year and a half to raise.

But it’s not all doom and gloom.

In Harry’s case, once they got to a certain point,

“Pitching was almost mechanical. We knew we’d hit a ratio, so if we do 30 more pitches, we’re going to get X more dollars.”

Plus, you don’t have to blitz your funding round or do it at an early stage. Because the more traction your company has, the better your company is, the less volume you’ll likely have to do to secure those checks.

We’ll leave you with Harry’s final words for founders looking to raise funding:

“Talk to everybody. Pitch everybody. Get out there, build your confidence, work on yourself, like never stop telling your story. You’re gonna get feedback on your product. You’re gonna get pitching advice. You’re gonna refine it. Don’t reserve it for one shot. Just pitch everybody.”

If you want even more insights on how to raise funding beyond pitching, you have to check out Ari, Sam, and Harry’s session, The New Rules of Funding.

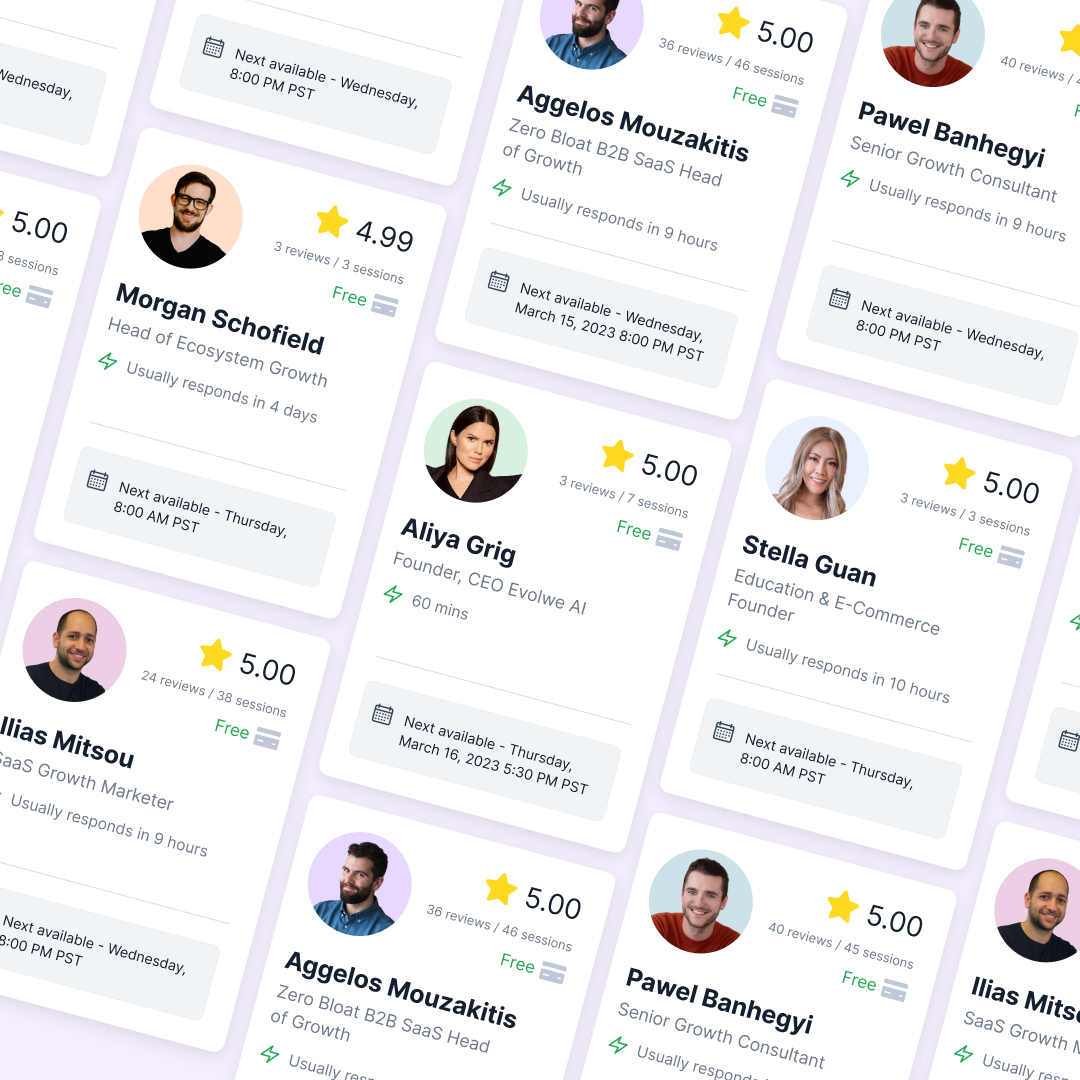

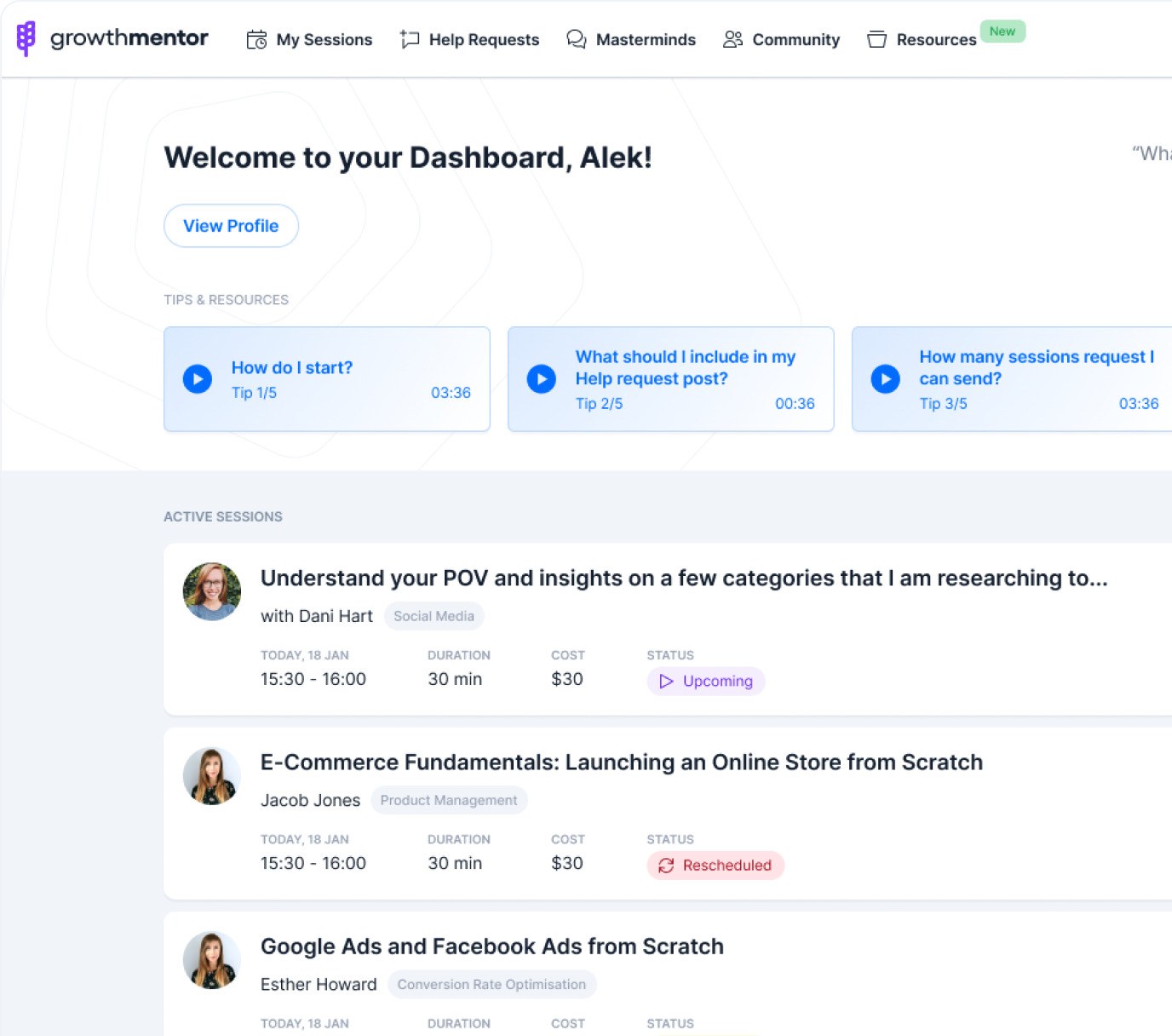

And if you want personalized advice? Join GrowthMentor Pro.

Want personalized funding advice?